- Home

- »

- Medical Devices

- »

-

U.S. Neurorehabilitation Devices Market, Industry Report, 2030GVR Report cover

![U.S. Neurorehabilitation Devices Market Size, Share & Trends Report]()

U.S. Neurorehabilitation Devices Market Size, Share & Trends Analysis Report By Product (Neurorobotics, Brain-Computer Interface, Wearable Devices), By Therapy Area (Stroke, Parkinson’s Disease), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-285-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

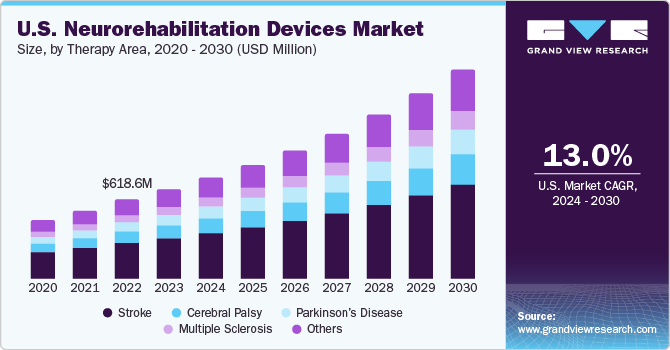

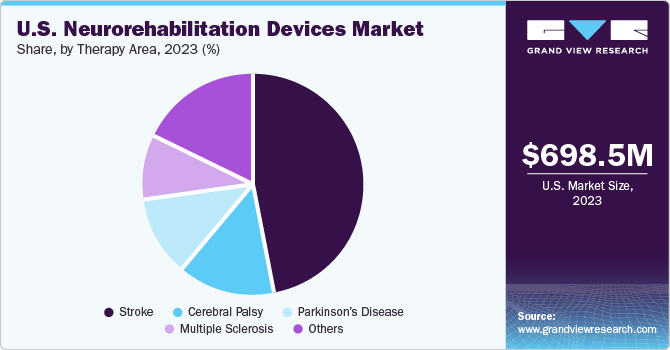

The U.S. neurorehabilitation devices market size was valued at USD 698.5 million in 2023 and is anticipated to grow at a CAGR of 13.0% from 2024 to 2030. The increasing geriatric population, growth in the prevalence of neurological conditions, and technological advancements in neurorehabilitation devices drive this market. The surge in clinical studies for neurorehabilitation solutions is opportunistic for market growth.

In 2023, U.S. accounted for a market share of over 35.0% in the global neurorehabilitation devices market. The U.S. market is witnessing substantial growth owing to the rising prevalence of neurological conditions. As per a study by the Parkinson's Foundation, over 90,000 Americans acquire Parkinson's disease annually. Furthermore, according to the Alzheimer's Association, over 6.7 million Americans were estimated to be living with Alzheimer's Dementia in 2022. 4.1 million of these people were aged 65 and older. According to the CDC, each year, over 2.8 million people in the country suffer from traumatic brain injuries, which lead to about 56,000 and 282,000 hospitalizations.

The occurrence of chronic diseases is growing at a significant pace. Along with generic age-related disorders, the senior population also suffers from chronic diseases, including diabetes, heart problems, cancer, Parkinson's disease, cerebral palsy, multiple sclerosis, dementia, Alzheimer's disease, and mental stress. Hospitalization for chronic health conditions can be expensive and involves excessive use of resources. The advent of assisted living facilities to accommodate new admissions each year and cater to such issues is expected to influence early diagnosis, creating new growth avenues for the market.

Market Concentration & Characteristics

The industry growth stage is high, and pace of the growth depicts an accelerating trend. The U.S. neurorehabilitation devices market is fragmented, which is marked by the presence of many companies competing for the market share. The industry is in a growth stage and is most likely to continue its trajectory in the coming 5-6 years.

Development of easy-to-use devices including internet-driven home monitors and telemedicine is likely to boost the product demand. Technological ecosystem encompasses a broad range of medical devices and services utilized to rehabilitate people with neurological health conditions. Advancements in technology have led to enhanced patient results, better access to rehabilitation services, and a significant improvement in the degree of personalized therapy programs. The need for advanced and efficient technologies is projected to boost, as more people need neurorehabilitation treatments. For instance, in February 2023, MindMaze announced the launch Izar, an innovative tool designed to help patients with neurological disorders like Parkinson’s disease to test practice of their hand function.

U.S. neurorehabilitation devices industry is characterized by substantial M&A and collaboration activities undertaken by key manufacturers. Numerous players in the country are collaborating with other relevant companies to strengthen their portfolios and expand their reach. For instance, in April 2023, Sensoria Health announced that it partnered with Padula Rehabilitation Technologies to launch the NeurOpTrek wearable device. The device is designed to enhance vision and limit the chance of falls, a crucial health issue among the geriatric population.

The approval process for neurological devices is lengthy and involves numerous protocols to be followed. For instance, distributing a new device or technology requires approval from the FDA and the Center for Devices and Radiological Health (CDRH). However, favorable initiatives undertaken by private and public organizations are likely to boost the demand. Favorable reimbursement policies allow reimbursement of neurorehabilitation devices when ordered by doctors or delivered as a part of a physician’s services.

Product Insights

The neurorobotics segment dominated and accounted for the largest revenue share of 36.1% in 2023. Neurorehabilitation significantly benefits from adopting neurorobotic devices, including exoskeletons, robotic arms, and brain-computer interfaces. Neurorobotics-driven companies are constantly creating and enhancing these devices. Robotic solutions can be customized to cater to each patient's unique requirements and abilities for more effective therapy.

The wearable devices segment is anticipated to exhibit the highest compound annual growth rate (CAGR) over the predicted period. Wearable devices are crucial for enhancing the rehabilitation process for patients with neurological disorders, enhancing their quality of life, and providing precise data to medical professionals. These devices can track a patient's movements, vital signs, and muscle activity. They offer real-time feedback to patients and professionals, supporting them in monitoring progress and adjusting their treatment plans as required.

Therapy Area Insights

The stroke segment captured the largest revenue share of 44.2% in 2023. With increasing age, the risk of having a stroke also increases. Stroke patients may require specialized rehabilitation to recover the body’s lost functional abilities. Treatment for stroke patients is required to begin immediately after the first sign of symptoms. Hence, one of the key reasons for a high survival rate in the country is the accessibility to prompt treatment.

The Parkinson's disease segment will witness a significant CAGR over the forecast period. The adoption of neurorehabilitation devices is important for assisting people with Parkinson's disease to improve their motor and cognitive capabilities. Several people in the country are seeking medical care and receiving diagnoses for Parkinson's disease as a result of growing awareness of the risk factors and symptoms of the condition. In addition, Parkinson's disease can now be diagnosed more precisely and at an earlier stage, owing to advancements in medical testing and imaging methods.

Key U.S. Neurorehabilitation Devices Company Insights

Key U.S. neurorehabilitation device companies include Medtronic, Bionic Laboratories Corp., and Bioventus. The key players are focusing on business growth strategies, including regulatory approvals, new product launches, collaborations, expansion, acquisitions, and partnerships.

Key U.S. Neurorehabilitation Devices Companies:

- Bioventus

- Ectron

- Hocoma

- Medtronic

- Tyromotion Inc.

- Biometrics Ltd

- Bionik Laboratories Corp. (BNKL)

- BioXtreme Ltd.

- Ekso Bionics

- Kinestica

- Kinova inc.

- Saebo, Inc

- Abbott

Recent Developments

-

In March 2024, ProMIS Neurosciences, Inc. announced that the United States Patent and Trademark Office granted US Patent 11,905,317 to PMN310 for immunogenic compositions of matter under development for treating Alzheimer’s disease. PMN310 is ProMIS’s innovative monoclonal antibody purposed to differentiate toxic oligomers of amyloid-beta (Aβ), which are a leading cause of Alzheimer’s disease.

-

In May 2023, Alberta Health Services partnered with the University of Calgary to launch the Researching Strategies for Rehabilitation (RESTORE) Network. This network was planned to perform clinical studies and new treatments to improve patients' quality of life suffering from neurological illnesses.

U.S. Neurorehabilitation Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.64 billion

Growth rate

CAGR of 13.0% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapy area

Country scope

U.S.

Key companies profiled

Bioventus; Ectron; Hocoma; Medtronic; Tyromotion Inc; Biometrics Ltd.; Bionik Laboratories Corp. (BNKL); BioXtreme Ltd.; Ekso Bionics; Kinestica; Kinova Inc.; Saebo, Inc.; Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Neurorehabilitation Devices Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. neurorehabilitation devices market report based on product, and therapy area:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurorobotics

-

Brain-Computer Interface

-

Wearable Devices

-

Non-Invasive Stimulators

-

Others

-

-

Therapy Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Stroke

-

Parkinson’s Disease

-

Multiple Sclerosis

-

Cerebral Palsy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. neurorehabilitation devices market size was estimated at USD 698.5 million in 2023 and is expected to reach USD 788.9 million in 2024.

b. The U.S. neurorehabilitation devices market is expected to grow at a compound annual growth rate of 13.0% from 2024 to 2030 to reach USD 1.64 billion by 2030.

b. The stroke therapy segment held the highest revenue share of more than 44.2% in 2023. The demand for neurorehabilitation services has been greatly influenced by the rising aging demographic.

b. Some key players operating in the U.S. neurorehabilitation devices market include Bioventus; Ectron; Hocoma; Medtronic; Tyromotion Inc; Biometrics Ltd.; Bionik Laboratories Corp. (BNKL); BioXtreme Ltd.; Ekso Bionics; Kinestica; Kinova Inc.; Saebo, Inc.; Abbott.

b. The primary factors driving the market's growth are the rising geriatric population, the high prevalence of neurological disorders, and technological developments in neurorehabilitation devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."