U.S. Oncology In-vivo CRO Market Size, Share & Trends Analysis Report By Indication (Blood Cancer, Solid Tumors, Others), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-4

- Number of Report Pages: 18

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Oncology In-vivo CRO Market Trends

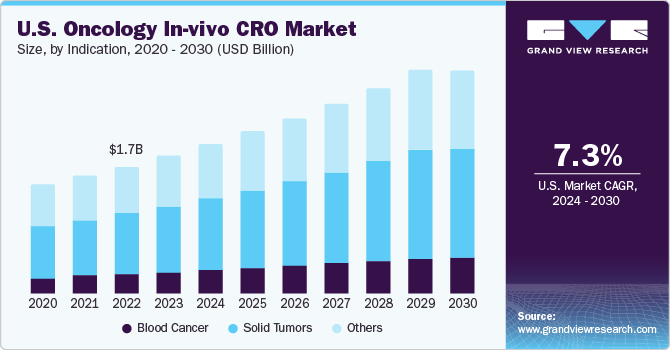

The U.S. oncology in-vivo CRO market size was estimated at USD 1.86 billion in 2023 and is estimated to grow at a CAGR of 8.2% from 2024 to 2030. The growth is attributed to the presence of local CROs across the country, presence of high healthcare expenditure per capita, and availability of government funds & reimbursements for R&D activities in oncology.

The U.S. oncology in-vivo CRO market accounted for over 35% of the global oncology in-vivo CRO market in 2023. U.S. has the highest per capita healthcare spending and availability of grants from government organizations such as the National Institute of Health (NIH) fosters research activities. The increasing R&D activities and need to reduce the overall trial expenditure are likely to fuel market growth.

Moreover, cancer is dominantly affecting the population across the U.S. Thus, CROs are actively focusing on R&D activities for oncology therapeutics. Several CROs are consistently focusing on new oncology drugs. According to an article published by ASCO journal, the National Institutes of Health (NIH) and the NCI and biopharmaceutical companies are highly investing in cancer therapeutics thereby fueling the market growth.

Market Concentration & Characteristics

The U.S. oncology in-vivo CRO industry is highly competitive and consists of several major industries, contributing to its fragmented nature. Due to the intensely competitive industry, major companies are prioritizing innovation and technological advancements to enhance their position. For instance, In July 2022, GSK Inc. announced an acquisition agreement with Sierra Oncology, Inc. which manufactures targeted therapeutics for rare cancer. Under this acquisition, the company would expand its oncology portfolio.

Participating in strategic acquisitions allows industries to boost their industries portfolios by improving capabilities, broadening product portfolios, and strengthening competencies. For instance, in June 2023, Coherus BioSciences, Inc. and Surface Oncology, Inc. announced a strategic partnership, with Coherus acquiring Surface Oncology. This merger agreement would establish clinical stage assets to Coherus’ novel I-O pipeline which include SRF388 and SFR114.

Regulatory bodies such as the U.S. FDA influence the approval process of drugs manufactured by oncology in-vivo CROs and undertake initiatives to further support the innovation and expansion strategies. For instance, in November 2023, The US FDA finalized its guidance on the eligibility and submission requirements for applicants interested in submitting new drug applications (NDAs) or biologics license applications (BLAs) for its real-time oncology review pilot (RTOR).

Several key industries are actively pursuing regional expansion initiatives to broaden their geographic reach and cater to the demands of consumers in those regions. For instance, in August 2023, an innovative CRO, Harvest Integrated Research Organization (HiRO) announced the agreement of acquisition with US-based Courante Oncology for oncology therapeutic development. This enhances HiRO's capacity to oversee international studies and expands its footprint in this market.

Indication Insights

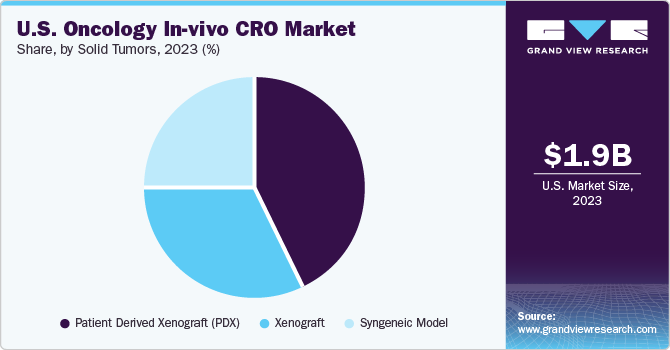

The solid tumor segment dominated the market with a share of 47% in 2023 and is projected to witness growth at the fastest CAGR over the forecast years. Increasing R and D activities in solid tumor therapeutics fuel market growth. As per the CDC cancer data and statistics, approximately 1,603,844 new cancer cases were reported, and 602,347 cancer-related deaths in 2020. Moreover, the high prevalence of various cancers in this country demands research in solid tumors sector thereby fueling market growth.

Blood cancer is anticipated to register growth at a significant CAGR from 2024 to 2030. This growth can be anticipated by rising in-vivo research for treating various myelomas. The increasing development of investigational molecules in oncology and ongoing research in stem cell technology is expected to drive significant investments in the in-vivo oncology sector. For instance, in June 2021, the antibody-drug conjugate targeting DR5 for Acute lymphoblastic leukemia was evaluated and published by Molecular Therapy Oncology Journal.

Key U.S. Oncology In-vivo CRO Company Insights

Key companies operating in the oncology in-vivo CRO market include Masimo,Nonin Medical Inc. American Diagnostic Corporation, Suntech Medical, Inc., and GE Healthcare. These companies are continuously introducing new products at competitive prices and expanding their market presence through acquisitions. Companies are trying to enhance their services and manufacturing capacities, aiming to gain a competitive edge.

Key U.S. Oncology In-vivo CRO Companies:

- The Jackson Laboratory

- Charles River Laboratory

- Thermo Fisher Scientific Inc.

- Taconic Biosciences

- Crown Bioscience

- LabCorp

- Sierra Oncology, Inc.

- Coherus BioSciences, Inc

- Courante Oncology

Recent Developments

-

In February 2024, Kelonia Therapeutics and Astellas Pharma Inc. announced partnership for research collaboration and licensing agreements to develop innovative Immuno-Oncology therapeutics. Under this agreement, Kelonia's in vivo gene placement system (iGPS) with Xyphos' ACCEL technology to create advanced in vivo CAR-T Cell therapies for up to two targeted programs.

-

In August 2022, Thermo Fisher Scientific Inc. announced an agreement with Prescient Therapeutics to advance the commercialization & development of the OmniCAR cell therapy platform. This agreement would assess the viability of leveraging automated closed-cell therapy solutions to create a unique technique for producing cell treatments on the OmniCAR platform without the use of viruses.

-

In January 2021, Charles River announced a collaboration with Cypre, aiming to expand its 3D in vitro services for cancer immunotherapy and targeted therapy drug screening. The partnership between Charles River and Cypre will give Charles River clients access to Cypre's Falcon-X 3D tumor model platform, enhancing Charles River's 3D in vitro testing services for immuno-oncology strategies.

U.S. Oncology In-vivo CRO Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.01 billion |

|

Revenue forecast for 2030 |

USD 3.23 billion |

|

Growth rate |

CAGR of 8.2% from 2023 to 2030 |

|

Actual estimates |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion & CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Indication |

|

Country scope |

U.S. |

|

Key companies profiled |

The Jackson Laboratory; Charles River Laboratory; Thermo Fisher Scientific Inc.; Taconic Biosciences Crown Bioscience; LabCorp; Sierra Oncology, Inc.; Coherus BioSciences, Inc; Courante Oncology |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Oncology In-vivo CRO Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. oncology in-vivo CRO marketbased on indication:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood cancer

-

Syngeneic model

-

Patient Derived Xenograft (PDX)

-

Xenograft

-

-

Solid tumors

-

Syngeneic model

-

Patient Derived Xenograft (PDX)

-

Xenograft

-

-

Others

-

Syngeneic model

-

Patient Derived Xenograft (PDX)

-

Xenograft

-

-

Frequently Asked Questions About This Report

b. The U.S. oncology based in-vivo contract research organization market size was estimated at USD 1.86 billion in 2023 and is expected to reach USD 2.01 billion in 2024.

b. The U.S. oncology based in-vivo contract research organization market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 3.23 billion by 2030.

b. The solid tumor segment dominated the market with a share of 47% in 2023 and is projected to witness growth at the fastest CAGR over the forecast years. Increasing R&D activities in solid tumor therapeutics fuel market growth

b. Some key players operating in the U.S. oncology based in-vivo CRO market include Crown Bioscience, Charles River Laboratory, ICON Plc., Eurofins Scientific, Taconic Biosciences, LabCorp, EVOTEC, The Jackson Laboratory, and Wuxi AppTec. Other players operating in this space are MI Bioresearch, Inc., Living Tumor Laboratory, Champion Oncology, Inc., and Xentech.

b. Key factors that are driving the U.S. oncology based in-vivo contract research organization market growth include a focus on core competencies by the pharmaceutical players, and accelerating time to market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."