- Home

- »

- Medical Devices

- »

-

U.S. Operating Room Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Operating Room Equipment Market Size, Share & Trends Report]()

U.S. Operating Room Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Anesthesia, Endoscopes), By End-use (Hospitals And Clinics, Ambulatory Surgical Centers), And Segment Forecasts

- Report ID: GVR-4-68040-271-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

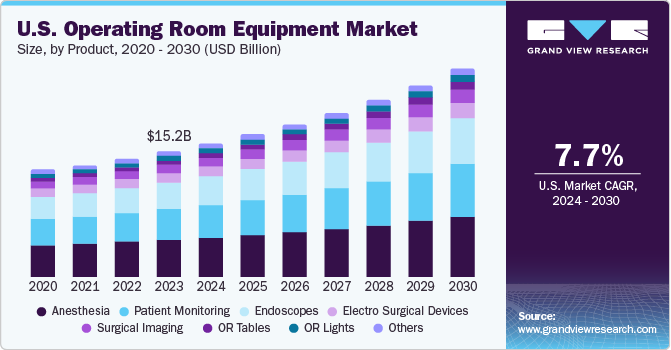

The U.S. operating room equipment market size was estimated at USD 15.21 billion in 2023 and is projected to grow at a CAGR of 7.7% from 2024 to 2030. The rising prevalence of chronic diseases requiring surgeries, the increasing number of hospitals and ambulatory surgery centers, and technological innovations in medical devices are contributing to the market growth.

The COVID-19 pandemic significantly impacted the market. A substantial wait time for elective surgeries was observed by patients due to the lockdown imposed, thus delaying or canceling the surgeries. Delayed surgeries reduced the demand for surgery products, impacting the overall performance of medical device companies.

The rising prevalence of chronic diseases such as cancer, chronic lung diseases, heart disease, stroke, Alzheimer’s disease, diabetes, and chronic kidney disease in the adult population demands well-equipped hospitals and operating rooms. As per the information published by the Centers for Disease Control and Prevention (CDC), six in ten people in the country are affected with at least one chronic disease, and about four in ten people suffer from two or more of these diseases. In addition, according to an article published by the American Cancer Society, cancer incidences in the U.S. are likely to cross a mark of 2 million in the coming years.

An increasing occurrence of heart attacks and strokes is also a significant factor boosting the growth of this market. An article published by the American College of Cardiology Foundation in August 2022 estimated that the incidences of stroke are expected to increase by 33.8%, or 15 million, between 2025 and 2060 in the U.S., which is likely to drive the demand for operating room equipment.

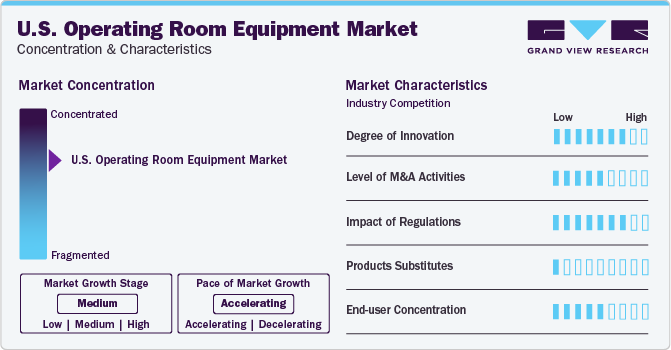

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The operating room equipment industry is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in imaging and minimally invasive surgeries. Subsequently, innovative artificial intelligence (AI) applications are constantly emerging in the global operating room equipment market, disrupting existing industries and creating new ones. For instance, in March 2023, Medtronic and NVIDIA collaborated to build an artificial intelligence platform for medical devices to introduce AI in the GI Genius module, an AI-assisted colonoscopy tool developed and manufactured by Cosmo Pharmaceuticals.

Mergers and acquisitions between hospitals and health systems and the expansion of health centers are further expected to drive industry growth owing to the increased influx of patients for major and minor surgeries. Cross-market mergers and acquisitions between healthcare providers operating in different geographical locations in the U.S. are observed. For instance, in June 2023, Christus Health acquired Gerald Champion Regional Medical Center in New Mexico, helping Texas-based Christus Health expand its geographical presence.

The impact of regulations is high as the operating room equipment is categorized under different classes of medical devices, such as Class I, Class II, and Class III, as per the U.S. Food and Drug Administration (FDA). This classification is based on the risk the device poses to patients. Low-risk posing devices are included in Class I, whereas high-risk posing devices are included under Class III. All Class III medical devices require a pre-market approval application (PMA), whereas a few Class I and Class II medical devices are exempted from the PMAs. The Class I and II medical devices exempted from the PMAs are subjected to limitations on exemptions. The Code of Federal Regulations, Title 21 (21CFR), enlists the limitations on exemptions for pre-market approvals.

There are no significant substitutes for operating room equipment, which makes it more important in performing surgeries and thereby drives its demand in the market.

End-user concentration is a significant factor in the U.S. market. Since there is a high demand from End-use industries such as hospitals and clinics for operating room equipment, it creates opportunities for the development of new and advanced products, further driving the market growth.

Product Insights

Based on products, the segment is categorized into anesthesia, endoscopes, electrosurgical devices, surgical imaging, operating room (OR) tables, OR lights, patient monitoring, and others. The anesthesia segment held the largest revenue share of 29.8% in 2023. Adopting Anesthesia Information Management Systems (AIMS) has also contributed to the high revenue share. AIMS is widely used in hospitals and ambulatory service centers due to the increasing number of chronic diseases and surgical procedures. As surgery requires anesthesia equipment to administer the precise amount of anesthesia during surgical procedures, the demand for these machines is expected to remain high.

The endoscopes segment is anticipated to experience the fastest CAGR over the forecast period. The growth of this sector is fueled by various factors, including the increasing demand for endoscopic operations, the rising awareness of minimally invasive procedures, and the growing use of technological advancements in surgical procedures. The market is predicted to continue to grow due to the rising incidence of gastrointestinal illnesses, cancer, and lifestyle-related diseases. For instance, in October 2023, Olympus announced the launch of its EVIS X1 endoscopy system at the annual meeting of the American College of Gastroenterology (ACG) in Vancouver, Canada, aiding the screening of gastroenterological diseases, making lesions and polyps more visible by improving image color and texture.

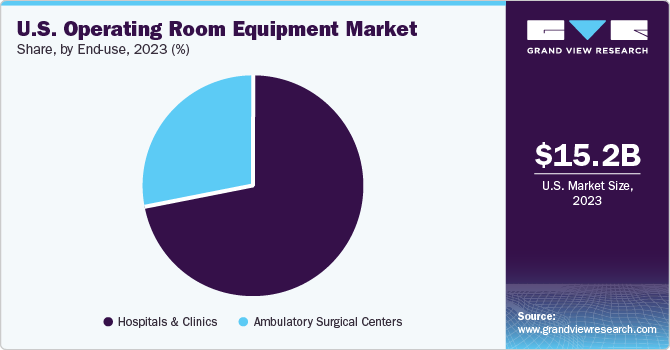

End-use Insights

Based on end-use, the hospitals and clinics segment held the largest market share in 2023. This iattributed to the rising number of hospitals across the country. For instance, according to the data published by the American Hospital Association in 2022, there were 6,120 hospitals in the U.S. The growth of this market is expected to be further driven by the increasing geriatric population, growing disease burden, rising healthcare expenditures, demand for hybrid operating rooms, and increasing investments in advanced technologies and infrastructure to yield effective outcomes.

The ambulatory surgery centers segment is anticipated to grow at the fastest CAGR over the forecast period. The demand for surgical care has led to an increase in the number of ambulatory surgical centers. This growth is driven by the needs of patients, physicians, and insurance providers. The market for these centers is expected to continue expanding due to the rise in ambulatory surgery centers, growing demand, high patient satisfaction, successful physician practices, and affordable and superior therapies.

Key U.S. Operating Room Equipment Company Insights

Some of the key players operating in the market include Koninklijke Philips N.V; Medtronic; Getinge AB; Steris; Skytron, LLC; Drägerwerk AG & Co. KGaA; Stryker Corporation; and Siemens Healthineers AG.

-

Skytron is a global original equipment manufacturer and distributor that focuses on research and development and provides advanced medical equipment to the healthcare industry. The company offers a wide variety of operating room equipment, including OR lights, OR tables, and OR table accessories, along with highly configured surgical booms.

-

Getinge AB invests in a diverse portfolio of operating room infrastructure, such as operating room tables, OR lights, ceiling supply units, anesthesia machines, and patient monitoring devices, as well as operating room management and integration.

GE HealthCare; Baxter International Inc.; and Olympus are some of the other market participants in the U.S. market

Key U.S. Operating Room Equipment Companies:

- Koninklijke Philips N.V

- Medtronic

- Getinge AB

- Stryker Corporation

- Siemens Healthineers AG

- GE HealthCare

- STERIS

- Skytron, LLC

- Drägerwerk AG & Co. KGaA

- Baxter International Inc.

- Olympus Corporation

Recent Developments

-

In February 2024, UCSF Health, Adventist Health, and Madera County officials announced a proposal to re-open Madera Community Hospital to provide high-quality medical services for the local community in Madera County.

-

In December 2023, Marin Health Medical Center inaugurated its new state-of-the-art hybrid operating room with advanced medical imaging technologies to treat cardiovascular diseases, orthopedic injuries, and traumatic emergencies.

-

In June 2023, Olympus Corporation announced its launch of ESG-410, a next generation electrosurgical generator in the treatment of bladder cancer and benign prostate hyperplasia.

-

In May 2023, one of the associate professors of SUNY Empire Innovation at Stony Brook University received a USD 1 million grant from the National Cancer Institute (NCI) to develop a light endoscope for detecting and destroying minute ovarian cancer tumors.

U.S. Operating Room Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 25.20 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V; Medtronic; Getinge AB; STERIS; Skytron, LLC; Drägerwerk AG & Co. KGaA; Stryker Corporation; Siemens Healthineers AG; GE HealthCare; Baxter International Inc.; and Olympus Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Operating Room Equipment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. operating room equipment market report based on product and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia

-

Endoscopes

-

Electro Surgical Devices

-

Surgical Imaging

-

OR Tables

-

OR Lights

-

Patient Monitoring

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Frequently Asked Questions About This Report

b. The U.S. operating room equipment market size was estimated at USD 15.21 billion in 2023 and is expected to reach USD 16.18 billion in 2024.

b. The U.S. operating room equipment market is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030 to reach USD 25.20 billion by 2030.

b. In terms of end-users, the hospitals and clinics segment dominated the market with the largest market share of 72.08% in 2023. This high share is attributable to the rising prevalence of chronic diseases requiring surgeries.

b. Some key players operating in the U.S. operating room equipment market include Koninklijke Philips N.V; Medtronic; Getinge AB; Steris; Skytron, LLC; Drägerwerk AG & Co. KGaA; Stryker Corporation; Siemens Healthineers AG; GE HealthCare; Baxter International Inc.; and Olympus.

b. Key factors driving the market growth are the rising prevalence of chronic diseases requiring surgeries, the increasing number of hospitals and ambulatory surgery centers, and technological innovations in medical devices

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.