- Home

- »

- Next Generation Technologies

- »

-

U.S. Non-fungible Token Market Size, Industry Report, 2030GVR Report cover

![U.S. Non-fungible Token Market Size, Share & Trends Report]()

U.S. Non-fungible Token Market Size, Share & Trends Analysis Report By Type (Physical Asset, Digital Asset), By Application (Art, Sports), By End-use (Commercial, Personal), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-253-7

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Non-fungible Token Market Trends

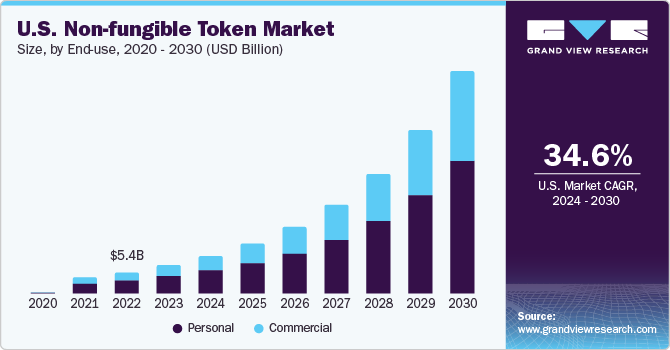

The U.S. non-fungible token market size was valued at USD 7.11 billion in 2023 and is anticipated to grow at a CAGR of 34.6% from 2024 to 2030. There has been a rapid growth concerning awareness and exploration of non-fungible token (NFT) usage among several American businesses in recent years, which has been a major factor for industry growth. American businesses have been extensively exploring the use of NFTs for various purposes, such as brand engagement, loyalty programs, and marketing campaigns. Companies can create exclusive NFTs for their customers, offer NFT rewards, or even leverage NFTs to establish authenticity and ownership of digital assets. Moreover, the presence of prominent NFT marketplaces such as Blur and OpenSea have enhanced business valuation and are expected to attract investments in the coming years, which is expected to bode well for the future demand for NFTs in the U.S. market.

The U.S. accounted for a revenue share of 26.33% in the global non-fungible token market in 2023. Cryptocurrencies have witnessed a huge boost in popularity in the country, while the areas of metaverse, Web 3.0, and decentralized finance have also been identified as opportunities by businesses to enhance their revenue generation. Cryptocurrency offers several advantages, such as reducing transaction costs and enabling faster money transfers. Moreover, as cryptocurrencies are decentralized, they do not collapse at a single point of failure. As a result, several investors and consumers in the country are purchasing cryptocurrencies. According to a report by Coinbase, as of February 2023, 20% of Americans, or over 50 million people, owned crypto, with 76% among these stating that blockchain and cryptocurrency are the future of the financial ecosystem. Consequently, the growth of the NFT market is also expected to remain healthy during the forecast period.

The growing popularity of NFTs among artists in the U.S. is another factor driving expansion. Artists are highly valuing NFTs as they ensure the validity and uniqueness of the blockchain representation of their work. Moreover, these tokens ensure the generation of an ongoing revenue stream for artists, shaping the dynamics of the art industry. In the music business also, NFTs have emerged as a convenient way to enable artists have a deeper understanding and connection with their fanbase. Furthermore, several artists are using NFTs to launch limited edition tracks, virtual experiences, and offer exclusive behind-the-scenes content. Besides these advantages, NFTs also ensure that they receive profits from resale, while also providing greater control over their creative output. Notable names such as Kings of Leon, Grimes, Eminem, Whitney Houston, and Avenged Sevenfold have launched NFTs in the past few years, which has helped the market maintain a positive outlook.

NFTs are an evolutionary trend over cryptocurrency, having shifted the market from crypto by making each token unique and irreplaceable. NFTs cannot be traded at the same value as cryptocurrencies. The conversion of a physical asset into a digital asset streamlines the process and removes intermediaries, ensuring market efficiency. In the next few years, in the United States, NFTs have the potential to create new markets for creation and forms of investments. They can be used for ensuring that certain tedious investments such as real estate can be simplified. For example, Decentraland, a virtual reality platform, implemented real estate investment via the NFT concept. As NFTs become more advanced and can be integrated into financial infrastructure, the same concept of tokenized pieces of land (varying in value and location) may become possible to implement in the physical world.

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. There are a significant number of innovative developments as more start-ups enter the industry. The space of digital arts and collectibles has seen substantial growth, with many emerging and established artists embracing this medium. Moreover, with blockchain technology itself undergoing numerous advancements, it is expected that there would be a positive impact on the NFT market, particularly with regard to increasing transaction volume without any compromises on speed and cost.

As the market competition is strong, there is a need for companies to expand their countrywide footprint and boost revenues through partnerships and collaboration. For instance, in July 2022, Funko Inc. announced its partnership with the multinational mass media and entertainment corporation Paramount Global. This partnership was aimed at introducing a series of Non-Fungible Tokens (NFTs) based on the Avatar Legends universe. In another example, in August 2021, Dolphin Entertainment partnered with West Realm Shire Services Inc., which owns and operates the FTX crypto exchange. This development aimed to launch an NFT marketplace to target brands across film, music, television, lifestyle, sports, gaming, e-sports, culinary, and charity industries. Such initiatives help companies in consolidating their market position.

In the U.S., there are several regulatory considerations when it comes to NFTs, with lawmakers facing policy challenges such as IP rights, consumer protection, appropriate financial regulations, privacy, and energy consumption. In recent years, advances have been made to help shape the country’s NFT market. For instance, in March 2022, President Joe Biden issued an Executive Order on Ensuring Responsible Development of Digital Assets. This order outlined objectives such as protection of consumers, businesses, and investors; promoting national and global financial stability and addressing financial system risks; and preventing security and financial risks arising out of digital asset misuse. The SEC has a specialized enforcement unit for the crypto space, called ‘Crypto Assets and Cyber Unit’, which investigates NFT-related securities law violations.

Since the NFT industry is evolving at a fast pace with various technological innovations and partnerships, there is currently a low risk of substitutes. Crypto wallets and digital assets can be considered as an alternative investment technique, but their quality is inferior when compared to non-fungible tokens.

NFTs are currently witnessing a healthy demand due to their applications in both commercial and personal customer segments. Once they are listed on the marketplace, they can be purchased, sold, or traded for personal or commercial use. NFTs can take the form of any art piece, which can be represented digitally. It may be art, music, scripts, video clips, or even an Instagram post. NFTs are used in the personal segment as investments, digital asset ownership, or simply to own the artwork. Additionally, NFTs are used by companies in the commercial segment to expand their digital asset portfolio and gain a competitive edge over other companies.

Application Insights

The collectibles segment, which includes video clips, audio clips, and gamification, accounted for a dominant revenue share of 53.80% in the market in 2023. Digital collectibles are usually verified via blockchain technology and can be sold, bought, or kept as investment. Their blockchain authentication makes each collectible unique, which can help creators and brands to better engage with their audience, boost fan loyalty, and generate added revenue streams. Within this segment, audio clip collectibles contributed significantly in terms of revenue to the overall market. An increasing number of artists in the U.S. are looking to ensure greater ownership of their creations and maintain profitability, while also improving fan engagement. This has been made possible through NFTs, as every time an audio NFT is traded, the artist gets a share of the payment. These benefits are encouraging more artists and musicians to invest in audio clip NFTs.

On the other hand, the art segment is expected to advance at the fastest CAGR through 2030. NFT artworks leverage a combination of art and technology. Virtual artworks, such as digital pictures and GIFs, are sold online as though they are physical items. When a piece of art is traded, the artist gets a commission for every trade, generating a new revenue stream for the artist. The significant benefits offered by NFT art are encouraging more artists to create digital art, driving segment growth. Initiatives being pursued toward this end are also contributing to segment expansion. For instance, in April 2022, an art exhibition was launched in Denver to allow visitors to view virtual art through AR headphones. This experience was a part of ‘Verse: The Art of the Future’, an exhibit run by the California-based start-up Enklu.

End-use Insights

In terms of end-use, the personal segment held the largest revenue share in the U.S. non-fungible token market in 2023. NFTs are mainly being adopted by customers interested in making crypto investments for personal usage. Subsequently, the rising preference for ownership of digitally created content is driving substantial growth. With advancements in technologies, NFTs are creating significant value for investors. The rapidly increasing popularity of Metaverse and Web3 is also highlighting the importance that NFTs are expected to hold as assets in the metaverse in the future. In comparison to conventional assets, NFTs are more reliable as they annul the risk of fraud. However, the value of NFTs can be extremely volatile, which can increase hesitation among for investment of their earnings into digital assets, restraining segment expansion.

Meanwhile, the commercial segment is projected to expand at the highest growth rate during the forecast period. With a view to enhance customer loyalty and engagement and develop additional revenue streams, modern businesses are increasingly turning to NFTs. Small-sized businesses can also profit greatly from this approach; for instance, customers can buy an NFT to join loyalty programs that provides them early access to sales or offers them special discounts. In recent years, several major global brands such as Adidas, Gap, and Damien Hirst have conducted successful campaigns through the use of non-fungible tokens. In December 2022, the Starbucks Odyssey program was launched by Starbucks, which offered customers a chance to engage in interactive activities called ‘Journeys’ for collecting NFTs to receive special benefits. There have been numerous such initiatives by other organizations that have enabled substantial market growth.

Type Insights

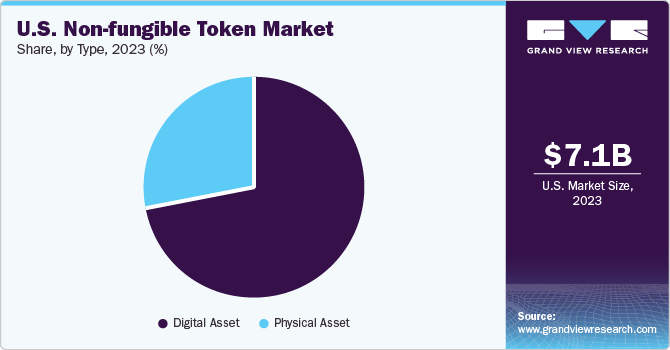

Based on type, the digital assets segment accounted for the largest share in the U.S. NFT market in 2023. This segment includes different types of NFTs, such as digital art, music, video games, and trade cards, among others. Advances in technology and the increasing traction in the Metaverse and Web3 segments are factors encouraging individuals to invest in digital assets. Between 2021 and 2022, awareness regarding NFTs grew sharply in the United States, while ownership also doubled from around 4.6 million people to 9.3 million people. With digital asset NFTs, the ownership of the asset gets registered on the Ethereum blockchain. Although digital art can be copied, the true owner of the asset is etched with a code on the blockchain. The ability to provide a record of authenticity and ownership is driving the popularity of NFTs, consequently driving growth in this segment.

The physical assets segment is expected to account for a significant revenue share in the market during the projection period. NFTs are increasingly being linked through tokenization to physical assets to bridge the gap between physical and virtual worlds, leading to segment growth. Through this, the asset gains a unique identification in terms of its origin, ownership history, and its authenticity, which helps in protecting IP rights, ensuring the asset’s trackability during its whole lifecycle, and combatting counterfeiting. Another advantage is fractional ownership that ensures that multiple people with a limited capital can own valuable assets that would otherwise have not been possible. Emerging concepts such as “phygitals”, which combine virtual and physical worlds to offer an immersive experience to NFT holders, are expected to further boost market expansion.

Key U.S. Non-fungible Token Company Insights

The NFT space in the United States is fast-growing, with several new companies emerging in the market in the past few years. As a result, existing organizations need to maintain an innovative streak to stay ahead of the competition. Companies are engaging in the development of new offerings, as well as partnerships with associations and celebrities, to boost their countrywide presence. The use of NFTs has been recognized by leading global brands in areas such as restaurants, food & beverages, automotive, fashion & accessories, and the consumer goods sector as a viable strategy to become more profitable.

In June 2022, Dolphin Entertainment announced that its Web3 subsidiary, We Come In Peace (WCIP), had created a variety of metaverse-related customers and NFT projects, including the noted American music manager Troy Carter and supermodel Bella Hadid. This came on the back of the companies’ partnership with celebrity restaurateurs and chefs Spike Mendelsohn and Tom Colicchio on the ‘Chfty’ NFT collection in early 2022. In another development, in September 2022, Funko Inc. announced a partnership with Walmart and Warner Bros. studio. This partnership brought digital collectibles to the retail space with a Digital Pop series featuring DC’s “The Brave and the Bold” #28 (1959) Comic Cover Pop. Thus, product launches and collaborations enable companies to drive growth.

Key U.S. Non-fungible Token Companies:

- YellowHeart, LLC

- PLBY Group, Inc.

- Cloudflare, Inc.

- Dolphin Entertainment, Inc.

- Ozone Networks, Inc.

- Funko

- Gemini Trust Company, LLC

- Dapper Labs, Inc.

- Onchain Labs, Inc.

- LooksRare

Recent Developments

-

In March 2024, the Coachella music and arts festival announced a partnership with OpenSea, a leading NFT marketplace, wherein the latter would be introducing three distinct NFT collections that would serve as all-access passes to highly exclusive merchandise and on-site experiences at the festival. The Avalanche blockchain network would be hosting these collections and released across three subsequent drops pairing Coachella IP with several festival perks

-

In January 2024, OpenSea introduced the process of wallet creation using email address for users to make it more convenient to collect and create NFTs. The OpenSea account does not require a separate wallet extension and would allow users to sell, buy, send, and add NFTs and crypto; manage funds; and monitor transactions on the blockchain

-

In November 2023, Dapper Labs announced the launch of Disney Pinnacle, which brings together Disney, Pixar, and Star Wars characters as tradable and collectible digital pins. This service would allow fans to securely trade and collect dynamic pins on their phones irrespective of their location

-

In October 2023, the Droppp Marketplace was launched as a comprehensive shop for Funko Digital Pop!. The Droppp Marketplace allows users to sell and buy Digital Pop! with other fans and collectors directly. It is highly user-oriented, offering features such as finding and purchasing digital collectibles rapidly through the Collection Tracker, as well as providing a purchase reservation system to prevent others from buying the same item simultaneously

U.S. Non-fungible Token Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 56.06 billion

Growth rate

CAGR of 34.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Type, application, end-use

Key companies profiled

YellowHeart, LLC; Cloudflare, Inc.; PLBY Group, Inc.; Dolphin Entertainment, Inc.; Funko; Ozone Networks, Inc.; Dapper Labs, Inc.; Gemini Trust Company, LLC; Onchain Labs, Inc.; LooksRare

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Non-fungible Token Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. non-fungible token market report based on type, application, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Physical Asset

-

Digital Asset

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Collectibles

-

Video Clip

-

Audio Clip

-

Gamification

-

Others

-

-

Art

-

Pixel Art

-

Fractal/Algorithmic Art

-

Computer Generated Painting

-

2D/3D Painting

-

2D/3D Computer Graphics

-

GIFs

-

Others

-

-

Gaming

-

Trading Card Game (TCG)

-

Video Game

-

Strategy Role Playing Game (RPG)

-

Others

-

-

Utilities

-

Tickets

-

Domain Names

-

Assets Ownership

-

-

Metaverse

-

Sports

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. non-fungible token market size was estimated at USD 7.11 billion in 2023 and is expected to reach USD 9,422.49 million in 2024.

b. The U.S. non-fungible token market is expected to grow at a compound annual growth rate of 34.6% from 2024 to 2030 to reach USD 56.06 billion by 2030.

b. Based on type, the digital asset segment dominated the market in 2023. Advances in technology and the increasing traction in the Metaverse and Web3 segments are factors encouraging individuals to invest in digital assets, propelling the segment’s growth.

b. Some key players operating in the U.S. non-fungible token market YellowHeart, LLC, PLBY Group, Inc., Cloudflare, Inc., Dolphin Entertainment, Inc., Ozone Networks, Inc., Funko, Gemini Trust Company, LLC, Dapper Labs, Inc., Onchain Labs, Inc. and LooksRare.

b. Some key players operating in the U.S. non-fungible token market YellowHeart, LLC, PLBY Group, Inc., Cloudflare, Inc., Dolphin Entertainment, Inc., Ozone Networks, Inc., Funko, Gemini Trust Company, LLC, Dapper Labs, Inc., Onchain Labs, Inc. and LooksRare.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."