U.S. Office Furniture Market Size, Share & Trends Analysis Report By Product (Seating, Modular Systems, Desk & Tables), By Distribution Channel (Offline, Online), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-149-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Office Furniture Market Size & Trends

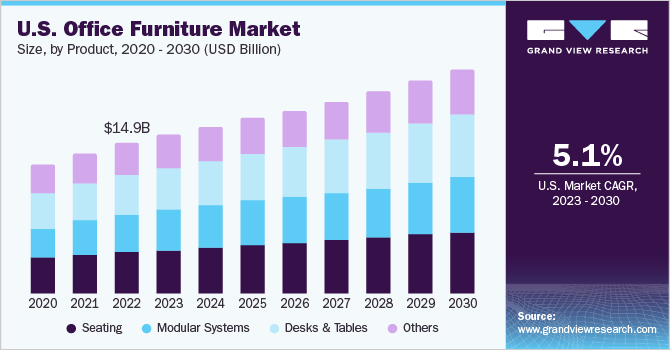

The U.S. office furniture market size was estimated to be estimated at USD 16.64 billion in 2024 and is expected to grow at a CAGR of 5.0% from 2025 to 2030. One of the major factors driving the market growth is the increasing building of households, offices, and commercial complexes. The growing number of people working from home or remote locations is increasing the demand for home office equipment among retailers and manufacturers. Customers are attracted to smart, comfy, and flexible furniture designs owing to the easy and quick delivery alternatives. In addition, the rapid creation of IT parks and commercial zones has increased the number of corporate offices, resulting in a need for contemporary office furniture all over the world.

Organizations are also creating informal office areas to improve colleague communications, collaborative environments, and social connections. As a result of this trend, office furniture makers have begun to produce intelligently designed furniture. In addition, due to technological advancements and an increase in the number of cases of health issues caused by employees' sedentary lifestyles, there has been an increase in the demand for smart workplace furniture that provides internet connectivity while also promoting better posture and movement support. During the projection period, this factor is projected to have a substantial impact on the demand for office furniture. Moreover, the dynamic company landscape, the swift establishment of IT parks, the rise in startup ventures, corporate expansions, and growing commercial zones have fueled the demand for office spaces and employment opportunities.

The increasing investments in office infrastructure, particularly driven by the development of corporate centers in different regions, are projected to create a demand for office furniture, such as ergonomic chairs, throughout the forecast period. According to a 2020 Economic Impact Study conducted by the Building Owners and Managers Association of the U.S. (BOMA), the establishment of company offices in the U.S. is on the rise. The study also revealed that BOMA's local associations serve approximately 25,000 square feet of private-sector office buildings in the U.S.

The information technology industry remains a robust and expanding sector, with its significant influence on the U.S. economy and the job market. This scenario is expected to have a positive effect on the U.S. market. The tech industry experienced rapid expansion and substantial profitability during the pandemic as a result of increased online shopping, remote work, and virtual social interactions. However, the resurgence of commercial office real estate, driven by the tech industry's recovery, is evident in the suburban areas of Phoenix. According to a report by CBRE Group, Inc., the tech industry's leasing of office space in the U.S. increased by 27% in 2021 compared to 2020.

One of the primary factors propelling the market growth is the widespread adoption of the work-from-home (WFH) paradigm as a result of the coronavirus (COVID-19) pandemic. Because of the unexpected spread of the infection and the statewide lockdown, many people were working from home, which is boosting the demand for comfortable and sturdy office furniture for home offices. Furthermore, to strengthen their distribution network, many key players are forming agreements with e-commerce retail stores. The demand for office furniture grew in tandem with the exponential growth of commercial buildings and service sector jobs. Another factor projected to boost market growth is a rise in the number of start-ups and corporate expansions. The market growth is expected to be fueled by the increased demand for office space and employment.

COVID-19 has expedited several preexisting trends in the commercial property market surrounding health and well-being, activity-based working, flexibility, and the need for greater space use, in the American market, according to an ARUP report published in June 2020 titled Future of offices: in a post-pandemic world. The commercial offer is also being reshaped by sustainability, smart buildings, and the digital workplace. Taken together, these trends and changes will have a significant impact on the kind of workplaces that will be required in the aftermath of a pandemic. Consumers shifting from regional brands to international brands are influenced by the design and aesthetic appeal, along with the availability of a variety of colors and materials.

High durability, standard testing, certifications, such as the Business and Institutional Furniture Manufacturers Association (BIFMA) and Leadership in Energy and Environmental Design (LEED), and warranty play a role in consumers shifting toward international brands. Furthermore, the raw materials and fabric used in office furniture play a significant role in affecting consumers’ purchasing decisions. The use of anti-sweat and anti-microbial fabric for office seating to maintain hygiene and day-long comfort acts as an added benefit for customers with specific needs in mind.

Product Insights

The seating segment accounted for the largest share of over 27% in 2024. Proper seating has become increasingly important as employees spend more than 8-10 hours every day at work. To minimize illness and fatigue, office chairs must be designed according to scientific principles as the optimal posture while working has a significant impact on health. In the U.S., there is a growing need for ergonomic seats, which aid in improving staff productivity, efficiency, and workplace aesthetics. Customers in the U.S. want to purchase high-quality furniture that not only looks good but is also composed of high-quality materials. When it came to selecting office furniture, in the U.S. in 2021, about a third of buyers prioritized desks and tables.

Demand for office modular systems is expected to rise at a CAGR of 5.5% from 2025 to 2030. Modular systems in offices are designed to be easily disassembled and reassembled in different configurations, allowing offices to quickly and easily modify their layouts to fit different needs. Modular pieces can be used either combined or separately, and they make it easy for offices to expand as they grow without changing the overall setup and style.

Distribution Channel Insights

The offline segment accounted for a share of about 65% of the U.S. office furniture market in 2024. Offline furniture shopping addresses customer needs such as personalized pre-sales information, installation support, and immediate delivery. The U.S. is developing in terms of technology infrastructure and internet adoption. Hence, a large portion of the population in these regions is still shopping for furniture, including eco-friendly furniture, offline. U.S.-based Williams-Sonoma Inc. offers eco-friendly office furniture through online and offline modes. U.S.-based Crate and Barrel is another eco-friendly furniture offering company that has stores and independent franchise stores in multiple continents and numerous countries.

Demand for office furniture in the U.S. through online channels is expected to grow at a CAGR of 9.1% from 2025 to 2030. The pandemic accelerated the adoption of e-commerce in the office furniture market. Businesses have increasingly turned to online platforms to source office furniture due to convenience, wider product selection, and reduced physical interactions. E-commerce offers a streamlined procurement process, enables remote browsing and purchasing, and provides opportunities for cost savings, making it a highly promising avenue for the office furniture industry post-pandemic.

Key U.S. Office Furniture Company Insights

The U.S. office furniture market is fragmented in nature. The market is characterized by the presence of a diverse array of players—from large corporations to smaller, regional/local providers. Some of the leading players in the market are Herman Miller Inc., HNI Corporation, Steelcase Inc., and Haworth Inc. among others. Players are engaging in acquisitions, product launches, and promotional activities to increase their customer base and brand loyalty.

Key U.S. Office Furniture Companies:

- Herman Miller Inc.

- HNI Corporation

- Steelcase Inc.

- Haworth Inc.

- 9to5 Seating LLC

- Ashley Furniture Industries, LLC

- Global Furniture Group

- Teknion

- OKAMURA CORPORATION

- Interior Systems, Inc.

Recent Developments

- In June 2023, 9to5 Seating LLC manufactured the Ellie Chair for ITO Design, an industrial design studio. The product was also given The Chicago Athenaeum's 2022 Good Design Award. The chair has a variety of configuration possibilities, stylish finish colors, and a distinctive spherical seat.

- In June 2023, Herman Miller Inc. increased the availability of its Sayl Chair by making it available in Latin America, North America, and Asia. Each chair contains 0.9 pounds or more of improperly disposed plastic garbage that was discovered around rivers. The momentum started when ocean plastic was added to the famous Aeron Chair in 2021 and is continued by Sayl Chair.

- In June 2023, HNI Corporation completed the acquisition of Kimball International, Inc., a provider of furnishings for workplaces, hospitality, and health spaces. Due to Kimball International, Inc.'s strong geographic presence in auxiliary markets and product knowledge, the company aims to better position itself to capitalize on post-pandemic trends in the fastest-growing countries.

U.S. Office Furniture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.43 billion |

|

Revenue forecast in 2030 |

USD 22.24 billion |

|

Growth rate (Revenue) |

CAGR of 5.0% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Herman Miller Inc.; HNI Corporation; Steelcase Inc.; Haworth Inc.; 9to5 Seating LLC; Ashley Furniture Industries, LLC; Global Furniture Group; Teknion; OKAMURA CORPORATION; Interior Systems, Inc. |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Office Furniture Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. office furniture market report by product, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Seating

-

Modular Systems

-

Desks & Tables

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. office furniture market size was estimated at USD 16.64 billion in 2024 and is expected to reach USD 17.43 billion in 2025.

b. The U.S. office furniture market is expected to grow at a compound annual growth rate of 5.0% from 2025 to 2030 to reach USD 22.24 billion by 2030.

b. Seating dominated the U.S. office furniture market with a share of 27.6% in 2024. This is attributable to the growth in commercial and office building construction and remodeling activities.

b. Some key players operating in the U.S. office furniture market include Herman Miller Inc.; HNI Corporation; Steelcase Inc.; Haworth Inc.; 9to5 Seating LLC; Ashley Furniture Industries, LLC; Global Furniture Group; Teknion; OKAMURA CORPORATION; Interior Systems, Inc.

b. Key factors that are driving the U.S. office furniture market growth include the growth of the commercial sector and an increase in office improvement activities.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."