- Home

- »

- Medical Devices

- »

-

U.S. Neurothrombectomy Devices Market, Industry Report, 2030GVR Report cover

![U.S. Neurothrombectomy Devices Market Size, Share & Trends Report]()

U.S. Neurothrombectomy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Clot Retrievers, Aspiration/Suction Devices, Vascular Stents), By End-use (Hospital, Emergency Clinics, Ambulatory Surgical Centers), And Segment Forecasts

- Report ID: GVR-4-68040-284-0

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

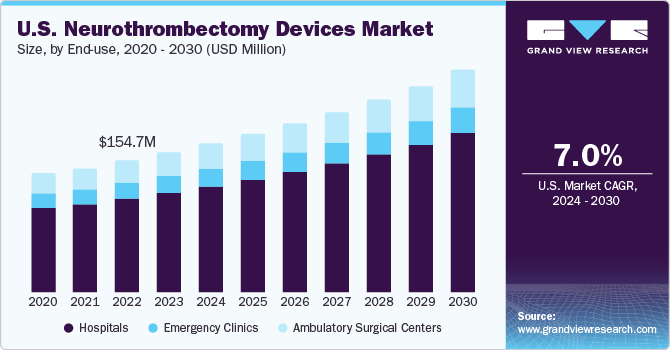

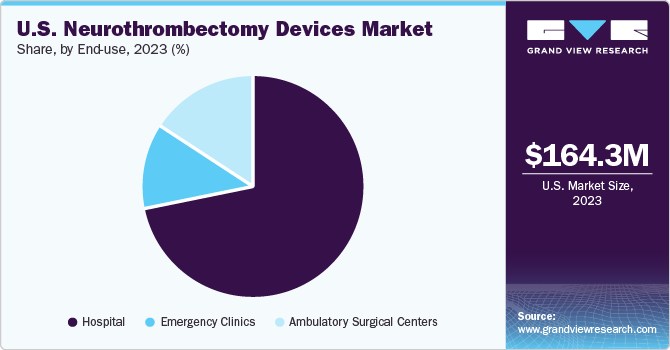

The U.S. neurothrombectomy devices market size was valued at USD 164.3 million in 2023 and is anticipated to grow at a CAGR of 7.0% from 2024 to 2030. The high market growth is due to technological advancements, growing incidence of hemorrhagic & ischemic stroke, and rising demand for minimally invasive procedures for treating neurovascular diseases.

Stroke is the most common cause of death, followed by heart and cancer diseases. It is estimated that 1 out of 20 Americans, or over 140,000 people die of stroke per year. Acute Ischemic Stroke (AIS) is the most common form of stroke, caused due to reduced blood supply to brain, making brain cells die. For instance, according to the CDC, over 87% of strokes are classified as ischemic strokes, with the U.S. being the most commonly affected country. Furthermore, according to National Center for Biotechnology Information (NCBI), strokes occur more commonly in women than men, especially in elderly population (aged 55 to 65).

In 2023, U.S. neurothrombectomy devices market accounted for a market share of over 24% in the global neurothrombectomy devices market. There are various initiatives undertaken by the government to prevent the occurrence of stroke. Some of the examples include Well-Integrated Screening and Evaluation for Women Across the Nation (WISEWOMAN) program started by the CDC in three states-North Carolina, Massachusetts, and Arizona-to minimize the risk of stroke & heart diseases in women by promoting a heart healthy lifestyle. These programs basically target uninsured women and low-income population aged 40 to 64 in an attempt to spread awareness about heart diseases and other chronic conditions. Over 91% of women who had stroke were offered effective care because of such awareness programs.

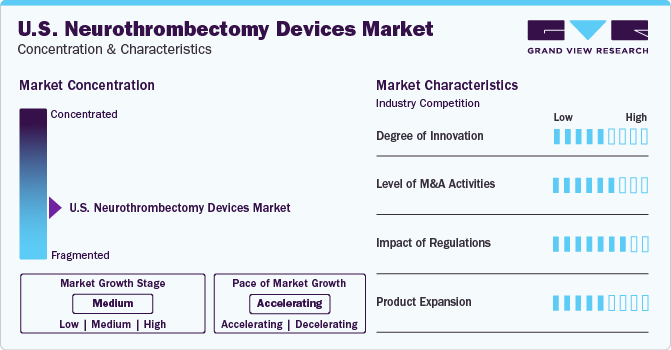

Market Concentration & Characteristics

The industry growth stage is medium (CAGR 5-10%) and pace of the growth depicts an accelerating trend. The U.S. neurothrombectomy devices industry is fragmented, which is marked by the presence of large number of companies competing for the market share. The industry is in moderate growth stage and will continue its trajectory in the coming 5-6 years.

The introduction of advanced technology products and expected commercialization of new products are factors projected to propel the demand over the upcoming years. There are different novel technologies being introduced for developing neurothrombectomy devices for the treatment of acute ischemic stroke and its related symptoms. For instance, in January 2023, Infinity Neuro announced that it had received the CE Mark approval for its debut product - Inspira aspiration catheters. The company also planned to release a line of products for hemorrhagic and ischemic stroke.

The U.S. neurothrombectomy industry is characterized by a moderate level of M&A and collaboration activities undertaken by key manufacturers. Companies are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in September 2021, Abbott announced the acquisition of Walk Vascular, LLC. With the help of this deal, Abbott incorporated peripheral thrombectomy systems of Walk Vascular, into its endovascular range of products. The company’s aspiration thrombectomy system is a mechanical minimally invasive system purposed to remove peripheral blood clots.

Regulations may negatively impact the growth of neurothrombectomy devices. The degree of regulatory scrutiny increases with potential risks of a medical device, represented by the device categorization. According to the FDA, neurothrombectomy devices are categorized under Class III (i.e., high-risk devices), and must undergo stringent device approval processes. Owing to its category, the product undergoes rigorous clinical trials prior to premarket approval. Such stringent pre device approval process may significantly increase the cost incurred by manufacturers. In addition, noncompliance with FDA regulations can result in product recalls.

Product Insights

The clot retriever segment held the highest market share of 60.3% in 2023. Clot retriever devices are witnessing increased demand growth owing to the increasing incidence of acute ischemic stroke and new product launches by leading companies. The adoption of clot retriever devices has rapidly increased due to increasing cases of stroke. Clot retrievers are neurothrombectomy devices used for removing blood clots from a blood vessel present in cerebral arteries. The clot retrieval process should be performed within 8 hours of stroke symptom onset.

The aspiration/suction devices segment is expected to witness the fastest CAGR from 2024 to 2030. Increasing incidence of acute ischemic stroke and surge in use of advanced technology for stroke treatment are factors fueling the overall demand of these devices. Aspiration/suction device is a catheter device that vacuums clot out of blood vessels. In suction thrombectomy, catheter tip is placed proximal to the clot and negative pressure is applied at the distal catheter opening by suctioning through a 50 or 60 ml syringe through the proximal catheter port, resulting in clot aspiration in the catheter.

End-use Insights

Hospitals dominated the market with a share of 71.5% in 2023. The growth in incidence of acute ischemic diseases and increasing awareness about advanced devices are factors expected to boost segment growth. Hospitals remain the preferred choice for treatment of acute ischemic disease than clinics as this disease is required to be treated within 8 hours of symptom onset. Thus, increasing prevalence of stroke is driving segment growth.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR from 2024 to 2030. Ambulatory surgical centers are novel healthcare facilities, providing same-day surgical care, including preventive and diagnostic procedures. They have transformed outpatient experience for millions of populations. More than half of the outpatient surgeries are performed in ASCs, including acute ischemic disease surgical treatment.

Key U.S. Neurothrombectomy Devices Company Insights

Key U.S. neurothrombectomy devices companies are focusing on adopting growth strategies, including collaborations, partnerships and mergers, and new product launches. Furthermore, Companies are also focusing on business strategies such as marketing and promotions, broadening product portfolios to expand the availability and reach of their product offerings. Continuous R&D efforts are being undertaken by companies for safe and effective solutions in the treatment of neurovascular diseases. Such activities are expected to bring novel and innovative medical devices into the market, fueling their growth over the forecast period.

Key U.S. Neurothrombectomy Devices Companies:

- Medtronic

- Stryker Corporation

- Acandis GmbH

- Phenox GmbH

- Penumbra Inc.

- Vesalio

Recent Developments

-

In March 2024, Sim&Cure announced receiving CE Certification for Sim&Size software product. Sim&Size is a prominent advancement for the treatment of brain aneurysms. It helps in modeling advanced therapeutic strategies and visualize multiple treatment options.

-

In September 2022, Vesalio announced receiving the FDA approval for commercializing NeVa VS for the treatment of symptomatic cerebral vasospasm. This solution is the first ever approved intracranial technology in the country.

-

In September 2021, Boston Scientific Corporation announced plans for the strategic acquisition of Devoro Medical.Inc., the developer of WOLF thrombectomy platform. WOLF is a lytic-free platform that uses prongs to recover and eliminate thrombi from the venous and arterial systems to target and collect blood clots.

U.S. Neurothrombectomy Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 261.7 million

Growth Rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, product outlook

Segments covered

Product, end-use

Country Scope

U.S.

Key companies profiled

Medtronic; Acandis GmbH; Phenox GmbH; Stryker; Penumbra, Inc.; Vesalio

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Neurothrombectomy Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. neurothrombectomy devices market report based on product and end-use:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Clot Retrievers

-

Aspiration/ Suction Devices

-

Vascular Snares

-

-

End-use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospital

-

Emergency Clinics

-

Ambulatory Surgical Centers

-

Frequently Asked Questions About This Report

b. The U.S. neurothrombectomy devices market size was estimated at USD 164.30 million in 2023 and is expected to reach USD 174.79 million in 2024.

b. The U.S. neurothrombectomy devices market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 261.70 million by 2030.

b. The clot retriever segment dominated the market in 2023 with the largest revenue share of 60.33%. Clot retriever devices are witnessing significant growth due to the rising prevalence of AIS and an increasing number of product launches by key market players.

b. Some key players operating in the U.S. neurothrombectomy devices market Medtronic; Acandis GmbH; Phenox GmbH; Stryker; Penumbra, Inc.; Vesalio

b. Increasing incidences of acute ischemic stroke globally are majorly driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.