U.S. Non-alcoholic Steatohepatitis Biomarkers Market Size, Share & Trends Analysis Report By Type (Serum, Hepatic Fibrosis, Apoptosis), By End-use (Hospitals, Diagnostic Labs), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-9

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

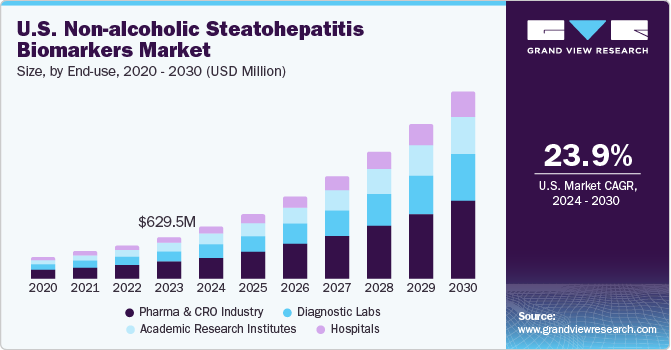

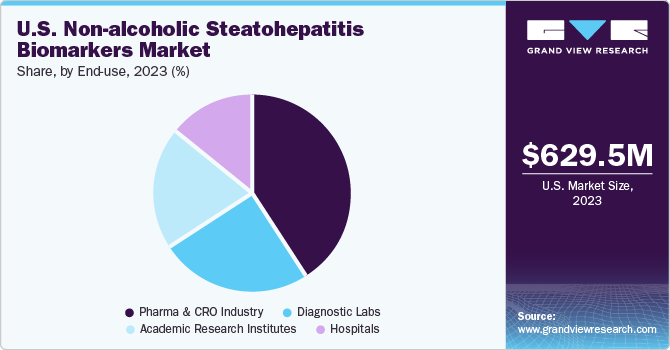

The U.S. non-alcoholic steatohepatitis biomarkers market size was estimated at USD 629.47 million in 2023 and is projected to grow at a CAGR of 23.9% from 2024 to 2030. The rising prevalence of obesity, type 2 diabetes, and metabolic syndrome has led to a significant increase in the incidence of non-alcoholic steatohepatitis (NASH) in the U.S. This growing patient population is driving the demand for accurate and reliable biomarkers for early detection and monitoring of NASH.

According to the National Institutes of Diabetes and Digestive and Kidney Diseases, non-alcoholic fatty liver disease (NAFLD) affects up to 24% of U.S. adults, and NASH is estimated to affect 1.5% to 6.5% of the U.S. population. As the prevalence of NAFLD and NASH continues to rise, there is a greater need for diagnostic tests and treatments, driving the demand for NASH biomarkers.

The progressive type of NAFLD, known as NASH, is characterized by a build-up of fat in the liver tissue and persistent inflammation. According to the National Library of Medicine, NAFLD is the most common chronic liver condition, affecting around 35 million people globally.NASH is a challenging disease for the diagnostic industry due to its non-specific symptoms, causing patients to be unaware until the late stages. To address this, researchers are developing novel functional tests to measure changes in liver function before fibrosis stages. Breath tests are also being considered for detecting molecules and compounds associated with NASH, which could provide robust information and compete with biomarker tests.

The market for non-invasive diagnostic tools for NASH detection is expected to grow due to the increasing demand for cost-effective and non-invasive methods such as biomarker tests. Traditional liver biopsy methods are costly and invasive, leading to the development of biomarker tests by major corporations, which is expected to drive the NASH biomarkers market over the forecast period. For instance, in May 2021, GENFIT and Laboratory Corporation of America Holdings launched NASHnext in the U.S. and Canada, a non-invasive NASH detection test powered by NIS4 technology for use in the clinic.

There are several ongoing research and development (R&D) activities in the field of NASH biomarkers, with numerous companies such as Genfit, Intercept Pharmaceuticals, and Shire developing biomarker assays for NASH diagnosis and monitoring. The development of novel biomarkers for NASH is an active area of research, with various academic and commercial organizations investing in discovering and validating new biomarkers. For instance, educational institutions such as the National Institutes of Health (NIH) and the Mayo Clinic are researching NASH biomarkers.

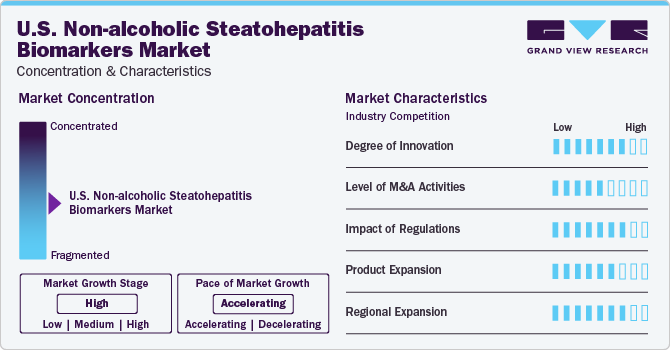

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The market is experiencing significant innovation, primarily focused on developing novel biomarkers to diagnose and monitor NASH accurately. Advances in omics technologies, such as genomics, proteomics, and metabolomics, have enabled researchers to identify new biomarkers associated with NASH pathogenesis and progression. Integrating AI and machine learning (ML) algorithms in biomarker discovery has further accelerated the pace of innovation, allowing for the analysis of large datasets to identify patterns and correlations that may not be apparent through traditional methods.

The U.S market has experienced significant merger and acquisition (M&A) activities in recent years. M&A transactions shape the market's competitive landscape, driving consolidation, fostering strategic partnerships, and accelerating product development. Companies in the NASH biomarkers market are expanding their product portfolios, accessing new technologies, and enhancing research capabilities. Strategic collaborations through M&As accelerate the development and commercializing of novel biomarkers for NASH diagnosis and monitoring.

The market is significantly influenced by regulations set by government agencies such as the FDA. These regulations ensure high accuracy, reliability, and clinical utility for NASH biomarkers. Companies developing NASH biomarkers must adhere to these guidelines throughout the product development lifecycle to demonstrate safety, effectiveness, and clinical validity. Regulatory approvals are crucial for commercializing NASH biomarkers and gaining market access. Compliance with these standards is essential for patient safety and building trust among healthcare providers and patients. Overall, regulations significantly impact the market. For instance, in March 2024, the U.S. FDA approved Madrigal Pharmaceuticals' Rezdiffra as the first treatment for NASH. The approval was based on data from Phase 3 showing Rezdiffra to improve liver fibrosis. It resolved NASH in patients with moderate to advanced liver fibrosis. Such developments are likely to create further opportunities for market growth.

Product expansion is crucial for the market's growth and competitiveness. Companies introduce new diagnostic tests, biomarker panels, point-of-care devices, and data analysis software to improve NASH diagnosis accuracy and patient outcomes. This diversification caters to diverse healthcare providers and addresses unmet needs in NASH diagnostics. Collaborations with key opinion leaders, academic institutions, research organizations, and healthcare professionals validate new products' clinical utility through real-world studies and clinical trials, driving innovation in the market.

The regional expansion of the market involves increasing market penetration across different regions. Companies are investing in marketing campaigns to raise awareness about NASH biomarkers among healthcare professionals and patients.

Type Insights

Based on type, the market is segmented into serum biomarkers, hepatic fibrosis biomarkers, apoptosis biomarkers, and oxidative stress biomarkers. The serum biomarker segment dominated the market with a revenue share of 32.45% in 2023. Compared to invasive diagnostic procedures such as liver biopsies, serum biomarkers offer a non-invasive alternative for assessing liver health in NASH patients, leading to increased adoption among both patients and healthcare providers. Utilizing serum biomarkers for NASH diagnosis and monitoring is often more cost-effective than traditional methods, making it a preferred choice in a healthcare landscape that values efficiency and affordability. The market is expected to grow with the launch of novel biomarkers such as apolipoprotein A1, apolipoprotein B, adiponectin, leptin, ghrelin, tumor necrosis factor-alpha, and free fatty acids. Key market players are focusing on gaining FDA approvals for their serum biomarkers-based tests. For instance, in 2021, Siemens Healthineers received marketing authorization from the FDA for its Enhanced Liver Fibrosis test.

The hepatic fibrosis biomarkers segment is expected to grow at the fastest CAGR during the forecast period. The rising prevalence of NASH, a consequence of obesity, sedentary lifestyles, and metabolic syndrome, has led to a greater focus on hepatic fibrosis biomarkers. According to the study published in the National Institutes of Diabetes and Digestive and Kidney Diseases, NAFLD affects one-third to two-thirds of individuals with type 2 diabetes. Studies also indicate that over 90% of individuals with extreme obesity and up to 75% of overweight have NAFLD. One of the key drivers propelling the demand for NASH-specific hepatic fibrosis biomarkers is the clinical significance of fibrosis staging. The risks and limitations associated with liver biopsies and non-invasive biomarkers offer a safer and more patient-friendly approach to monitoring hepatic fibrosis progression in NASH patients.

End-use Insights

The pharma & CRO industry segment dominated the market in 2023 and is expected to grow with the fastest CAGR over the forecast period from 2024 to 2030. The substantial investments made by pharmaceutical companies and CROs in R&D activities have propelled the discovery and validation of NASH biomarkers. These investments encompass various activities, including biomarker identification, preclinical studies, clinical trials, and regulatory approvals. With NASH being a significant unmet medical need in the U.S., pharmaceutical companies are actively developing novel drugs and biologics targeting different aspects of the disease, including hepatic fibrosis, inflammation, and metabolic dysfunction.

The pharma and CRO industries heavily invest in R&D efforts focused on NASH biomarkers. This includes funding for biomarker discovery, validation studies, and clinical trials to identify novel biomarkers that can accurately diagnose and monitor NASH progression, including hepatic fibrosis. Collaborations and partnerships between pharmaceutical companies, CROs, academic institutions, and healthcare organizations have become instrumental in advancing NASH biomarker research. These collaborations foster knowledge exchange, access to diverse patient populations, and shared resources for biomarker validation studies. In September 2023, GENFIT, a biopharmaceutical company, published data demonstrating the efficacy of their non-alcoholic steatohepatitis diagnostic technology, NIS4, in the scientific journal Nature Medicine. The study, part of the FNIH Biomarkers Consortium, evaluated five blood-based panels, including NIS4, its predecessor.

Key U.S. Non-alcoholic Steatohepatitis Biomarkers Company Insights

Some of the key players operating in the market include GENFIT; Prometheus Laboratories; and Siemens Medical Solutions USA, Inc.

-

GENFIT is a biopharmaceutical company focused on discovering and developing innovative therapeutic and diagnostic solutions for metabolic and inflammatory diseases, particularly in liver and gastrointestinal conditions.

-

Siemens Medical Solutions USA, Inc. is a medical technology company offering various diagnostic solutions for liver diseases, including biomarkers for NASH. One of Siemens’ key offerings in the NASH biomarkers market is the Enhanced Liver Fibrosis (ELF) test. The ELF test is a serum-based test that measures three biomarkers of liver fibrosis: hyaluronic acid, tissue inhibitor of metalloproteinases 1 (TIMP-1), and aminoterminal propeptide of type III procollagen (P3NP).

Key U.S. Non-alcoholic Steatohepatitis Biomarkers Companies:

- GENFIT

- Prometheus Laboratories.

- Siemens Medical Solutions USA, Inc.

- Quest Diagnostics

- AstraZeneca

- Laboratory Corporation of America Holdings.

- Pfizer, Inc.

- Bristol-Myers Squibb Company

Recent Developments

-

In February 2024, Gilead Sciences agreed to acquire CymaBay Therapeutics for USD 4.3 billion to expand its liver disease treatment portfolio.

-

In September 2023, the Foundation for the National Institutes of Health (FNIH) revealed research results published in Nature Medicine that showcase the efficacy of noninvasive blood tests for diagnosing NASH. This breakthrough represents a significant step towards obtaining approval from the U.S. Food and Drug Administration (FDA). The study findings originate from the FNIH’s Biomarkers Consortium, which is dedicated to validating and qualifying biomarkers to expedite the development of new treatments and healthcare technologies through collaborative efforts across various sectors.

U.S. Non-alcoholic Steatohepatitis Biomarkers Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 2.84 billion |

|

Growth rate |

CAGR of 23.9% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Country scope |

U.S. |

|

Region scope |

West; Midwest; Northeast; Southwest; Southeast |

|

Key companies profiled |

GENFIT; Prometheus Laboratories; Siemens Medical Solutions USA, Inc.; Quest Diagnostics; AstraZeneca; Laboratory Corporation of America Holdings; Pfizer, Inc.; Bristol-Myers Squibb Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Non-alcoholic Steatohepatitis Biomarkers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. non-alcoholic steatohepatitis biomarkers market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Serum Biomarkers

-

Hepatic Fibrosis Biomarkers

-

Apoptosis Biomarkers

-

Oxidative Stress Biomarkers

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & CRO Industry

-

Hospitals

-

Diagnostic Labs

-

Academic Research Institutes

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. non-alcoholic steatohepatitis biomarkers market size was estimated at USD 629.47 million in 2023.

b. The U.S. non-alcoholic steatohepatitis biomarkers market is projected to grow at a compound annual growth rate (CAGR) of 23.9% from 2024 to 2030 to reach USD 2.84 billion by 2030

b. The serum biomaker segment dominated the market with a revenue share of 32.5% in 2023. Compared to invasive diagnostic procedures such as liver biopsies, serum biomarkers offer a non-invasive alternative for assessing liver health in NASH patients, leading to increased adoption among both patients and healthcare providers.

b. Some of the key players operating in the market include GENFIT; Prometheus Laboratories; Siemens Medical Solutions USA, Inc.; GENFIT; Prometheus Laboratories; Quest Diagnostics; and Pfizer, Inc.; among others.

b. The rising prevalence of obesity, type 2 diabetes, and metabolic syndrome has led to a significant increase in the incidence of non-alcoholic steatohepatitis (NASH) in the U.S. This growing patient population is driving the demand for accurate and reliable biomarkers for early detection and monitoring of NASH.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."