- Home

- »

- Pharmaceuticals

- »

-

U.S. Ophthalmic Drugs Market Size, Industry Report, 2030GVR Report cover

![U.S. Ophthalmic Drugs Market Size, Share & Trends Report]()

U.S. Ophthalmic Drugs Market Size, Share & Trends Analysis Report By Drug Class, By Disease, By Dosage Form, By Route Of Administration, By Type, By Product, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Ophthalmic Drugs Market Size & Trends

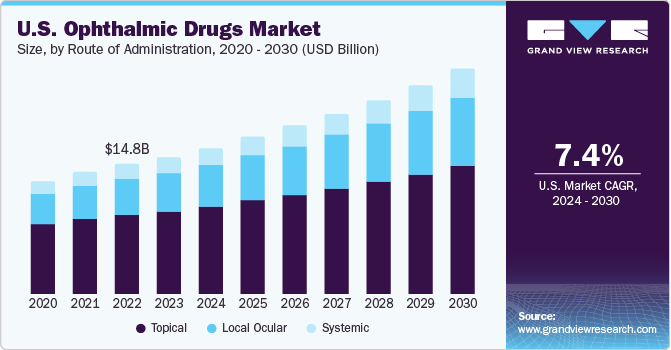

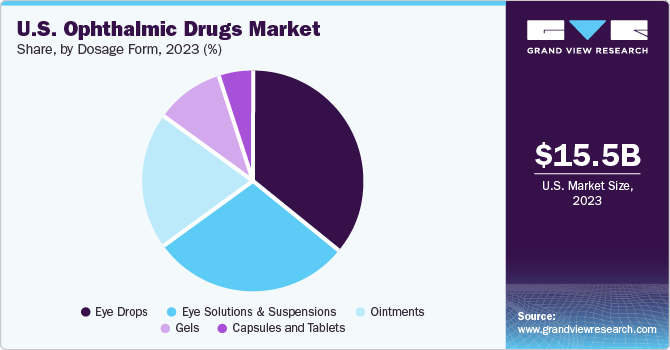

The U.S. ophthalmic drugs market size was estimated at USD 15.53 billion in 2023 and is anticipated to grow at a CAGR of 7.4% from 2024 to 2030. The steady growth in the aging population in the country, coupled with an increasing prevalence of eye-related disorders among adults and children, is expected to remain a significant contributing factor to the demand for ophthalmic drugs. As per the 2022 National Health Interview Survey estimates, over 50 million Americans aged 18 years and above stated that they experienced vision loss with varying degrees. Among this demographic, around four million people claimed to have significant vision issues while wearing glasses, while 340,000 stated that they could not see at all.

The U.S. market for ophthalmic drugs accounted for a revenue share of 41.1% in the global ophthalmic drug market in 2023. The increasing incidence of diabetes among the population due to sedentary and unhealthy lifestyle patterns has increased the risk of diabetic retinopathy (DR), leading to a significant demand for medications. Age-related macular degeneration (AMD) is another common disorder among American adults, with one in every 10 Americans aged 50 and older having an early form of AMD and one out of every 100 Americans having the vision-threatening late form of AMD. According to an article published by BrightFocus Foundation, around 20 million adults in the country had some form of AMD, with recent studies showing that growth in the prevalence of this disorder has been around twice the previous estimation. The condition worsens with age and thus requires diagnosis at the earliest possible instance to provide more effective treatment. The increasing incidences of eye infections and allergies are also expected to present significant growth opportunities for the industry.

Frequent approvals and new product launches are supporting the market growth in the U.S. Due to the increasing coverage of ophthalmic drugs under healthcare plans, the out-of-pocket expenditure on drugs has significantly decreased in the last decade. Top-selling ophthalmic drugs in the U.S. are Eylea, Lucentis, Restasis, Vigamox, Azopt, and Lotemax. Key regional players have taken several initiatives to address a broader population base suffering from ocular diseases. For instance, in July 2023, Harrow, a Nashville, Tennessee-based ophthalmic healthcare company, announced the launch of VIGAMOX for treating bacterial conjunctivitis in the country. This followed the company’s release of three ophthalmic drugs - nepafenac ophthalmic suspension 0.3% (ILEVRO), dexamethasone ophthalmic suspension 0.1% (MAXIDEX), and nepafenac ophthalmic suspension 0.1% (NEVANAC) - in the U.S. market in May 2023.

Such strategic initiatives by key players operating in the country propel the growth of the overall ophthalmic drugs market. In addition, increasing awareness about ophthalmic disorders is estimated to boost the overall market over the forecast period. For instance, the American Academy of Ophthalmology provides data on patients suffering from different ophthalmic disorders, such as key statistics and information about awareness campaigns for particular disorders. The rising prevalence of product recalls due to insufficient evidence of product efficacy has compelled manufacturers to improve their medications, which is expected to ensure a constant pace of development. For instance, Aldeyra Therapeutics announced in March 2024 that it would be resubmitting an NDA (new drug application) for reproxalap, indicated for dry eye disease. The company stated its plans to initiate a dry eye chamber clinical trial in the first half of the year and, depending on positive results, resubmit the NDA in the second half of 2024.

Drug Class Insights

The anti-VEGF agents segment held a dominant revenue share of 32.5% in 2023. A steady rise in the prevalence of disorders, such as diabetic retinopathy and macular degeneration, in the U.S. population is expected to boost the demand for innovative drug classes, such as anti-VEGF (vascular endothelial growth factor) agents. According to the study, “Prevalence of Diabetic Retinopathy in the U.S. in 2021”, published in JAMA Ophthalmology, there were approximately 10 million people in the country battling diabetic retinopathy (DR), while close to 2 million people were living with vision-threatening diabetic retinopathy (VTDR).

Anti-VEGF therapy involves combating the ‘VEGF protein’ growth factor that results in the development of abnormal blood vessels in the retina. The therapy uses specially designed drugs administered into the eye via injections to prevent new blood vessel growth. As per an article in PubMed Central published in May 2023, there has been recent evidence showing that drugs from this class can stop the progression of DR severity markers, lower the chances of DR worsening, and slow down the onset of new macular edema.

The gene & cell therapy segment is expected to register the fastest CAGR of 18.6% from 2024 to 2030. There has been significant interest among researchers concerning implementing gene & cell therapy to combat ophthalmic disorders among the general population, leading to substantial growth potential of this segment. Gene therapy involves replacing faulty genes that are passed down through generations and can lead to severe vision problems if left untreated. These genes are replaced by their healthy copies, which can correct the issue for a lifetime.

The gene therapy medication Voretigene neparvovec, developed by a collaboration between Spark Therapeutics and Children’s Hospital of Philadelphia, is a well-known treatment for people with vision loss due to inherited retinal dystrophy. It is sold under the LUXTURNA brand name and is available in designated treatment centers, such as Bascom Palmer Eye Institute, University of Miami Health System; Boston Children’s Hospital; Duke Eye Center; Cincinnati Children’s Hospital; OHSU Casey Eye Institute; and UAB Callahan Eye Hospital (Alabama). Thus, the extensive availability of treatment options in the country is projected to enable segment expansion.

Disease Insights

The retinal disorders segment held the largest revenue share of 36.7% in 2023. A steady increase in the country’s aging population in recent years has led to a corresponding growth in the incidences of common retinal issues, such as diabetic retinopathy and AMD. As per estimates by the National Eye Institute, around 10 million new diabetic retinopathy cases are expected in the country by 2030, and this number is likely to increase to approximately 14 million by 2050. Technological advancements and a rising number of strategic collaborations also propel the segment's growth. For instance, in August 2023, Regeneron Pharmaceuticals received approval from the U.S. FDA for EYLEA HD (aflibercept) for treating wet ADME, wet AMD, and diabetic retinopathy. Such developments help shape the market.

The glaucoma segment is anticipated to remain a significant contributor to the regional market's revenue. Glaucoma is a group of diseases that result in damage to the optic nerve and is a major cause of irreversible blindness in the U.S., impacting over 3 million people in the country. Treatment for glaucoma includes medicines, surgery, laser, trabeculoplasty, or combination therapy. The loss of peripheral vision is the major sign of glaucoma. Although progressive blindness is preventable, vision loss cannot be restored or reversed. The presence of strong pipeline products indicated for the treatment of glaucoma is estimated to drive the demand for ophthalmic drugs in this area. Moreover, increasing awareness campaigns by government and non-government bodies are expected to support segment growth in the coming years.

Route of Administration Insights

The topical administration of ophthalmic drugs accounted for the largest share of the U.S. market revenue in 2023. The U.S. is home to several major pharmaceutical organizations that have developed advanced solutions to combat eye-related disorders, with the topical route of administration considered very effective in treating such conditions. To improve the effectiveness of the delivery of topical drugs to the required site, companies are coming up with different strategies, which are expected to aid segment growth. Some common strategies include increasing the solubility and lipophilicity to enhance the molecular design; altering the formulation science by increasing corneal penetration, residence time, and viscosity; and increasing the effective dose by raising the frequency or dose of administration.

The local ocular segment is anticipated to emerge as the second-largest segment in the market over the forecast period. Intraocular delivery of drugs enables medications to be directly administered to the eye, targeting specific locations affected by disorders, such as diabetic retinopathy, glaucoma, and macular degeneration. This route helps improve treatment efficacy, compared to systemic administration, by delivering drugs directly to the action site. Moreover, with advancements in formulation, sustained release of medication during an extended period, thus avoiding the requirement for frequent dosing.

In May 2022, Alcon entered into an agreement with the Massachusetts-based Kala Pharmaceuticals regarding acquiring the latter’s EYSUVIS (loteprednol etabonate suspension) 0.25% pharmaceutical eye drop solution. The medication is indicated for patients with dry eye disease and uses a proprietary drug delivery technology, AMPPLIFY, to improve the penetration of loteprednol etabonate into the targeted tissue on the ocular surface, thus preventing flares associated with the disease.

Type Insights

The prescription drugs segment held the leading revenue share in 2023. In the U.S., prescription drugs are a leading factor for the increased spending in healthcare, with ophthalmologists and optometrists responsible for the highest claim percentage for branded medications among all specialties. Among prescription medications, glaucoma accounted for the largest share of costs generated by these eye care providers, followed by DES. Increasing support from public and private bodies to boost sales of prescription ophthalmic drugs is expected to aid market growth. For example, in May 2023, Novaliq and Bausch + Lomb announced that their MIEBO prescription eye drop for treating dry eye disease (DED) had received approval from the U.S. Food and Drug Administration (FDA).

The OTC (over-the-counter) drugs segment is projected to experience the fastest CAGR from 2024 to 2030. Due to their relative cost-effectiveness, the demand for these medications has grown, particularly among the low-income and middle-class demographics. Over-the-counter ophthalmic drugs have anti-infective, antibiotic, and anti-inflammatory properties and are widely available in various forms, including emulsions, gels, ointments, eye drops, and capsules. However, severe eye conditions, such as cataracts, glaucoma, and macular degeneration, do not have any OTC treatments available, while there have been several safety recalls in recent years concerning OTC eye drop solutions, according to the U.S. FDA.

Product Insights

The branded drugs segment accounted for the largest share in 2023. The growing prevalence of eye disorders and an increasing requirement for innovative treatments and therapies are factors expected to boost the segment’s growth. In March 2023, Iveric Bio, part of Astellas Pharma, announced that its IZERVAY (avacincaptad pegol intravitreal solution) medication, indicated to treat geographic atrophy secondary to AMD, received a permanent and unique Healthcare Common Procedure Coding System (HCPS) J-code from the U.S. Centers for Medicare and Medicaid Services (CMS). As a result, the development of such long-term therapies to address conditions, such as glaucoma and dry eye, is expected to support the market's growth.

The generic drugs segment is expected to showcase the fastest growth in the coming years. An increasing expiry rate of branded drug patents in the country and the cost-effectiveness of generic drugs are expected to support the segment's leading position in the market. Moreover, government organizations are encouraging drug makers to boost generic drug development.

Dosage Form Insights

The eye drops segment held the largest revenue share in 2023 as this form of dosage is highly preferred to treat disorders, such as corneal ulcers, glaucoma, and acute allergies. Moreover, the cost-effectiveness of eye drops further increases their appeal as an efficient mode of drug delivery for manufacturers. In October 2021, the U.S. FDA approved Vuity (pilocarpine hydrochloride ophthalmic solution) 1.25%, developed by Allergan (an AbbVie company), for adult patients with presbyopia, indicated for a single use per day. In March 2023, the company received approval for a twice-daily drop of this medication that would extend the duration of its effect for up to 9 hours.

Eye solutions & suspensions are expected to grow significantly during the projection period. Eye solutions provide a notable clinical benefit of facilitating the direct delivery of drugs and are generally indicated for conditions, such as AMD and dry eye syndrome. An increasing focus on developing advanced technologies to improve the physiochemical stability and bioavailability during drug delivery is expected to advance segment growth in the coming years.

Key U.S. Ophthalmic Drugs Company Insights

Some of the major companies in the U.S. market for ophthalmic drugs include Pfizer, Alcon, Regeneron Pharmaceuticals, and Nicox Ophthalmics.

-

Alcon, operationally headquartered in Fort Worth, Texas, offers products for treating disorders of the eyes and vision, specifically cataracts, refractive errors, vitreoretinal, and other ocular health disorders. The company offers a wide variety of solutions in vision care & ophthalmic surgery, including contact lenses & solutions, eye care products, cataract surgery solutions, LASIK, refractive technology, and vitreoretinal surgery. Alcon offers both OTC drugs (SYSTANE, GenTeal Tears, Naphcon-A, and Pataday) and prescription drugs (Rhopressa, SIMBRINZA, and INVELTYS) to address eye disorders in consumers

Key U.S. Ophthalmic Drugs Companies:

- Pfizer Inc.

- Novartis AG

- Alcon

- Bausch Health Companies Inc.

- Merck & Co., Inc.

- Regeneron Pharmaceuticals Inc.

- AbbVie Inc.

- Bayer Corporation

- Genentech, Inc.

- Nicox Ophthalmics, Inc.

- Coherus BioSciences

Recent Developments

-

In May 2024, Regeneron Pharmaceuticals presented positive long-term results, as well as subgroup analyses, from the clinical program of EYLEA HD (aflibercept) Injection 8 mg at the annual meeting of the Association for Research in Vision and Ophthalmology (ARVO) held in Seattle. EYLEA HD has been indicated for patients living with diabetic macular edema, diabetic retinopathy, and wet age-related macular degeneration

-

In March 2024, Sandoz announced that it acquired the U.S. biosimilar CIMERLI (ranibizumab-eqrn) from Coherus BioSciences, Inc. The acquisition is expected to help Sandoz expand its biosimilar portfolio and strengthen its ophthalmic platform in the country. The product addresses certain retinal disorders that can lead to vision loss if left untreated, which is a leading cause of disability in the U.S.

-

In January 2024, Nicox SA announced that it received confirmation for a 5-year patent term extension for latanoprostene bunod’s U.S. patent. This is a pharmaceutical active ingredient developed and patented by Nicox and used in VYZULTA, commercialized by Bausch + Lomb, which is indicated for reducing intraocular pressure (IOP) in patients with ocular hypertension or open-angle glaucoma

U.S. Ophthalmic Drugs Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 25.6 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, disease, route of administration, dosage form, type, product

Key companies profiled

Pfizer Inc.; Novartis AG; Alcon; Bausch Health Companies Inc.; Merck & Co., Inc.; Regeneron Pharmaceuticals Inc.; AbbVie Inc.; Bayer Corporation; Genentech, Inc.; Nicox Ophthalmics, Inc.; Coherus BioSciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ophthalmic Drugs Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ophthalmic drugs market report based on drug class, disease, route of administration, dosage form, type, and product:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-allergy

-

Anti-inflammatory

-

Non-steroidal drugs

-

Steroidal drugs

-

-

Anti-VEGF Agents

-

Anti-glaucoma

-

Gene & Cell Therapy

-

Others

-

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Eye

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Allergies

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Glaucoma

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Eye Infection

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Retinal Disorders

-

Retinal Disorder Treatment Market, By Type

-

Macular Degeneration

-

Diabetic Retinopathy

-

Others

-

-

Retinal Disorder Treatment Market, By Dosage Type

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

-

Uveitis

-

Gels

-

Eye Solutions & Suspensions

-

Capsules & Tablets

-

Eye Drops

-

Ointments

-

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Gels

-

Eye Solutions & Suspensions

-

Capsules and Tablets

-

Eye Drops

-

Ointments

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Local Ocular

-

Subconjunctival

-

Intravitreal

-

Retrobulbar

-

Intracameral

-

-

Systemic

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Drugs

-

OTC

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Drugs

-

Generic Drugs

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."