- Home

- »

- Medical Devices

- »

-

U.S. Non-PVC IV Bags Market Size, Industry Report, 2030GVR Report cover

![U.S. Non-PVC IV Bags Market Size, Share & Trends Report]()

U.S. Non-PVC IV Bags Market Size, Share & Trends Analysis Report By Product (Single Chamber, Multi Chamber), By Material (Ethylene Vinyl Acetate, Polypropylene, Copolyester Ether), By Content (Frozen Mixture, Liquid Mixture), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-225-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Non-PVC IV Bags Market Size & Trends

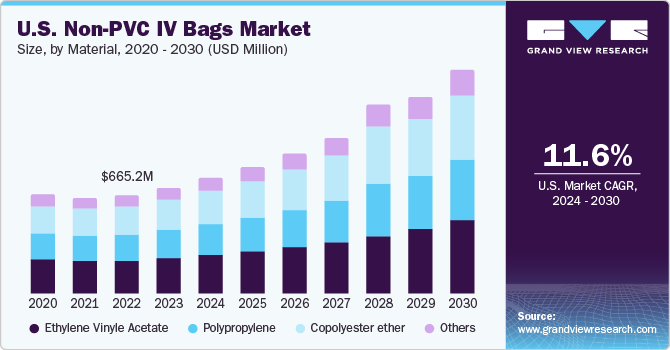

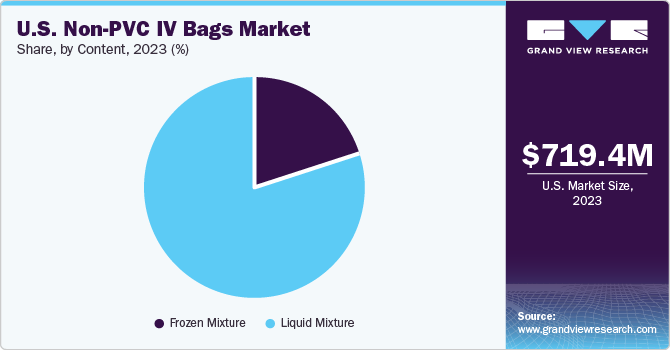

The U.S. Non-PVC IV bags market size was valued at USD 719.36 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.6% from 2024 to 2030. The increasing incidence of chronic disorders such as chronic kidney disease (CKD) is significantly driving the market growth. As per data reported in 2023 by CDC, over 35.5 million individuals in the U.S. are currently suffering from CKD. Furthermore, an increase in novel product launches by the key industry players is a major factor contributing to market demand.

In 2023, U.S. accounted for a market share of over 38% in the global Non-PVC IV bags market. The rising prevalence of cancer is anticipated to boost the market growth over the forecast period. For instance, as per the American Cancer Society report, in 2022, there were an estimated 268,490 newly diagnosed cases of prostate cancer and 34,500 associated deaths in the U.S. Similarly, data from the American Society of Clinical Oncology (ASCO) estimates that about 151,030 adults in the U.S. were diagnosed with colorectal cancer in 2022.

Moreover, according to Breastcancer.org, around one in eight American women (or roughly 13%) is anticipated to develop invasive breast cancer at some point in life. Increasing cases of breast cancer is expected to boost demand for non-PVC IV bags because cancer treatment causes the body to become malnourished and may cause reduced physical functioning, affect taste, smell, appetite, gastrointestinal disorders, and ulcers. As a result, patients are likely to require more parenteral nutrition, which is expected to drive market expansion. Furthermore, the growing healthcare expenditure in the nation is expected to encourage market players to develop non-PVC IV bags and transition to PVC-free IV bag manufacturing. This factor is anticipated to drive market expansion during the forecast period.

Market Concentration & Characteristics

The industry growth stage is high (CAGR > 10%) and pace of the growth depicts an accelerating trend. Key drivers include the increasing geriatric population, prevalence of chronic diseases, and advancements in technology leading to more advance and user-friendly devices.

Product Expansion & Degree of Innovation: The industry is witnessing a considerable degree of innovation driven by rapid technological advancements and the increasing adoption of innovative products, specifically in home care application. The increasing demand for home care services has fueled the integration of advanced technologies including AI, big data analytics, and remote monitoring. Companies investing in these technologies are gaining a stronger foothold in the industry, contributing to the overall demand growth. One of the emerging trends in the industry includes the integration of non-PVC IV bags with telehealth solutions.

Level of M&A: The U.S. non-PVC IV bags industry is characterized by a moderate level of M&A activities undertaken by leading players. Several players in the country are undertaking this strategy to strengthen their portfolio. For instance, in April 2023, Fresenius Kabi AG announced the acquisition of JW Life Science for a deal of USD 70 million. This transaction was aimed to support Freesenius Kabi in expanding its non-PVC IV bags product portfolio.

Impact of Regulations: The industry is influenced by stringent regulatory norms and quality protocols imposed by various organizations, aimed at ensuring patient safety and data integrity. These regulations have a significant impact on the operational capabilities of companies in the industry. Manufacturers following robust compliance measures and a track record of aligning with regulatory standards not only build patient trust but also gain visibility from MedTech sponsors. However, compliance with these stringent regulations requires extensive resources, which creates challenges and acts as a barrier for newer and smaller companies entering the sector.

Product Insights

The single chamber segment accounted for the largest share of 63.5% in 2023. Single chamber bags are specially made to store and deliver one type of medicine or fluid. This intentional design enhances patient safety. These bags are easy for users, making it simpler to prepare and give medications. This is especially crucial in busy healthcare settings where efficiency is crucial. The single-chamber design also helps lower the risk of contamination by keeping different substances separate, ensuring the medication stays pure and effective for the patient. Single chamber bags are safer and more environmentally friendly compared to traditional PVC bags. Their popularity is growing as more people understand the benefits, both for the environment and patient safety. Advancements in technology and supportive government regulations are also boosting the demand for these bags.

The multi-chambered segment is estimated to exhibit the fastest growth during the forecast period. Introduction of novel products is expected to drive segment growth. For instance, in June 2022, Gufic Biosciences Ltd. launched high-quality dual chamber bags made of DEHP-free polypropylene, which has a peelable aluminum foil. These bags are used for the storage of sensitive medications, allowing healthcare providers to reconstitute them just before offering them to patients. Moreover, due to their exceptional stability, ability to handle high pressure, and durability, these non-PVC IV bags have gained significant popularity in the pharmaceutical industry. The increasing use of multi-chambered containers in various applications, such as parenteral nutrition and drug reconstitution, and the availability of personalized product choices are among the key factors propelling the growth of the segment.

Material Insights

Ethylene vinyl acetate dominated the market in 2023 with a share of 33.5%. Ethylene-Vinyl Acetate (EVA) is considered a safe and flexible polymer widely adopted in various medical devices, including the manufacturing of non-PVC IV bags. EVA is considered a more environmentally friendly option compared to PVC. Since EVA does not have chlorine, it is less harmful both during production and after disposal. Choosing non-PVC IV bags produced using EVA reflects the increasing inclination toward healthcare options that prioritize sustainability and eco-friendliness. There is increasing demand for non-PVC IV bags, especially in blood banks and for preserving frozen mixtures. The increasing demand for blood & its components, driven by the expansion of blood banks, are expected to significantly contribute to the segment growth.

The copolyester ether segment is projected to exhibit fastest growth during the forecast period. Copolyester ether’s transparent nature allows healthcare providers to easily monitor the contents of the IV bag, which is a crucial aspect in ensuring accurate administration of medications and fluids. Copolyester ether enhances its overall strength, providing a holistic solution for pharmaceutical packaging when combined with materials like polypropylene and different polyolefin resins.

Content Insights

The liquid mixture segment captured the largest share of around 79.9% in 2023. The segment is also projected to garner the fastest CAGR during the forecast period. Liquid mixtures refer to medications or fluids, including lipids, amino acid solutions, dextrose solutions, and electrolyte solutions. The contents of a non-PVC IV bag are customized depending on the needs and medical condition of each patient.

Moreover, non-PVC IV bags are designed with protective features, such as colored films or coatings, which shield delicate liquid mixtures from potential harm caused by exposure to light. The non-PVC material IV bags are essential to maintain the compatibility and integrity of liquid mixtures, as they help reduce the chances of contamination or the release of harmful substances. This is crucial for safeguarding the quality and safety of the substances within the mixture.

Key U.S. Non-PVC IV Bags Company Insights

The U.S. non-PVC IV bags companies include Stryker Corporation; Medline Industries, and Medtronic PLC among others. These players are investing in R&D to improve their product features and distinguish themselves from competitors by enhancing their product portfolios with novel product launches. The competition is largely influenced by major pharmaceutical and healthcare corporations, along with specialized medical device manufacturers.

Key U.S. Non-PVC IV Bags Companies:

- Baxter

- B. Braun Melsungen AG.

- Pfizer, Inc.; (Hospira)

- Fresenius Kabi AG

- JW Life Science

- RENOLIT

- PolyCine GmbH

- Shanghai Xin Gen Eco-Technologies Co., Ltd.

- ANGIPLAST PVT. LTD

- Shanghai Solve Care Co Ltd.

- Kraton Corporation

- Jiangxi Sanxin Medtec Co., Ltd.;`

Recent Developments

-

In June 2022, Gufic Biosciences Ltd. launched high-quality dual chamber bags made of DEHP-free polypropylene, which has a peelable aluminum foil. These bags are used for the storage of sensitive medications

-

In April 2022, Fresenius Kabi introduced Calcium Gluconate in Sodium Chloride Injection in ready-to-administer freeflex bags in the U.S. These packs, made of polyolefin, are devoid of Di-2-ethylhexyl phthalate (DEHP) plasticizers and are non-PVC.

U.S. Non-PVC IV Bags Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 783.53 million

Revenue forecast in 2030

USD 1.52 billion

Growth Rate

CAGR of 11.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Product, material, content

Country Scope

U.S.

Key companies profiled

Baxter; B. Braun Melsungen AG.; Pfizer, Inc.; (Hospira); Fresenius Kabi AG; JW Life Science; RENOLIT; PolyCine GmbH; Sealed Air; Shanghai Xin Gen Eco-Technologies Co., Ltd.; ANGIPLAST PVT. LTD; Shanghai Solve Care Co Ltd.; Kraton Corporation; Jiangxi Sanxin Medtec Co., Ltd.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Non-PVC IV Bags Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. non-PVC IV bags market report based on product, material, and content.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Chamber

-

Multi Chamber

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Ethylene Vinyle Acetate

-

Polypropylene

-

Copolyester ether

-

Others

-

-

Content Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen Mixture

-

Liquid Mixture

-

Frequently Asked Questions About This Report

b. The U.S. non-PVC IV bags market size was estimated at USD 719.36 million in 2023 and is expected to reach USD 783.53 million in 2024.

b. The U.S. non-PVC IV bags market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 1.52 billion by 2030.

b. Single chamber segment accounted for the largest share of 63.5% in 2023. Single chamber bags are specially made to store and deliver one type of medicine or fluid. This intentional design enhances patient safety. These bags are easy for users, making it simpler to prepare and give medications.

b. Some prominent players in the U.S. non-PVC IV bags market include Baxter; B. Braun Melsungen AG.; Pfizer, Inc.; (Hospira); Fresenius Kabi AG; JW Life Science; RENOLIT; PolyCine GmbH; Sealed Air; Shanghai Xin Gen Eco-Technologies Co., Ltd.; ANGIPLAST PVT. LTD; Shanghai Solve Care Co Ltd.; Kraton Corporation; Jiangxi Sanxin Medtec Co., Ltd.

b. Rising demand for preventive measures for errors such as improper dose delivery and augmented demand for advanced IV containers are among the major drivers of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."