- Home

- »

- Medical Devices

- »

-

U.S. Myopia And Presbyopia Treatment Market, Industry Report, 2030GVR Report cover

![U.S. Myopia And Presbyopia Treatment Market Size, Share & Trends Report]()

U.S. Myopia And Presbyopia Treatment Market (2024 - 2030) Size, Share & Trends Analysis Report By Myopia Treatment Type (Corrective, Surgical), By Presbyopia Treatment Type (Prescription, Contact Lenses), And Segment Forecasts

- Report ID: GVR-4-68040-239-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

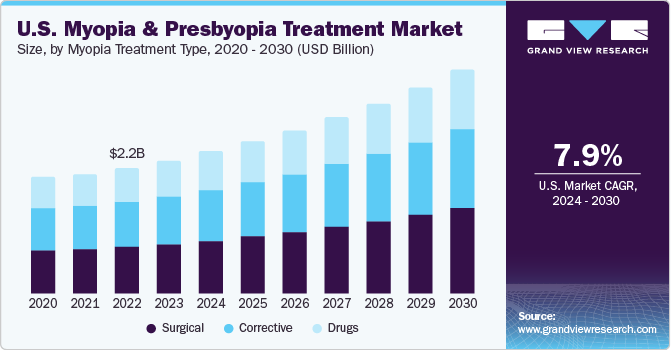

The U.S. myopia and presbyopia treatment market size was estimated at USD 4.0 billion in 2023 and is expected to grow at a CAGR of 7.9% from 2024 to 2030. The rise in vision loss, primarily due to myopia, and the increasing incidence of distance vision impairment from uncorrected myopia are expected to boost market growth. Eye disorders, especially myopia and high myopia, are becoming more prevalent across various regions. Aging is a key factor leading to eye disorders like presbyopia, mainly found in those aged 40 and above. By 2050, the global population aged 60 and above is predicted to be 22%. The number of people aged 65 and above in the U.S. is expected to nearly double from 52 million in 2018 to 95 million by 2060, likely increasing the prevalence of presbyopia.

The U.S. accounted for over 21.4% of the global myopia and presbyopia treatment market in 2023. Growing geriatric population worldwide, who are susceptible to vision loss, is driving market growth. Most individuals, starting in their mid-40s, begin to experience vision issues related to age and lifestyle. These issues are anticipated to progress into myopia and presbyopia, thereby increasing the demand for their treatment. One of the significant challenges is undiagnosed presbyopia, which is expected to significantly impact the vision care industry. The pathophysiology of presbyopia remains unclear to many, leading to delayed diagnosis and higher treatment costs.

The prevalence of presbyopia varies between 43.8% and 93.4% in low- and middle-income countries. It’s estimated that about 2.2 million people in the U.S. will be blind by 2030. Hence, the growing prevalence of eye disorders is anticipated to drive market growth. Furthermore, during the COVID-19 pandemic, individuals suffering from myopia or presbyopia had begun to opt telemedicine. As telemedicine became more prevalent, eye care specialists and regular consultants persisted in monitoring the progression of myopia, causing only a slight effect on market growth. The pandemic impacted many medical practices and hospitals due to alterations in protocols. Ophthalmology procedures have also been affected as health checkups, including those related to eye health, have been curtailed due to COVID-19 restrictions. Given the heightened risk of infection transmission via contact lenses, many individuals chose LASIK surgery for vision correction.

The market is anticipated to grow lucratively during the forecast period, driven by the introduction of advanced lenses such as intraocular phakic presbyopic lenses and implantable contact lenses. These lenses are predicted to become increasingly popular due to their advantages, including the ability to correct a substantial degree of nearsightedness, lower susceptibility to dry eyes, surgical removability, and suitability for patients who are not candidates for LASIK. PresbyLASIK is an advanced option for presbyopia correction, which uses laser therapy to induce spherical aberration and make the cornea multifocal. Corneal inlays are another advanced option for presbyopic patients, with currently only two approved for presbyopia correction. The market growth is expected to be boosted by an increasing number of ongoing studies and a broad product pipeline.

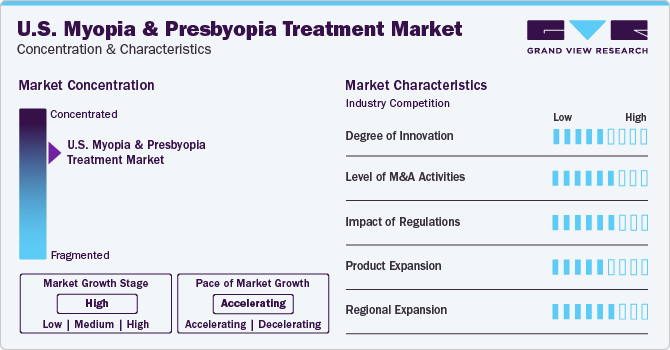

Market Characteristics & Concentration

Companies in the U.S. myopia and presbyopia treatment industry are actively participating in activities such as product innovation, mergers and acquisitions, and regional expansion to fortify their position.

With rapidly increasing geriatric population, the U.S. is expected to face an increasing demand for presbyopia treatment procedures over the forecast period. Furthermore, presence of ophthalmology associations, such as American Academy of Ophthalmology (AAO), involved in organizing programs that provide a base for launch of new research & innovations in the field of myopia & presbyopia care, is expected to aid to growth of the market. AAO 2019 program was to be held in the month of October in San Francisco, U.S.

In the U.S., mergers and acquisitions are key to the industry, helping companies like Johnson & Johnson Vision, Essilor, and Zeimer Ophthalmic Systems AG to expand their market presence, innovate, and improve treatment options. For example, Essilor introduced a progressive web app to optimize the digital ecosystem for eye care professionals. These strategies allow companies to invest in research, early diagnosis, and effective procedures, fostering ongoing innovation and strengthening their market position.

The increasing need for myopia and presbyopia treatment is being met using innovative products such as corrective lenses, contact lenses, surgical procedures, and medications. Furthermore, market growth is fuelled by technological advancements like implantable contact lenses and intraocular lenses. Key players in the industry, including Johnson & Johnson Vision, Essilor, and ALCON Inc., are spearheading innovation and catering to the demands of this expanding market. For instance, In June 2021, Ziemer launched FEMTO Z8 Neo femtosecond laser. This product launch helped the company expand its product offerings.

Geographic expansion for companies in the U.S. myopia and presbyopia treatment market is essential to capitalize on the growing demand for innovative solutions, leverage regional dominance, benefit from technological advancements, tap into market opportunities, and participate in awareness initiatives to drive growth and meet evolving consumer needs.

The medical technology and innovation industry fetches thousands of proposals for medical devices approval every year including ophthalmic devices. However, there are concerns about performance and safety of high-risk devices. Thus, United States Federal regulation is looking up for new shift in the way to monitor and approve medical devices and are stringent with their laws. For instance, recently, in May 2021, Johnson & Johnson received FDA approval for novel contact lens technology, known as Abiliti Overnight therapeutic lenses. This technology was developed to combat childhood myopia.

Myopia Treatment Type Insights

Surgical dominated the market and held around 36.9% in 2023 and is also expected to grow at a fastest CAGR during the forecast period. Laser surgery has been a treatment option for myopia for the past 20 years, with procedures including LASIK, LASEK, and PRK. These surgeries are quick, outpatient procedures that restore vision rapidly. LASEK combines the benefits of LASIK and PRK and can treat astigmatism, nearsightedness, and farsightedness. It involves partially detaching a thin layer of surface epithelium, reshaping the cornea, and then allowing the layer to heal naturally. It's more adaptable than LASIK and is growing in popularity, especially among patients with thin corneas or those who have previously undergone LASIK surgery. However, the risk of infection and slow recovery time are limiting factors. The fact that patients no longer need to wear glasses or contact lenses after these surgeries is increasing demand, particularly among athletes.

Contact lenses is expected to have a lucrative growth during the forecast period. The most used contact lenses include standard rigid gas-permeable, bifocal, and multifocal contact lenses. Orthokeratology is a practice that uses soft gas-permeable contact lenses to reshape the cornea and treat myopia. It can impart nearly a 45% reduction of myopia after two years, measured in terms of axial length. Bifocal lenses and multifocal lenses are expected to show a steady growth rate over the forecast period, due to their ability to reduce hyperopic defocus and impose myopic defocus, which could prevent an increase in axial length of the eyeball, thereby, slowing progression of myopia. Depth of Focus (DOF) contact lenses sub segment is expected to grow at the fastest rate over the forecast period. This can be attributed to its advantages, such as significant reduction in progression of myopia, absence of ghosting and halo effects, and clarity of vision at all distances.

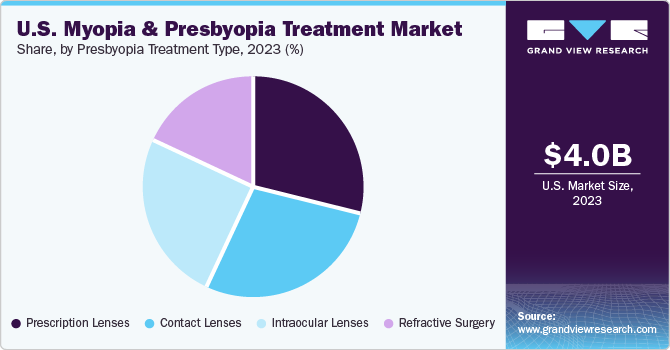

Presbyopia Treatment Type Insights

Prescription lenses dominated the market and held the largest revenue share of more than 29.0% in 2023. Prescription lenses are classified into single focal, bifocal, and trifocal lenses. The prescription lenses segment is expected to grow at a healthy rate over the forecast period, owing to an increasing prevalence of myopia—a condition linked to genetics—in children. Due to the difficulties in use of contact lenses by children without any parental support, ophthalmologists generally prescribe lenses to children. Executive bifocals can significantly reduce the rate of myopia progression in children. This is expected to foster the market growth during the forecast period.

Intraocular lenses is expected to witness the fastest growth of CAGR 8.61% during the forecast period. Intraocular Lenses (IOL) for the correction of presbyopia are expected to gain significant popularity over the coming years. They are effective for treating presbyopic patients who do not qualify for laser refractive surgery and avoid use of reading glasses. Manufacturers are expanding their product portfolio by developing or acquiring IOL assets. For instance, in March 2019, Alcon acquired PowerVision, Inc. enhancing its portfolio in advanced intraocular lenses for cataract surgery and presbyopia correction. In addition, a growing number of clinical trials with respect to efficiency and effectiveness of IOLs in the correction of presbyopia are expected to drive segment growth.

Key U.S. Myopia And Presbyopia Treatment Company Insights

Companies in the U.S. that are involved in the treatment of myopia and presbyopia are adopting various growth strategies. These include innovating existing technologies, introducing efficient techniques, and engaging in mergers and acquisitions. Market leaders are investing heavily in research and development to facilitate early diagnosis and develop efficient and quick surgical methods. This not only brings innovation to the field but also strengthens their market position.

There is an increase in collaborations among major players such as Johnson and Johnson, Essilor, Zeimer Ophthalmic Systems AG, and others. The aim is to develop advanced techniques and treatment strategies to provide better and more efficient treatment for myopia and presbyopia. For instance, in July 2021, Essilor introduced a progressive web app version of its existing Essilor Companion for all eye care professionals. This initiative is designed to simplify the digital ecosystem for Essilor’s industry partners, including Eye Care Professionals (ECPs), and provide an enhanced in-store digital experience with the Essilor brand. Such initiatives are expected to strengthen their presence in the market.

Key U.S. Myopia And Presbyopia Treatment Companies:

- Ziemer Ophthalmic Systems AG

- NIDEK CO., LTD.

- Johnson & Johnson Vision

- Essilor Ltd.

- ALCON VISION LLC

- Bausch & Lomb Incorporated

- Haag-Streit UK

- Topcon Corporation

Recent Developments

-

In February 2023, NIDEK entered into a partnership with HOYA Vision Care. This partnership provides HOYA’s ECP associates with the opportunity to utilize NIDEK’s top-tier optical products, services, and instruments, which are available through local distributors. This arrangement will bolster an ECP’s capacity to provide their patients with the most recent eye and vision examination tools, as well as improved visual quality and performance.

-

In December 2022, Johnson & Johnson Visions launched ABILITI 1-Day and ABILITY OVERNIGHT in Canada, Singapore and Hon Kong. This was the company’s approach for myopia management.

-

In June 2021, Ziemer launched FEMTO Z8 Neo femtosecond laser. This product launch helped the company expand its product offerings.

U.S. Myopia And Presbyopia Treatment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.76 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Myopia treatment type, presbyopia treatment type

Country scope

U.S.

Key companies profiled

Ziemer Ophthalmic Systems AG; NIDEK CO., LTD.; Johnson & Johnson Vision; Essilor Ltd.; ALCON VISION LLC; Bausch & Lomb Incorporated; Haag-Streit UK; Topcon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Myopia And Presbyopia Treatment Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. myopia and presbyopia treatment market based on myopia treatment type, and presbyopia treatment type:

-

Myopia Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Corrective

-

Prescription Lenses

-

Single

-

Bifocal

-

Trifocal

-

Others

-

-

Contact Lenses

-

-

Surgical

-

Drugs

-

-

Presbyopia Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Lenses

-

Reading Glasses

-

Bifocals

-

Trifocals

-

Progressive Multifocal

-

Office Progressives

-

Contact Lenses

-

Bifocal

-

Multifocal

-

Monovision

-

Modified Monovision

-

Intraocular Lenses

-

Refractive Surgery

-

Frequently Asked Questions About This Report

b. The U.S. myopia and presbyopia treatment market size was estimated at USD 4.0 billion in 2023 and is expected to reach USD 4.27 billion in 2024.

b. The U.S. myopia and presbyopia treatment market is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 to reach USD 6.76 billion by 2030.

b. Based on type, myopia dominated the U.S. myopia and presbyopia treatment market with a share of 58.2% in 2023. This is attributable to the increasing prevalence of vision-related problems, neurological disorders, and the growing installation of pupillometer in hospitals in the U.S.

b. Some key players operating in U.S. myopia and presbyopia treatment market include Ziemer Ophthalmic Systems AG, NIDEK CO., LTD., Johnson & Johnson Vision, Essilor Ltd., Zeiss International, ALCON VISION LLC, Bausch & Lomb Incorporated, Haag-Streit UK, and Topcon Corporation.

b. Key factors that are driving the U.S. myopia and presbyopia treatment market growth include the growing prevalence of eye-related disorders, growing awareness programs for myopia and presbyopia, and the growing number of product launches for the treatment of myopia and presbyopia.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.