- Home

- »

- Biotechnology

- »

-

U.S. Oligonucleotide Synthesis Market, Industry Report 2030GVR Report cover

![U.S. Oligonucleotide Synthesis Market Size, Share & Trends Report]()

U.S. Oligonucleotide Synthesis Market (2024 - 2030) Size, Share & Trends Analysis Report By Product & Service (Oligonucleotides, Equipment/Synthesizer), By Application (PCR Primers, Sequencing), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-290-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

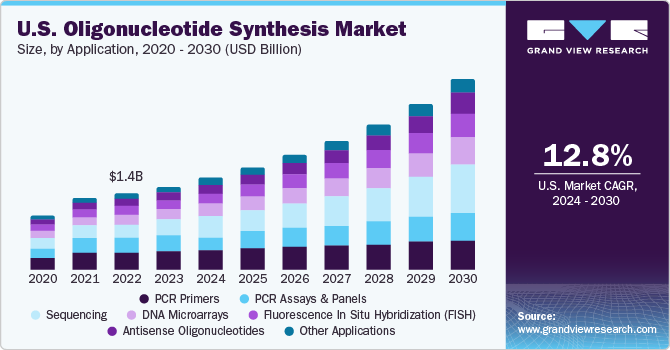

The U.S. oligonucleotide synthesis market size was estimated at USD 1.36 billion in 2023 and is projected to grow at a CAGR of 12.80% from 2024 to 2030. The growth can be attributed to the increasing demand for synthetic DNA & RNA sequences in various applications, such as research, diagnostics, and therapeutics development. The competitive landscape of this market is characterized by a mix of established players and emerging companies striving to capture a share of the expanding market. Moreover, Integrated DNA Technologies, Thermo Fisher Scientific, Eurofins Scientific, and Bio-Synthesis, Inc. are some of the leading players in the U.S. market.

The companies mentioned above are known for their comprehensive portfolio of high-quality products and services. Furthermore, some companies are engaging in strategic collaborations and partnerships to expand their product offerings, enhance technological capabilities, and access new markets. For instance, in February 2023, Fluor Corp., based in Irving, Texas, was chosen by Agilent Technologies, Inc. to enhance its oligonucleotide therapeutics manufacturing facility in Colorado, U.S., situated just north of Denver. Under this collaboration, Fluor will support the project's engineering and procurement. The total value of the project is estimated at USD 725 million.

A strong pipeline of oligonucleotide therapeutics in clinical trials is among the major drivers in the U.S. market. The FDA has authorized three oligonucleotide medicines. Ionis Pharmaceuticals (previously Isis Pharmaceuticals) created two of the three drugs-fomivirsen (Vitravene) and mipomersen (Kynamro)-which work by cleaving the targeted RNA using RNase H. Pegaptanib (Macugen), an aptamer created by OSI Pharmaceuticals & Pfizer, is the third authorized oligonucleotide. Oligonucleotide therapeutics participants are present in the late stages of clinical trials and are expected to be approved & commercialized over the forecast period. Furthermore, companies have increased investments to develop oligonucleotide-based therapeutics. For instance, in October 2023, GSK plc and Arrowhead Pharmaceuticals announced a contract with Janssen Pharmaceuticals, Inc. (Janssen), a Johnson & Johnson company, to assign to GSK exclusive worldwide rights to develop and commercialize JNJ-3989. Janssen initially in-licensed JNJ-3989 (previously ARO-HBV) from Arrowhead in 2018. Similar initiatives by well-established pharmaceutical companies are anticipated to drive market growth over the forecast period.

Furthermore, the growing number of cancer cases in the U.S. is having a positive impact on the U.S. market. The American Cancer Society predicts that in the year 2024, there will be 2,001,140 new cancer cases and 611,720 cancer-related deaths in the U.S. As the demand for new and improved cancer treatments increases, the requirement for synthetic oligonucleotides is growing. The synthetic oligonucleotides are used in a variety of research and diagnostic applications. The global oligonucleotide synthesis market is expected to continue to grow in the coming years as more and more companies invest in developing new and innovative cancer therapies.

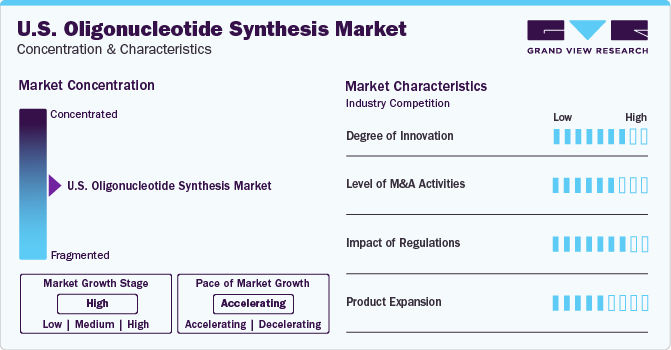

Market Concentration & Characteristics

The oligonucleotide synthesis industry in the U.S. has seen a significant degree of innovation in recent years, with the development of new technologies and processes that have increased the speed, accuracy, and efficiency of oligonucleotide synthesis. Many companies are investing heavily in research and development to stay ahead of the competition and bring new and innovative products to the industry. This has led to the introduction of new synthesis platforms, automation systems, and software tools that are designed to simplify the oligonucleotide synthesis process and improve yield, quality, and cost-effectiveness.

In recent years, there has been a significant increase in the level of M&A (mergers and acquisitions) activities in the U.S. oligonucleotide synthesis industry. For instance, in March 2021, IDT, a Danaher subsidiary, acquired Swift Biosciences, an NGS library preparation firm. The acquisition involves the integration of Swift's employees and products into IDT while maintaining operations at Swift's Ann Arbor, Michigan, facilities.

Regulations play a significant role in shaping the oligonucleotide synthesis industry in the U.S. The U.S. Food and Drug Administration (FDA) regulates the development, production, and distribution of oligonucleotide-based products, including diagnostic tools and therapeutic agents. Industry players must comply with various regulations to obtain FDA approval for their products, which can be time-consuming and expensive. However, adhering to these regulations is crucial for ensuring patient safety and gaining market access.

There is a growing demand for modified oligonucleotides with enhanced stability, specificity, and pharmacokinetic properties for therapeutic and diagnostic applications in the U.S. oligonucleotide synthesis industry. Product expansion in this area involves the development of novel modifications such as locked nucleic acids (LNAs), phosphorothioate linkages, and 2'-O-methyl modifications to improve oligonucleotide performance and efficacy.

Product & Service Insights

The services segment dominated the market with the largest share of 37.34% in 2023 and is expected to witness the fastest CAGR during the forecast period. As the complexity of genomic research and therapeutic applications increases, researchers & companies are turning to outsourcing for the synthesis, purification, and customization of oligonucleotide sequences. This trend is fueled by factors such as intricate design requirements of therapeutic oligonucleotides, the expanding scope of personalized medicine, and the growing need for cost-effective & scalable solutions. Outsourced services in oligonucleotide synthesis not only provide access to advanced technologies and expertise but also contribute to the acceleration of research and development timelines. In November 2023, Twist Bioscience launched Express Genes, an innovative gene synthesis service with a rapid turnaround time of 5 to 7 business days. This service, performed at Twist Bioscience's manufacturing facility located in Wilsonville, Oregon, facilitates the speedy production of genes.

The oligonucleotide segment is anticipated to grow at a significant CAGR of 13.24% from 2024 to 2030.Oligonucleotides are essential tools in molecular biology research, genetic testing, and drug development. With advancements in scientific research and the growing understanding of genomics & personalized medicine, the demand for custom oligonucleotides for experimentation & analysis is also growing. In addition, these are increasingly used in diagnostics for detecting genetic variations and mutations associated with diseases. Their therapeutic applications include gene therapy, antisense therapy, and RNA interference (RNAi). The expanding field of precision medicine and the development of nucleic acid-based therapies contribute to the growing demand for custom oligonucleotides. For instance, in October 2019, an Antisense Oligonucleotide (ASO) therapy tailored for CLN7 Batten disease was developed by neurologists and researchers at Boston Children’s Hospital, resulting in the halving of daily seizure frequency and an over 80% reduction in the duration of each seizure.

Application Insights

The PCR primers segment held the largest revenue share of 22.33% in 2023. PCR technology, fueled by specific primers, enables laboratories to identify minute amounts of pathogen DNA or RNA, aiding in the diagnosis of infectious diseases, such as viral infections, bacterial infections, and parasitic infections. It allows rapid and accurate diagnoses, leading to faster treatment interventions and improved patient outcomes. Furthermore, PCR primers help identify specific genetic markers associated with cancer types, enabling early detection and personalized treatment approaches. In addition, they play a role in monitoring cancer progression and assessing treatment response. According to NIH, laboratories are increasingly adopting multiplex PCR assays that simultaneously target multiple genes or pathogens. This requires specialized primer sets offering high multiplexity and specificity, creating opportunities for manufacturers catering to this growing demand.

The sequencing segment is anticipated to witness the fastest CAGR of 17.41% during the forecast period. Sequencing applications play a vital role in researching diverse aspects of genomics and genetics by analyzing genetic material such as DNA and RNA. This enables a deeper understanding of the genetic composition and functionality of organisms. Sequencing is particularly essential for identifying and monitoring pathogens, including emerging viruses and antibiotic-resistant bacteria. It requires swift and precise pathogen detection methods, often relying on oligonucleotide-based assays. The oligonucleotide synthesis market for sequencing in the U.S. has expanded due to advancements in sequencing technologies and bioinformatics tools, enhancing the efficiency and accuracy of genetic analysis.

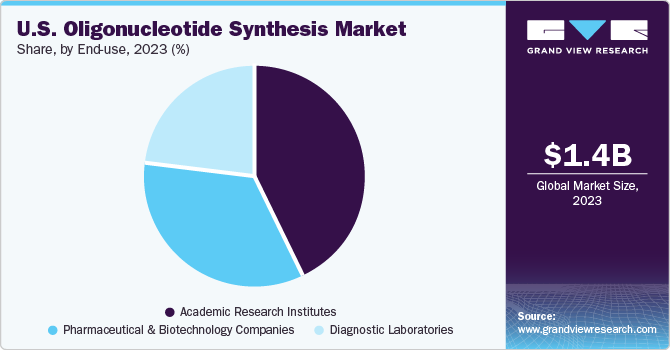

End-use Insights

In 2023, academic research institutes held the largest market share of 43.16%. Academic institutions are at the forefront of genomic research and innovation in the U.S. market. Researchers in academia are driven by interest and the purpose of knowledge, leading them to explore diverse areas of genomics. The segment growth can be attributed to the increasing number of research studies being conducted in these institutes and the availability of funding for research activities. For instance, in January 2020, the U.S. Intelligence Advanced Research Projects Activity offered USD 23.0 million to DNA Script and its partners, including Illumina, for DNA-based data storage. The organizations have collaborated for over four years to investigate the potential integration of enzymatic DNA synthesis technology and NGS into a unified instrument.

Pharmaceutical and biotechnology companies are expected to grow at the fastest CAGR of 14.67% from 2024 to 2030. Pharmaceutical and biotechnology companies in the U.S. are adopting precision medicine approaches that involve targeting specific genetic mutations, biomarkers, or pathways implicated in disease pathology. Oligonucleotide-based therapies offer the potential for personalized treatment strategies tailored to individual patients' genetic profiles. As a result, there is an increasing demand for custom-designed oligonucleotides with specific sequences, modifications, and delivery strategies to enable precise targeting and therapeutic efficacy.

Key U.S. Oligonucleotide Synthesis Company Insights

The market players operating in the U.S. oligonucleotide synthesis industry are undertaking product approvals to expand their product presence and enhance accessibility across various geographical regions. Expansion serves as a strategy to bolster production and research purposes. Moreover, numerous market entities are engaging in acquisitions of smaller firms to improve their market position. This approach enables companies to enhance capabilities, broaden product offerings, and develop new competencies.

Key U.S. Oligonucleotide Synthesis Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- Dharmacon Inc.

- Agilent Technologies

- Bio-synthesis

- LGC Biosearch Technologies

- Twist Bioscience

- TriLink BioTechnologies

- Genscript

Recent Developments

-

In October 2023, Danaher Corporation (Integrated DNA Technologies) inaugurated a new therapeutic manufacturing facility in the U.S. to meet the increasing demand for genomic medicine. The new facility is equipped to support the production of therapeutic oligonucleotides, catering to the expanding needs in the field of genomics and personalized medicine.

-

In May 2023, Thermo Fisher Scientific Inc. and Pfizer partnered to expand access to next-generation sequencing testing for lung and breast cancer patients in over 30 countries across Africa, Latin America, Asia, and the Middle East. By enabling local access to NGS testing, the collaboration seeks to expedite the analysis of relevant genes, enabling healthcare professionals to make more informed decisions regarding individualized therapy for patients.

-

In April 2023, Agilent Technologies Inc. introduced the NGS assay for comprehensive genomic profiling for advancing precision oncology.

U.S. Oligonucleotide Synthesis Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.09 billion

Growth rate

CAGR of 12.80% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & service, application, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies; Bio-synthesis; LGC Biosearch Technologies; Twist Bioscience; TriLink BioTechnologies; Genscript

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Oligonucleotide Synthesis Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. oligonucleotide synthesis market report based on product & service, application, and end-use.

-

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Oligonucleotides

-

DNA

-

Column-based

-

Array-based

-

RNA

-

By Technology

-

Column-based

-

Array-based

-

By Type

-

Short RNA Oligos (<65 nt)

-

Long RNA Oligos (>65 nt)

-

CRISPR (sgRNA)

-

Equipment/Synthesizer

-

Reagents

-

Services

-

DNA

-

Custom Oligo Synthesis Services

-

25 nmol

-

50 nmol

-

200 nmol

-

1000 nmol

-

10000 nmol

-

Modification Services

-

Purification Services

-

RNA

-

Custom Oligo Synthesis Services

-

25 nmol

-

100 nmol

-

1000 nmol

-

10000 nmol

-

Modification Services

-

Purification Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

PCR Primers

-

PCR Assays & Panels

-

Sequencing

-

DNA Microarrays

-

Fluorescence In Situ Hybridization (FISH)

-

Antisense Oligonucleotides

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research Institutes

-

Diagnostic Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Frequently Asked Questions About This Report

b. The U.S. oligonucleotide synthesis market size was estimated at USD 1.36 billion in 2023 and is expected to reach USD 1.50 billion in 2024.

b. The U.S. oligonucleotide synthesis market is expected to grow at a compound annual growth rate of 12.80% from 2024 to 2030 to reach USD 3.09 billion by 2030.

b. The services segment dominated the U.S. oligonucleotide synthesis market with a share of 37.34% in 2023. This is attributable to rising awareness and increasing adoption of oligonucleotide synthesis for research and development activities.

b. Some key players operating in the U.S. oligonucleotide synthesis market include Thermo Fisher Scientific, Inc.; Merck KGaA; Danaher Corporation; Dharmacon Inc.; Agilent Technologies; Bio-synthesis; LGC Biosearch Technologies; Twist Bioscience; TriLink BioTechnologies; Genscript.

b. Factors such as decreasing prices of sequencing and increasing demand for custom-made nucleotides for applications across genetic testing, research, and drug development are expected to boost the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.