- Home

- »

- Pharmaceuticals

- »

-

U.S. Nanomedicine Market Size, Industry Report, 2030GVR Report cover

![U.S. Nanomedicine Market Size, Share & Trends Report]()

U.S. Nanomedicine Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Drug Delivery), By Indication (Clinical Oncology, Infectious Diseases), By Molecule Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-288-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nanomedicine Market Size & Trends

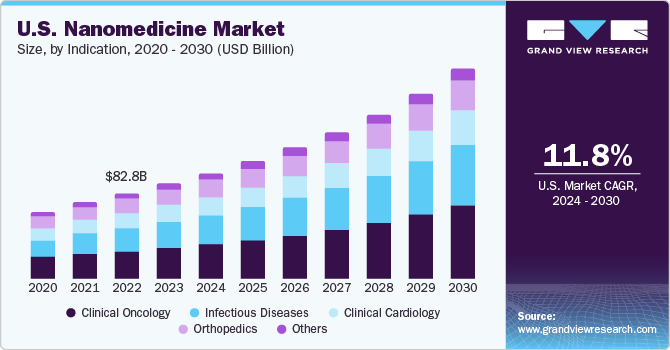

The U.S. nanomedicine market size was valued at USD 91.15 billion in 2023 and is expected to grow at a CAGR of 11.84% from 2024 to 2030 owing to the presence of substantial players involved in development and manufacturing of nanomedicine for various therapeutic fields. Moreover, rising cases of disease-related morbidity and mortality in the country have accentuated the need to develop more robust therapies, thereby driving growth of the market.

U.S. accounted for 48% of the global nanomedicine market in 2023. The funding bodies have played a major role in reshaping the market. Government has made huge investments to accelerate nanoscience R&D in this arena. For instance, in August 2020, the National Science Foundation declared that it would invest a huge amount of USD 84 million over five years for the re-establishment of National Nanotechnology Coordinated Infrastructure to bring further advancements in nanoscale engineering, science, and technology.

Furthermore, the presence of organizations involved in conducting conferences and workshops for growing awareness about the application of nanoscience in therapeutic development is expected to accelerate the market growth in this country in the coming years. For instance, the American Society for Nanomedicine is involved in conducting quarterly conferences on nanoscience and nanomedicine.

Moreover, developed infrastructure, and growing popularity of nanoparticle-based drugs in the country are driving the nanomedicine market. An increase in nanomedicine R&D in the country owing to rising funds and investments from small & medium-sized enterprises and other venture funds is the high impact-rendering driver for the market in this country.

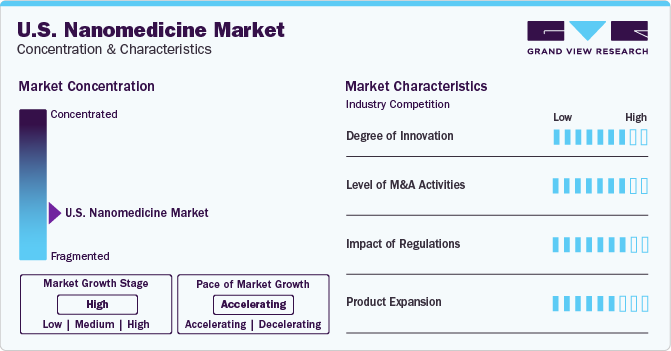

Market Concentration & Characteristics

The market is fragmented by nature and the presence of prominent players in this industry is significantly boosting the growth. These players are adopting several growth strategies such as mergers and acquisitions (M&A) activities, partnerships, R&D activities, and product launches, to strengthen their foothold. Advancements in technology are another factor expected to significantly contribute to the industry growth during the forecast period.

Presence of established players who are investing in nanotechnology research and development for product enhancement is expected to present potential avenues for innovation, growth, and expansion in the market. The industry players are furthermore trying to receive FDA clearance for their products to be accessible in the market. For instance, in October 2023, Xenix received U.S. FDA 510(k) clearance to launch the SOLACE Sacroiliac Fixation System. It consists of 3D printed, threaded implants ranging from 10.5mm or 12.0mm in diameter and 30mm to 115mm in length and features Xēnix Medical’s NANOACTIV nanotechnology surface

Mergers & acquisitions, and partnerships and collaborations are common trends in the industry to gain a competitive edge. A high number of nanomedicines are produced by small pharmaceutical companies which are later acquired by established major players. Such activities keep the market competitive and promote further growth. For instance, in January 2024, Cencora entered into a collaboration with Sigrid Therapeutics with an aim to accelerate the commercialization of Sigrid’s SiPore technology designed to prevent diabetes and obesity.

Regulatory bodies play a crucial role in the large share of the country. However, the government has accelerated the nanomedicine development in the country by initiating various favorable guidelines. In addition, FDA’s approach to effective regulation of nanotechnology-based products is expected to lower the impact of the restraints such as adverse effects associated with consuming nanoparticles, in the coming years.

Application Insights

The drug delivery segment dominated the market with a share of 34% in 2023. The rising adoption of metal-based nanoparticles for biomedical applications is expected to contribute to market growth. Furthermore, growing interest in vivo-specific targeting of gold-based drug delivery for larger sizes of conjugates is projected to drive the demand for segment. Ongoing research on drug delivery applications with the usage of gold and other metal and metal oxide nanoparticles in combination with their intrinsic ability for photothermal therapy, is anticipated to boost the segment’s rapid growth.

The therapeutics segment is expected to witness highest growth over the forecast period. Advancements in the field of nanotherapeutics development related to crossing biological barriers are projected to drive market growth over the forecast period. Nanotherapeutics with multiple advantages are expected to aid in addressing the existing gaps in the current field of therapeutics. Blood disorders, diabetes, cancer, and neurodegenerative diseases are some of the therapeutic areas that are anticipated to benefit from nano-based drug delivery systems

Indication Insights

The clinical oncology segment dominated the market with a share of 33% in 2023. This can be attributed to cancer being a leading cause of mortality and morbidity. The need for developing more targeted cancer therapies is a key factor expected to drive R&D for clinical oncology. Nanomedicine is a rapidly evolving treatment modality owing to its targeting efficiency and fewer adverse effects in cancer treatment. Research in Cancer Nanotechnology (IRCN) is also expected to further enhance the segment’s growth.

The infectious disease segment is expected to register considerable growth over the forecast period. Application of nanoparticle-based therapies for targeting non-cancer conditions such as infectious diseases has increased in recent years. Ongoing R&D to develop solutions to address the increasing infectious diseases burden is another key factor expected to propel growth of nanomedicine market over the forecast period.

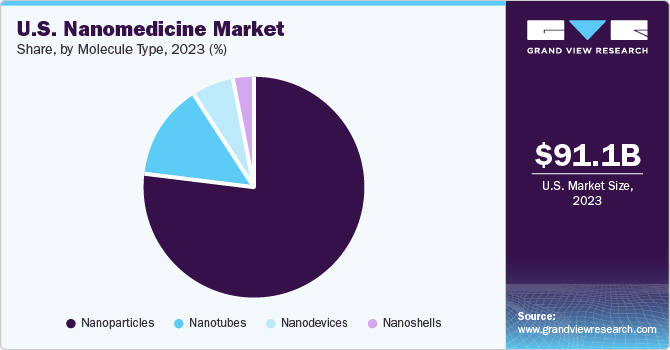

Molecule Type Insights

The nanoparticles segment dominated the market with a share of 76% in 2023. Studies are conducted to assess ongoing advancements in drug delivery of targeted nanoparticles to treat melanoma. Moreover, several research projects are carried out to study nanoparticle implementation in homeopathy. Such factors are expected to boost the segment’s growth in the upcoming years.

The nanoparticles segment is expected to register a considerable CAGR over the forecast period. Nanoparticles offer several advantages over conventional molecular imaging probes. Nanotubes are used in designing strategies for delivering genes & molecular probes and pharmaceuticals into cells. They also play a pivotal role in stem cell therapies and aid in tissue regeneration. Carbon nanotubes have received great attention as carriers of biologically relevant molecules due to their unique chemical, physical, and physiological properties.

Key U.S. Nanomedicine Company Insights

Some prominent U.S. nanomedicine market companies include Abbott Laboratories; CombiMatrix Corporation; Celgene Corporation; Nanospectra Biosciences, Inc.; GE Healthcare; and Johnson & Johnson Services, Inc. Presence of these major players coupled with well-established healthcare framework in the country is expected to boost the market growth.

These players are involved in the acquisition of the smaller players and enhancement of the product portfolio. Collaborations with clinical labs and established players for product commercialization is also surge the growth of the market. Key players are also strategizing to geographically expand their businesses for their companies to run businesses through various other channels.

Key U.S. Nanomedicine Companies:

- Abbott Laboratories

- CombiMatrix Corporation

- Celgene Corporation

- Nanospectra Biosciences, Inc.

- GE Healthcare

- Johnson & Johnson Services, Inc.

- Mallinckrodt Pharmaceuticals

- Merck & Co., Inc.

- Pfizer, Inc.

- Teva Pharmaceutical Industries Ltd.

- Arrowhead Pharmaceuticals, Inc.

Recent Developments

-

In March 2024, Onward Medical received an award on Breakthrough Device designation from the US FDA for its ARC-BCI system that combines brain-computer interface technology with company’s ARC-IM therapy for restoring thought-driven mobility after spinal cord injury

-

In November 2023, Boston Scientific Corporation announced the acquisition of Relievant Medsystems. The acquisition was aimed at adding the latter’s Intracept intraosseous nerve ablation system to Boston Scientific’s chronic pain portfolio, including spinal cord stimulation

-

In July 2023, Fortis Life Sciences announced the acquisition of International Point of Care, Inc. This acquisition aims to provide customized, and end-to-end solutions to advance their products related to immunodiagnostic and molecular diagnostic, for consumers

U.S. Nanomedicine Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 199.57 billion

Growth rate

CAGR of 11.84% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, indication, molecule type

Country scope

U.S.

Key companies profiled

Abbott Laboratories; CombiMatrix Corporation; Celgene Corporation; Nanospectra Biosciences, Inc.; GE Healthcare; Johnson & Johnson Services, Inc.; Mallinckrodt Pharmaceuticals; Merck & Co., Inc.; Pfizer, Inc.; Teva Pharmaceutical Industries Ltd.; Arrowhead Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nanomedicine Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. nanomedicine market report based on application, indication, and molecule type:.

-

Application Scope Outlook (Revenue, USD Billion, 2018 - 2030)

-

Therapeutics

-

In-vitro Diagnostics

-

Drug Delivery

-

In-vivo Imaging

-

Implants

-

-

Indication Scope Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Oncology

-

Infectious Diseases

-

Clinical Cardiology

-

Orthopedics

-

Others

-

-

Molecule Type Scope Outlook (Revenue, USD Billion, 2018 - 2030)

-

Nanoparticles

-

Metal & Metal Oxide Nanoparticles

-

Liposomes

-

Polymers & Polymer Drug Conjugates

-

Hydrogel Nanoparticles

-

Dendrimers

-

Inorganic Nanoparticles

-

-

Nanoshells

-

Nanotubes

-

Nanodevices

-

Frequently Asked Questions About This Report

b. The U.S. nanomedicine market size was estimated at USD 91.16 billion in 2023 and is expected to reach USD 101.11 billion in 2024.

b. The U.S. nanomedicine market is expected to grow at a compound annual growth rate of 11.84% from 2024 to 2030 to reach USD 199.57 billion by 2030.

b. Drug Delivery segment dominated the U.S. nanomedicine market with a share of 34.08% in 2023. This is attributable to rising healthcare awareness coupled with the increasing number of nanomedicine-based research and development initiatives.

b. Some key players operating in the U.S. nanomedicine market include Abbott Laboratories, CombiMatrix Corporation, Celgene Corporation, Nanospectra Biosciences, Inc., GE Healthcare, Johnson & Johnson Services, Inc., Mallinckrodt Pharmaceuticals, Merck & Co., Inc., Pfizer, Inc., Teva Pharmaceutical Industries Ltd., Arrowhead Pharmaceuticals, Inc.

b. Key factors that are driving the market growth include the increase in commercialization of products, such as mRNA and liposome-based vaccines and nano-particle based drug delivery systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.