U.S. Oleochemicals Market Size & Trends

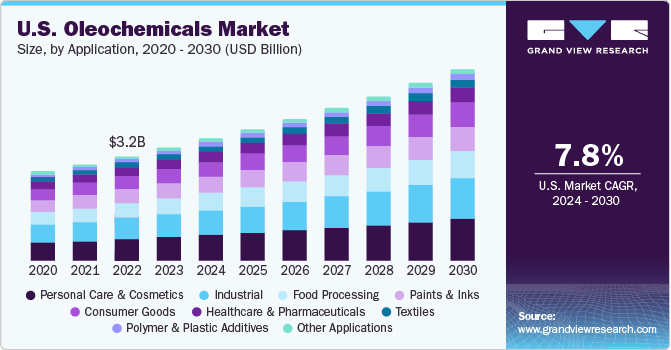

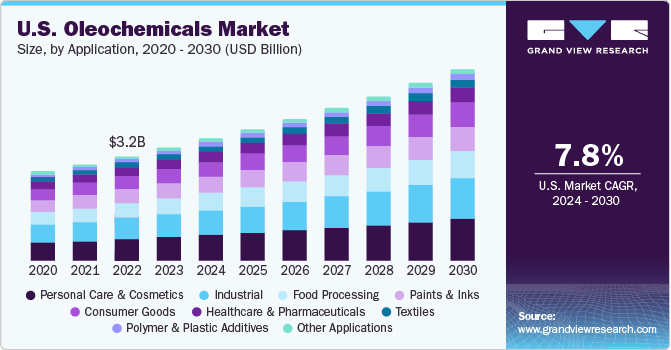

The U.S. oleochemicals market size was estimated at USD 3.4 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. The key growth drivers for this market are the growing demand for sustainable products, increasing development of biodegradable products, and growth experience by end use industries, such as pharmaceuticals, personal care, and food products.

The U.S. oleochemicals market held a share of 65.6% of the global oleochemicals market revenue in 2023. Oleochemicals are chemical compounds derived from natural sources of oils and fats, such as plants & animals. To derive these, numerous processes are followed where triglycerides are split into fatty acids and glycerol. Some major sources of oleochemicals include coconut, palm, olive, soybean, fish, sunflower seed, poultry fats, and other organic materials.

Oleochemicals are extensively used in consumer goods, such as toothpaste, soaps, and moisturizing lotions. The demand for such products is increasing as brands operating in the personal care & hygiene industry focus on offering diverse product portfolios and enhancing the brand visibility to potential customers through increased offline presence and other promotional activities. A few other factors driving industry growth include the rising consumer disposable income levels, leading to an increased demand for personal care products, such as hair care, acne treatment products, and male grooming personal care products.

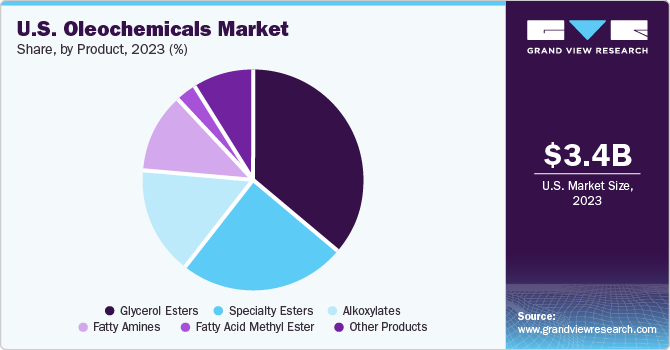

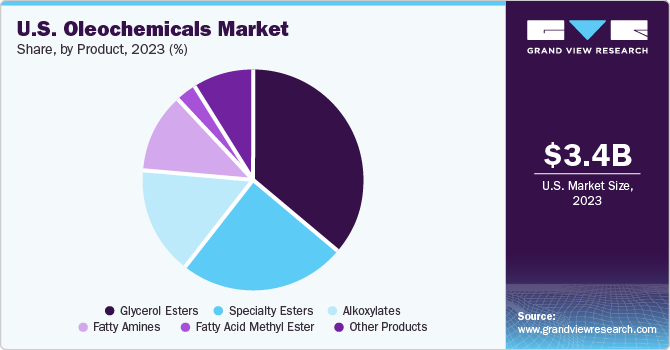

Product Insights

The glycerol esters segment dominated the market and held the largest revenue share of 36.6% in 2023. This is primarily due to the growing consumption of food products where food-grade glycerol is used as a key ingredient in the manufacturing process. These products include flavored beverages, ice creams, and chewing gum. Glycerol monostearate (GMS) is utilized in the food & beverage industry and cosmetic products. It is also used as an emulsifier in confectionery and exotic foods.

The fatty acid methyl ester (FAME) segment is expected to grow at a CAGR of 10.2% from 2024 to 2030. FAME, a derivative of the original compound fatty acid ester, is produced through the transesterification of fats, such as vegetable oils, waste cooking oils, animal fats, and methanol while using sodium hydroxide or sodium methoxide as a catalyst. This product is extensively used in the development of biodiesel. According to the U.S. Department of Energy, U.S. biodiesel production was 1.7 billion gallons in 2023.

Application Insights

The personal care & cosmetics segment held the largest revenue share of 21.1% in 2023. The segment growth is driven by the rising inclusion of oleochemicals in developing and manufacturing personal care & cosmetic products. Oleochemicals provide moisturizing properties to the product and enhance its feel and texture. Rising acceptance of personal care products & cosmetics is expected to drive demand for oleochemicals in the coming years.

The industrial applications segment is expected to grow at a CAGR of 8.4% from 2024 to 2030. This segment includes industries, such as oilfield chemicals, pulp & paper chemicals, construction chemicals, lubricant additives, metalworking fluids, agrochemicals, water management chemicals, and rubber processing. In recent years, products that are increasingly used include alcohol sulfates, ether sulfates, fatty amines, and others.

Key U.S. Oleochemicals Company Insights

Some of the key and emerging companies in the U.S. oleochemicals market include Vantage Specialty Chemicals, Cargill Incorporated, Godrej Industries, Stepan Company, Emery Oleochemicals, Oleon NV, BASF SE, Procter & Gamble (P & G Chemicals) and others. With the increasing number of end use industries and organizations, the key players are adopting strategies, such as innovation, enhanced R&D, collaborations, and capacity expansions.

-

Vantage Specialty Chemicals, a prominent global supplier of naturally derived specialty ingredients and formulations, provides solutions to multiple industries, such as personal care, food, life sciences, and other niche market participants. It has a geographical reach of nearly 89 countries. Vantage Chicago is the oleochemicals headquarters of the company

-

Cargill Inc., a major market participant in the global industry, provides a range of products, including esters, fatty acids, and polyols. Its effort towards attaining sustainability and continuous innovation has strengthened its position in the market. Glycerol esters are one of the key offerings from the company’s oleochemicals portfolio

Key U.S. Oleochemicals Companies:

- Vantage Specialty Chemicals

- Cargill Incorporated

- Godrej Industries

- Stepan Company

- Emery Oleochemicals

- Oleon NV

- BASF SE

- Procter & Gamble (P & G Chemicals)

- Apical

Recent Developments

-

In April 2024, Vantage Specialty Chemicals expanded its N-Methyl Taurine capacity at its Leuna site. The strategic expansion is aimed at meeting unceasing consumer demand in the personal care, industrial, and household sectors

U.S. Oleochemicals Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 5.8 billion

|

|

Growth rate

|

CAGR of 7.8% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments Covered

|

Product, application

|

|

Key companies profiled

|

Vantage Specialty Chemicals; Cargill Inc.; Godrej Industries; Stepan Company; Emery Oleochemicals; Oleon NV; BASF SE; Procter & Gamble (P & G Chemicals); Apical

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Oleochemicals Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. oleochemicals market report based on application and product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Glycerol Esters

-

Specialty Esters

-

Alkoxylates

-

Fatty Amines

-

Other Products

-

Fatty Acid Methyl Ester

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal Care & Cosmetics

-

Industrial

-

Food Processing

-

Paints & Inks

-

Consumer Goods

-

Healthcare & Pharmaceuticals

-

Textiles

-

Polymer & Plastic Additives

-

Other Applications