- Home

- »

- Homecare & Decor

- »

-

U.S. Newspaper Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Newspaper Market Size, Share & Trends Report]()

U.S. Newspaper Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Advertising, Circulation), By Platform (Print, Digital), By Publication (National, Local/Regional), And Segment Forecasts

- Report ID: GVR-2-68038-190-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Newspaper Market Size & Trends

The U.S. newspaper market size was estimated at USD 20.61 billion in 2024 and is expected to record a CAGR of -1.3% from 2025 to 2030. This contraction is primarily due to the continued shift from print to digital media, changes in consumer behavior, and a decrease in print ad revenues, which have been further exacerbated by the growing dominance of online platforms and social media for news consumption. In addition, the rise of alternative news outlets and subscription-based models has led to reduced circulation, making it challenging for traditional newspapers to maintain profitability.

The COVID-19 pandemic has led to a rise in digital readership and subscriptions as consumers seek the most up-to-date information on the pandemic. Readership has increased most dramatically among the younger demographics. A Press Gazette analysis earlier this year found that America’s top 25 largest newspapers have lost 20% of their weekday print circulation since the COVID-19 crisis began.

Newsletters have become a prime driver of print and digital subscriptions, filing email databases with a wealth of valuable opt-in customers and attracting new advertisers while retaining the current ones. Subscribers/readers are already voicing their satisfaction with the limited content in newsletters. For example, USA Today alone offers more than 30 newsletters. They have a dedicated audience team with newsletter specialists to ensure their automated newsletters are on point.

America’s largest newspaper brands have switched much of their focus to building the digital subscription business in recent years. A trend that has become more pronounced over the past 18 months. But print remains an important revenue stream for the industry, both for circulation and advertising income. For instance, USA Today, owned by the regional press giant Gannett, launched a paywall recently and is seeking to build its digital revenues as print sales decline.

The Wall Street Journal remains America’s largest newspaper by some distance, with an average weekday circulation of nearly 800,000 between October 2020 and March 2021. But it has lost 21% of its print circulation since 2020. Like USA Today, the Journal’s circulation has been lost significantly by lost hotel sales.

The research by the Financial Times revealed that half of the US daily newspapers are now controlled by private equity, hedge funds, and other investment groups. In 2019, Gannett, US’s largest newspaper publisher, was acquired by New Media Investment Group, run by asset manager Fortress Investment Group. This practice of buying up the struggling newsrooms helps them turn a profit.

Type Insights

Circulation newspapers accounted for a revenue share of over 55% in 2024. Circulation newspapers continue to hold a significant revenue share due to their established role in providing daily local and regional news. These publications generate revenue from both subscriptions and newsstand sales, especially in areas with loyal readership.

For instance, The New York Times and The Wall Street Journal continue to see growth in subscription revenues, with digital subscriptions providing a substantial portion of their earnings. While print sales have seen a decline overall, newspapers that have adapted to the digital shift by offering exclusive content or hybrid models are maintaining strong circulation revenue. As of 2023, The New York Times reported 9 million subscriptions, with digital subscriptions growing by 23% year-over-year, helping to sustain circulation revenue in the face of declining print sales.

Advertising newspapers are projected to record a CAGR of -0.6% from 2025 to 2030. The category is facing a decline in growth due to the continued shift of advertising budgets from traditional print media to digital platforms. Digital advertising on websites like Google, Facebook, and programmatic advertising has outpaced print advertising, as advertisers seek broader reach and better targeting capabilities.

Platform Insights

Print newspaper sales accounted for a share of over 58% in 2024. Print newspapers continue to represent the largest portion of total newspaper revenue despite the ongoing digital transformation. This is particularly evident in markets where traditional newspaper readership remains strong, such as rural or less urbanized areas. Publications such as USA Today and The Washington Post still generate substantial income from print sales, especially from local and regional markets where online subscriptions have not fully taken over. However, this dominance is under pressure as younger readers increasingly turn to digital formats, and traditional publishers explore new monetization strategies, such as paywalls or premium content offerings.

The demand for digital newspapers is projected to grow at a CAGR of 0.3% from 2025 to 2030, driven by the increasing adoption of online news. Despite the overall decline in print media, digital newspapers have carved out a stable niche, especially with younger, tech-savvy readers who prefer accessing news via smartphones or tablets. Key players such as The Guardian and The Washington Post have invested heavily in digital platforms, offering both free and subscription-based models for accessing premium content. This growth is largely attributed to the shift in advertising and subscription revenue toward digital formats.

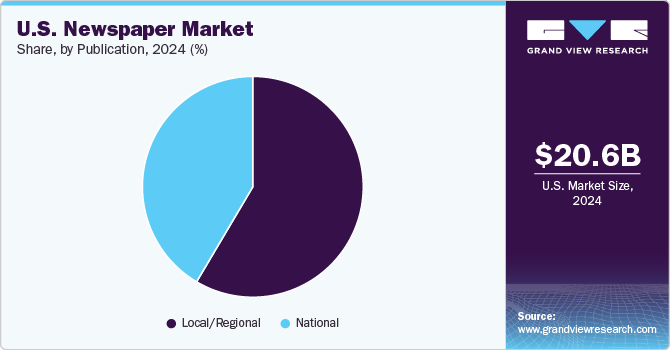

Publication Insights

Local/regional publications accounted for a share of over 58% in 2024. These publications benefit from deep community ties, local advertisers, and loyal readership, which sustains their financial performance. Newspapers such as The Los Angeles Times and Chicago Tribune have diversified revenue sources by offering localized content, event listings, and niche reporting that appeal to specific communities. In addition, these publications have found success by embracing hybrid models, combining both print and digital subscriptions to maintain a robust revenue base. The local advertising market for newspapers remains relatively strong, with businesses seeking to target local audiences effectively.

National publications are facing an ongoing decline, projected to shrink at a CAGR of -1.9% through 2030. The decline is attributed to a combination of factors, including the fragmentation of the media landscape, the rise of digital platforms, and the overall decline in print advertising. Major national newspapers such as The New York Times and USA Today are still struggling with print revenue loss as they pivot to digital strategies, but their growth is often slower compared to local publications. National brands face intense competition from online news aggregators such as Google News and social media platforms, which provide immediate access to breaking news without the need for subscriptions.

Key U.S. Newspaper Company Insights

The U.S. newspaper market is characterized by intense competition, driven by both traditional and digital players vying for market share. Established newspapers such as The New York Times, The Washington Post, and USA Today continue to dominate the market, but they are increasingly challenged by digital-first outlets like BuzzFeed, HuffPost, and digital news platforms. The competitive landscape is further complicated by the rise of subscription-based models, as traditional newspapers pivot to increase revenue streams.

Key U.S. Newspaper Companies:

- The Wall Street Journal

- Tribune Publishing

- Gannett Co. Inc

- MediaNews Group. Inc.

- News Corporation

- New York Times Company

- The Washington Post

- New York Post

- Los Angeles Times

- Newsday

Recent Developments

-

In March 2022, Media Matters Worldwide, a 100% women-owned media strategy, won the 2022 Female Frontier Awards hosted by the Campaign US. Media Matters Worldwide continuously invests in the latest media technologies to develop strategic, efficient, and transparent solutions.

-

In February 2022, local newspapers found hints of success with online subscriptions. For an industry accustomed to doomsaying, the willingness of the people to pay for digital access is giving many publishers hope that they have found a way to survive. The newspapers that first found success emphasizing online subscriptions are The Wall Street Journal and the New York Times.

-

In July 2021, newspaper circulation revenue surpassed the advertising segment in America. As per the Pew Research Center, circulation revenue from people buying or print subscriptions reached USD 11.1 billion in 2020, and advertising revenue was reported as USD 8.8 billion revenue.

U.S. Newspaper Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.28 billion

Revenue forecast in 2030

USD 18.99 billion

Growth rate (Revenue)

CAGR of -1.3% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, and publication

Country scope

U.S.

Key companies profiled

The Wall Street Journal; Tribune Publishing; Gannett Co. Inc.; MediaNews Group. Inc.; News Corporation; New York Times Company; The Washington Post; New York Post; Los Angeles Times; Newsday

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Newspaper Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. newspaper market on the basis of type, platform, and publication:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Advertising

-

Circulation

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Print

-

Digital

-

-

Publication Outlook (Revenue, USD Billion, 2018 - 2030)

-

National

-

Local/Regional

-

Frequently Asked Questions About This Report

b. The U.S. newspaper market was valued at USD 20.61 billion in 2024 and is anticipated to contract to USD 20.28 billion in 2025.

b. The U.S. newspaper market is declining at a compound annual growth rate of -1.3% from 2025 to 2030, contracting to USD 18.99 billion by 2030.

b. Circulation newspapers accounted for a revenue share of over 55% in 2024. Circulation newspapers continue to hold a significant revenue share due to their established role in providing daily local and regional news.

b. Some key players operating in the U.S. newspaper market include The Wall Street Journal, Tribune Publishing, Gannett Co. Inc., and MediaNews Group. Inc., News Corporation, New York Times Company, The Washington Post, New York Post, Los Angeles Times, Newsday

b. Key factors that are driving the U.S. newspaper market growth include the Pandemic has led to a rise in digital readership and subscriptions as consumers seek the most up-to-date information on pandemic.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.