- Home

- »

- Consumer F&B

- »

-

U.S. Olive Oil Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Olive Oil Market Size, Share & Trends Report]()

U.S. Olive Oil Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Refined, Virgin, Extra Virgin), By Packaging (Bottle, Pouches, Cans), By Application (Food & Beverage, Personal Care And Cosmetics), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-485-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Olive Oil Market Size & Trends

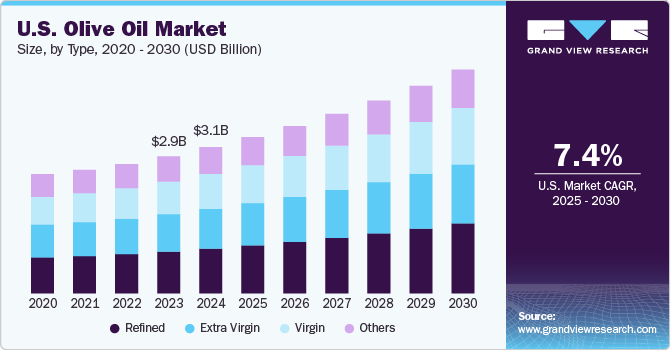

The U.S. olive oil market size was estimated at USD 3.13 billion in 2024 and is expected to grow at a CAGR of 7.4% from 2025 to 2030. The olive oil market in the U.S. is driven by a confluence of health trends, culinary preferences, and evolving consumer attitudes. Central to this is the increasing recognition of olive oil's health benefits. As American consumers become more health-conscious, they are drawn to olive oil for its monounsaturated fats and antioxidants, which are associated with reduced risk of heart disease and overall wellness. The growing awareness of the Mediterranean diet, known for its positive health impact, has further fueled demand, as olive oil is a staple in this diet.

The Mediterranean diet’s rise in popularity is further reinforced by endorsements from health professionals and coverage in mainstream media, creating a broader appeal beyond health-conscious individuals. Cooking shows, food blogs, and celebrity chefs often highlight the benefits of incorporating olive oil into daily meals, making it a fashionable choice among American households. For instance, the Mediterranean diet was ranked as the #1 diet in the U.S. News & World Report’s Best Diets Overall 2023 for the sixth consecutive year.

Furthermore, as American consumers become more concerned with the quality and origin of the food types they purchase, there has been a noticeable shift toward organic and premium olive oils. Organic olive oil, free from synthetic pesticides and fertilizers, is viewed as a healthier and more environmentally friendly option, aligning with the broader consumer movement toward clean-label and sustainable types.

In addition to organic options, there is growing demand for extra virgin olive oil, which is considered the highest quality due to its minimal processing and superior taste profile. This shift toward premiumization has resulted in an increased willingness among consumers to pay higher prices for superior olive oils, particularly those with certifications such as "cold-pressed" or "first press".

Type Insights

Refined olive oil accounted for a market share of 30.6% of the U.S. revenues in 2024. Demand for refined olive oil in the U.S. is driven by several factors, including health trends, culinary preferences, and the rising popularity of Mediterranean diets. As consumers become more health-conscious, they are increasingly seeking healthier alternatives to traditional cooking oils, and refined olive oil, with its lower acidity and neutral flavor, offers a versatile option. For example, health studies promoting olive oil's benefits, such as reducing heart disease risk due to its monounsaturated fat content, have led to greater consumer interest.

The U.S. virgin olive oil market is projected to grow at a CAGR of 8.3% from 2025 to 2030. The rise of the Mediterranean diet, which emphasizes olive oil as a key component, has also boosted its popularity. Additionally, the type’s cold-pressed nature, which preserves more antioxidants and nutrients, makes it particularly appealing to health-conscious consumers. Virgin olive oil is often used for dressings, drizzling over dishes, or light sautéing, offering a rich taste that enhances various cuisines.

Packaging Insights

Bottled olive oil accounted for a market share of 52.6% of the U.S. revenues in 2024. Bottled olive oil is widely favored by American consumers for its ease of use and storage, making it a staple in households for cooking, dressing, and finishing dishes. The health benefits of olive oil, particularly its heart-healthy monounsaturated fats and antioxidant properties, have boosted its popularity, especially as people increasingly prioritize wellness in their diets.

The canned olive oil market is projected to grow at a CAGR of 6.2% from 2025 to 2030. The demand for olive oil in cans in the U.S. is fueled by factors such as longer shelf life, bulk purchasing preferences, and sustainability concerns. Canned olive oil, often used by restaurants, caterers, and bulk buyers, offers better protection against light and air, preserving the oil’s quality over time. This packaging format is especially appealing to those who use olive oil frequently and in larger quantities, as it helps maintain the oil's freshness for longer periods compared to bottles.

Application Insights

Olive oil in food & beverages accounted for a market share of 43.3% of the U.S. revenues in 2024. As consumers increasingly prioritize healthy eating, olive oil’s well-documented benefits, such as its high content of monounsaturated fats and antioxidants, make it a preferred ingredient in cooking oils, salad dressings, and ready-to-eat types. Additionally, the growth of Mediterranean and gourmet cuisine in restaurants and packaged foods has further propelled olive oil as a premium ingredient across a variety of dishes and food types.

The application of olive oil in pharmaceutical industry is projected to grow at a CAGR of 7.4% from 2025 to 2030. In the U.S. pharmaceutical industry, the demand for olive oil is driven by its natural therapeutic properties, versatility, and increasing use in the formulation of various health types. Olive oil is valued for its antioxidant and anti-inflammatory properties, making it a key ingredient in supplements, topical ointments, and skincare types.

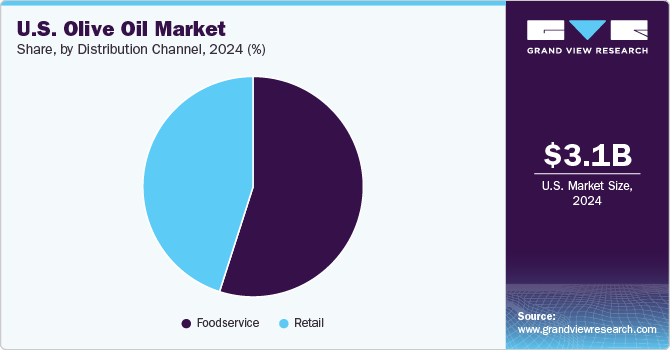

Distribution Channel Insights

Sales of olive oil through food service is accounted for a share of 54.9% of the U.S. revenues in 2024. Restaurants, especially those offering Mediterranean, Middle Eastern, and Italian cuisines, heavily use olive oil due to its health benefits and rich flavors. The rising demand for these cuisines and the growing popularity of plant-based and vegan diets in the U.S. have made olive oil a key ingredient in many dishes. As a plant-based fat source, it is widely used in salads, dips, and plant-forward menus, driving its increased use in foodservice. These factors are expected to boost olive oil demand in the foodservice sector.

The sales of olive oil through retail channels are anticipated to grow at a CAGR of 8.2% from 2025 to 2030. The rise of culinary trends that emphasize high-quality ingredients has had a significant impact on the demand for olive oil in the retail sector. As more consumers adopt this diet, they are purchasing olive oil to incorporate into their cooking routines. Moreover, the growing trend of home cooking, which accelerated during the COVID-19 pandemic, has further boosted retail sales of olive oil. With people spending more time at home, there has been a surge in demand for high-quality cooking ingredients, including olive oil. Cooking shows, food blogs, and social media influencers have also contributed to this trend by promoting the use of olive oil in a wide range of recipes, from simple salads to elaborate gourmet meals.

Key U.S. Olive Oil Company Insights

The market is fragmented in nature, attributed to the presence of numerous players in this market. U.S. manufacturers are focusing on producing organic and extra virgin olive oil (EVOO) to cater to health-conscious consumers. Furthermore, to attract consumers looking for variety, manufacturers are developing olive oils infused with herbs, garlic, chili, and other flavors. In addition, manufacturers are increasingly leveraging e-commerce platforms to reach consumers directly. Many olive oil brands are selling through online marketplaces, and company websites, providing consumers with easy access to olive oil.

Key U.S. Olive Oil Companies:

- Pompeian, Inc

- BERTOLLI

- FILIPPO BERIO

- Colavita USA, LLC

- STAR Fine Foods

- Goya Foods, Inc.

- California Olive Ranch Inc.

- OLIVARI

- Olivina, LLC

- Botticelli Foods LLC

- Spectrum Naturals

- Oliviers & Co. USA, Inc

- Corto Olive Co

- La Tourangelle, Inc.

Recent Developments

-

In September 2024, Corto Olive Co. launched its limited-edition Harvest 2024 Agrumato-Method Calabrian Chili Olive Oil, perfect for enhancing fall and holiday recipes. This unique oil combines the vibrant flavors of fresh heirloom Calabrian chilies and fall-harvest olives, delivering a complex and multi-dimensional taste experience. Renowned for its 100% California-grown olive oil, Corto aims to inspire home chefs seeking to add a spicy twist to their culinary creations this season.

-

In April 2024, Filippo Berio teamed up with the Alzheimer’s Drug Discovery Foundation to raise awareness and fund research for Alzheimer’s disease and related dementias. This partnership aligns with emerging research suggesting that olive oil may benefit both cardiovascular and brain health. The collaboration aims to promote awareness of lifestyle changes, particularly healthy dietary choices, that can positively impact brain health, helping consumers make informed health decisions.

-

In March 2024, California Olive Ranch (COR), a leading producer of extra virgin olive oil (EVOO) and related types, launched its new Chef's Bottles, designed to provide a versatile and user-friendly option for enjoying high-quality EVOO in everyday cooking. This type follows COR's recent expansions, which include a 100% California EVOO Bag-in-Box and a recyclable aluminum bottle line. The Chef's Bottle offers improved pouring control and reflects the brand's dedication to California's stringent quality standards, which are recognized as the highest in the world for EVOO

U.S. Olive Oil Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.34 billion

Revenue forecast in 2030

USD 4.78 billion

Growth rate

CAGR of 7.4% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, packaging, application distribution channel

Key companies profiled

Pompeian, Inc.; BERTOLLI; FILIPPO BERIO; Colavita USA, LLC; STAR Fine Foods; Goya Foods, Inc.; California Olive Ranch Inc.; OLIVARI; Olivina, LLC; Botticelli Foods LLC; Spectrum Naturals; Oliviers & Co. USA, Inc; Corto Olive Co; La Tourangelle, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Olive Oil Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. olive oil market report on the basis of type, packaging, application, and distribution channel:

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Refined

-

Virgin

-

Extra Virgin

-

Others

-

-

Packaging Outlook (Revenue, USD Million; 2018 - 2030)

-

Bottles

-

Pouches

-

Cans

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Food & Beverage

-

Personal Care and Cosmetics

-

Pharmaceuticals

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. olive oil market size was estimated at USD 3.13 billion in 2024 and is expected to reach USD 3.34 billion in 2025.

b. The U.S. olive oil market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 4.78 billion by 2030.

b. Refined olive oil dominated the U.S. olive oil market with a share of 30.6% in 2024. Demand for refined olive oil in the U.S. is driven by several factors, including health trends, culinary preferences, and the rising popularity of Mediterranean diets.

b. Some key players operating in the U.S. olive oil market are Pompeian, Inc., BERTOLLI, FILIPPO BERIO,, Colavita USA, LLC, STAR Fine Foods, Goya Foods, Inc., California Olive Ranch Inc., OLIVARI, Olivina, LLC, Botticelli Foods LLC, Spectrum Naturals, Oliviers & Co. USA, Inc, Corto Olive Co, La Tourangelle, Inc.

b. Key factors that are driving the U.S. olive oil market growth include confluence of health trends, culinary preferences, and evolving consumer attitudes. Central to this is the increasing recognition of olive oil's health benefits. As American consumers become more health-conscious, they are drawn to olive oil for its monounsaturated fats and antioxidants, which are associated with reduced risk of heart disease and overall wellness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.