- Home

- »

- Medical Devices

- »

-

U.S. Nutritional Supplements Market, Industry Report, 2030GVR Report cover

![U.S. Nutritional Supplements Market Size, Share & Trends Report]()

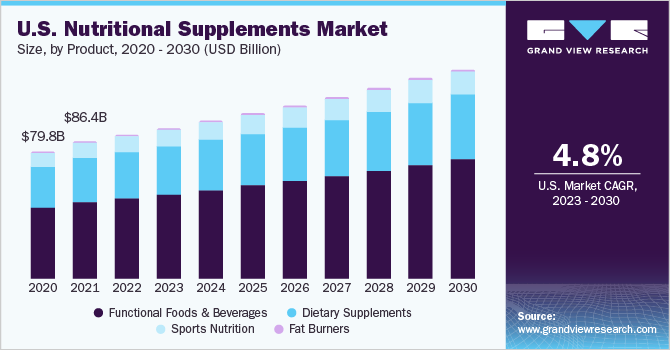

U.S. Nutritional Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report by Product (Sports Nutrition, Fat Burners, Dietary Supplements, Functional Foods & Beverages), By Consumer Group, By Formulation, By Sales Channel, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-244-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nutritional Supplements Market Trends

The U.S. nutritional supplements market size was valued at USD 112.6 billion in 2024 and is anticipated to grow at a CAGR of 4.9% from 2025 to 2030. The growing awareness and prioritization of health and wellness among consumers fuels the demand for nutritional supplements. This includes approaching proactive ways such as improving their well-being, which leads to purchasing supplements that address nutritional deficiencies and obesity and enhance immunity, energy levels, and mental health. E-commerce has become a significant distribution channel, allowing consumers an easier access to a wide range of products. Therefore, the market is poised for substantial expansion as consumer awareness of health and preventive care continues to rise.

The prevalence of chronic health conditions, such as heart disease, diabetes, and obesity, is rising globally. As these conditions have become more common, people are turning to supplements as a preventive or complementary approach to traditional medical treatments. Nutritional supplements are increasingly perceived as a way to manage and prevent health issues, especially among those looking to avoid medications or seek natural alternatives. The aging population in the U.S. has contributed to the growing demand for supplements. Adults require extra nutritional support for bone, joint, cognitive, and heart health. The need for supplements to maintain vitality and manage age-related conditions is increasing with demand.

Concerns such as immunity and overall health are making individuals shift their focus toward supplements to bolster their immune systems and protect against illnesses. This results in the demand for immune-supporting supplements, such as Vitamin C, D, and zinc, accelerating market growth. For instance, in 2023, a recent survey revealed that most adults in the U.S. use dietary supplements, 58.5% of adults reported using at least one supplement, and a third of children and adolescents followed the same pattern.

According to the U.S. Food and Drug Administration, the dietary supplements are coordinated by the Human Foods Program’s Office of Food Chemical Safety, Dietary Supplement, and Innovation. In addition, before the product is marketed, manufacturers and distributors are expected to evaluate the safety and labeling of their products and meet all the requirements amended by DSHEA and FDA regulations. The expansion of e-commerce has made nutritional supplements more accessible to a wider audience. Online shopping platforms provide consumers with a convenient way to purchase various supplements alongside expert recommendations, reviews, and competitive pricing. This ease of access, combined with social media influence and marketing, is expected to fuel the popularity of supplements among younger demographics, who are particularly influenced by wellness trends.

Product Insights

The functional foods and beverages segment dominated the market with a share of 49.5% in 2024, which can be attributed to the increasing demand of consumers and its innovative product offerings. There has been a significant increase in innovative products, including formulations such as textures, new flavors, and functional ingredients. According to an article published by Ingredients Network in July 2024, functional mushroom products, including supplements and fortified foods and beverages, are gaining popularity among young consumers in the U.S. Furthermore, 37.0% of people consume foods and beverages derived from functional mushrooms. Varieties such as reishi and lion’s mane are gaining popularity regarding health benefits such as immunity and mental health.

The sports nutrition segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. Individuals, from casual gym-goers to professional athletes, prioritize performance enhancement, muscle recovery, and overall health, increasing their need for products. Sports nutrition products, such as protein powders, energy bars, and electrolyte drinks, provide targeted benefits such as improved endurance, muscle building, and hydration. In addition, the increasing popularity of fitness and wellness trends, coupled with greater awareness of the importance of nutrition in athletic performance, drives demand.

Consumer Group Insights

The adult segment dominated the market with a share of 51.3% in 2024 as the adult population is becoming more health-conscious and is increasing awareness of maintaining proper nutrition. These include supplements that fill dietary gaps, boost energy, and support overall wellness. The growing popularity of preventive health measures, including supplements for immune support and general well-being, further contributes to this demand. With advancements in supplement formulations, such as personalized and clean-label products, adults increasingly opt for these solutions to enhance their health and longevity.

The geriatric segment is expected to witness considerable growth over the forecast period. The geriatric population often experiences changes in metabolism, digestion, and the ability to absorb nutrients, making it more challenging to meet their nutritional needs through food alone. Supplements tailored to older adults help address these gaps by supporting bone health, cognitive function, heart health, and immune support. The increase in life expectancy and a greater focus on healthy aging also drive the demand for products specifically designed for the geriatric population. With the convenience of supplements and the growing availability of products that cater to the unique nutritional needs of seniors, this segment is expected to see continued growth in the U.S. nutritional supplements market.

Formulation Insights

The powder segment dominated the market with a share of 38.7% in 2024. Powdered supplements, such as protein powders, meal replacements, and vitamins, are favored by consumers for their ability to be easily mixed into beverages or smoothies, allowing for quick and customizable nutrient intake. As more people adopt active lifestyles and focus on fitness, powdered formulas offer a convenient way to support muscle growth, energy levels, and overall health. The growing trend of personalized nutrition also contributes to the rise of powder-based supplements, as they can be easily tailored to meet specific health goals or dietary preferences.

The capsules segment is expected to grow at the fastest CAGR of 7.2% over the forecast period as they are a quick method of taking supplements, making them a favored choice for busy individuals seeking a simple and effective way to incorporate vitamins, minerals, or other nutrients into their daily routine. In addition, capsules are often associated with high-quality formulations, as they can contain a wide range of ingredients, from herbal extracts to specialized nutrients, without the need for artificial fillers or preservatives.

Sales Channel Insights

The brick-and-mortar segment dominated the market with a share of 58.2% in 2024. Consumers prefer shopping in physical stores where they can seek advice from familiar staff, especially when navigating the wide range of supplement options available. In-store experiences provide a sense of trust and reliability that online shopping may not offer, as consumers can directly evaluate product quality through labeling and packaging. In addition, physical stores often provide convenience for those who wish to make spontaneous purchases without waiting for delivery times.

The e-commerce segment is expected to grow at the fastest CAGR of 6.4% over the forecast period. Online shopping allows consumers to browse various nutritional supplements from various brands and compare prices easily without leaving home. E-commerce platforms also provide detailed product information, reviews, and ratings that help consumers make informed purchasing decisions. In addition, the rise of subscription-based services and targeted marketing, such as personalized supplement recommendations based on health goals, is further driving online sales.

Application Insights

The weight management segment dominated the market with a share of 58.2% in 2024. As more people become aware of the health risks associated with excess weight, including heart disease, diabetes, and joint problems, there is a growing interest in products that support healthy weight loss and maintenance. Supplements such as fat burners, appetite suppressants, and metabolism boosters are becoming popular as individuals seek additional ways to manage their weight alongside diet and exercise. The increasing focus on fitness and body image and the desire for quick and convenient solutions have also driven demand for weight management products.

The sports & athletics segment is expected to grow at the fastest CAGR of 9.9% over the forecast period. With the growing number of individuals engaging in physical activities, from recreational fitness enthusiasts to competitive athletes, there is an increasing need for supplements that aid in muscle recovery, endurance, and overall performance. Products such as protein powders, amino acids, creatine, and electrolytes are sought after to improve strength, energy, and hydration. The growing emphasis on healthy living and sports participation, combined with the desire to optimize athletic performance, is contributing to this trend. With greater awareness of the role nutrition plays in performance, the sports and athletics application segment in the nutritional supplements market is expected to continue growing.

Key U.S. Nutritional Supplements Company Insights

Some key players operating in the U.S. nutritional supplements market are Glanbia PLC and Abbott.; Nestlé Health Science; Herbalife International of America, Inc.; Amway Corp.; PepsiCo; Mondelez International group. (Clif Bar & Company); SiS (Science in Sport) PLC; and CSN Supplements. These companies employ various strategies to gain a competitive edge, such as launching new products to cater to diverse patient needs, focusing on personalized medicine to enhance treatment efficacy, and leveraging emerging markets to tap into increasing awareness about botanicals and acupuncture. Furthermore, these businesses engage in collaborative research initiatives with healthcare organizations to drive innovation while integrating digital health solutions for enhanced patient access and adherence.

-

Glanbia PLC is a nutrition company known for its extensive portfolio of nutritional products, particularly in the dietary supplement sector. The company operates through several sectors, such as Glanbia Performance Nutrition, which produces brands such as Optimum Nutrition, ISOPURE, and BSN. The brands are popular among fitness enthusiasts and athletes.

-

Nestlé Health Science was established to focus on the intersection of nutrition, science, and wellness. The company aims to develop its portfolio of products, such as dietary supplements, medical nutrition products, and consumer health solutions. It also focuses on strengthening its position through strategic acquisitions, such as the acquisitions of Atrium Innovations and Vital Proteins.

Key U.S. Nutritional Supplements Companies:

- Glanbia PLC

- Abbott.

- Nestlé Health Science

- Herbalife International of America, Inc.

- Amway Corp.

- PepsiCo

- Mondelez International group (Clif Bar & Company)

- SiS (Science in Sport) PLC

- THG PLC

- CSN

Recent Developments

-

In July 2024, Nestlé Health Science launched the GLP-1 Nutrition initiative to support consumers’ side effects from weight loss medications. The popularity of weight loss increases has led to a change in the consumer’s diet. The company provides hair growth supplements, electrolyte tablets, and collagen peptides to address hair loss and skin elasticity issues. Furthermore, it emphasizes preserving lean muscle mass and ensuring adequate nutrition intake.

-

In April 2024, Glanbia PLC acquired Flavor Producers LLC from Aroma Holding Co., LLC with a consideration of USD 300 million for expanding its nutrition platforms. Flavor Producers specializes in developing and manufacturing natural and organic flavors. The acquisition is expected to enhance Glanbia’s capabilities in natural flavors segments.

U.S. Nutritional Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 118.1 billion

Revenue forecast in 2030

USD 150.1 billion

Growth rate

CAGR of 4.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, consumer group, formulation, sales channel, application

Country scope

U.S.

Key companies profiled

Glanbia PLC; Abbott; Nestlé Health Science; Herbalife International of America, Inc.; Amway Corp.; PepsiCo; Mondelez International group (Clif Bar & Company); SiS (Science in Sport) PLC; THG PLC; CSN

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nutritional Supplements Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nutritional supplements market report based on product, consumer group, formulation, sales channel, and application.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Nutrition

-

Sports Supplements

-

Protein Supplements

-

Egg Protein

-

Soy Protein

-

Pea Protein

-

Lentin Protein

-

Hemp Protein

-

Casein

-

Quinoa Protein

-

Whey Protein

-

Whey Protein Isolate

-

Whey Protein Concentrate

-

-

-

Vitamins

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

-

Amino Acids

-

BCAA

-

Arginine

-

Aspartate

-

Glutamine

-

Beta Alanine

-

Creatine

-

L-carnitine

-

-

Probiotics

-

Omega-3 Fatty Acids

-

Carbohydrates

-

Maltodextrin

-

Dextrose

-

Waxy Maize

-

Karbolyn

-

-

Detox Supplements

-

Electrolytes

-

Others

-

-

Sports Drinks

-

Isotonic

-

Hypotonic

-

Hypertonic

-

-

Sports Foods

-

Protein Bars

-

Energy Bars

-

Protein Gel

-

-

Meal Replacement Products

-

Weight Loss Product

-

-

Fat Burners

-

Green Tea

-

Fiber

-

Protein

-

Green Coffee

-

Others

-

-

Dietary Supplements

-

Vitamins

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

-

Minerals

-

Enzymes

-

Amino Acids

-

Conjugated Linoleic Acids

-

Others

-

-

Functional Foods and Beverages

-

Probiotics

-

Omega-3

-

Others

-

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Powder

-

Softgels

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Brick & Mortar

-

Direct Selling

-

Chemist/ Pharmacies

-

Health Food Shops

-

Hyper Markets

-

Super Markets

-

-

E-Commerce

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Infants

-

Children

-

Adults

-

Age Group 21 to 30

-

Age Group 31 to 40

-

Age Group 41 to 50

-

Age Group 51 to 65

-

-

Pregnant

-

Geriatric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Athletics

-

General Health

-

Bone & Joint Health

-

Brain Health

-

Gastrointestinal Health

-

Immune Health

-

Cardiovascular Health

-

Skin/ Hair/ Nails

-

Sexual Health

-

Women Health

-

Anti-Aging

-

Weight Management

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.