U.S. Oncology Information Systems Market Size, Share, And Trends Analysis Report By Products & Services, By Application (Medical Oncology, Surgical Oncology, Radiation Oncology), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-287-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

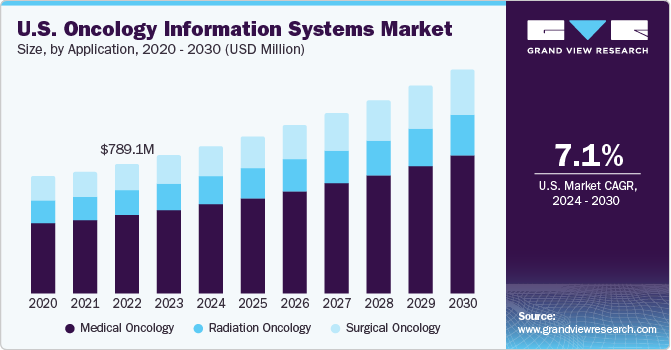

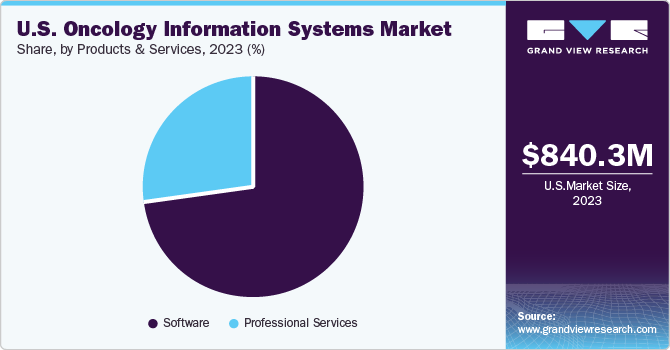

The U.S. oncology information systems market was valued at USD 840.3 million in 2023, the market is projected to grow significantly at a CAGR of 7.1% from 2024 to 2030. The growing prevalence of cancer among various demographics and rising demand for advanced innovative oncology information systems are some of the driving factors for the U.S. market. Oncology information solutions deployment is high in hospitals & cancer research institutes in the U.S. due to the rise in the prevalence of cancer and the increase in healthcare expenditure budget.

The U.S. accounted for over 31% of the global oncology information systems market in 2023. This region has proven to be competitive and a leading market for novel cancer treatment solutions. It is considered a pioneer in adopting cancer treatment-related devices and solutions. Cancer prevalence is rising in North America, accounting for the second leading cause of death in the U.S. As per the National Cancer Institute, in January 2019, the U.S. had a cancer caseload of 16.9 million and is estimated to reach 22.2 million by 2030.

The presence of nonprofit organizations in the country is boosting R&D efforts to introduce innovative oncology information systems and solutions. Additionally, the penetration and adoption of artificial intelligence in cancer treatment software solutions are estimated to create further growth opportunities in the market. Therefore, due to the increasing adoption of oncology information systems in the region, the rising prevalence of cancers, the increasing number of players, and consistent product innovations, the market is anticipated to grow at a substantial rate during the forecast period.

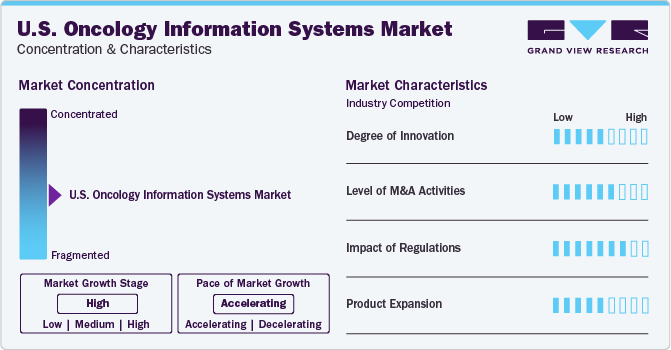

Market Concentration & Characteristics

The industry is witnessing a considerable amount of growth with several activities and growth strategies being adopted by the key players. This includes mergers and acquisitions (M&A), partnerships, collaborations, product developments and launches, geographical expansions, and investments.

An increase in investments in cancer research by companies is driving the industry growth. A wide range of novel technologies is being developed, which have the potential to drastically change the treatment regime. The OIS helps organizations and healthcare centers in managing the treatment of cancer. For instance, in December 2021, RaySearch Laboratories launched RayStation 11B, an advanced treatment planning system with innovative features such as improved dosage calculation accuracy. Thus, increasing investments in oncology by governments and well-established industry players for R&D activities is expected to boost industry growth.

The established players in the industry such as Cerner Corporation, Accuray Incorporated, and BrainLab are adopting growth strategies such as the launch of new products and mergers & acquisitions, partnerships, and collaborations to expand their industry presence. For instance, in May 2022, Cerner Corporation (Oracle Corporation) collaborated with Freenome and Elligo Health Research to develop advanced clinical trial solutions using the Learning Health Network, which would allow clinicians to detect cancers early.

OIS solutions need to be constantly updated due to advancements in technology and the need to comply with newer regulations. Supportive government policies in various countries are creating growth opportunities in the industry. Furthermore, the presence of sophisticated healthcare infrastructure and cancer research institutes coupled with high healthcare expenditures & patient disposable incomes with an existing regularized reimbursement framework is supporting the adoption of oncology information systems. However, unpredictable changes in healthcare policies by governments are expected to be a major challenge in the future.

Application Insights

The medical oncology segment accounted for the largest share of 60.84% in 2023. This modality offers a comprehensive and efficient approach to treating cancer. Furthermore, the increasing prevalence of cancer is expected to drive market growth. Increasing usage of chemotherapy, immunotherapy, targeted therapy, and hormonal therapy for effective treatment of cancer is expected to drive market growth.

The surgical oncology segment is expected to witness the highest CAGR over the forecast period. Surgery is no longer the treatment for most solid malignancies, but the combination of surgery and multi-modal therapies mostly focused on radiotherapy, targeted molecular therapies, and chemotherapy is the preferred treatment. Some of the surgical procedures such as cytoreductive surgery, isolated limb perfusion, laparoscopic cancer surgery, and sarcoma surgery can be performed in highly specialized healthcare centers. Thus, increasing complexity in surgical treatments for solid malignancies is expected to drive the growth of the surgical oncology OIS market.

Products And Services Insights

The software segment accounted for the largest share of 73.14% in 2023. These software solutions facilitate the exchange of patient information across healthcare organizations to create a bridge between practitioners and radiology centers, which helps improve the safety and efficiency of cancer treatment. Companies such as Varian (Siemens Healthineers), Flatiron, and Elekta are developing innovative products by integrating solutions, including oncology-specific EMR. Hence, the software segment dominates the market as it helps streamline patient and data management processes, which can otherwise compromise data quality & participant safety.

The professional services segment is expected to witness a considerable CAGR over the forecast period. As hospitals and clinics lack the in-house resources and skills required for the deployment of OIS software, these services are outsourced. Outsourcing can be a short-term project or a long-term contract. Companies such as Varian (Siemens Healthineers), Elekta, eviCore Healthcare, and Asclepius Consulting are some of the major players providing professional services for cancer care globally.

Key U.S. Oncology Information Systems Company Insights

Some of the prominent U.S. oncology information system companies are Elekta AB, Accuray Incorporated, RaySearch Laboratories, Cerner Corporation, BrainLab, and Philips Healthcare. Launch of new products and mergers & acquisitions are key strategic undertakings of participants in the market.

For instance, in December 2019, ViewRay, Inc. announced its strategic collaboration with Elekta AB and Medtronic. The collaboration with Elekta is aimed at advancing the utilization and knowledge of MR-guided radiation therapy. Such collaborations are expected to help in creating strong commercial relations with other key players in the market, thereby strengthening the player’s foothold.

Key U.S. Oncology Information System Companies:

- Elekta AB

- Accuray Incorporated

- Varian Medical Systems (Siemens Healthineers)

- RaySearch Laboratories

- Cerner Corporation (Oracle Corporation)

- BrainLab

- Philips Healthcare

- Prowess, Inc.

- DOSIsoft S.A.

- ViewRay Inc.

- MIM Software and Flatiron

Recent Developments

-

In May 2022, RaySearch Laboratories collaborated with GE Healthcare to codevelop an advanced radiation therapy simulation and incorporate the latest advancements made in the field of treatment planning systems technology. Under this collaboration, RaySearch would integrate GE Healthcare’s multi-modality simulator in its RayStation treatment planning system.

-

In June 2022, Accuray Incorporated and Limbus AI Inc. entered a strategic partnership to amalgamate Limbus’ AI-powered auto-contouring algorithms with Accuray’s adaptive radiotherapy capabilities. The two companies would focus on enhancing treatment planning process software solutions as part of the agreement.

U.S. Oncology Information System Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 1.36 billion |

|

Growth rate |

CAGR of 7.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Products and services, application |

|

Country scope |

U.S. |

|

Key companies profiled |

Elekta AB; Accuray Incorporated; Varian Medical Systems(Siemens Healthineers); RaySearch Laboratories; Cerner Corporation (Oracle Corporation); BrainLab; Philips Healthcare; Prowess, Inc.; DOSIsoft S.A.; ViewRay Inc.; MIM Software and Flatiron |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Oncology Information Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the subsegments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the U.S. oncology information systems market on the basis of product and services, and application:

-

Products And Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Patient Information Systems

-

Treatment Planning Systems

-

-

Professional Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Oncology

-

Radiation Oncology

-

Surgical Oncology

-

Frequently Asked Questions About This Report

b. The U.S. oncology information systems market size was estimated at USD 840.3 million in 2023 and is expected to reach USD 896.01 million in 2024.

b. The U.S. oncology information systems market is expected to grow at a compound annual growth rate of 7.26% from 2024 to 2030 to reach USD 1.36 billion by 2030.

b. The medical oncology segment dominated the U.S. oncology information systems market and accounted for the largest revenue share of 61.06% in 2023, owing to the rapid advancements in immunotherapy, hormonal therapy, and targeted therapy for effectively treating various cancers.

b. The solution segment dominated the U.S. oncology information systems market and accounted for the largest revenue share of 73.47% in 2023, owing to healthcare providers' rising adoption of proper radiology imaging management.

b. Key factors driving the U.S. oncology information systems market growth include the monumental growth of healthcare IT, the increasing prevalence of cancer, increasing expenditures in development around treatments and solutions for cancer care, and increasing adoption of OIS solutions by healthcare facilities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."