- Home

- »

- Biotechnology

- »

-

U.S. mRNA Synthesis Raw Materials Market Size Report, 2033GVR Report cover

![U.S. mRNA Synthesis Raw Materials Market Size, Share & Trends Report]()

U.S. mRNA Synthesis Raw Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Capping Agents, Nucleotides, Plasmid DNA, Enzymes), By Application (Vaccine Production, Therapeutics Production), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-283-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. mRNA Synthesis Raw Materials Market Summary

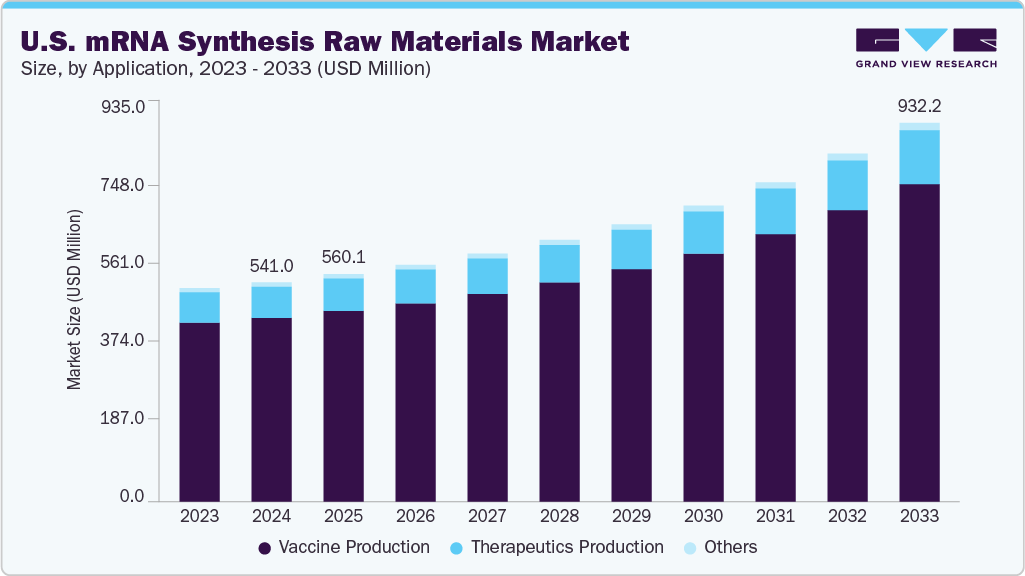

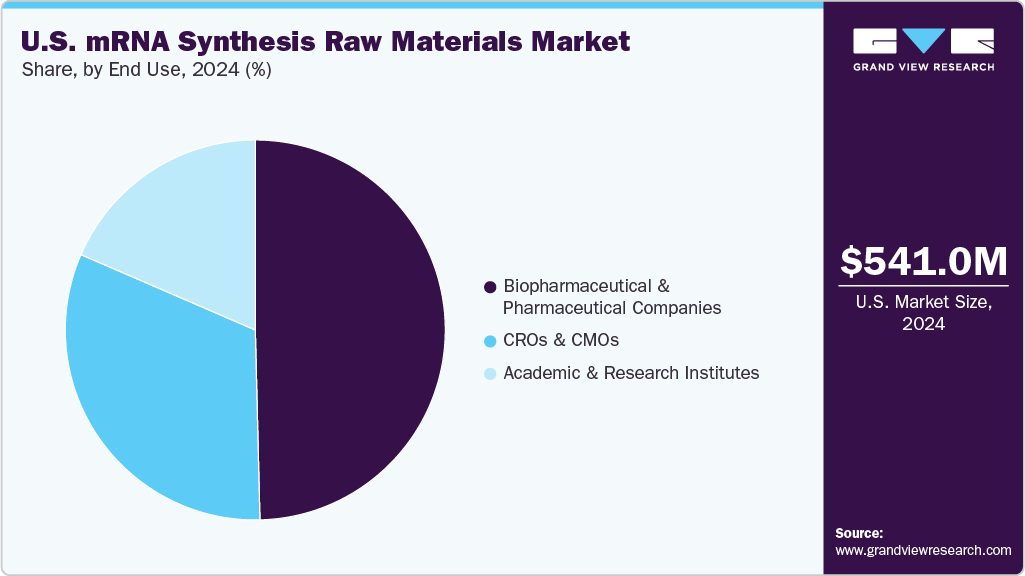

The U.S. mRNA synthesis raw materials market size was estimated at USD 541.0 million in 2024 and is projected to reach USD 932.2 million by 2033, growing at a CAGR of 6.57% from 2025 to 2033. This growth is attributed to the growing academic & industrial interest in mRNA technology, increasing funding for mRNA research, and rising awareness of the advantages of mRNA-based vaccines.

Key Market Trends & Insights

- By type, the nucleotides segment held the largest market share of 40.08% in 2024.

- Based on application, the vaccine production segment held the largest market share of 83.77% in 2024.

- By end use, the biopharmaceutical & pharmaceutical companies segment held the fastest market share of 49.61%in 2024.

Market Size & Forecast

- 2024 Market Size: USD 541.0 Million

- 2033 Projected Market Size: USD 932.2 Million

- CAGR (2025-2033): 6.57%

Moreover, the increasing therapeutic applications of RNA technology are anticipated to provide significant demand for the mRNA synthesis raw materials over the forecast period.

Increasing Funding for mRNA Research

The pipeline of financial backing for mRNA research has remained robust through late 2024 and into 2025, signaling continued confidence in the technology’s potential. In January 2025, the U.S. government awarded Moderna USD 590 million through BARDA’s Rapid Response Partnership Vehicle to accelerate development of an mRNA-based bird flu (H5N1) vaccine, building on a prior USD 176 million allocation in 2024 for pre-pandemic influenza preparedness. These investments underscore the federal commitment to leveraging mRNA platforms for emerging public health threats.

Parallel to public investment, private and venture funding have also surged: in July 2025, Centivax, a Silicon Valley-based biotech startup developing a universal flu mRNA vaccine, secured a USD 45 million Series A round led by Future Ventures. Despite increasing political skepticism surrounding mRNA vaccines, this capital injection reflects investor belief in the broad applicability of mRNA beyond traditional vaccine targets.

In March 2025, Arcturus Therapeutics secured a contract valued at up to USD 63 million from the U.S. Biomedical Advanced Research and Development Authority (BARDA) to support its Phase I trial for an mRNA-based bird flu vaccine (LUNAR‑H5N1) in healthy adults, marking a notable private-public investment in innovative mRNA platforms for pandemic preparedness. This award highlights BARDA’s ongoing strategy to diversify the mRNA vaccine pipeline and reinforces the competitive landscape for raw material suppliers, as both established and emerging developers scale up production.

These instances exemplify a dual-track funding strategy, public grants reinforcing national preparedness and venture capital backing innovation in novel mRNA modalities. Together, they are strengthening the raw materials supply chain by generating sustained demand for high-grade nucleotides, enzymes, lipid carriers, and capping agents, ultimately reinforcing the market growth.

Expanding Research and Commercialization of mRNA-Based Therapeutics

The U.S. mRNA synthesis raw materials market is witnessing strong momentum due to the increasing academic and industrial focus on mRNA technology. Universities and research institutes across the country are actively exploring the potential of mRNA in various therapeutic areas beyond infectious diseases, including oncology, rare genetic disorders, and autoimmune conditions. This academic engagement has led to a surge in basic and translational research, supported by government funding and collaborative initiatives aimed at accelerating mRNA innovation.

From an industry standpoint, pharmaceutical and biotech companies are significantly expanding their mRNA-based drug development pipelines. Major players are investing in proprietary platform technologies, scaling up in-house manufacturing capabilities, and entering strategic partnerships to enhance access to critical raw materials such as nucleotides, enzymes, and capping agents. The success of mRNA vaccines has validated the technology, encouraging companies to explore its broader application potential across therapeutic categories. This growing industrial investment is creating sustained demand for high-purity and performance-optimized synthesis materials.

Moreover, the convergence of academic innovation and industry execution is fostering a robust ecosystem that supports continuous advancements in mRNA delivery, design, and manufacturing. This collaborative environment not only accelerates the commercialization of novel mRNA-based therapies but also increases the need for reliable raw material suppliers that can meet evolving regulatory and quality standards. As a result, the expanding research and commercialization of mRNA therapeutics is expected to remain a key driver of market growth over the forecast period.

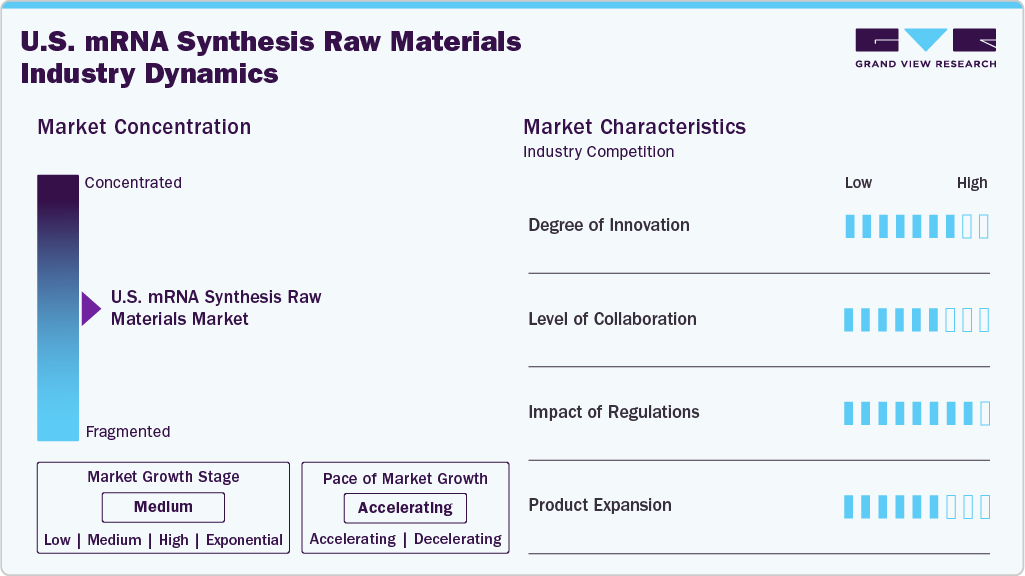

Market Concentration & Characteristics

The market growth stage is high, and the pace of the industry growth is accelerating. This growth stage reflects increasing demand for mRNA-based therapeutics and vaccines, driven by their effectiveness, versatility, and potential applications across various medical fields. Factors such as technological advancements, supportive regulatory frameworks, and strategic collaborations are fueling the growth of the market. Thus, continuous development and collaboration are propelling the market expansion.

In the U.S. mRNA synthesis raw materials industry, collaboration activities are at a high level of engagement within the industry. These collaborations facilitate technology transfer, expedite research and development efforts, and promote the commercialization of mRNA-based products. Biopharmaceutical companies, research institutions, and raw material suppliers are actively partnering to leverage expertise, share knowledge, and accelerate innovation in mRNA technology. For instance, in May 2024, TriLink BioTechnologies (part of the Maravai LifeSciences company) collaborated with Johns Hopkins University to accelerate transformational research in RNA discovery.

The U.S. has the most stringent standards for mRNA approval in the world. In the U.S., the FDA is the regulatory body solely responsible for the commercialization of mRNA-based therapeutics or vaccines. The FDA enforces laws enacted by the U.S. Congress and regulations established by the agency to protect consumer safety and health. However, mRNA is regulated by the FDA’s Center for Biologics Evaluation and Research (CBER) and is not yet categorized as a regenerative medicine advanced therapy.

The U.S. mRNA synthesis raw materials market currently exhibits a high level of product expansion. The rising demand for mRNA-based therapeutics and vaccines is propelling the growth of the market. Moreover, Technological advancements have enhanced production efficiency and quality, while substantial investments and strategic collaborations have bolstered manufacturing capacity and innovation. For instance, in April 2025, ProBio, a global CDMO, introduced GMP-grade plasmid DNA manufacturing at its Hopewell, NJ facility, enabling end-to-end production from cell bank to batch release within three months, supporting faster development of gene and cell therapies in the mRNA synthesis raw materials market.

Type Insights

The nucleotides segment led the U.S. mRNA synthesis raw materials industry with the largest revenue share of 40.08% in 2024. This is attributed to their critical role in mRNA construction and the high consumption rate during in vitro transcription processes. Additionally, the growing preference for modified nucleotides to enhance mRNA stability and reduce immunogenicity is driving demand, especially as mRNA applications expand into oncology and rare disease therapeutics.

The capping agents segment is expected to register the fastest CAGR over the forecast period. This growth is driven by the increasing use of advanced capping technologies to improve mRNA translation efficiency and stability. As more mRNA-based therapies advance into clinical trials, demand for high-quality capping agents is rising to meet regulatory and performance standards in therapeutic development.

Application Insights

The vaccine production segment dominated the U.S. mRNA synthesis raw materials market with a revenue share of 83.77% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the growing pipeline of mRNA-based vaccines targeting non-COVID indications such as influenza, RSV, and cancer. Recent advancements in mRNA platform technology and increasing clinical trial activity in the U.S. are further driving demand for raw materials in vaccine development.

The therapeutics segment is expected to grow at a significant CAGR over the forecast period. Rising expenditures by key market players for the production of novel and effective mRNA therapeutics are expected to boost market growth over the forecast years. Moreover, the development and production of mRNA for therapeutic applications is relatively easy, scalable, and incredibly rapid; due to this, the demand for the production of mRNA therapeutics to combat future pandemics is increasing gradually over the forecast years.

End Use Insights

The biopharmaceutical & pharmaceutical companies dominated the U.S. mRNA synthesis raw materials industry with a revenue share of 49.61% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the increasing demand for the development of new therapeutics due to significant expansions in the pharmaceutical industry pipeline. The dominance of biopharmaceutical & pharmaceutical companies is further fueled by the ongoing expansion of mRNA-based therapeutic pipelines beyond vaccines, particularly in oncology and rare diseases. Continued funding and partnerships with biotech firms are also accelerating raw material demand in this segment.

The CROs & CMOs segment is expected to grow at a significant CAGR over the forecast period. The fast growth is due to the pandemic; vaccine developers entered into strategic agreements with contract service providers to meet the urgent global demand for mRNA-based vaccines, which led to a sharp increase in the outsourcing industry. In addition, some of the leading outsourcing companies are increasing their finances to strengthen their mRNA synthesis infrastructure and support segment growth.

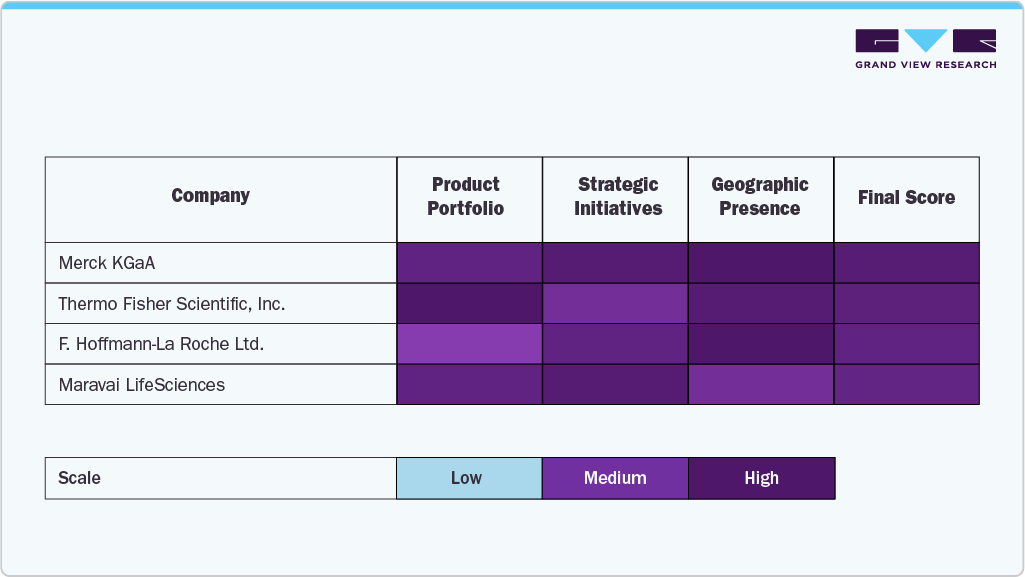

Key U.S. mRNA Synthesis Raw Materials Company Insights

The U.S. mRNA synthesis raw materials market is characterized by the presence of a mix of established life sciences players and emerging biotech firms, each contributing to a dynamic and highly competitive landscape. Companies such as Thermo Fisher Scientific, Merck KGaA, and TriLink BioTechnologies are among the key players holding a significant share of the market. These firms leverage their extensive expertise in molecular biology and raw material manufacturing to supply high-purity nucleotides, enzymes, capping agents, and reagents used in the synthesis of mRNA. Their vertically integrated capabilities, strong distribution networks, and compliance with GMP standards give them a strategic advantage in meeting the scale and quality demands of biopharmaceutical clients.

The growing number of long-term supply agreements and strategic collaborations further influences market share concentration. For instance, Thermo Fisher has expanded its manufacturing capacity and partnered with several mRNA therapy developers to secure a consistent supply of raw materials. Similarly, TriLink BioTechnologies, a Maravai LifeSciences company, has positioned itself as a critical supplier of CleanCap capping analogs and custom mRNA synthesis reagents. These partnerships not only strengthen market presence but also support innovation pipelines, especially as the demand for modified nucleotides and specialty enzymes continues to rise with the expansion of mRNA applications into oncology, cardiovascular, and rare disease therapeutics.

Innovation remains a key differentiator in this market. Several players are focusing on the development of proprietary technologies to enhance reaction efficiency, product stability, and overall yield. Moreover, newer entrants and specialized biotech firms are capturing niche opportunities by offering custom synthesis services or focusing on synthetic biology approaches to optimize raw material production. As mRNA manufacturing becomes increasingly decentralized and localized, especially in the U.S., the competitive landscape is expected to further diversify with players targeting both large-scale pharma and small biotech clients.

Looking ahead, consolidation and capacity expansion are likely to shape the next phase of market evolution. Companies are actively investing in facility upgrades and regional expansions to reduce supply chain risks and shorten lead times. With mRNA-based therapeutics advancing through clinical pipelines and the growing focus on pandemic preparedness, the demand for consistent, high-quality raw materials will continue to intensify. As a result, firms that can offer both scalability and customization are expected to retain a competitive edge in the U.S. mRNA synthesis raw materials industry.

Key U.S. mRNA Synthesis Raw Materials Companies:

- F. Hoffmann-La Roche Ltd.

- Jena Bioscience GmbH

- Merck KGaA

- Yeasen Biotechnology (Shanghai) Co., Ltd.

- BOC Sciences

- Thermo Fisher Scientific, Inc.

- Maravai LifeSciences

- New England Biolabs

- Creative Biogene

- HONGENE

- Evonik Industries AG

- GENEVANT SCIENCES CORPORATION

Recent Developments

-

In May 2025, TriLink BioTechnologies launched its first mRNA synthesis kit featuring proprietary CleanCap capping technology, marking the debut with donations to leading academic institutions to support research and innovation.

-

In May 2025, Elegen expanded its ENFINIA platform by launching IVT Ready DNA, a high-accuracy, full-length linear DNA template with a poly(A) tail. Manufactured via a cell-free process and delivered within 10 days, it eliminates cloning and purification steps. This product streamlines mRNA synthesis, supporting rapid development of RNA therapeutics like personalized cancer vaccines and gene therapies.

-

In April 2024, TriLink BioTechnologies opened a new cGMP mRNA manufacturing facility in San Diego. The 32,000 square meter facility is specifically designed for mRNA production to support drug developers from Phase 2 to commercialization through TriLink's mRNA production capabilities.

U.S. mRNA Synthesis Raw Materials Market Report Scope

Report Attribute

Details

Revenue Forecast in 2033

USD 932.2 million

Growth rate

CAGR of 6.57% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use

Key companies profiled

F. Hoffmann-La Roche Ltd.; Jena Bioscience GmbH; Merck KGaA; Yeasen Biotechnology (Shanghai) Co., Ltd.; BOC Sciences; Thermo Fisher Scientific, Inc.; Maravai LifeSciences; New England Biolabs; Creative Biogene; HONGENE; Evonik Industries AG; GENEVANT SCIENCES CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. mRNA Synthesis Raw Materials Market Report Segmentation

This report forecasts revenue growth in the U.S. and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. mRNA synthesis raw materials market report based on type, application, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Capping Agents

-

CleanCap Reagents

-

ARCA (Anti-Reverse Cap Analog)

-

Others

-

-

Nucleotides

-

Modified Nucleic Acids

-

N1-methylpseudouridine-triphosphate

-

5-Methylcytidine triphosphate (5mCTP)

-

Others

-

-

Natural Nucleic Acids

-

Adenine

-

Guanine

-

Cytosine

-

Uracil

-

-

-

Plasmid DNA

-

Enzymes

-

Polymerase

-

RNase Inhibitor

-

DNase

-

Others

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Vaccine Production

-

Therapeutics Production

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical & Pharmaceutical Companies

-

CROs & CMOs

-

Academic & Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. mRNA synthesis raw materials market size was estimated at USD 541.0 million in 2024 and is expected to reach USD 560.1 million in 2025.

b. The U.S. mRNA synthesis raw materials market is expected to grow at a compound annual growth rate of 6.57% from 2025 to 2033 to reach USD 932.2 million by 2033.

b. On the basis of type, nucleotides held the largest revenue share of 40.08% in 2024 for the U.S. mRNA synthesis raw materials market. This growth is driven by their essential role in mRNA formulation and increasing demand for high-quality inputs in advanced therapeutics.

b. Some of the key players operating in the market include F. Hoffmann-La Roche Ltd.; Jena Bioscience GmbH; Merck KGaA; Yeasen Biotechnology (Shanghai) Co., Ltd.; BOC Sciences; Thermo Fisher Scientific, Inc.; Maravai LifeSciences; New England Biolabs; Creative Biogene; HONGENE; Evonik Industries AG

b. The major factors driving the market growth include the growing academic & industrial interest in mRNA technology, increasing funding for mRNA research, and rising awareness of the advantages of mRNA-based vaccines.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.