- Home

- »

- Automotive & Transportation

- »

-

U.S. Mountain E-bikes Market Size, Industry Report, 2030GVR Report cover

![U.S. Mountain E-bikes Market Size, Share & Trends Report]()

U.S. Mountain E-bikes Market (2024 - 2030) Size, Share & Trends Analysis Report By Propulsion Type (Pedal-assisted, Throttle-assisted), By Drive Type, By Battery, And Segment Forecasts

- Report ID: GVR-4-68040-253-9

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Mountain E-bikes Market Size & Trends

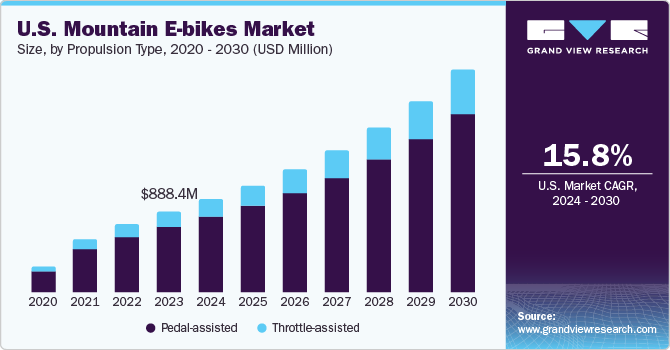

The U.S. mountain e-bikes market size was valued at USD 1.05 billion in 2023 and is anticipated to grow at a CAGR of 15.8% from 2024 to 2030. Electric mountain bikes (e-MTBs) offer several advantages over conventional mountain bikes, driving their adoption in the country. The growing need among riders to explore more challenging trails and cover greater distances without exhausting themselves is boosting sales of eMTBs. The assistance provided by the electric motor, which allows riders to traverse difficult terrains and steep hills with ease, is a major benefit of these bikes. In addition, e-MTBs offer a sustainable alternative to traditional gasoline-powered bikes, making them eco-friendly. With growing concerns regarding the environment and government regulations encouraging the use of greener alternatives in transportation, e-bikes have emerged as a viable solution, as they contribute to a greener future by reducing carbon emissions and promoting clean energy.

The U.S. accounted for 2.02% of the overall revenue share in the global mountain e-bikes market in 2023. An extensive presence of innovative manufacturers in the country is leading to increased adoption of e-bikes among riding enthusiasts. These manufacturers are being aided by government incentives and programs that have led to their increased countrywide presence. For instance, in March 2023, the Electric Bicycle Incentive Kickstart for the Environment (E-BIKE) Act was reintroduced in the Congress, offering a 30% refundable tax credit, capped at USD 1500, on purchase of a new electric bike. Such initiatives are expected to increase awareness among the general population about e-bikes, driving their adoption.

The various advancements in mountain e-bike technologies have emerged as another major driver for industry growth. Continuous improvements in battery life, bike design, and motor efficiency have made mountain e-bikes powerful, lighter, and more capable than conventional mountain bikes. The integration of digital connectivity is a significant factor that allows users to better control their mountain e-bikes. Wireless technologies such as Wi-Fi and Bluetooth are commonly used in these bikes, allowing for their better management. These developments enable users to monitor battery range and power and connect their bikes with their headphones, mobile devices, and other accessories. GPS navigation has become another notable integration in modern eMTBs, allowing riders to easily access their trail without any risk of losing their way.

The national bicycle advocacy group PeopleForBikes has been instrumental in passing standardized regulations regarding eMTB usage through a 3-Class system, which has been adopted by over 30 states in the U.S. These classes have defined where the e-bike can be ridden and where its usage is not allowed. For instance, Class 1 e-mountain bikes include bikes with maximum 750 watt motor, only pedal-assist, and no throttle, with the highest assisted speed being 20 mph. On the other hand, Class 2 eMTBs include rides that have pedal and throttle assists, with the same maximum speed as Class 1 bikes. Meanwhile, Class 3 includes e-mountain bikes with the same properties as Class 1 bikes, but with the maximum speed increased to 28 mph. Proper awareness and management of this system is expected to act as a major factor in industry growth in the coming years.

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. There is an extensive base for innovative advancements in this industry, as riders demand better convenience and overall riding experience. Manufacturers are focusing on improving product sustainability through introduction of novel materials. For instance, at CES 2024, the eco-friendly material Re:ancel was introduced by ANPOLY, manufactured from plant-derived cellulose. The material is five times stronger than iron and also lighter, making it a promising option for e-mountain bike manufacturers in the U.S. Additionally, novel solutions developed by companies, such as Bosch’s Performance Line SX motor released in 2023, add to the growth potential of the market.

The intensifying competition among e-mountain bike manufacturers in the U.S. has led to the launch of several advanced products. Key companies adopting this growth strategy include Bulls Bikes USA, Heybike Inc., Magnum Electric Bikes, Husqvarna E-Bicycles, and Pedego. For instance, in January 2023, Husqvarna E-Bicycles unveiled its Mountain Cross range of e-mountain bikes, including Mountain Cross 4, 2, 5, and 6. This line-up is designed to assist both climbing and descending, offering an improved experience on various trail types. These bikes feature a lightweight carbon frameset with advanced features such as motor and clean battery integration and cutting-edge aesthetics.

Regulatory dynamics are a decisive factor in the U.S. market for mountain e-bikes. Some states and local governments offer incentives or rebates for e-bike purchases to promote clean transportation and reduce carbon emissions. These incentives vary by location and may include tax credits, rebates, or other financial incentives for individuals purchasing e-bikes. For instance, in June 2023, Magnum Electric Bikes and Utah Clean Air Partnership (UCAIR) collaborated to offer an e-bike incentive program for Salt Lake County residents. This initiative provides discounts of up to USD 800 on select Magnum e-bikes and up to USD 1,200 on select Magnum cargo e-bikes. A majority of states in the country have implemented helmet requirements for mountain e-bike riders, which is expected to facilitate developments in the accessories segment.

There is a low-to-moderate level of risk of substitutes in this market, as conventional mountain bikes offer a lower-cost alternative to budget-conscious or fitness-focused riders. In urban areas, e-scooters provide a more affordable and convenient option for short commutes or leisure rides. Furthermore, for longer distances or off-road enthusiasts seeking higher speeds, motorcycles are a viable option. However, in the coming years, as governments push to promote e-mobility, it is expected that rising demand for e-mountain bikes would provide several growth avenues to manufacturers.

End-users in the U.S. mountain e-bike market include individuals of all ages and genders. These users make use of different sales channels to purchase e-MTBs. Increasing demand for mountain e-bikes from the young age population of the country is propelling market expansion. Furthermore, e-mountain bike manufacturers are focusing on improving their after-sales service to end users, including repair, maintenance services, and warranties. The quality of after-sales services strongly influences customer satisfaction and loyalty.

Propulsion Type Insights

Based on propulsion type, the pedal-assisted segment dominated the market with a revenue share of 81.45% in 2023. Pedal-assisted e-mountain bikes are designed to aid the biker’s pedalling efforts. Pedal assisted bikes offer several benefits to enhance user rider convenience, which drive segment demand. For instance, it provides riders with an extra boost in speed and acceleration, making it easier to ride hills, inclines, and rough terrains. This results in a smoother ride and reduces the stress on joints, making it a more comfortable and enjoyable experience for riders. Moreover, pedal-assist e-bikes provide reduced rider fatigue and extended range when compared to throttle-assist bikes, increasing their appeal.

On the other hand, the throttle-assisted segment is expected to advance at the fastest CAGR during the forecast period. Throttle-assisted e-MTBs are gaining popularity among mountain biking enthusiasts in the United States as they offer a unique rider experience with their convenient and intuitive control mechanisms. In addition, throttle-assisted e-bikes are adaptable to various riding conditions. They perform well on both hilly landscapes and flat terrain, enabling bikers to easily adjust the power output and speed to match the demands of the route. As there is no requirement for pedalling, there is no strain on the rider’s thighs and knees, making it very suitable for older people or those with medical conditions that can hinder pedalling.

Drive Type Insights

In terms of drive type, the chain drive segment accounted for the highest revenue share in 2023. Chain drive e-MTBs remain widely used because of their relatively low cost. Chain drives have been a fundamental component of bicycle design for more than a century with proven durability and reliability. With proper maintenance, including regular lubrication, chain drives can last for an extended period. The use of chains in e-MTBs provides a wide range of gearing options, making them suitable for a variety of terrains and bikers. Thus, the demand for chain-driven e-mountain bikes is increasing among participants in outdoor activities. The wide availability of bikes using chain drives also makes it easier to get a spare or replacement whenever required, and their high compatibility is another influencing factor for their demand.

The belt drive segment is anticipated to witness the fastest growth rate through 2030. E-MTBs featuring belt drives are popular among mountain bikers for their low maintenance and cleanliness requirements. In addition, belt drives operate silently, making them perfect for riders preferring a quieter riding experience or urban commuters. They are often lighter and appeal to bikers seeking ease and agility. Furthermore, modern belt drives are constructed from advanced synthetic materials such as nylon and carbon fiber, which are resistant to rust and corrosion. The lack of oil and grease for maintenance, along with their long-lasting nature and silent functioning, have further enhanced segment demand.

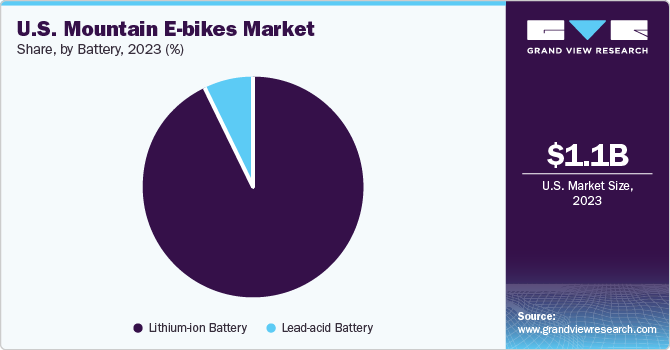

Battery Insights

The lithium-ion battery segment held a dominant revenue share in the U.S. mountain e-bikes market in 2023. Electric mountain bike manufacturers are increasingly utilizing lithium-ion batteries due to their high energy density, lightweight design, and long lifespan. These batteries can store a large amount of energy, providing riders with the power they need to tackle steep inclines and challenging terrains. Manufacturers are constantly striving to develop more efficient and lighter batteries to improve the range and performance of e-MTBs, further driving segment expansion. For instance, batteries in Pedego e-MTBs use high-quality lithium-ion cells sourced from leading manufacturers such as LG, Panasonic, and Samsung Electronics, all of which comply with UL2580 standards.

The lead acid battery segment is expected to advance at a moderate CAGR from 2024 to 2030. Lead-acid batteries are commonly used in e-mountain bikes due to benefits such as their low cost compared to lithium-ion batteries. These batteries can be purchased from local stores and several different online retailers. Purchasing sealed lead-acid batteries locally allows e-MTB manufacturers to avoid additional costs associated with shipping, ultimately lowering the total cost of e-MTBs. These batteries also offer very high power output potential, making them a good choice for riders looking to purchase high-power e-bikes. However, their substantial weight and shorter lifespan are factors expected to restrain their demand, as buyers prefer low-maintenance and portable solutions.

Key U.S. Mountain E-bikes Company Insights

Trek Bicycle Corporation; Pedego; Cycling Sports Group, Inc.; Magnum Electric Bikes; and Bulls Bikes USA are considered as leaders in the U.S. market for mountain e-bikes. These companies are mainly involved in technological advances, innovations, and new product launches to boost their sales. Furthermore, they are undertaking strategies such as partnerships, mergers & acquisitions, and collaborations with organizations to increase their brand reach and popularity.

For instance, in February 2022, Pedego Electric Bikes, a California-based company, partnered with Connections Individual and Family Services, a non-profit organization that has been established to support at-risk youth. Under this partnership, Pedego’s New Braunfels outlet in Texas donated the ‘Pedego Element’ fat tire e-bike, which was raffled off at a fundraising event held by Connections Individual and Family Services. The company also opened stores across Florida, New Jersey, and Nevada in the opening months of 2022, boosting its presence across the country.

Key U.S. Mountain E-bikes Companies:

- BULLS Bikes USA

- Cycling Sports Group, Inc. (Cannondale)

- Heybike Inc.

- Hi Power Cycles, LLC

- Husqvarna E-Bicycles

- Magnum Electric Bikes

- Pedego

- RANDRIDE

- Trek Bicycle Corporation

- Cynergy E-Bikes

- Aventon

Recent Developments

-

In February 2024, Aventon announced the launch of its first mountain e-bike, the Ramblas. The bike features a mid-drive motor, the A-100, exclusively developed by the company, which can deliver 100 Nm torque for a smoother riding experience. It can reach a speed of up to 20 miles/hour through pedal assist and carries a range of maximum 80 miles

-

In February 2024, Heybike Inc. released its ground-breaking all-terrain e-bike model called HERO. The bike features a 750 W mid-drive motor and is designed from T800 carbon fiber, offering improved performance to cater to the demands of numerous riders. The bike also features 26*4-inch fat tires and offers up to 60 mile range on a single charge through its 864Wh battery

-

In June 2023, Magnum Electric Bikes introduced two mid-drive e-bikes: the Pilot, an urban-focused model; and the Vertex, a hybrid mountain bike suitable for light trail riding and urban use. Both bikes feature the Mid-Drive Ananda M100 motor with 500 watts of power and 130 Nm of torque

-

In February 2023, Heybike Inc. introduced the Tyson, the company’s most advanced electric bike model, featuring a sleek and robust magnesium alloy frame. The Tyson can reach a maximum speed of 28 mph and is equipped with hydraulic front fork suspension and disc brakes for a safe and smooth riding experience. The bike comes with a 4A fast charger and has a 48V/15AH high-capacity battery that provides a cruising range of up to 55 miles in pedal-assisted mode and 40 miles in pure electric mode

U.S. Mountain E-bikes Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.92 billion

Growth rate

CAGR of 15.8% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drive type, propulsion type, battery

Key companies profiled

BULLS Bikes USA; Cycling Sports Group, Inc. (Cannondale); Heybike Inc.; Hi Power Cycles, LLC; Husqvarna E-Bicycles; Magnum Electric Bikes; Pedego; RANDRIDE; Trek Bicycle Corporation; Cynergy E-Bikes; Aventon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mountain E-bikes Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mountain e-bikes market report based on drive type, propulsion type, and battery:

-

Drive Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Belt Drive

-

Chain Drive

-

-

Propulsion Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Pedal-assisted

-

Throttle-assisted

-

-

Battery Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Lead-acid

-

Lithium-ion

-

Frequently Asked Questions About This Report

b. The U.S. mountain e-bikes market size was estimated at 1.05 billion in 2023 and is expected to reach 1.21 billion in 2024.

b. The U.S. mountain e-bikes market is expected to grow at an annual compound rate of 15.8% from 2024-2030 to reach 2.92 billion by 2030.

b. The pedal-assisted segment dominated the market with a revenue share of 81.45% in 2023. Pedal-assisted e-mountain bikes are designed to aid the biker’s pedalling efforts. Pedal assisted bikes offer several benefits to enhance user rider convenience, which drive segment demand.

b. Some of the companies operating in the U.S. mountain e-bikes market, include BULLS Bikes USA; Cycling Sports Group, Inc. (Cannondale); Heybike Inc.; Hi Power Cycles, LLC; Husqvarna E-Bicycles; Magnum Electric Bikes; Pedego; RANDRIDE; Trek Bicycle Corporation; Cynergy E-Bikes; Aventon.

b. The growing need among riders to explore more challenging trails and cover greater distances without exhausting themselves is boosting sales of eMTBs. The assistance provided by the electric motor, which allows riders to traverse difficult terrains and steep hills with ease, is a major benefit of these bikes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.