- Home

- »

- Medical Devices

- »

-

U.S. Neurovascular Catheters Market, Industry Report, 2030GVR Report cover

![U.S. Neurovascular Catheters Market Size, Share & Trends Report]()

U.S. Neurovascular Catheters Market Size, Share & Trends Analysis Report By Type (Microcatheter, Balloon Catheter), By Applications (Embolic Stroke, Brain Aneurysms), By End Use (Hospitals, Clinics, Diagnostic Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-229-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Neurovascular Catheters Market Trends

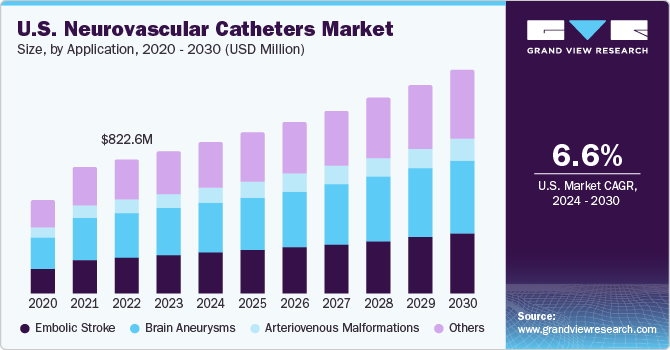

The U.S. neurovascular catheters market size was valued at USD 1.06 billion in 2023 and is anticipated to grow at a CAGR of 6.58% from 2024 to 2030. The increasing prevalence of neurological conditions such as brain aneurysms and stroke, unhealthy lifestyles, rising awareness on the treatment of neurological conditions, increasing disposable income, and new product launches by the key market players are factors driving the neurovascular catheter market growth.

The U.S. accounted for 27% of the global neurovascular catheters market in 2023. According to Brain Aneurysm Foundation, more than 6.5 million people in the U.S. suffer from unruptured brain aneurysm, and nearly, 30,000 people suffer an intracranial aneurysm rupture every year. Furthermore, as per the National Institute of Health, around 795,000 people in the country have a stroke, causing 137,000 deaths. Thus, the increasing prevalence of cerebral aneurysms and cases of other neurological disorders m is expected to drive the market growth.

Furthermore, an increasing number of initiatives being undertaken by various organizations is expected to fuel market growth. For instance, The Bee Foundation (TBF), a nonprofit organization, is focused on spreading awareness and reducing the number of deaths due to cerebral aneurysms through innovative research. TBF invites proposals for a brain aneurysm research grant, which is likely to help the organization achieve its aim of reducing mortality due to brain aneurysms. These factors are expected to boost the market during the forecast period. Similarly, well-established healthcare infrastructure and favorable reimbursement & regulatory policies in the healthcare industry are among the factors expected to create significant growth opportunities in the market.

Minimally invasive surgeries are gaining popularity owing to the reduced risk and trauma associated with these procedures. Neurovascular catheters along with other advanced devices are considered minimally invasive techniques for the treatment of aneurysm, stroke, and other blood vessel conditions in the brain. Moreover, these surgeries involve fewer muscle and tendon interruptions, making them a more natural and easier procedure. Moreover, rising concern for esthetic and natural appearance among all age groups and lesser amount of blood loss during minimally invasive surgeries are few of the major market growth drivers.

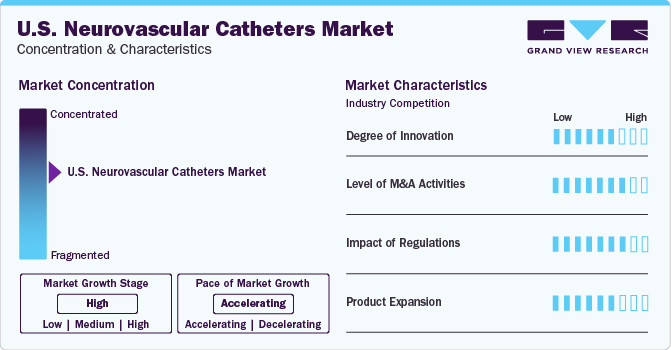

Market Concentration & Characteristics

The neurovascular catheters market is highly competitive and major players are adopting various strategies to sustain in the market.The market is dominated by several global players, which are devising strategies to gain a competitive edge and introducing new innovative products to increase their market shares. These global players offer products at competitive prices. Moreover, key market players are constantly incorporating technologies that can meet the specific requirements of patients.

Launching technologically advanced products is one of the major strategies adopted by key players to increase their market share. For instance, in April 2019, Stryker announced the launch of the Sonopet iQ Ultrasonic Aspirator System at the American Association of Neurological Surgeons annual meeting in San Diego. This technology was designed to increase power and speed with improved precision & control to enhance its usability. With this launch, Stryker is expected to increase its product portfolio in acute ischemic disease treatment.

The competitive rivalry in the market is expected to be high due to the increasing number of mergers and collaborations by major market players. Additionally, the market players are also emphasizing acquisitions to offer a diverse and advanced portfolio of neurointervention catheters in the market. For instance, In Jan 2021, Genesis MedTech Group agreed to fully acquire Hua Medtech, to establish a specialized neurovascular franchise.

Neurovascular catheters fall under Class II of FDA regulations. Standards set by regulatory bodies have to be complied with in order to survive in the market, which often becomes a restraining factor for new and local players. In addition, many local players are not aware of regulatory standards, thus affecting the quality of the products. The devices undergo rigorous clinical trials before a Premarket Approval (PMA), which takes a minimum of 5 to 10 years. This leads to a substantial rise in the cost for manufacturers. Compared to foreign markets, it is more difficult to enter the domestic U.S. market, due to stringent FDA regulations in the country. Thus, the complex regulatory framework for the approval of neurovascular catheters is likely to hinder the market growth.

Type Insights

The embolization catheters segment accounted for the largest share of 27.57% in 2023. Neurovascular embolization catheters, which are minimally invasive treatments offering better control over bleeding than open surgeries, can close off vessels supplying blood to a tumor or treat aneurysms. The increasing demand for embolization catheters in aneurysm treatment is expected to boost the market significantly.

The microcatheter segment is expected to register the highest CAGR during the forecast period. These devices are designed with several properties, including softness, trackability, hydrophilic coating, & stability. Since the number of neurological procedures is increasing, the demand for interventional products such as microcatheters or neurovascular catheters is expected to grow. Adoption of technologically advanced products, recommendations by neurosurgeons, and new product launches by key players are major factors driving the microcatheters market.

Application Insights

The brain aneurysms segment accounted for the largest share of 33.02% in 2023. Factors responsible for the formation of brain aneurysms are hypertension, smoking, injury or trauma to blood vessels, complications from certain blood infections, and genetic predisposition. The increasing prevalence of brain aneurysm is anticipated to boost the U.S. market in the forecast period

The embolic stroke segment is expected to register a considerable CAGR during the forecast period. Embolic stroke is a type of ischemic stroke. The primary focus in stroke rehabilitation is the recovery of lost arterial functions with the help of stents and embolization coils. According to WHO, stroke is the second most common cause of death and the third most common cause of disability around the world. Neurovascular catheters are used for the treatment of stroke. Thus, the increasing incidence of ischemic stroke is expected to boost the market in the coming years.

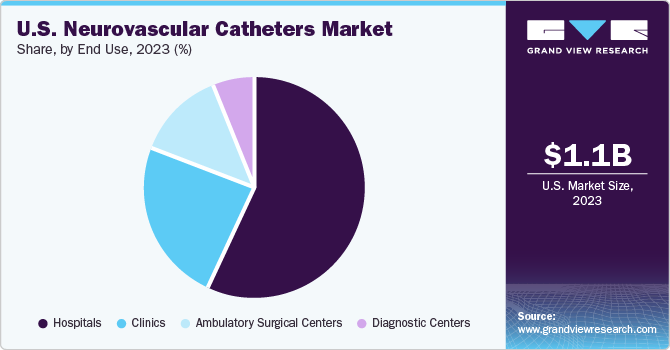

End Use Insights

The hospital segment accounted for the largest share of 56.63% in 2023. The growth of this segment can be attributed primarily to the rising number of patients suffering from neurovascular disorders, such as ischemic & hemorrhagic stroke, brain aneurysm, and AVM. A growing number of patients admitted to hospitals for treatments, surgeries, and therapies, is projected to influence the neurovascular catheters market significantly. Moreover, neurovascular catheters that are technologically advanced, coupled with favorable reimbursement policies, will possibly enhance the market growth during the forecast period.

The ambulatory surgical centers (ASCs) segment is expected to register the highest CAGR during the forecast period. Most of the neurosurgeries can be performed at ASCs now, owing to more advanced and less invasive surgical procedures. Surgeries at ASCs are quicker, recovery is faster, and the infection rate is lower than that in hospital settings. Owing to factors such as being comparatively lesser expensive than hospitals, ASCs provide significant cost savings to patients. This is projected to positively impact the segment growth in the upcoming years.

Key U.S. Neurovascular Catheters Company Insights

Some of the prominent U.S. neurovascular catheter companies operating in the market include Medtronic, Stryker Corporation, Penumbra, Inc., Integer Holdings Corporation, MicroVention Inc., (Terumo Corporation), Codman Neuro (Integra LifeSciences Corporation), Acandis GmbH, and Cerenovus (Johnson and Johnson Services, Inc.). These companies are focusing on technological advancements, launching innovative medical devices, and other growth strategies. Moreover, market players develop and maintain long-term contracts with their regular suppliers to source high-quality materials. This increases the power of suppliers in the market.

However, advancements in technology are leading to higher manufacturing costs and restricting new players from entering the market, thereby posing a threat to the new market players. These players require significant capital investments and advanced technologies and need to adhere to stringent government regulations and bear high setup costs. These factors are expected to limit the number of companies entering the market.

Key U.S. Neurovascular Catheters Companies:

- Medtronic

- Stryker

- Terumo Corporation

- Integer Holdings Corporation

- Penumbra, Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- Acandis GmbH

- Spiegelberg GmbH & Co. KG

Recent Developments

-

In January 2024, Perfuze received US FDA clearance for the Millipede 070 catheter which is intended to remove blood clots rapidly and safely in the treatment of acute ischaemic stroke

-

In February 2022, CERENOVOUS by Johnson & Johnson announced the launch of EMBOGUARD the next-gen balloon guide catheter, used in endovascular procedures such as for patients with acute ischemic stroke

U.S. Neurovascular Catheters Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.36 billion

Growth rate

CAGR of 6.58% from 2024 to 2030

Volume in 2024

3.89 million Unit

Volume forecast in 2030

5.67 million Unit

Growth Rate

CAGR of 6.41% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume unit, and CAGR from 2023 to 2030

Country scope

U.S.

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use

Key companies profiled

Medtronic, Stryker, Terumo Corporation, Integer Holdings Corporation, Penumbra, Inc., Johnson & Johnson Services, Inc., Integra LifeSciences Corporation, Acandis GmbH, Spiegelberg GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Neurovascular Catheters Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. neurovascular catheters market report based on type, application, and end-use:

-

Type Outlook (Revenue USD Million; Volume Unit; 2018 - 2030)

-

Microcatheters

-

Balloon Catheters

-

Access Catheters

-

Embolization Catheters

-

Others

-

-

Application Outlook (Revenue USD Million; Volume Unit; 2018 - 2030)

-

Embolic Stroke

-

Brain Aneurysms

-

Arteriovenous Malformations

-

Others

-

-

End Use Outlook (Revenue USD Million; Volume Unit; 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Frequently Asked Questions About This Report

b. Embolization catheters segment accounted for the largest share of 27.57% in 2023. Neurovascular embolization catheters, which are minimally invasive treatments offering better control over bleeding than open surgeries, can close off vessels supplying blood to a tumor or treat aneurysms. The increasing demand for embolization catheters in aneurysm treatment is expected to boost the market significantly.

b. Some of the key players in the U.S. neurovascular catheters market are Medtronic, Stryker, Terumo Corporation, Integer Holdings Corporation, Penumbra, Inc., Johnson & Johnson Services, Inc., Integra LifeSciences Corporation, Acandis GmbH, Spiegelberg GmbH & Co. KG.

b. Increasing prevalence of neurological conditions such as brain aneurysms and stroke, the adoption of unhealthy lifestyle, increasing awareness among the population about the treatment of neurological conditions, increasing disposable income, and new product launch by the key market players are some of the prime factors driving the market.

b. The U.S. neurovascular catheters market size was estimated at USD 1.06 billion in 2023 and is expected to reach USD 1.1 billion in 2024.

b. The U.S. neurovascular catheters market is expected to grow at a compound annual growth rate of 6.58% from 2024 to 2030 to reach USD 1.36 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."