- Home

- »

- Medical Devices

- »

-

U.S. Non-invasive Aesthetic Treatment Market, Industry Report 2030GVR Report cover

![U.S. Non-invasive Aesthetic Treatment Market Size, Share & Trends Report]()

U.S. Non-invasive Aesthetic Treatment Market Size, Share & Trends Analysis Report By Procedure (Injectables, Skin Rejuvenation), By End-use (Hospital, Medspa, HCP-owned Clinic), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-280-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

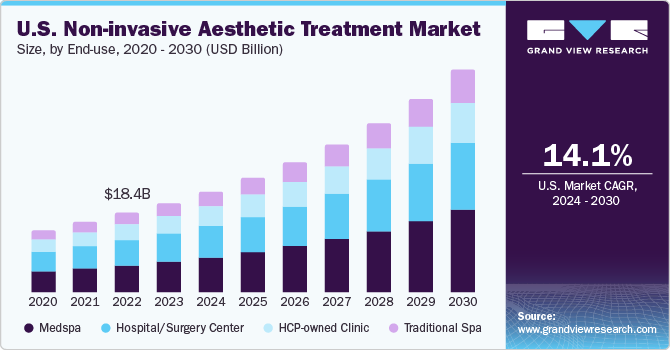

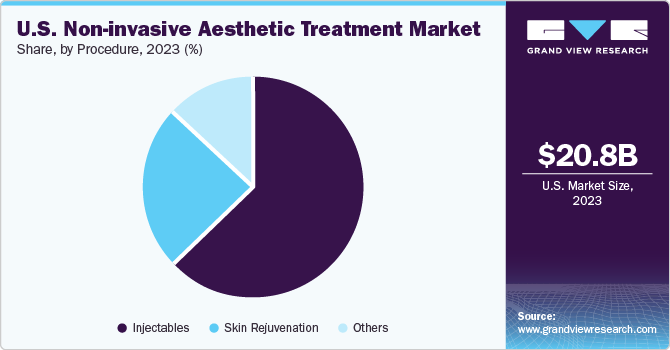

The U.S. non-invasive aesthetic treatment market size was estimated at USD 20.8 billion in 2023 and is expected to grow at a CAGR of 14.1% from 2024 to 2030. The rising incidence of skin conditions and the rising geriatric population are significantly contributing to the rising demand for U.S. non-invasive aesthetic treatment market.

The growing awareness among individuals concerning aesthetic appeal and the continuous advancements in aesthetic treatment technology are substantially boosting the adoption of such procedures. High disposable income and growing awareness about availability of a variety of aesthetic procedures are some of the factors responsible for market growth. Moreover, innovations in medical technology have led to the development of advanced devices and techniques that offer unprecedented precision in treatments like laser therapy, dermal fillers, radiofrequency, ultrasound, and cryolipolysis.

Remarkably, the current range of minimally invasive surgeries is more efficient and delivers superior outcomes compared to conventional surgical treatments. This shift towards less invasive procedures is driven by factors such as reduced recovery time, lower risks, and more natural-looking results, making them more appealing to a wide range of consumers.

Rising prevalence of skin diseases, such as psoriasis, eczema, vitiligo, and acne, is also expected to boost the market. According to National Psoriasis Foundation 2022 statistics, over 8 million people were suffering from psoriasis in the U.S. Non-invasive aesthetic procedures offer several benefits, such as shorter recovery time, less pain and surgical wounds, smaller incisions, faster wound healing, and reduced complications compared to invasive surgeries.

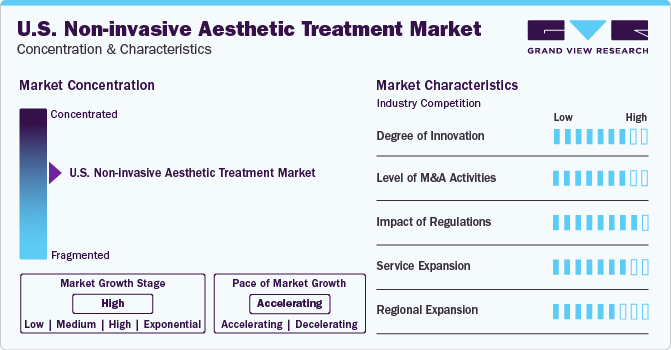

Market Concentration & Characteristics

The industry is witnessing a high degree of innovation in the U.S., and is among the most favored market for aesthetic companies for new product launches. The U.S. also reported 64% hike in virtual consultations requests, as patients are considering treatments to be done after the pandemic. Since social media has destigmatized the option of aesthetic procedures, technological innovations such as laser therapy and ultrasound have broadened treatment choices and enhanced effectiveness, drawing more consumers who seek safer and more efficient cosmetic procedures.

Key factors influencing the competitive landscape of the industry comprise the swift adoption of advanced equipment for enhanced treatment and continuous technological advancements. To maintain market share and broaden their product range, major players frequently engage in mergers and acquisitions. For example, in February 2020, Cynosure launched the Potenza radiofrequency micro-needling device, which assists in offering versatile and customized skin treatments to patients, thereby expanding the company’s skin revitalization portfolio.

Laser and ultrasound devices employed in non-invasive aesthetic treatments in the U.S. face stringent regulatory requirements due to potential radiation hazards. Manufacturers are obliged to adhere to the Federal Food, Drug, and Cosmetic Act (FFDCA) and Title 21 Code of Federal Regulations (Subchapter J, Radiological Health), including Parts 1010, 1040.10, 1040.11, and 1050.10. As of February 2023, a proposal for implementing a licensing regime for non-surgical cosmetic procedures has been rejected.

Currently, the consciousness about minimally invasive procedures is growing due to numerous beauty campaigns spearheaded by major market players. This has prompted major expansion in the industry concerning varied non-invasive treatments that are attracting consumers.

Several prominent players in the market are globally present, and have utilized the U.S. industry for its demographic potential. For instance, in October 2020, Hologic’s Medical esthetics subsidiary Cynosure expanded its TempSure 300-watt platform with the introduction of new FlexSure device in the U.S. and Canada.

Procedure Insights

Injectable procedures dominated the market with over 60% of the revenue share in 2023. Moreover, the segment is also anticipated to register the fastest CAGR, owing to the popularity of botulinum toxin and hyaluronic acid fillers. The U.S. has a high procedural volume of botulinum toxin and hyaluronic acid fillers because they are FDA approved and safe for aesthetic use.

Skin rejuvenation procedures are anticipated to have significant growth over the forecast period. According to the American Society for Aesthetic Plastic Surgery, approximately 997,245 Laser skin resurfacing procedures were performed in the year 2020 in the U.S. Thus, rising preference for skin rejuvenation is estimated to drive segment growth till 2030.

End-use Insights

Medspas account for the largest share of the U.S. market, commanding nearly 35% of the revenue share in 2023, and are expected to register the fastest growth over the forecast period. Factors such as membership subscriptions, service marketing, minimal wait times, cost-effective treatments, and adoption of novel laser technologies, are expected to significantly boost med spa market. Owing to these factors, medical spas now outnumber physician-based cosmetic practices in 73% of the major U.S. cities, according to a 2022 ScienceDirect study.

Hospitals, as the second-largest market segment concerning end-use, are expected to grow significantly owing to the high number of plastic surgeons in the U.S., who need to be affiliated with hospitals to conduct surgeries. According to the American Association for Accreditation of Ambulatory Surgery Facilities, private practices are only accredited when the surgeon has hospital credentials for such procedures. Thus. factors like a large pool of skilled surgeons, advanced healthcare infrastructure, and widespread adoption of new skin treatment technologies contribute to market growth.

Key U.S. Non-invasive Aesthetic Treatment Company Insights

The U.S. non-invasive aesthetic treatment market dominates globally due to high awareness about non-invasive aesthetic treatment and the presence of major key players. The market is characterized by a few prominent players that have established themselves as leaders in the industry, contributing to the consolidation of the market landscape. Some key companies in the U.S. non-invasive aesthetic treatment market include Alma Lasers GmbH; Cynosure, Inc.; Solta Medical, Inc.; Cutera, Inc.; Syneron Medical Ltd.; Hologic Inc; Allergan Inc; Galderma S.A; Johnson & Johnson; Merz Pharma and Revance Therapeutics Inc.

Thedesire for companies to expand service offerings, access new markets, achieve economies of scale, and strengthen competitive positions is high. In September 2021, Massachusetts-based Boston Scientific completed its acquisition of Lumenis. This strategic sale will enable Lumenis to focus on its Aesthetics and Vision businesses, positioning it well to pursue new growth opportunities in these domains.

Key U.S. Non-invasive Aesthetic Treatment Companies:

- Hologic, Inc.

- Allergan, Inc.

- Galderma S.A.

- Alma Lasers

- Syneron Candela

- Johnson & Johnson

- MerzPharma

- Lumenis

- Solta Medical

- Cutera Inc.

- Revance Therapeutics Inc.

Recent Developments

-

In June 2023, AviClear by Cutera gained FDA clearance as a long-term treatment for mild to severe acne, representing a significant milestone in the field of non-invasive aesthetic treatments in the U.S., challenging the conventional acne treatment landscape and offering a secure and enduring option for both patients and providers.

-

In August 2023, the U.S. FDA approved Revance’s DAXXIFY for the treatment of cervical dystonia, marking a significant advancement in neuromodulator therapy. This approval not only expanded DAXXIFY’s label but also provided entry into the U.S. therapeutic neuromodulator market.

-

In July 2021, the FDA cleared Cytrellis’ ellacor Micro-Coring technology, introducing a new noninvasive aesthetic category for treating moderate to severe wrinkles in the mid to lower face. This breakthrough device, removing excess skin without surgery or scarring, offered patients and physicians a more effective and natural-looking solution.

-

In February 2021, Galderma announced that its Restylane Defyne was approved by the U.S. FDA for treatment and correction of mild to moderate chin restoration in adults above 21 years of age.

-

In January 2021, Candela Medical announced the launch of Frax Pro system, which is a dual-depth skin resurfacing system in the U.S.

-

In June 2020, Cynosure launched the Elite iQ platform in the U.S., Europe, and Australia. This device is made for customized laser hair removal treatments and to permanently reduce unwanted hair for all skin types.

U.S. Non-invasive Aesthetic Treatment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 52.04 billion

Growth rate

CAGR of 14.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Procedure, end-use

Country scope

U.S.

Key companies profiled

Hologic, Inc.; Allergan, Inc.; Galderma S.A.; Alma Lasers; Syneron Candela; Johnson & Johnson; MerzPharma; Lumenis; Solta Medical; Cutera Inc.; Revance Therapeutics Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Non-invasive Aesthetic Treatment Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. non-invasive aesthetic treatment market report based on procedure, and end-use:

-

Procedure Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectables

-

Botulinum Toxin

-

Calcium Hydroxylapatite

-

Hyaluronic Acid

-

Polymer Filler

-

Collagen

-

-

Skin Rejuvenation

-

Chemical Peel

-

Laser Skin Resurfacing

-

Photorejuvenation

-

-

Others

-

Hair Removal

-

Nonsurgical Fat Reduction

-

Sclerotherapy

-

Cellulite Treatment

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital/Surgery Center

-

Medspa

-

Traditional Spa

-

HCP-owned Clinic

-

Frequently Asked Questions About This Report

b. The U.S. non-invasive aesthetic treatment market size was estimated at USD 20.8 billion in 2023 and is expected to reach USD 23.5 billion in 2024.

b. The U.S. non-invasive aesthetic treatment market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 52.04 billion by 2030.

b. Injectable procedures dominated the market with over 60.0% of revenue share in 2023. Moreover, this segment is also anticipated to register the fastest CAGR, owing to the popularity of botulinum toxin and hyaluronic acid fillers.

b. Some key companies in the U.S. non-invasive aesthetic treatment market include Alma Lasers GmbH; Cynosure, Inc.; Solta Medical, Inc.; Cutera, Inc.; Syneron Medical Ltd.; Hologic Inc; Allergan Inc; Galderma S.A; Johnson & Johnson; Merz Pharma and Revance Therapeutics Inc.

b. The growing focus on physical appearance among adults has led to an increased demand for non-invasive aesthetic treatments in recent years. Another key revenue-generating population to watch out for is the ones aged 50 years and above.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."