- Home

- »

- Pharmaceuticals

- »

-

U.S. Nuclear Medicine Market Size, Industry Report, 2030GVR Report cover

![U.S. Nuclear Medicine Market Size, Share & Trends Report]()

U.S. Nuclear Medicine Market Size, Share & Trends Analysis Report By Product (Diagnostic (SPECT, PET), Therapeutic (Alpha, Beta Emitters, Brachytherapy)), By Application, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-261-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Nuclear Medicine Market Size & Trends

The U.S. nuclear medicine market size was estimated at USD 5.1 billion in 2023 and is projected to grow at a CAGR of 12.6% from 2024 to 2030. The growth of the market is attributed to the rising incidence of cancer and cardiovascular diseases in the U.S. According to American Cancer Society Statistics, in 2023, in the U.S. the number of new cancer cases was 1,958,310, and projected deaths due to cancer were at 609,820. Technological advancements in nuclear medicine and growing demand for accurate diagnostic & treatment methods is further propelling growth.

Cardiovascular diseases are leading cause of death for people of most ethnic and racial groups in the U.S. According to CDC article in May 2023, in the U.S., about 805,000 people witness heart attacks annually, of these 605,000 people witness the first episode of a heart attack. Therefore, the U.S. government spent around USD 239 billion every year from 2018 to 2019 on prevention and treatment of heart diseases. This includes the cost of medicines and health care services. Certain factors such as alcohol consumption, improper diet, and lack of exercise can cause cancer and heart-related diseases. Hence, the rapid increase in the incidence of cancer and cardiovascular disorders is likely to boost the demand for nuclear medicine in the U.S.

Technological advancements in the global nuclear medicine market are boosting the growth. Radiopharmaceuticals play a pivotal role in the realms of cardiology and oncology, revolutionizing diagnosis, and treatment methodologies. Continual research and studies underscore the efficacy of radioisotopes across various medical domains, propelling their application in diagnosing and treating cancer, thyroid-related ailments, respiratory disorders, bone conditions, and digestive tract maladies. The burgeoning exploration in nuclear medicine fosters the development of innovative products tailored for diagnostic and therapeutic objectives, thereby stimulating growth in the field. For instance, in June 2022, Siemens Healthineers introduced Symbia Pro.specta, an advanced SPECT and CT imaging system.

In addition, this new product received the U.S. FDA clearance with CE mark for use in a wide range of applications such as, patient type, clinical trials, and departmental. Furthermore, an intuitive and automated workflow to guide the user through the entire decision-making process of examination, automatic SPECT motion correction for additional image clarity, and a low-dose CT of up to 64 parts for enhanced information are some capabilities of this product, which gives a competitive edge over other radiopharmaceutical products available in market.

Growing demand for accurate diagnostic & treatment methods fuels the growth of the market. Positron Emission Tomography (PET) employs radioisotopes for targeted organ diagnosis. Its adoption as a diagnostic tool is experiencing rapid growth due to its superior accuracy compared to alternative diagnostic methods. Physicians heavily rely on PET's high accuracy in diagnosis and its effectiveness in monitoring treatment progress to bolster their decision-making capabilities. PET is frequently combined with X-ray and computed tomography to enhance diagnostic precision. In October 2023, Positrigo AG announced the launch of its dedicated PET system NeuroLF in the U.S. by incorporation of its U.S. subsidiary. Thus, R&D for novel nuclear medicine products and increasing demand for these diagnostic procedures are expected to fuel market growth during the forecast period.

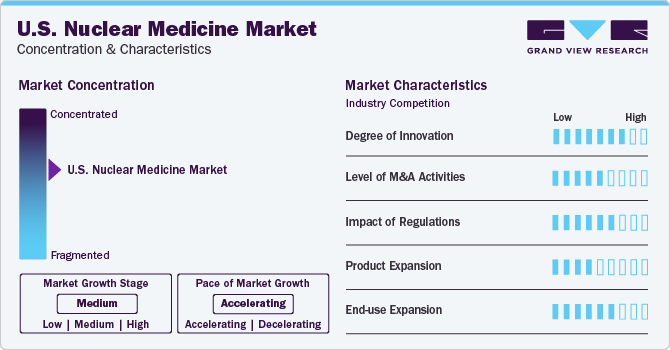

Market Concentration & Characteristics

The degree of innovation is high in the market characterized by a growing level of research and development, and a transformative shift in diagnostic and therapeutic approaches within the medical field. Nuclear medicine techniques, encompassing imaging and treatment methodologies, have witnessed substantial advancements in recent years. Innovations such as PET (Positron Emission Tomography), SPECT (Single Photon Emission Computed Tomography), and radiopharmaceuticals have revolutionized medical diagnostics and treatment strategies.

Several players engage in mergers & acquisitions to strengthen their market position. This approach allows businesses to enhance their capacities, broaden their range of products, and elevate their proficiency. For instance, in December 2023, Bristol Myers Squibb agreed to acquire RayzeBio for USD 4.1 billion. RayzeBio is currently conducting clinical trials for two potential cancer therapies using actinium-255.

Regulatory bodies like the Food and Drug Administration (FDA) are essential in guaranteeing the safety, effectiveness, and quality of nuclear medicine products and procedures. Stringent regulatory standards govern the development, manufacturing, and distribution of radiopharmaceuticals, imaging devices, and therapeutic agents used in nuclear medicine. Compliance with these regulations is essential to mitigate potential risks to patient safety and public health while maintaining the integrity and reliability of diagnostic and therapeutic procedures.

The potential replacement or alternative solutions that compete with traditional nuclear medicine technologies and practices. This phenomenon arises from advancements in medical imaging, diagnostic techniques, and therapeutic modalities that offer comparable or superior benefits to patients and healthcare providers. One notable substitute in nuclear medicine is the advancement of non-invasive imaging technologies such as MRI (Magnetic Resonance Imaging) and CT (Computed Tomography). These modalities provide high-resolution anatomical images without the need for radioactive tracers, offering clinicians valuable diagnostic information while minimizing radiation exposure to patients.

Signifies the broadening scope of nuclear medicine applications across diverse medical specialties and healthcare settings. Traditionally utilized in diagnostic imaging and oncology, nuclear medicine techniques are increasingly integrated into various clinical specialties, including cardiology, neurology, and rheumatology, among others. One key area of end-use expansion is in cardiology, where nuclear imaging techniques such as myocardial perfusion imaging (MPI) play a crucial role in diagnosing and managing cardiovascular diseases. MPI helps assess myocardial blood flow, detect coronary artery disease, and evaluate myocardial viability, aiding in treatment planning and risk stratification for patients with heart conditions.

Product Insights

The diagnostic products segment dominated the market and accounted for 71.2% of the global revenue in 2023. SPECT is employed for the diagnosis of a wide range of diseases and conditions, including neurological disorders, cardiovascular diseases, and thyroid-related conditions. The accuracy of the SPECT diagnostic technique is better than other non-radiopharmaceutical techniques. SPECT held the largest market share in 2023, owing to the low cost of scans and the ability to use easily obtained radioisotopes with longer life, compared to PET. In addition, the introduction of dedicated gamma cameras, portable SPECT scanners, and the development of the I-123 radiotracer are factors expected to boost the market.

The therapeutic products segment is anticipated to grow at the fastest CAGR over the forecast period. Alpha emitters, beta emitters, and brachytherapy are widely employed in radiopharmaceutical therapeutic procedures. Brachytherapy is commonly used as a treatment option for prostate, gynecological, breast, and other cancers due to its advantages, such as short procedure time. Major players are finding novel ways of using I-131 to treat various other diseases. For instance, in December 2023, Cellectar Biosciences, Inc., a clinical biopharmaceutical company, recently expanded its collaboration with the Wisconsin Alumni Research Foundation (WARF). The collaboration focuses on developing and commercializing iopofosine I 131 for pediatric cancers. This agreement grants Cellectar an exclusive license to work on iopofosine in pediatric solid cancers like high-grade glioma, neuroblastoma, and sarcoma.

End-use Insights

Hospitals & clinics dominated the market with the largest share in 2023. The nuclear medicine market in the U.S. is expanding due to the rise in the number of hospitals and clinics. The demand for nuclear medicine products is high owing to rising inpatient visits for diagnosis and treatment of diseases. According to the American Hospital Association, in 2024, around 6,120 hospitals were operating across different U.S. states, with 33.67 million hospital admissions. The availability of skilled staff and the ability to buy high-cost nuclear medicine products owing to the high budget are key factors expected to drive the segment.

The diagnostic centers segment is projected to witness significant growth rate over the forecast period. The diagnostic centers segment is growing due to the rising number of nuclear medicine diagnostic procedures. As per the National Cancer Institute, in 2023, nearly 2 million people were diagnosed with cancer in the U.S. Thus, the rising incidence of chronic diseases is expected to boost the diagnosis rate during the forecast period, driving market growth.

Application Insights

The oncology segment dominated the market with the largest share in 2023, due to high cancer prevalence and increased preference for radiopharmaceutical diagnosis. As per the American Cancer Society’s 2022 statistics, it is estimated that there will be approximately 1.9 million new cancer cases diagnosed and 609,360 cancer-related deaths in the U.S. in 2022. This pervasive presence of cancer has a direct influence on the growth of the market. The demand for nuclear medicine technologies is expected to rise as they play a crucial role in diagnosing and treating various cancers.

The endocrine tumor segment is anticipated to grow at the fastest CAGR over the forecast period. Endocrine tumors originate from the gastroenteropancreatic tract and are defined by histological pattern & endocrine metabolism. Endocrine tumors are rare types of tumors that affect 2.5 to 5 people in every 100,000, according to statistics released by the National Cancer Institute U.S. For the detection of endocrine tumors, radiopharmaceuticals and functional imaging tools are preferred over CT, MRI, and ultrasound. The competitive landscape is influenced by the strategic initiatives of key players. For instance, recent collaboration between Jubilant Draximage Inc. (Jubilant Radiopharma) and Evergreen Theragnostics, Inc. in June 2023. Jubilant Radiopharma, with its Radiopharmacy business division holding one of the largest nuclear medicine pharmacy networks in the U.S., agreed with Evergreen Theragnostics.

Key U.S. Nuclear Medicine Company Insights

Some of the leading players operating in the market include GE Healthcare, Cardinal Health, Lantheus Medical Imaging, Inc, Siemens Healthineers AG, and Novartis. Major industry participants leverage their established customer networks within the region to prioritize upholding rigorous quality standards and securing significant market share. This approach proves advantageous for brands with established trust in the market. These leading players allocate substantial investments toward advanced applications and infrastructure, enabling efficient processing and analysis of large sample volumes. Furthermore, companies engage in strategic collaborations with other firms and distributors to fortify their market positioning.

NTP Radioisotopes SOC Ltd., Eczacıbaşı-Monrol, Lantheus Medical Imaging, Inc. and Nordion (Canada), Inc are several emerging market participants are making their presence known in the market. These companies concentrate on securing funding support from government bodies and healthcare organizations while leveraging novel product launches to capitalize on untapped opportunities.

Key U.S. Nuclear Medicine Companies:

- Eckert & Ziegler

- Curium

- GE Healthcare

- Jubilant Life Sciences Ltd.

- Bracco Imaging S.P.A

- Nordion (Canada), Inc.

- The Institute For Radioelements (IRE)

- NTP Radioisotopes SOC Ltd.

- Eczacıbaşı-Monrol

- Lantheus Medical Imaging, Inc.

- The Australian Nuclear Science and Technology Organization

- Novartis (Advanced Accelerator Applications)

- Siemens Healthineers AG

Recent Developments

-

In December 2023, Eli Lilly and Company has recently finalized a definitive agreement to acquire POINT Biopharma, Inc., a prominent radiopharmaceutical company. This strategic maneuver is geared towards broadening Lilly's capabilities within the oncology sector, with a particular emphasis on advancing next generation radioligand therapies.

-

In November 2023, BWXT Medical, a subsidiary of BWX Technologies, is set to supply Fusion Pharmaceuticals with generators for producing actinium-225, a crucial medical isotope in cancer treatment trials. This agreement grants Fusion a preferential radium-225 supply and access to advanced generator technology, supporting the manufacturing of Ac-225 for clinical trials.

-

In November 2023, Telix Pharmaceuticals has strategically initiated the acquisition of radiopharmaceutical company QSAM for a significant USD 125 million. The structured payment plan includes an initial USD 2 million upfront, USD 33 million upon closing, and potential milestone-based payments of up to USD 90 million. The acquisition encompasses QSAM's lead therapeutic agent, CycloSam. Expected to conclude in Q1 2024.

U.S. Nuclear Medicine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.01 billion

Revenue forecast in 2030

USD 12.27 billion

Growth rate

CAGR of 12.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, country

Country scope

U.S.

Key companies profiled

Eckert & Ziegler; Curium; GE Healthcare; Jubilant Life Sciences Ltd.; Bracco Imaging S.P.A ; Nordion (Canada), Inc.; The Institute For Radioelements (IRE); NTP Radioisotopes SOC Ltd.; Eczacıbaşı-Monrol; Lantheus Medical Imaging; Inc.; The Australian Nuclear Science and Technology Organization; Novartis (Advanced Accelerator Applications); Siemens Healthineers AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nuclear Medicine Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. nuclear medicine market report based on product, application, end-use, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Products

-

SPECT

-

TC-99m

-

TL-201

-

GA-67

-

I-123

-

Other SPECT Products

-

-

PET

-

F-18

-

SR-82/RB-82

-

Other PET products

-

-

-

Therapeutic Products

-

Alpha Emitters

-

RA-223

-

Others

-

-

Beta Emitters

-

I-131

-

Y-90

-

SM-153

-

Re-186

-

Lu-117

-

Other Beta Emitters

-

-

Brachytherapy

-

Cesium-131

-

Iodine-125

-

Palladium-103

-

Iridium-192

-

Other Brachytherapy Products

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

SPECT

-

PET

-

Therapeutic Applications

-

-

Neurology

-

Oncology

-

Thyroid

-

SPECT

-

Therapeutic Applications

-

-

Lymphoma

-

Bone Metastasis

-

SPECT

-

-

Therapeutic Applications

-

Endocrine Tumor

-

Pulmonary Scans

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. nuclear medicine market size was estimated at USD 5.10 billion in 2023 and is expected to reach USD 6.01 billion in 2024.

b. The U.S. nuclear medicine market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 12.27 billion by 2030.

b. On the basis of diagnostics, SPECT dominated the market with a share of 60.7% in 2023, owing to high accuracy and wide-scale usage in different applications.

b. Some key players operating in the U.S. nuclear medicine include Eckert & Ziegler, Curium, GE Healthcare, Jubilant Life Sciences Ltd., Bracco Imaging S.P.A, Nordion (Canada), Inc., The Institute For Radioelements (IRE), NTP Radioisotopes SOC Ltd., Eczacıbaşı-Monrol, Lantheus Medical Imaging, Inc., The Australian Nuclear Science and Technology Organization, Novartis, Siemens Healthineers AG, and Cardinal Health.

b. Key factors that are driving the U.S. nuclear medicine growth include rising incidence of cancer and cardiovascular diseases, technological advancement in nuclear medicine, and growing demand for accurate diagnostic & treatment methods.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."