- Home

- »

- Medical Devices

- »

-

U.S. Neurovascular Devices Market, Industry Report, 2030GVR Report cover

![U.S. Neurovascular Devices Market Size, Share & Trends Report]()

U.S. Neurovascular Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device (Cerebral Embolization & Aneurysm Coiling Devices, Neurothrombectomy Devices), By Therapeutic Applications, By Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-225-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Neurovascular Devices Market Trends

The U.S. neurovascular devices market size was valued at USD 1.77 billion in 2024 and is projected to grow at a CAGR of 4.75% from 2025 to 2030. Increasing prevalence of neurovascular disorders such as stroke & brain aneurysms along with the rising demand for minimally invasive neurological procedures are responsible for the market growth. Moreover, well-established healthcare infrastructure and favorable reimbursement & regulatory policies in the country create significant growth opportunities in this market.

The growth can be attributed to the increasing prevalence of neurovascular devices, increasing awareness programs by the government and non-government organizations, and an increase in training programs. There are various initiatives undertaken by the government worldwide to prevent stroke. Moreover, the FDA has been collaborating with neurological device manufacturers and professional societies, such as the NeuroPoint Alliance and the National Institutes of Health (NIH) (StrokeNet), with the aim to develop robust registries for the use of generating data for premarket and post-market application and surveillance.

Poor or unhealthy lifestyle choices such as alcohol addiction & smoking are among major factors leading to the development of arterial ischemic stroke (AIS), and the incidence of strokes is increasing every year. Brain strokes are commonly caused due to high blood pressure and weakened blood vessels. For instance, in the U.S., around 795,000 stroke cases occur every year, out of which 23.0% are fatal or cause permanent disability. Moreover, smoking, hypertension, drug abuse, heavy alcohol consumption, and older age are considered major risk factors for brain aneurysms. Thus, increasing adoption of unhealthy lifestyles is likely to boost the growth of the neurovascular devices market.

U.S. accounted for 24.0% of the global neurovascular devices market in 2023. Furthermore, according to the Brain Aneurysm Foundation, more than 6.5 million people in the U.S. have an unruptured brain aneurysm. The brain aneurysm is predominantly found in women aged above 55 than men with a ratio of 3:2, respectively. Moreover, 500,000 deaths occur due to brain rupture every year globally. The continuous introduction of technologically advanced system for treating intracranial aneurysms is also expected to propel the market growth.

Favorable initiatives undertaken by private and public sectors related to neurovascular devices are likely to boost market growth. For instance, the Brain Aneurysm Foundation organized Advocacy Day on Capitol Hill in March 2020 to raise awareness and impart relevant knowledge regarding neurovascular devices. Favorable reimbursement policies by Centers for Medicare and Medicaid Services (CMS) and Musculoskeletal Clinical Regulatory Advisors, LLC (MCRA), among others allow reimbursement of neurovascular devices when ordered by doctors or provided as a part of a physician’s services.

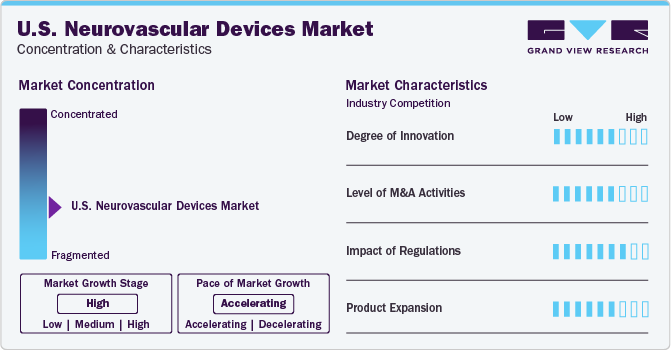

Market Concentration & Characteristics

The U.S. neurovascular devices industry is fragmented owing to the presence of several key and small players. New product launches, mergers & acquisitions, and product, and geographical expansion are the key strategic undertakings of the participants in this industry.

Economic growth in the country provides huge growth opportunities for manufacturers to expand their sales and distribution networks. Several key players are investing in R&D for the launch of innovative minimally invasive surgical instruments such as closure devices, and cholangiogram catheters. The industry rivalry is anticipated to increase over the forecast period as market players are implementing various strategies to increase their market shares such as launching new products, and adopting price reduction strategies.

Market players are undertaking various strategic initiatives such as partnerships, mergers, acquisitions, and collaboration for company expansion. For instance, in May 2023, Stryker announced the acquisition of Cerus Endovascular Ltd. The company aimed at expanding its product portfolio on aneurysm treatment solutions by using the latter’s CE Marked products, the Contour Neurovascular System, and the Neqstent Coil Assisted Flow Diverter.

Neurovascular embolization devices are regulated under the Food, Drug, and Cosmetic Act by the FDA. These devices are regulated by the Center for Devices and Radiological Health (CDRG) and manufacturers need to comply with all the rules to gain device approval. A stringent pre-approval process is in place which may significantly increase the cost incurred by manufacturers. In addition, non-compliance with FDA regulations can result in product recalls. However, several initiatives undertaken by the government and the non-profit organizations are expected to boost the market growth.

Device Insights

The cerebral embolization and aneurysm coiling devices segment held the largest market share with 38.44% in 2023. Rising prevalence of aneurysm is expected to propel the segment over the forecast period. Coil embolization is a minimally invasive procedure for the treatment of aneurysms, wherein, the material closes the sac and reduces the risk of bleeding. These devices are further classified into embolic coils, flow diversion devices, and liquid embolic agents.

The neurothrombectomy devices segment is expected to grow at the highest CAGR during the forecast period. An increase in number of people suffering from acute ischemic stroke is expected to increase the use of neurothrombectomy devices. These devices are designed to remove or dissolve blood clots from the cerebral neurovasculature using mechanical, laser, ultrasound, or a combination of these technologies.

Size Insights

The 0.021" segment held the largest market share with 26.93% in 2023. The segment growth is attributed to several R&D activities, product launches and approvals. For instance, in April 2021, the U.S. FDA cleared the use of 0.021" Bendit21 microcatheter by the Bendit Technologies, for use in the brain, peripheral, and coronary vasculature.

Others segment, including 0.015”, 0.060”, 0.84”, 0.091”, and 0.074” sized devices, is expected to grow at the highest CAGR during the forecast period. Availability and advantages provided by these devices are contributing towards the segment’s growth. For instance, AVIGO 0.014” hydrophilic guidewire provides support for tracking for 021” and 027” systems smoothly. In addition, this device helps cross and maintain catheter stability. Moreover, the availability of abundant products in this segment is expected to propel segment growth over the forecast period.

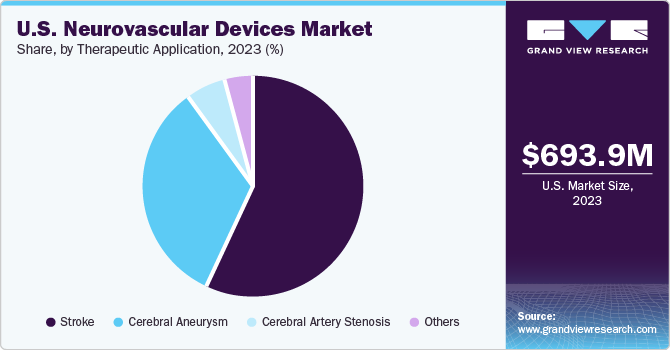

Therapeutic Application Insights

Stroke segment held the largest market share with 56.96% in 2023. According to the latest available CDC statistics, every year, more than 795,000 people in the U.S. suffer from stroke, of which, 610,000 are new cases. Moreover, as per the National Library of Medicine, 63% stroke cases are ischemic, which leads to blockage of blood supply to the brain. Neurovascular devices help revascularize blood flow in blocked veins & arteries. Thus, with such an increase in the number of stroke-prone populations worldwide, the use of neurovascular devices is expected to increase, propelling segment growth.

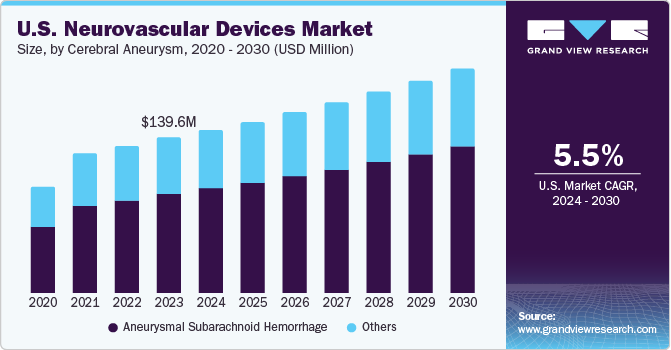

Cerebral aneurysm segment is expected to grow at the highest CAGR during the forecast period. Increase in number of people suffering from high blood pressure, and rise in the number of tobacco smokers are boosting the overall prevalence of cerebral aneurysms. Nearly 30,000 people in the U.S. suffer a brain aneurysm rupture every year. As high blood pressure can increase the pressure on the walls of the blood vessels inside the brain, it potentially increases the chances of developing an aneurysm. Hence, the segment is expected to witness significant growth over the forecast period.

End-use Insights

The hospitals segment held the largest market share with 71.51% in 2023. It is also expected to grow at the fastest CAGR during the forecast period. The segment growth can be attributed primarily to increasing patient pool suffering from neurovascular disorders, such as ischemic & hemorrhagic stroke, and brain aneurysm. The availability of technologically advanced neurovascular devices, coupled with favorable reimbursement policies is expected to enhance U.S. neurovascular devices market growth in hospitals during the forecast period.

In addition, the growing number of patients admitted to hospitals for therapies, treatments, and surgeries, will favor the neurovascular devices market in the upcoming years in the U.S. Thus, subsequent increases in the number of patients, launch of technologically advanced products, and favorable reimbursement policies are projected to propel the segment’s pace of growth during the forecast period.

Key U.S. Neurovascular Devices Company Insights

Some of the prominent U.S. neurovascular devices market companies are Medtronic, Inc.; Stryker Corporation; Integra LifeSciences and Microvention Inc. and Penumbra Inc. These players are increasingly focusing on product launches, and other growth strategies, such as mergers & acquisitions to strengthen their foothold in the market.

Market players are making constant efforts to introduce technologically advanced products in the market. For instance, in October 2022, Medtronic plc launched a platform that is designed to accelerate the urgent requirement for innovation in stroke care and treatment. The platform has been named Neurovascular Co-lab.

Key U.S. Neurovascular Devices Companies:

- Medtronic

- Johnson and Johnson Services Inc.

- Penumbra, Inc.

- Microport Scientific Corporation

- Stryker

- Microvention Inc (Terumo Corporation)

- Codman Neuro (Integra Lifesciences)

Recent Developments

-

In February 2024, Philips announced the launch of the Azurion neuro biplane system which is a major enhancement to Azurion, which is its image-guided therapy system. This is designed to help run neurovascular procedures smoothly, allow care teams to make effective decisions faster, and attend to more patients

-

In May 2022, Medtronic acquired Intersect ENT, which is an ENT medical leader. This acquisition is aimed at expanding the company’s product portfolio used for ENT procedures

-

In April 2022, Medtronic and GE Healthcare collaborated to provide care at Office-Based Labs (OBLs) and Ambulatory Surgery Centers (ASCs). This partnership between major industry players is to cater to the rising needs for outpatient care

U.S. Neurovascular Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.86 billion

Revenue forecast in 2030

USD 2.35 billion

Growth rate

CAGR of 4.75% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Country scope

U.S.

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Device, therapeutic application, size, end-use

Key companies profiled

Medtronic, Johnson and Johnson Services Inc., Penumbra, Inc., Microport Scientific Corporation, Stryker, Microvention Inc (Terumo Corporation), Codman Neuro (Integra Lifesciences)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Neurovascular Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. neurovascular devices market report based on device, therapeutic application, size, and end-use:

-

Device Outlook (Revenue USD Million; Volume Unit; 2018 - 2030)

-

Cerebral Embolization and Aneurysm Coiling Devices

-

Embolic coils

-

Flow diversion devices

-

Liquid embolic agents

-

-

Cerebral Angioplasty and Stenting Systems

-

Carotid artery stents

-

Embolic protection

-

-

Neurothrombectomy Devices

-

Clot retrieval devices

-

Suction devices/aspiration catheters

-

Vascular snares

-

-

Support Devices

-

Micro catheters

-

Micro guidewires

-

-

Trans Radial Access Devices

-

-

Therapeutic Application Outlook (Revenue USD Million; 2018 - 2030)

-

Stroke

-

Cerebral Artery

-

Cerebral Aneurysm

-

Aneurysmal Subarachnoid Hemorrhage

-

Others

-

-

Others

-

-

Size (in Inches) Outlook (Revenue USD Million; 2018 - 2030)

-

0.027"

-

0.021"

-

0.071"

-

0.017"

-

0.019"

-

0.013"

-

0.058"

-

0.068"

-

Others

-

-

End-use Outlook (Revenue USD Million; 2018 - 2030)

-

Hospitals

-

Specialty Clinics

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.