U.S. Natural Insect Repellent Market Size, Share & Trends Analysis Report By Product (Sprays/Aerosols, Creams/Lotions, Essential Oils, Candle, Liquid Vaporizers & Diffusers), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-531-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Natural Insect Repellent Market Trends

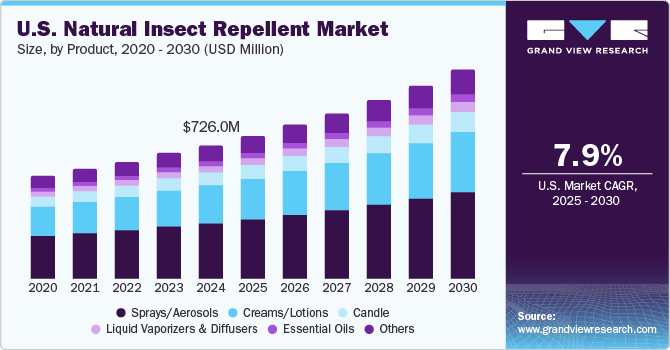

The U.S. natural insect repellent market size was valued at USD 726.0 million in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2030. The industry is witnessing significant growth, driven by increasing consumer awareness of health and environmental concerns associated with chemical-based repellents. The demand for plant-based, eco-friendly alternatives is rising as families and health-conscious individuals prioritize safe, non-toxic products. Growing interest in outdoor recreational activities and sustainable pest control solutions has further fueled this market expansion. Innovations in natural formulations and diversified product offerings continue to support the growth of the natural insect repellent industry, meeting the needs of consumers seeking effective yet eco-friendly solutions.

The demand for such products is surging as consumers become more aware of the potential health risks and environmental impact of synthetic chemicals like DEET. Many users are now opting for alternatives that provide effective protection without the drawbacks of synthetic options, such as oily residues, unpleasant odors, or skin irritation. Plant-based repellents, derived from essential oils like citronella, lemongrass, and eucalyptus, are gaining traction for their non-toxic nature and suitability for children and pets. These products align with broader wellness trends by offering a pleasant fragrance and prioritizing safety and eco-friendliness.

Scientific research continues to bolster the credibility of the U.S. natural insect repellent industry, highlighting the efficacy of plant-based repellents. Essential oils, including citronella, lemon eucalyptus, and coconut oil, have demonstrated strong mosquito-repelling properties in various studies. For instance, USDA research has shown that compounds from coconut oil outperform DEET in repelling ticks and biting flies under controlled conditions. Additionally, research efforts at institutions like Iowa State University are focused on enhancing the longevity and potency of natural compounds, such as terpenes from catnip and Osage orange, to create solutions that rival synthetic alternatives.

The industry has also seen notable product launches catering to health-conscious consumers. In June 2022, SC Johnson introduced STEM, a pest control brand featuring mosquito repellents formulated with botanical extracts like rosemary and citronella oils. These products, designed with input from entomologists, are effective against pests while being safe for use around children and pets. STEM exemplifies how the natural insect repellent industry can blend nature-based ingredients with scientific precision, providing families with practical, eco-friendly pest control solutions.

Consumer Insights

Demand for health-conscious, non-toxic products in the U.S. has been rising over the years. As consumers become more aware of the potential risks associated with synthetic repellents, they seek safer, plant-based solutions that prioritize both efficacy and safety. B'Lou Bug Spray caters to this preference by offering a trustworthy, all-natural product that aligns with environmental and wellness values. The brand offers B'Lou Bug Spray, an innovative, all-natural insect repellent crafted with a unique combination of essential oils, including lemon eucalyptus, cedar wood, lavender, rose geranium, and tea tree oil, blended with a touch of castile soap. This formulation stands out for its natural composition and effectiveness, rivaling conventional DEET-based repellents without harmful chemicals.

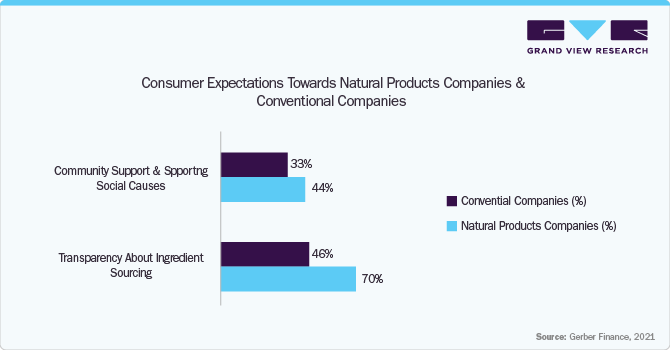

A survey by Gerber Finance of 1,000 consumers highlights a clear preference for natural product companies, with 61% holding them to higher standards than conventional ones. Transparency and quality emerge as key expectations: 70% expect natural brands to disclose sourcing and ingredients, compared to just 46% for conventional brands, and 62% expect natural products to be high quality, versus 49% for conventional alternatives. These findings underscore the growing consumer demand for natural insect repellents. The higher expectations for transparency and quality align with the attributes consumers value in natural products, making them a preferred choice in this category.

Camping continues to gain popularity in the U.S., with over 87.99 million campers in 2023, according to data by Camper Champ, marking a 23% increase since 2014. Millennials and Gen Z dominate the trend, making up nearly 50% of campers, with one-third of first-time campers aged 18 to 34. National parks play a central role, attracting 92.39 million recreation visits, with over 8.42 million opting to camp. Yosemite National Park leads in tents (275,278) and RV (196,092) camping. This surge in outdoor activity drives demand for insect repellents, particularly natural ones, as health-conscious campers seek effective, eco-friendly solutions to protect against pests during their adventures.

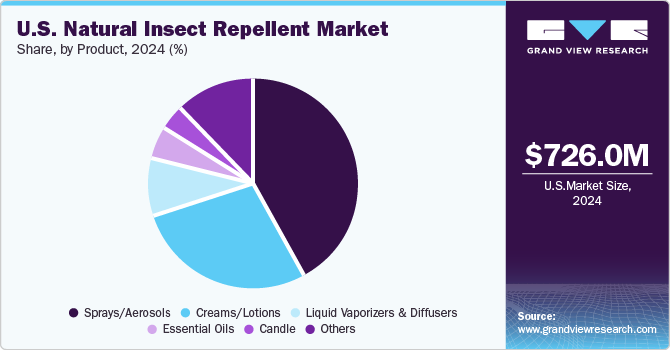

Product Insights

Sprays/aerosols accounted for the highest revenue share of 42.6% in 2024. These are popular due to their convenience, ease of application, and immediate effectiveness. They cater to a broad range of consumers, including families and outdoor enthusiasts, by offering quick protection for skin, clothing, and surroundings. Their portability and ability to provide uniform coverage make them ideal for on-the-go use. Additionally, plant-based formulations appeal to eco-conscious buyers seeking safe, non-toxic alternatives to chemical repellents.

Demand for natural insect repellent creams/lotions in the U.S. is expected to grow at a CAGR of 8.5% from 2025 to 2030. Natural insect-repellent creams and lotions are often preferred in the U.S. due to their controlled application, allowing for precise and even coverage across the skin. Unlike sprays, lotions enable users to visually confirm that all areas are adequately protected, reducing the risk of missed spots and ensuring effective repellency. Additionally, creams and lotions minimize the potential for inhaling aerosols, making them a safer option for sensitive areas like the face. Their targeted application also makes them ideal for precise use, providing reliable protection while avoiding unintended exposure to non-targeted areas.

Key U.S. Natural Insect Repellent Company Insights

The U.S. natural insect repellent market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the industry include Wondercide LLC., Murphy's Naturals, W. S. Badger Company, Thistle Farms, and others.

-

Wondercide LLC. is one of the prominent players in the U.S. natural insect repellent industry. Its insect repellents are plant-powered and lab-proven to protect against ticks and mosquitoes. Wondercide's products are available in various scents, including Peppermint, Lemongrass, Cedarwood, and Rosemary. These repellents are safe for the whole family and are free from artificial colors and fragrances.

-

Murphy's Naturals is another player in the U.S. natural insect repellent industry committed to creating natural mosquito repellents that are good for people and the planet. Their products are made with high-quality natural ingredients and are tested for efficacy. Murphy's Naturals offers a range of mosquito-repellent products, including sprays, incense sticks, candles, and balms.

Key U.S. Natural Insect Repellent Companies:

- Wondercide LLC.

- Murphy's Naturals

- California Baby

- W. S. Badger Company

- Thistle Farms

- SallyeAnde

- Earthley.com

- Primally Pure

- 3 Moms Organics

- Repel

Recent Developments

-

In July 2024, Spectrum Brands Holdings Inc. announced the spin-off of its Home & Personal Care (HPC) business to create a standalone platform focused on personal care appliances, shaving products, and specialty items under brands like Remington and Russell Hobbs. The remaining company shifted its focus to the Pet and Home & Garden segments, which include insect repellent brands such as Cutter, EcoLogic, and Spectracide.

-

In May 2024, Vanilla Mozi, an Australian skincare brand, entered the U.S. market with its innovative, natural insect repellent products. The company’s product line includes insect repellent solutions using natural ingredients that protect against mosquitoes and other pests. It was launched through a national distribution network and was made available in stores like Natural Grocers, healthy Edge Retail Group, and others.

-

In May 2023, Murphy’s Naturals, an outdoor lifestyle company known for its natural products, launched an exclusive insect repellent spray kit at Costco. The Lemon Eucalyptus Oil Insect Repellent Spray Bundle includes one 4-ounce spray bottle and two 2-ounce bottles designed to repel mosquitoes for up to six hours. Priced at USD 14.99, the kit was released just in time for summer camping trips. With this launch, Murphy’s Naturals expanded its presence to over 2,500 retail locations nationwide.

U.S. Natural Insect Repellent Market Report Scope

|

Report Attribute |

Details |

|

Market revenue in 2025 |

USD 777.0 million |

|

Revenue forecast in 2030 |

USD 1.13 billion |

|

Growth rate |

CAGR of 7.9% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product |

|

Country scope |

U.S. |

|

Key companies profiled |

Wondercide LLC.; Murphy's Naturals; California Baby; W. S. Badger Company; Thistle Farms; SallyeAnde; Earthley.com; Primally Pure; 3 Moms Organics; Repel |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Natural Insect Repellent Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. natural insect repellent market report based on product:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sprays/Aerosols

-

Creams/Lotions

-

Essential Oils

-

Candle

-

Liquid Vaporizers and Diffusers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. natural insect repellent market was estimated at USD 726.0 million in 2024 and is expected to reach USD 777.0 million in 2025.

b. The U.S. natural insect repellent market is expected to grow at a compound annual growth rate of 7.9% from 2025 to 2030 to reach USD 1.13 billion by 2030.

b. The natural spray/aerosol insect repellent market accounted for about 42% of the overall U.S. natural insect repellent market. These products are popular due to their convenience, ease of application, and immediate effectiveness.

b. Key players in the U.S. natural insect repellent market are Wondercide LLC.; Murphy's Naturals; California Baby; W. S. Badger Company; Thistle Farms; SallyeAnde; Earthley.com; Primally Pure; 3 Moms Organics; Repel.

b. Key factors that are driving the U.S. natural insect repellent market growth include growing outdoor recreational activities and the need for sustainable pest control solutions fuel market expansion, supported by innovations in natural formulations and diversified product offerings.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."