- Home

- »

- Power Generation & Storage

- »

-

U.S. Motive Lead Acid Battery Market Size Report, 2030GVR Report cover

![U.S. Motive Lead Acid Battery Market Size, Share & Trends Report]()

U.S. Motive Lead Acid Battery Market Size, Share & Trends Analysis Report By Construction (Flooded, Valve Regulated Lead Acid (VRLA), By Application (Automotive, Telecom, UPS, Golf carts, Mining), By Purity, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-112-0

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

Report Overview

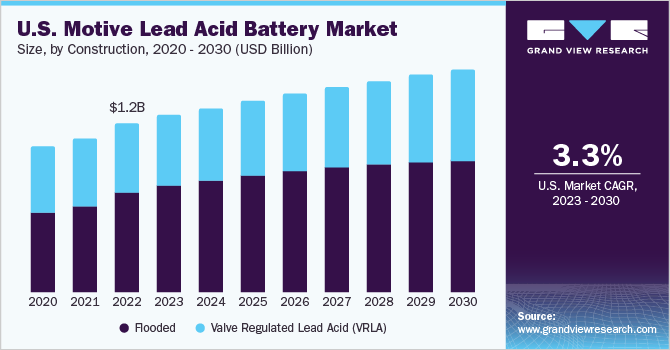

The U.S. motive lead acid battery market size was valued at USD 1,190.22 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.3% from 2023 to 2030. Lead acid batteries find application in uninterruptible power supply (UPS) systems as they provide high power density and enhanced life expectancy. Furthermore, the low cost and reliability of lead-acid batteries in terms of performance are expected to drive the growth of the market over the forecast period.

Increasing application scope, ranging from electric vehicles to energy storage solutions has driven the need for innovation in this industry, leading to the development of advanced lead acid batteries in the U.S. market.

Construction Insights

Flooded accounted for the highest revenue market share of 59.13% in the U.S. motive lead acid battery market in 2022. Increasing penetration for flooded batteries in marine applications on account of their high-effective power output is expected to augment their demand in the near future. For instance, in January 2023, East Penn Manufacturing Company announced an addition to its lead-acid battery portfolio by launching the Deka marine master battery line for applications including deep cycle batteries for boats in the U.S. market. The marine industry is growing in the U.S. with increasing marine ventures and their applications in trading, coast guard securities, and other leisure activities.

These batteries can operate continuously under a broad temperature range and eliminate the need for air conditioners. This increases the demand for VRLA batteries in several industries. For instance, in August 2022, GLOBE TELECOM, INC., a telecommunications company, announced the adoption of sustainable batteries VRLA batteries for its core network sites in the U.S. market.

Purity Insights

99.9% Purity (Pure Lead Acid) segment led the purity segment with a market share of 82.10% in 2022. Lead-acid batteries are made with two lead plates and an acid-resistant outer covering, and these plates act as electrodes. Moreover, the lead plates are crafted using a combination of tin and lead, which cleverly reduces the internal pressure within the battery. The batteries with 99.9% purity have more efficiency and reliability. They offer a great solution for various applications wherein performance is a major output.

Less than 99.9% purity accounted for second largest share in purity segment in 2022. Lead-acid batteries with a purity of less than 99.9% comprise deviations from the standard combination of sulfuric and lead-acid. In addition, these batteries are recyclable at the end of their life cycle and are adopted by manufacturers when the cost of production goes higher as manufacturing lead acid batteries with less purity is cheaper compared to manufacturing pure lead-acid batteries. Moreover, the U.S. market has a focus on sustainability, waste reduction, and developing battery recycling facilities, which is expected to drive the demand for lead acid batteries with less than 99.9% purity in the country.

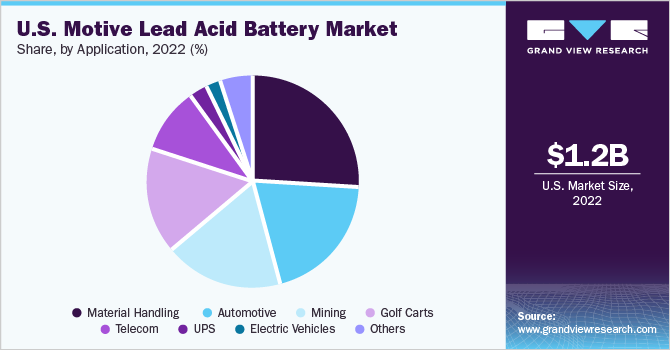

Application Insights

In the application segment, material handling accounted for the 25.96% revenue market share in 2022 and is projected to grow at the second highest CAGR during the forecast period. The material handling application segment consists of forklifts and others such as Automated Guided Vehicles (AGVs). The forklift segment consists of an end-controlled rider pallet jack, narrow aisle forklifts, counterbalanced forklifts, and large counterbalanced forklifts. Increasing investment in this equipment and machinery is expected to propel the market demand for motive lead-acid batteries in the material handling application.

The automotive industry has grown significantly in the past few years owing to the growing population and technological advancements. Government loans to automotive manufacturers and consumers for the expansion of the automotive industry are expected to augment the market. Increasing production of passenger cars, commercial vehicles, and motorcycles are anticipated to spur the market demand for motive lead-acid batteries in the country.

State Insights

Texas accounted for 7.23% revenue market share of the U.S. motive lead acid battery in 2022.Growth is owing to the increasing focus on sustainability by the state government. For instance, The State of Texas Alliance for Recycling and the Texas Sustainability Energy Research Institute are promoting the use of sustainable and recyclable lead-acid batteries with lower lead content. The growing demand for sustainable lead-acid batteries from various application industries, including telecommunications, is driving the demand motive lead-acid batteries in the Texas market.

The VRLA lead-acid battery is widely used in Texas by several end-use industries as a EVs for powering electric trucks and other automobiles. The Texas market for VRLA is witnessing significant growth to meet the growing demand from various end-user industries. For instance, Green Frog Systems., a battery manufacturer, announced the launch of a new manufacturing facility in Plano, Texas, to manufacture various battery solutions, including motive lead-acid batteries, to meet its rising demand in the Texas market.

Key Companies & Market Share Insights

The market is competitive with key participants involved in R&D and constant innovation done by the vendors has become one of the most important factors for companies to perform in this industry. For instance, some of the prominent players operating in the U.S. motive lead acid battery market are:

-

Crown Battery

-

East Penn Manufacturing

-

EnerSys

-

Exide Technologies

-

GS Yuasa Energy Solutions, Inc.

-

Hitachi Chemical Co., Ltd.

-

Johnson Controls

-

Panasonic Corporation of North America

-

Trojan Battery Company

-

U.S. Battery Mfg.

U.S. Motive Lead Acid Battery Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.57 billion

Growth rate

CAGR of 3.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Construction, purity, application, and material handling application

Key companies profiled

C&D Technologies Inc., Crown Battery, East Penn Manufacturing, EnerSys, Exide Technologies, Hitachi Chemical Co., Ltd., Johnson Controls, Panasonic Corporation of North America, Trojan Battery Company, U.S. Battery Mfg., GS Yuasa Energy Solutions, Inc.

, Leoch International Technology Limited Inc.

, Hitachi Chemical Co. Ltd., Discover Battery, Triathlon Battery Solutions, Inc., Clarios, HOPPECKE Batteries Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Motive Lead Acid Battery Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. motive lead acid battery market based on construction, purity application, and material handling:

-

Construction Outlook (USD Million, 2018 - 2030)

-

Flooded

-

Valve Regulated Lead Acid (VRLA)

-

-

Application Outlook (USD Million, 2018 - 2030)

-

Automotive

-

Telecom

-

UPS

-

Electric vehicles

-

Golf carts

-

Mining

-

Material Handling

-

Forklift

-

End-Controlled Rider Pallet Jack

-

Narrow Aisle Forklifts

-

Counterbalanced Forklifts

-

Large Counterbalanced Forklifts

-

-

Others (AGVs, etc.)

-

-

Other

-

-

Purity Outlook (USD Million, 2018 - 2030)

-

99.9% Purity (Pure Lead acid)

-

Less than 99.9% Purity

-

-

Material Handling Application Outlook (USD Million, 2018 - 2030)

-

VRLA Motive Lead Acid Battery

-

Forklift

-

End-Controlled Rider Pallet Jack

-

Narrow Aisle Forklifts

-

Counterbalanced forklifts

-

Large counterbalanced forklifts

-

-

Others

-

-

Flooded Motive Lead Acid Battery

-

Forklift

-

End-Controlled Rider Pallet Jack

-

Narrow Aisle Forklifts

-

Counterbalanced forklifts

-

Large counterbalanced forklifts

-

-

Others

-

-

-

State Outlook (USD Million, 2018 - 2030)

-

Texas

-

Frequently Asked Questions About This Report

b. The U.S. motive lead acid battery market size was estimated at USD 1,190.22 million in 2022 and is expected to reach USD 1.25 billion in 2023.

b. The U.S. motive lead acid battery market is expected to grow at a compound annual growth rate of 3.3% from 2023 to 2030 to reach USD 1.57 billion by 2030.

b. The flooded dominated the U.S. motive lead acid battery market with a revenue share of 59.13% in 2022. This is attributable to the growing demand for flooded batteries in marine applications on account of their high-effective power output

b. Some key players operating in the U.S. motive lead acid battery market include Crown Battery, East Penn Manufacturing, EnerSys, Exide Technologies, Hitachi Chemical Co., Ltd., Johnson Controls, Panasonic Corporation of North America, Trojan Battery Company, U.S. Battery Mfg., and GS Yuasa Energy Solutions, Inc.

b. Key factors driving the market growth include the growing demand for UPS systems in various industries and the increasing demand for material handling applications. The aforementioned factors will drive demand for motive lead acid batteries in the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."