- Home

- »

- Processed & Frozen Foods

- »

-

U.S. Mushroom Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Mushroom Market Size, Share & Trends Report]()

U.S. Mushroom Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Button, Shiitake, Oyster), By Form, By Distribution Channel, By Application (Food, Pharmaceuticals, Cosmetics), And Segment Forecasts

- Report ID: GVR-4-68040-204-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mushroom Market Size & Trends

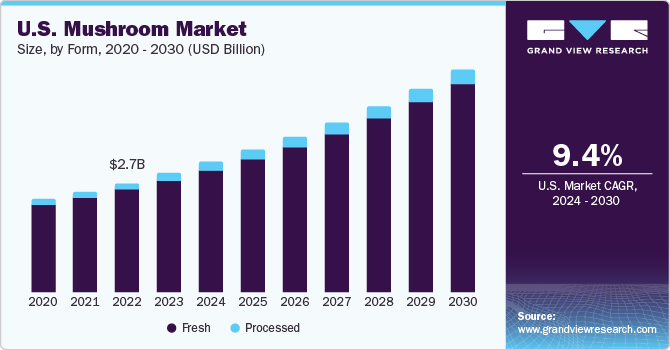

The U.S. mushroom market size was estimated at USD 2.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2024 to 2030.The U.S. market accounted for a share of 4.9% of the global mushroom market in 2023.

Increasing demand for exotic food products with natural and organic ingredients is expected to drive the growth of mushroom market in the country. A large number of pizza and burger outlets in the country are responsible for the higher consumption of mushrooms.

However, as a result of the COVID-19 forcing the majority of restaurants and food chains to temporarily close in 2020, the consumption from hotels and restaurants decreased. The fact that the U.S. government keeps raising the import taxes on mushrooms is another factor driving up their cost. There are about 320,000 eateries in the nation that provide on-site dining. Between March 2020 and May 2020, there was a significant national fall in restaurant transactions, which increased to 40% in April 2020. The demand for mushrooms from the eateries has suffered as a result. However, when the lockdown limitations were loosened in the latter half of 2020, restaurant transactions have shown a sluggish rebound, which has progressively increased demand for mushrooms.

Customers are looking for items with natural ingredients and are being more mindful of labels. Cosmetics with clean labels that are derived solely from plant extracts and don't include any artificial ingredients are becoming increasingly popular. As a result, producers of beauty and personal care products are incorporating more botanical elements into their formulas, which is predicted to boost demand. Because of their high water content, mushrooms only last one to three days on the shelf. Therefore, post-harvest transportation and storage are essential to a productive crop.

Furthermore, lockdowns were imposed in an effort to stop the COVID-19 pandemic from spreading further. Owing to lack of staff and the indecision the pandemic produced, the logistics and goods transportation industries also witnessed a sluggish growth in the early months of the outbreak. Farmers faced huge losses as a result due to the fact that mushrooms have a shorter shelf life compared to other vegetables. Thus, it is projected that during the course of the projected period, the market growth will be hindered.

Market Concentration & Characteristics

The U.S. mushroom market is moderately fragmented with the presence of a few large-sized and medium-sized players. Key players operating in in this country increasingly emphasize sustainable production of mushrooms to attract an environment-conscious customer base and improve brand position.

Leading agribusiness is expected to buy up small and medium-sized mushroom businesses in the upcoming years due to the mushroom market's expanding appeal in light of the world's growing vegan population and growing health consciousness. Furthermore, as food startups have created chicken alternatives utilizing the Laetiporus mushroom, often known as chicken of the woods, the growing desire for meat substitutes is probably going to drive up demand for mushrooms. In the upcoming years, mushroom farmers should be able to access new markets thanks to such creative product debuts.

Product Insights

Button mushrooms held a revenue share of around 36% in 2023. This type of mushrooms were largely sold in the country in 2020 owing to their low cost. The higher per capita income of the country is likely to boost the demand for other exotic mushrooms, including oyster and shiitake, from various end-use industries in the coming years.

The demand for oyster mushrooms is projected to grow at a CAGR of 12.7% from 2024 to 2030. Oyster mushrooms are used in many different types of cooking, but because of their mildly savory flavor and delicate texture, they are especially popular in Asian cookery.

Form Insights

Fresh mushrooms accounted for a revenue share of over 90% in 2023. The higher prevalence of restaurants, cafés, pubs, and other fast-food outlets in the country is projected to fuel the demand for fresh mushrooms. The sales at eating and drinking establishments in the U.S. grew by over 10% 2020 and 2021, and the trend is expected to continue over the forecast period.

The demand for processed mushrooms is expected to grow at a CAGR of 9.8% from 2024 to 2030. Processed variants include things like powdered, frozen, canned, pickled, and dried. Mushrooms must need further processing, such as canning, freezing, or drying, to extend their shelf life. Industrial enterprises are increasingly manufacturing packaged goods in an attempt to gain market share in the processed food and convenience product categories. Using additional extracts and powder forms is expected to be used by food and cosmetics manufacturers to assist industry growth during the projected term.

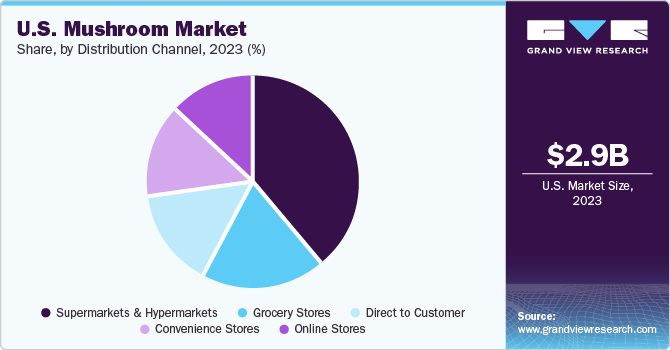

Distribution Channel Insights

Supermarkets/hypermarkets accounted for a revenue share of over 38% in 2023. Mushrooms are majorly sold via supermarkets/hypermarkets, convenience stores, and grocery stores in the country. Consumers in the country are preferring supermarkets/hypermarkets for retail shopping owing to the high per capita income and luxury lifestyles.

However, the demand for organic and natural products, which are popularly sold at supermarkets in the country, is expected to grow. This, in turn, is anticipated to boost the sales of mushrooms through supermarkets/hypermarkets distribution channel over the forecast period.

Application Insights

The use of mushrooms in food applications accounted for a revenue share of nearly 87% in 2023. This application takes into account how households and food services use both fresh and processed versions. Mushrooms have very little gluten and salt, and they are low in fat and cholesterol. In addition, mushrooms are a great source of selenium, proteins, minerals, and other important elements, and as a result, have become popular with those that value their health and enjoy working out. Consumers are gravitating toward foods and beverages with higher nutrient contents that originate from natural or clean sources.

The demand for mushrooms in cosmetic formulations is projected to grow at a CAGR of 9.8% from 202 to 2030. Due to their outstanding antiaging, anti-wrinkle, antioxidant, and moisturizing properties, mushrooms and their ingredients/extracts have many uses in cosmetics. Over the course of the forecast year, there is expected to be an increase in demand for mushrooms due to the growing desire for natural cosmetics and personal care products. In the U.S., demand for immunity boosters skyrocketed in 2020. Furthermore, throughout the course of the forecast period, a growing trend toward a vegan diet is anticipated to increase demand for meat substitutes like mushrooms.

Key U.S. Mushroom Company Insights

The mushroom companies in the U.S. have been experiencing strong year-on-year growth for the past few years owing to the rising preference for plant-based nutritious, health, and wellness products. The market is largely fragmented owing to the presence of a large number of key players, market innovators, and contract manufacturers. Most companies are focused on launching new products in order to attract and meet the evolving needs of consumers.

Key U.S. Mushroom Companies:

- Bonduelle Group

- Costa Group

- CMP Mushroom

- Drinkwater Mushrooms

- Greenyard

- Monaghan Group

- Monterey Mushroom, Inc

- OKECHAMP S.A

- Shanghai Fengke Biological Technology Co., Ltd

- The Mushroom Company

Recent Developments

-

October 2021 - Beatnic, New York City's renowned vegan restaurant, declared its collaborations with Fable Food Co, an Australian-based brand, to launch its first meaty mushroom product in the U.S. Meat substitute is prepared from real and natural shiitake variety and will be provided at all Beatnic’s locations.

-

October 2021 - Big Mountain Foods, a Vancouver-based food producer, declared its strategic collaboration with Sprouts Farmers Market, a pioneer in gut-healthy foods, to unveil the first Lion’s Mane mushroom product line across North America.

U.S. Mushroom Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.24 billion

Revenue forecast in 2030

USD 5.58 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million/Billion, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, distribution channel, application

Country scope

U.S.

Key companies profiled

Bonduelle Group; Costa Group; CMP Mushroom; Drinkwater Mushrooms; Greenyard; Monaghan Group; Monterey Mushroom, Inc; OKECHAMP S.A; Shanghai Fengke Biological Technology Co., Ltd; The Mushroom Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mushroom Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. mushroom market report based on product, form, distribution channel, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Button

-

Shiitake

-

Oyster

-

Matsutake

-

Truffles

-

Other

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fresh

-

Processed

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct to Customer

-

Grocery Stores

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online Stores

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Pharmaceutical

-

Cosmetics

-

Frequently Asked Questions About This Report

b. The U.S. mushroom market size was estimated at USD 2.97 billion in 2023 and is expected to reach USD 3.24 billion in 2024.

b. The U.S. mushroom market is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 5.58 billion by 2030.

b. Button mushrooms dominated the U.S. mushroom market with a share of around 36% in 2023. This is attributable to abundant availability and growing demand from end-use industries.

b. Some key players operating in the U.S. mushroom market include Bonduelle Group; Costa Group, CMP Mushroom, Drinkwater Mushrooms, Greenyard, Monaghan Group, Monterey Mushroom, Inc., OKECHAMP S.A, Shanghai Fengke Biological Technology Co., Ltd, and The Mushroom Company.

b. Key factors that are driving the market growth include growing consumer demand for food products with natural ingredients and the increasing product demand from the food-service sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.