- Home

- »

- Medical Devices

- »

-

U.S. Negative Pressure Wound Therapy Market, Industry Report, 2030GVR Report cover

![U.S. Negative Pressure Wound Therapy Market Size, Share & Trends Report]()

U.S. Negative Pressure Wound Therapy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Conventional NPWT Devices, Single-use NPWT Devices, NPWT Accessories), By Wound Type (Chronic Wounds, Acute Wounds), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-294-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

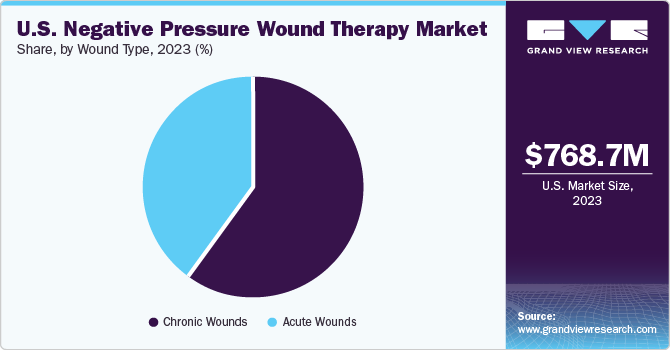

The U.S. negative pressure wound therapy market size was estimated at USD 768.67 million in 2023 and is estimated to grow at a CAGR of 5.94% from 2024 to 2030. Major factors contributing to the growth of this market include the growing awareness of negative pressure wound therapy (NPWT) benefits, a rising rate of surgical site infections, and an increasing need for improved wound care to reduce mortality rates.

The U.S. negative pressure wound therapy accounted for 31.0% of the global market. The increasing prevalence of chronic diseases, such as diabetes, cancer, and autoimmune conditions, is expected to drive the growth of the negative pressure wound therapy market over the forecast period. This trend can be attributed to the fact that diabetes often leads to complications like diabetic foot ulcers.

The rising number of chronic wounds in the US is attributed to factors like diabetes, increased age, and obesity. For instance, in 2018, around 52 million individuals aged 65 and above were reported to have chronic wounds, with projections indicating this number could reach about 95 million by 2060 in the US. This surge in chronic wounds fuels the demand for negative pressure wound therapy (NPWT).

Older adults have low immunity levels and, thus, are prone to chronic disorders, such as diabetes, cancers, and heart diseases. The rising geriatric population is a significant factor propelling the growth of the negative pressure wound therapy devices market. For instance, American Health Rankings statistics show approximately 58 million adults aged 65 and older reside in the United States, representing approximately 17.3% of the nation's population in 2022 and is projected to increase to 22.0% by 2040.

Furthermore, the advanced features of negative pressure wound therapy (NPWT) aim to enhance its delivery. It offers a range of pressure settings from -40mmHg to -200mmHg that can be customized for different wound types. Additionally, disposable wound vacuum-assisted closure (VAC) systems, whether battery-operated or purely mechanical suction, are available for use and are typically suitable for smaller wounds. Such advancements in NPWT will likely escalate growth opportunities and demand in the market.

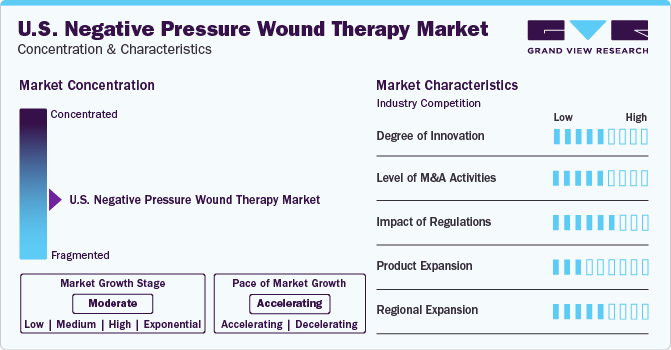

Market Concentration & Characteristics

The U.S. negative pressure wound therapy market is identified as a fragmented industry due to the presence of numerous medical device manufacturers. Furthermore, technological advancements, increasing adoption rates of NPWT, and a surge in chronic wound incidences are likely to increase the growth trajectory of this industry over the forecast years.

The negative pressure wound therapy industry is experiencing significant innovation due to technological advancements and the adoption of advanced products, especially in home care settings. Companies investing in these technologies are gaining a competitive edge, driving industry growth. The latest NPWT devices, such as single-use systems, wireless remote monitoring, and enhanced patient mobility, offer more effective wound-healing solutions.

Key companies engage in various collaborations and partnerships to foster growth, innovation and enhance competitiveness by leveraging the expertise and resources of diverse organizations. These collaborative efforts reinforce relationships and enhance the execution of clinical programs to provide better patient outcomes. For instance, in November 2022, InfuSystem partnered with Sanara MedTech to enhance patient outcomes, reduce care costs, and increase satisfaction for patients and providers. This collaboration will allow InfuSystem to offer a range of products, including Cork Medical LLC's negative pressure wound therapy (NPWT) devices and supplies and Sanara's advanced wound care product line, to new customers.

U.S. negative pressure wound therapy companies increasingly focus on expanding regionally to enhance their competitive advantage and broaden their market presence. This strategy involves establishing partnerships, acquiring businesses, and implementing localized marketing tactics to strengthen their footprint in key geographical areas. For instance, in February 2022, Cork Medical collaborated with MedTech Solutions Group (MTSG) to expand its NPWT business in all countries. This would extend access and revenue growth of the company's Medical Nisus® negative pressure wound therapy system in new and existing markets worldwide.

Stringent quality protocols and regulatory norms significantly influence the negative pressure wound therapy market. U.S. FDA oversees the regulatory approvals for the devices and therapy to ensure patient safety and data integrity. For instance, in April 2023, 3M received FDA approval for Veraflo Therapy, allowing for hydromechanical removal of infectious materials, non-viable tissue, and wound debris. This clearance showcases 3 M's innovative approach to utilizing science to enhance patient outcomes through improved healthcare solutions.

Product Insights

Based on product, conventional NPWT devices dominated the market with an 84.0% share in 2023. The growing adoption rates and favorable benefits of conventional NPWT boost the growth. These devices minimize hospital stays, thereby reducing overall treatment costs. Moreover, renting and purchasing options are further expected to escalate its adoption rate among people. These trends of conventional NPWT devices increase their demand in the market and boost growth.

The single-use NPWT devices segment is expected to grow fastest from 2024 to 2030. This growth can be attributed to cost-effectiveness, innovative product launches, and widespread applicability in home care settings. These devices promote the healing of open wounds and reduce complication rates in closed surgical incisions, making it a safer and more efficient alternative to traditional negative pressure wound therapy. These features of single-use NPWT are anticipated to expand the growth trajectory over the forecast period.

Wound Type Insights

Based on wound type, chronic wounds held the largest market share in 2023. This growth can be attributed to the growing preference for NPWT for treating chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Chronic wounds require a long time to heal and pose a high risk of getting a microbial infection. NPWT improves wound healing by reducing edema, removing bacterial products, and approximating wound edges, increasing demand for curing chronic wounds. Such applications of NPWT further accelerate segment growth.

The acute wounds segment is projected to grow fastest from 2024 to 2030. Acute wounds include accidental and surgical wounds. The rising incidences of surgical site infections are driving the market growth. For instance, according to the CDC healthcare-associated infection (HAI) prevalence survey, approximately 110,800 surgical site infections (SSIs) were reported in the U.S. Moreover, the rising number of accidental wounds will escalate the segment’s growth over the forecast period.

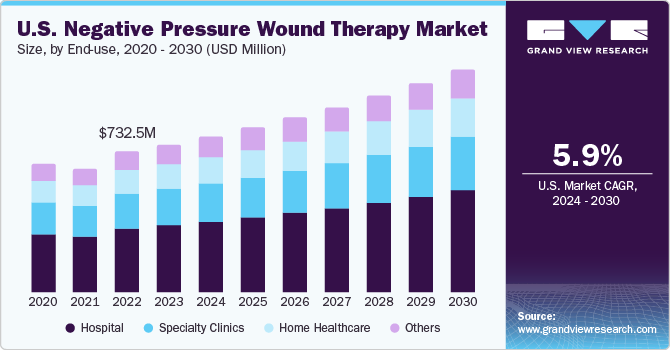

End-use Insights

Based on end-use, hospitals dominated the market with a share of 45.0% in 2023. The driving factors contributing to the growth of this segment include increasing chronic diseases and an increase in the number of hospitals. For instance, according to the American Hospital Association, in 2023, around 6,129 hospitals were available in the U.S. Thus, introducing new healthcare hospitals will likely enhance patient wound care facilities and fuel the demand for negative pressure wound therapy devices in the forecast period.

Home healthcare is expected to grow fastest from 2024 to 2030. The rising adoption of home-based NPWT is driving the growth of this segment. Home‐based NPWT allows a patient to recover rapidly while minimizing the risks of prolonged hospitalization. Thus, higher recovery rates and effectiveness are likely to increase the growth of this segment over the forecast period.

Key U.S. Negative Pressure Wound Therapy Insights

Key companies in the U.S. negative pressure wound therapy market include 3M, InfuSystem, Baxter, and Bausch Health Companies Inc., among others.

These companies provide a variety of NPWT devices, such as durable devices with multiple therapy modalities, portable and disposable units, and integrated wound management systems. Moreover, companies implement strategic initiatives, including innovative product launches, M&A activities, and regional expansion, to enhance their portfolio in the market.

Key U.S. Negative Pressure Wound Therapy Companies:

- 3M

- De Royal Industries

- Cardinal Health

- Ethicon

- Medline

- Baxter

- Organogenesis

- Integra Lifesciences

- MiMedx.

- Pensar Medical

- Guard Medical

- Infusystem Holdings Inc

Recent Developments

- In April 2023, InfuSystem. Holdings Inc. announced a distribution agreement with Genadyne Biotechnologies Inc. for its NPWT systems and supplies. This partnership allows InfuSystem to offer Genadyne's complete line of wound care products, including the advanced XLR8 Plus NPWT Pump and the XLR8 Dressing Kit with Silver, aiming to provide patients with innovative wound care solutions.

U.S. Negative Pressure Wound Therapy Market Report Scope

Report Attribute

Details

The revenue forecast for 2030

USD 1.14 billion

Growth rate

CAGR of 5.94% from 2023 to 2030

Actual estimates

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion & CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, wound type, end-use

Country Scope

U.S.

Key companies profiled

3M; DeRoyal Industries; Cardinal Health; Ethicon;

Medline; Baxter; Organogenesis; Integra Lifesciences; MiMedx.; Pensar Medical; Guard Medical; Infusystem Holdings Inc

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Negative Pressure Wound Therapy Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. Negative Pressure Wound marketbased on product, wound type, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional NPWT Devices

-

Single-Use NPWT Devices

-

NPWT Accessories

-

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Pressure Ulcer

-

Diabetic Foot Ulcer

-

Venous Leg Ulcer

-

Others

-

-

Acute Wounds

-

Surgical & Traumatic Wounds

-

Burns

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Specialty Clinics

-

Home Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. negative pressure wound therapy market size was estimated at USD 768.67 million in 2023 and is expected to reach USD 849.22 million in 2024.

b. The U.S. negative pressure wound therapy market is expected to grow at a compound annual growth rate of 5.94% from 2024 to 2030 to reach USD 1.14 billion by 2030

b. Conventional segment dominated the U.S. negative pressure wound therapy market with a share of 86.1% in 2023. This can be attributed to their high price and increasing adoption.

b. Some key players operating in the U.S. negative pressure wound therapy market include 3M Company, Talley Group Ltd, Smith & Nephew, Devon Medical Products, Molnlycke Health Care AB, Medela AG, DeRoyal Industries Inc., Covatec Inc. Cardinal Health, Paul Hartmann AG and Others

b. Key factors that are driving the U.S. negative pressure wound therapy market growth include increasing demand for advanced wound care, rising prevalence of chronic and acute wounds, rising number of surgeries, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.