- Home

- »

- Medical Devices

- »

-

U.S. Nurse Call Systems Market Size, Industry Report, 2030GVR Report cover

![U.S. Nurse Call Systems Market Size, Share & Trends Report]()

U.S. Nurse Call Systems Market Size, Share & Trends Analysis Report By Technology (Wired Communication Equipment, Wireless Communication Equipment), By Type (Mobile Systems), By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-274-5

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Nurse Call Systems Market Trends

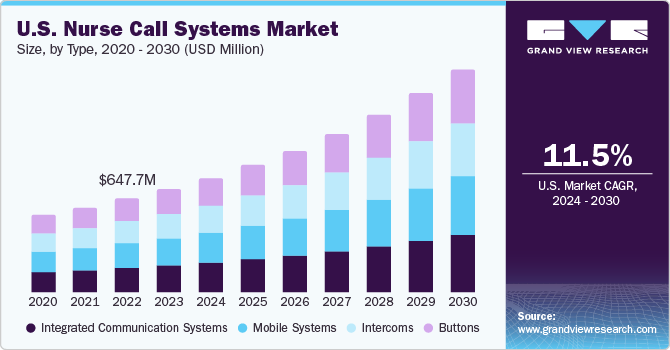

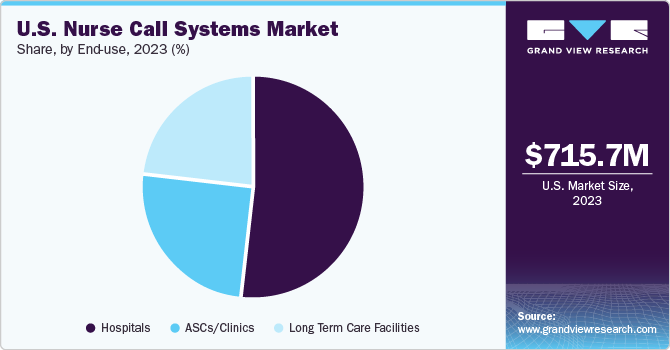

The U.S. nurse call systems market size was valued at USD 715.7 million in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030. The increasing need for a diverse & integrated platform that supports growing preference for mobility aids is driving the market growth.

The U.S. nurse call systems market accounted for over 38% share in the global nurse call systems market in 2023. Nurse call systems enable reliable and flexible communication between the patients and caregivers. Increasing patient numbers in healthcare facilities and introduction of advanced ways to expand communication, workflow, and management to provide quality patient care is fueling the market growth. Market growth is also driven by technological advancements that have allowed companies to create innovative devices. Moreover, with the rise in home healthcare and nursing home facilities, major industry players are focusing on the need for better patient response time along with eliminating nurse fatigue. Vendors are differentiating their products by integrating their devices with different diagnostic solutions and technologies.

Integration of nurse call system with electronic health records for transition of conventional call systems to digital systems has revolutionized the market. Moreover, adoption of internet protocol-based nurse call system facilitates central management of data from different hospitals, enabling integrating diverse healthcare settings. Government support to adopt digital healthcare for paperless data and improvement in regulatory framework to standardize nurse call system approval process for streamlining healthcare workflow are expected to boost the market growth.

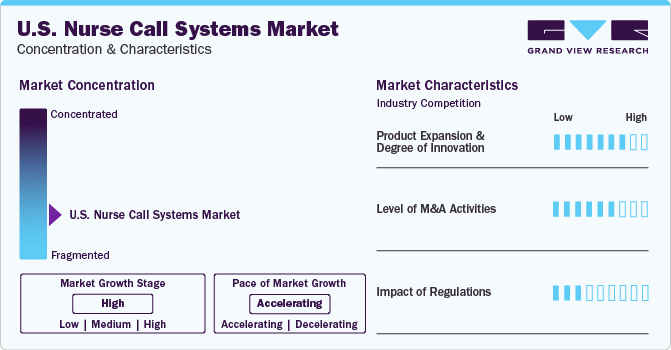

Market Concentration & Characteristics

Development of sophisticated & easy-to-use devices and services, such as internet-enabled monitors, alert systems, telemedicine, and apps for mobile health, have helped in the provision of enhanced long-term care services. Such developments are helpful to increase the product demand.

-

Growing adoption of real-time location system (RTLS) integrated with wireless technologies in various healthcare facilities is propelling the market demand. RTLS allows healthcare facilities to track the movement of attendants and equipment to increase productivity. For instance, Televic's AQURA Care Communication Platform is an integrated platform with various modules such as nurse call, personal localization (RTLS), patient and staff safety, alarm delivery, personal mobility, and mediator control. The platform is open for integrating both its module and mediator module, along with the hospital infrastructure data.

-

The U.S. nurse call systems market is characterized by a high level of M&A activities undertaken by leading companies. This is due to factors including the increasing focus on portfolio enhancement and the need to consolidate in a rapidly growing market. Several market participants are undertaking this strategy to strengthen their portfolio. For instance, in May 2023, West-Com Nurse Call Systems entered into a strategic partnership with Vitalchat to deliver AI-driven virtual care in hospital systems and other healthcare facilities across U.S.

-

Stringent FDA regulations help maintain the quality of nurse call systems, thereby enabling high quality and reliable products. The FDA’s Quality System regulations set regulatory standards for the designing and manufacturing of these systems. Companies are required to follow Good Manufacturing Practices (GMP). They are expected to maintain certain records, as FDA conducts routine inspections for assessing and regulating manufacturing processes and quality of products.

Technology Insights

Wired communication equipment segment held the largest market share of 53.3% in 2023. Key industry participants are offering integrated solutions, wherein the data saved in monitor screen is a summation of the readings from different systems. Hospitals are expanding their facilities to offer real-time information by incorporating technology-updated systems.

Wireless communication equipment segment is anticipated to witness lucrative growth owing to the higher level of integration, reduced cost for installation as compared to wired technology, and better patient mobility. For senior and assisted living facilities patients, mobility is crucial, where wireless nurse call buttons or pendants prove to be a great support. In January 2019, Rauland Corporation launched a next-generation platform for its Responder intelligent nurse call solution to optimize clinical workflow for better patient outcomes.

Type Insights

Integrated communication systems dominated the market, accounting for a share of 26.2% in 2023. Increased acceptance of the latest technology, increased patient satisfaction, and improved care efficiency are factors attributable for the prominent segment share. With rapid technological advances, government is concentrating its efforts to fund hospitals to support the use of state-of-the-art communication devices.

The buttons segment is expected to register lucrative growth during the forecast period. Patients typically use a push-button device to alert caregivers that assistance is needed. These devices are easy to use because the patient only has to press a push-button switch. The button system can be used in various healthcare settings such as hospitals, clinics, and home medical facilities, and contributes to smooth operation of medical facilities while ensuring the safety of patients.

Application Insights

The wanderer control segment accounted for a significant revenue share of 34.5% in 2023. Wanderer control systems send wander alerts, including resident photo, name, and location to the relevant network and devices. Increasing concerns regarding safety and security are propelling the segment demand.

Workflow optimization is projected to register the fastest CAGR during the forecast period. Incresing need to reduce operating cost and effective healthcare resource allocation is likely to favor the segment growth. Increasing efforts by hospitals to reduce the incidence of fall is augmenting the fall detection and prevention segment growth.

End-use Insights

The hospitals segment held largest market share of 51.6% in 2023. Increasing number of patient flow, incorporation of sophisticated clinical alert devices, and increasing incidences of emergency cases are factors attributable for the segment growth. Increasing demand for integrated communication solutions from hospitals is fuelling the segment growth. The increasing adoption of emergency medical alerts systems in hospitals and rising investment in integrated communication technologies is opportunistic for the segment growth. Furthermore, increasing number of large chain hospitals are anticipated to drive the product demand.

Long term care facilities is projected to register significant growth over the forecast period owing to the increasing number of senior care facilities. Nurse call pendants such as Tek-CARE has a passive infrared (PIR) motion detector, which helps staff keep a check on the patients. Moreover, with technology advancements, patient monitoring, and medical reporting are integrated with the nurse calling devices to improve quality and productivity. The software keeps track of the caregiver response time, several emergency calls, and patients’ requests, thus improving patient care.

Key U.S. Nurse Call Systems Company Insights

Honeywell International, Inc., Cornell Communications, and Stanley Healthcare are some of the key companies operating in the market. Competitors are enhancing their share through a various marketing strategies, including product launches, investments, and mergers, and acquisitions. Companies are further investing in improving their product portfolio. For instance, in July 2020, Hill-Rom Holdings Inc., collaborated with Aiva, for hands-free communication between caregiver-to-patient and caregiver-to-caregiver using Hill-Rom’s Voalte Mobile solution.

Key U.S. Nurse Call Systems Companies:

- Hill-Rom Holding, Inc.

- Rauland Corporation

- Honeywell International, Inc.

- Ascom Holding AG

- TekTone Sound and Signal Mfg., Inc.

- Austco Healthcare

- Stanley Healthcare

- Critical Alert Systems LLC

- West-Com Nurse Call Systems, Inc.

- JNL Technologies

- Cornell Communications

Recent Developments

-

In July 2023, Connect America’s Lifeline Senior Living division entered into a collaboration with Amazon Alexa Smart Properties for developing a resident safety voice-enabled system to improve senior care across North American Assisted and Independent Living communities.

-

In June 2023, Cornell Communications announced a transformed use of Multimedia Engine for enhancing the utility and value of nurse call solutions for senior care facilities.

-

In April 2023, JNL Technologies unveiled the launch of Quantum Multi-Call Pull Cord. This innovative wireless device delivers enhanced security for customers and their residents.

U.S. Nurse Call Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 793.1 million

Revenue forecast in 2030

USD 1.55 billion

Growth rate

CAGR of 11.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, application, end-use

Country scope

U.S.

Key companies profiled

Tyco SimplexGrinnell; Hill-Rom Holding, Inc.; Rauland-Borg Corporation; Honeywell International, Inc.; Ascom Holding; TekTone Sound and Signal Mfg., Inc.; Azure Healthcare; Stanley Healthcare; Critical Alert Systems LLC; West-Com Nurse Call Systems, Inc.; JNL Technologies; Cornell Communications.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nurse Call Systems Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nurse call systems market based on technology, type, application, and end-use:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wired Communication Equipment

-

Wireless Communication Equipment

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integrated Communication Systems

-

Buttons

-

Mobile Systems

-

Intercoms

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Alarms & Communications

-

Workflow Optimization

-

Wanderer Control

-

Fall Detection & Prevention

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

ASCs/Clinics

-

Long Term Care Facilities

-

Frequently Asked Questions About This Report

b. The U.S. nurse call systems market size was estimated at USD 715.7 million in 2023 and is expected to reach USD 793.1 million in 2024.

b. The U.S. nurse call system market is expected to grow at a compound annual growth rate of 11.84% from 2024 to 2030 to reach USD 1.55 billion by 2030.

b. The wired communication equipment segment dominated the U.S. nurse call systems market with a share of 53.30% in 2023. Industry players are offering integrated solutions, wherein the data saved on the monitor screen is a summation of the readings from different systems.

b. Some key players operating in the U.S. nurse call system market include Tyco SimplexGrinnell; Hill-Rom Holding, Inc.; Rauland-Borg Corporation; Honeywell International, Inc.; Ascom Holding; TekTone Sound and Signal Mfg., Inc.; Azure Healthcare; Stanley Healthcare; Critical Alert Systems LLC; West-Com Nurse Call Systems, Inc.; JNL Technologies; and Cornell Communications.

b. Key factors that are driving the U.S. nurse call systems market growth include the need for diversified and integrated platforms with increasing preference for mobility devices, and changing reimbursement scenarios.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."