U.S. Next-generation Sequencing Services Market Size, Share & Trends Analysis Report By Service Type, By Workflow (Pre-sequencing, Sequencing, Data Analysis), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-286-5

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

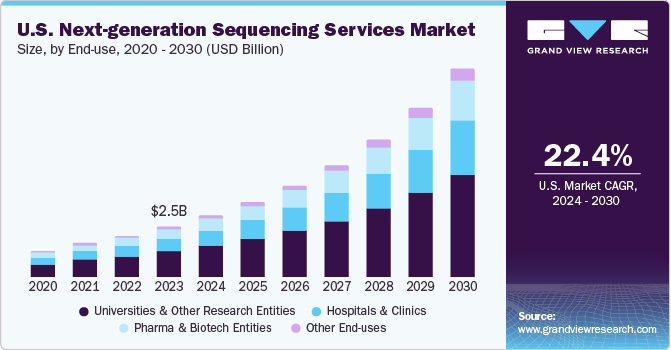

The U.S. next-generation sequencing services market size was estimated at USD 2.48 billion in 2023 and is expected to grow a CAGR of 22.39% from 2024 to 2030. Next-generation sequencing (NGS) technology in the country is driven by a robust presence of pharmaceutical, biotech entities, and research institutions. The market is propelled by increasing research and development (R&D) programs focusing on cancer, infectious diseases, and precision medicine. Moreover, genetic testing advancements are fueling NGS adoption in clinical labs for diagnosing rare conditions and guiding precision medicine.

The U.S. next-generation sequencing services market dominated the global next-generation sequencing services market in 2023 with a staggering 42.11% share of the total revenue generated. The market is significantly influenced by the presence of numerous pharmaceutical, biotechnological entities, and research institutions, along with a rise in R&D programs focusing on cancer, infectious diseases, and precision medicine. These entities are dedicated to addressing medical needs through their studies.

In addition, the market is notably impacted by the increasing prevalence of cancer, driving the demand for early cancer detection diagnostics. Transcriptome profiling, especially in oncology, has become a vital tool for predictive and prognostic purposes, revolutionizing cancer management. Major U.S. market players offer RNA sequencing products for diagnosing various cancers, exemplified by companies like Personalis, Inc., specializing in immune-precision oncology products.

Advancements in genetic testing are poised to boost NGS adoption in clinical labs, aiding in rare condition diagnosis and precision medicine identification. NGS implementation provides crucial genetic data for disease prognosis. Players, healthcare agencies, and government investments drive strategic developments in NGS technology for clinical diagnosis. The scientific community’s active engagement in cancer transcriptomics research, exemplified by a September 2020 NLM study involving researchers from Harvard Medical School, Massachusetts General Hospital, and Johns Hopkins University, accelerates market growth by exploring single-cell transcriptomics’ potential in cancer.

Over time, there has been a notable decrease in the expenses associated with sequencing technologies. Nevertheless, the cost of sequencing information fluctuates depending on the specific services and platforms used. The National Human Genome Research Institute has observed a substantial drop in the cost of genome sequencing since the initial Human Genome Project’s inception in 2000.

In the U.S., around 287,850 new cases of invasive breast cancer are expected to be diagnosed among women, leading to approximately 43,250 deaths, as reported by the American Cancer Society in 2022. Thus, the increasing occurrence of women’s health issues, along with a rising consciousness surrounding these conditions, has spurred the need for the advancement of diagnostic tools to enhance prevention and treatment methods.

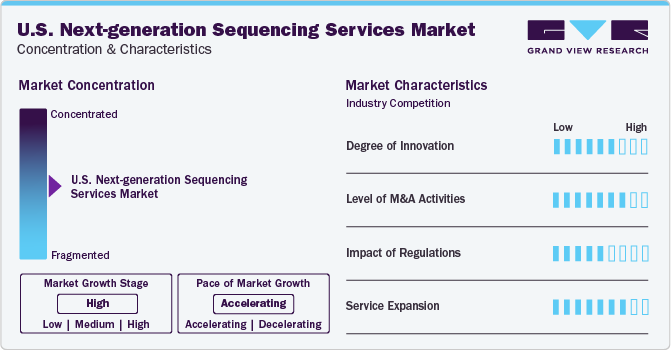

Market Concentration & Characteristics

The industry demonstrates significant innovation, with companies consistently investing in R&D. Their focus is on introducing cutting-edge technologies, enhancing sequencing processes, and improving data analysis capabilities. This commitment to innovation is propelling the industry forward, allowing for the introduction of advanced services and solutions that meet the evolving needs of both customers and the healthcare sector.

The industry is witnessing a substantial amount of mergers and acquisitions, reflecting a vibrant landscape where businesses are pursuing strategic alliances to bolster their industry standings. Recent instances involve acquisitions undertaken by major players, such asThermo Fisher Scientific’s October 2023 proposal to acquire Olink, a leading provider of next-generation proteomics solutions, reflecting the industry’s trend towards strategic alliances to drive growth and innovation.

In the U.S., clinical laboratories are required to secure accreditation from CMS and comply with CLIA regulations to conduct genetic and diagnostic tests, as mandated by entities like the New York State Department of Health and the College of American Pathologists. The initiation of fundraising programs by governmental bodies and funding organizations to boost R&D in genomics is anticipated to offer profitable growth opportunities for this industry. For example, the NIH significantly funds genomics research, covering about 50%-60% of the estimated USD300 million expense for producing the initial human genome sequence.

Businesses are broadening their range of services to deliver all-encompassing solutions to their clients. In addition to creating sophisticated sequencing platforms, they are also providing an extensive array of sequencing services to cater to the varied requirements posed. For instance, in November 2023, MedGenome and PacBio announced a grant for De Novo Genome Assembly and Annotation. The initiative aimed to support the creation of reference genomes

Major players in the industry are broadening their geographical reach to access varied regional industries and utilize local resources. This strategic growth enables these companies to cater to a wider customer base, set up local centers for R&D, and take advantage of the distinct opportunities offered by various regions across the U.S. For instance,in January 2024, Eurofins Genomics, a global leader in sequencing services, opened a new lab in Bothell, Washington, catering to the Seattle area.

Service Type Insights

Human genome sequencing services dominated the market in 2023, generating nearly 32% of the total revenue share. These services play a crucial role in deciphering the cause of monogenic disorders like sickle-cell anemia, retinoblastoma, and cystic fibrosis, and also contribute to a better understanding of complex diseases such as diabetes and cancer. By providing insights into human genetic information, these services facilitate personalized medicine, the discovery of biomarkers, identification of genes associated with cancer, and the study of how genes affect the body’s response to drugs (pharmacogenomics).

Furthermore, the progress in precision medicine and related fields, which collects human genome data, has significantly contributed to creating suitable human reference genomes for designing customized medications. Consequently, these factors, along with reduced costs and the increasing adoption of genome mapping projects, are anticipated to drive market expansion throughout the forecasted period.

Gene regulation services are anticipated to register the fastest CAGR over the forecast period. NGS offers a more advanced platform for gene regulation, enabling the examination and analysis of a sample’s transcriptional complexity. These gene regulation services play a crucial role in identifying cardiovascular disorders and offer an overview of actively expressed genes and transcripts across various medical conditions.

Gene regulation services are further categorized into small RNA sequencing services, ChIP sequencing services, and other gene regulation-related services. Among these, ChIP sequencing services held the largest market share in 2023. In this technology, chromatin immunoprecipitation aims to recover specific protein-DNA complexes, while NGS is employed for sequencing of the recovered DNA.

The use of ChIP sequencing services is vital for acquiring a comprehensive understanding of human genome and its regulatory mechanisms, making it a valuable asset in next-generation sequencing services. In 2022, Quantum-Si Incorporated announced that the American Association for the Advancement of Science has published a new research study that explains the potential of single-molecule protein sequencing transforming biomedical research through time domain sequencing and semiconductor chip.

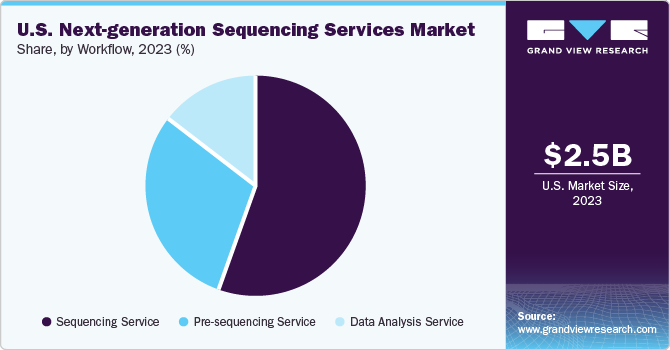

Workflow Insights

Sequencing services dominated the market in 2023, with a share of 55.22% of the total revenue. Moreover, the segment is anticipated to exhibit the highest CAGR throughout the forecast period. This significant growth can be attributed to the pivotal role sequencing services play in the entire workflow. The presence of numerous sequencers in the market, which are the most commonly used platforms in sequencing workflows, further supports this dominance. In addition, the competitive landscape in the market is expected to intensify as companies develop innovative, benchtop, or portable sequencing platforms. This development is likely to propel segment growth over the forecast period.

Pre-sequencing services are estimated to experience lucrative growth from 2024 to 2030. These services encompass library preparation and clonal amplification services, which are offered for individual barcoded libraries and/or pooled libraries as per the customer’s preference. The advancements and introduction of new products in library preparation solutions have expanded the scope of sequencing technologies in the fields of epigenetics and transcriptomics. Furthermore, the development of advanced library preparation kits by key companies enhances the reproducibility and consistency of standard molecular biology reactions, while also providing access to innovative preparation strategies.

End-use Insights

In 2023, universities and other research entities held the largest market share, accounting for nearly 53% of the total revenue. NGS services are utilized by researchers across various sectors, including universities & other research entities, hospitals & clinics, pharma & biotech entities, and other end-users for diverse research projects.

Key factors driving the adoption of NGS services by universities and other research entities include the increase in R&D funding, growing demand for NGS, and the expansion of genomic studies. This growth presents several opportunities for NGS providers that focus on development of NGS-based solutions. In October 2022, the American Society for Microbiology received funding from the CDC to enhance pathogen genomic sequencing for pandemic preparedness.

Hospitals & clinics are expected to grow at the fastest rate over the forecast period, primarily due to the extensive applications of NGS in clinical studies related to cancer prognosis. Advanced NGS tools play a crucial role in pathogen detection, molecular diagnostics, personalized medicine research, and genetic mutation identification. As a result, NGS services cater to clinical studies on infectious diseases, cancer detection, infection control, and antimicrobial resistance testing, which in turn support clinicians in treatment decisions. Moreover, strategic developments among hospitals, clinics, and service providers contribute to the market growth in this sector.

Key U.S. Next-generation Sequencing Services Company Insights

The market is trending towards consolidation, characterized by ongoing strategic partnerships and mergers & acquisitions. Market participants are aiming to secure a competitive edge by exploiting untapped opportunities that are available. The U.S. NGS services market’s dominance in the global market can be attributed to the local presence of market leaders such as Illumina, Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; PerkinElmer, Inc.; QIAGEN; Quest Diagnostics Incorporated; and Azenta Life Sciences (GENEWIZ), which are involved in the development of NGS solutions.

Companies in the U.S. next-generation sequencing services market aim to expand service offerings, access new markets, achieve economies of scale, and strengthen competitive positions. For instance, in February 2024, DNAnexus and Curio Bioscience announced a collaboration to streamline data analysis for large-scale spatial transcriptomics projects. By combining Curio Seeker with the Precision Health Data Cloud, they provided scientists with a secure and scalable solution for managing and sharing high-resolution, spatially resolved gene expression data.

Key U.S. Next-generation Sequencing Services Companies:

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- PerkinElmer, Inc.

- QIAGEN

- Quest Diagnostics Incorporated

- Azenta Life Sciences (GENEWIZ)

- NanoString

- PacBio

- bioMérieux

- BGI Group

- F. Hoffmann-La Roche Ltd

- ARUP Laboratories

- Novogene Co, Ltd.

- Gene by Gene Ltd.

- Lucigen Corporation

Recent Developments

-

In January 2024, Illumina Inc., a leading DNA sequencing company, announced a collaboration with Janssen Research & Development to develop its novel molecular residual disease assay, a whole-genome sequencing multi-cancer research solution.

-

In January 2023, QIAGEN Digital Insight, the bioinformatics business of QIAGEN, announced the launch of ultra-fast NGS analysis that would process whole genome in 25 minutes.

-

In April 2022, LGC acquired Rapid Genomics to bolster its position in the NGS application and offer advanced solutions to the agricultural sector, enhancing their capabilities in genetic analysis for crop improvement and animal breeding.

-

In March 2022, LetsGetChecked, a prominent health testing company, took over Veritas Genetics to leverage their genome sequencing services, enabling LetsGetChecked to provide more comprehensive and personalized health insights to their customers.

-

In July 2021, ARUP Laboratory inaugurated a 220,000 sq. ft. cutting-edge facility at the University of Utah Research Park, U.S. The lab aimed to enhance the quality of laboratory testing and support research advancements.

U.S. Next-generation Sequencing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2.48 billion |

|

Revenue forecast in 2030 |

USD 10.14 billion |

|

Growth rate |

CAGR of 22.39% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Service type, workflow, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

Illumina, Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; PerkinElmer, Inc.; QIAGEN; Quest Diagnostics Incorporated; Azenta Life Sciences (GENEWIZ); NanoString; PacBio; bioMérieux; BGI Group; F. Hoffmann-La Roche Ltd; ARUP Laboratories; Novogene Co, Ltd.; Gene by Gene Ltd.; Lucigen Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Next-generation Sequencing Services Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. next-generation sequencing services market report based on service type, workflow, and end-use.

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Genome Sequencing Services

-

Single Cell Sequencing Services

-

Microbial Genome-based Sequencing Services

-

Gene Regulation Services

-

ChIP Sequencing Service

-

Small RNA Sequencing Service

-

Other Gene Regulation-based Service

-

-

Animal & Plant Sequencing Services

-

Other Sequencing Services

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-sequencing Service

-

Sequencing Service

-

Data Analysis Service

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Universities & Other Research Entities

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other End-uses

-

Frequently Asked Questions About This Report

b. The U.S. next-generation sequencing services market size was estimated at USD 2.48 billion in 2023

b. The U.S. next-generation sequencing services market is expected to grow at a compound annual growth rate of 22.39% from 2024 to 2030 to reach USD 10.14 billion by 2030.

b. Human genome sequencing services dominated the NGS services market with a share of 31.89% in 2023 owing to high penetration of sequencing in deciphering human genetic profiles.

b. Some key players operating in the U.S. NGS services market include Illumina, Inc.; Thermo Fisher Scientific Inc.; Eurofins Scientific SE; PerkinElmer, Inc.; QIAGEN; Quest Diagnostics Incorporated; Azenta Life Sciences (GENEWIZ); NanoString; PacBio; bioMérieux; BGI Group; F. Hoffmann-La Roche Ltd; ARUP Laboratories; Novogene Co, Ltd.; Gene by Gene Ltd.; Lucigen Corporation.

b. Key factors that are driving the next-generation sequencing services market growth include declining sequencing price, increasing implementation of NGS in clinical workflows, and rising market competition between the players to gain substantial revenue share in the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."