U.S. Molecular Diagnostics Market Size, Share & Trends Analysis Report By Disease (Healthcare-associated Infections, Respiratory), By End-use (Hospital Core Laboratory, Decentralized Test Sites), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-126-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

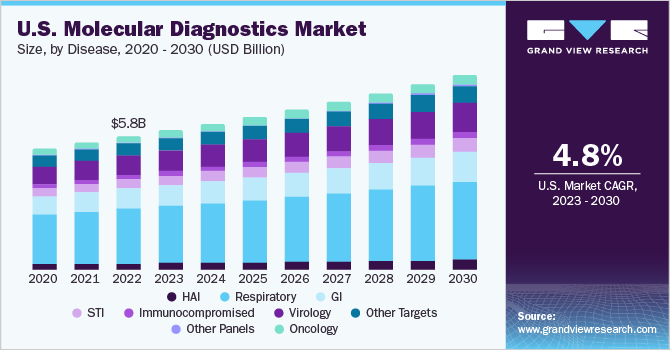

The U.S. molecular diagnostics market size was estimated at USD 5.83 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.82% from 2023 to 2030. The increasing prevalence of infections and technological advancements in molecular diagnostic tests drive the market. Furthermore, the presence of favorable reimbursement policies coupled with rising government support in the form of funding and initiatives for the development of diagnostics tests is anticipated to drive the U.S. molecular diagnostics growth over the forecast period.

The COVID-19 pandemic has positively impacted the market by encouraging players to develop novel and rapid diagnostic kits capable of detecting coronavirus. This has resulted in positive revenue growth for major market players operating in the infectious disease segment. For instance, Thermo Fisher Scientific reported 150% revenue growth owing to the rising demand for diagnostics offerings in April 2021. However, the rising adoption of vaccination in the region is anticipated to reduce the demand for COVID-19 testing over the forecast period.

Moreover, increasing incidences of infections in the country primarily drive the demand for cost-effective and efficient diagnostics techniques. According to a study published by the Journal of Clinical Virology in March 2023, enterovirus infection incidents increased by 21.7% compared to the previous year. Furthermore, enterovirus majorly affects the population with ages less than 5 years, of which around 41% of the infected toddlers require supplemental oxygen. In addition, according to the article published by the National Library of Medicine in May 2021, around 40 % of the U.S. population in the U.S. is affected by H. pylori infection every year.

The presence of government support in the form of approvals and funding is anticipated to fuel the market growth over the forecast period. For instance, in May 2022, Abbot received approval for its Alinity m STI Assay from the U.S. FDA. The test is capable of differentiating and detecting STIs. In addition, in 2020, ASPR’s Biomedical Advanced Research and Development Authority and NIH’s National Institute of Allergy and Infectious Diseases organized the Antimicrobial Resistance Diagnostic Challenge in which Visby Medical’s rapid PCR test won USD 19 million in federal funding.

High prices associated with molecular tests are one of the major factors impeding the market for U.S. molecular diagnostics. Furthermore, the scarcity of comparable tests is another reason for price hikes. The significant variations in prices for different applications of each molecular diagnostic product further compound this problem. However, the presence of favorable reimbursement policies in the country is anticipated to fuel the market demand. For instance, in January 2022, the U.S. Department of Health and Human Services announced that individuals with group health plans or covered by private health insurance who purchase at-home COVID-19 tests will get benefits of cost coverage from the insurance or plan.

Disease Insights

The respiratory disease segment dominated the market with a share of 40.79% in 2022. The growth is attributed to the increasing prevalence of respiratory infections such as HPIVs, MDR-TB, and group A streptococcal, among others, coupled with the increasing awareness regarding the availability of diagnostics tests for diagnosing and treatment of infections. According to a study conducted by the CDC, there has been a significant increase in the number of parainfluenza infections till December 2022. This is further contributing to the growing number of hospitalizations caused by HPIVs.

The healthcare-associated infections segment is anticipated to witness the fastest growth from 2023 to 2030. The growth is attributed to the increasing incidences of HAI and technological advancements in diagnostic techniques are driving the growth. According to a study published by the National Library of Medicine in December 2022, around 4% of the total hospitalizations are affected by HAI in the U.S. every year. Furthermore, rising government support in the form of initiatives to reduce the incidence of infections during hospitalizations is anticipated to fuel the growth over the forecast period. For instance, in 2022, the Centers for Medicare & Medicaid Services introduced the Hospital-Acquired Condition (HAC) Reduction Program to encourage hospitals to reduce incidences of infection during hospitalization and improve overall patient safety.

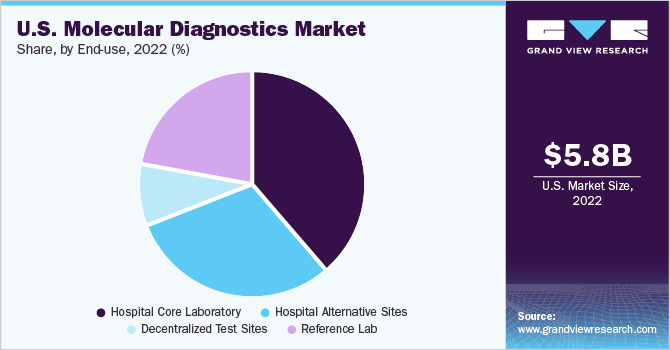

End-use Insights

The hospital core laboratory held the largest share of 38.43% of the market for U.S. molecular diagnostics in 2022 and is anticipated to grow at the fastest CAGR over the forecast period. The segment growth is attributed to the increasing prevalence of infections, such as MRSA, Staphylococcus aureus (SA), and enterovirus. According to a study published by NCBI in May 2022, the prevalence of SA carriage was found to be 30.2% among individuals aged between 18 years and 64 years, 20.7% among children, and 16.7% among people aged more than 65 years.

Reference labs are also expected to register a considerable CAGR during the forecast period. Increasing government support through initiatives and reimbursement policies is anticipated to drive market growth over the forecast period. For instance, in March 2023, the U.S. government launched the AHRQ Safety Program for MRSA Prevention. The program is anticipated to boost the demand for molecular diagnostic techniques by creating awareness regarding multidrug-resistant organisms and MRSA transmission.

Key Companies & Market Share Insights

Major players in the market are adopting various strategies such as new product launches, acquisitions, partnerships, collaborations, and expansions to enhance their product penetration and expand their customer base. For instance, in January 2023, QIAGEN N.V. and Helix entered into a strategic partnership for the development of hereditary disease companion diagnostics. This partnership is anticipated to assist QIAGEN N.V. in expanding critical access to providers and patients for genomic testing. Moreover, in May 2021, F. Hoffmann-La Roche Ltd announced the acquisition of GenMark Diagnostics for USD 1.8 billion. The goal of this acquisition is to expand Roche’s syndromic testing portfolio with the help of GenMark’s expertise. Some prominent players in the U.S. molecular diagnostics market include:

-

Abbott

-

Siemens Healthcare GmbH

-

QIAGEN

-

F. Hoffmann-La Roche Ltd

-

Quest Diagnostics Incorporated

-

Danaher

-

Thermo Fisher Scientific, Inc.

-

Hologic Inc.

-

BD

-

Charles River Laboratories

-

Bio-Rad Laboratories, Inc.

-

Illumina, Inc.

-

Agilent Technologies, Inc.

U.S. Molecular Diagnostics Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 8.46 billion |

|

Growth rate |

CAGR of 4.82% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Disease, end-use |

|

Key companies profiled |

Abbott; Siemens Healthcare GmbH; QIAGEN; F. Hoffmann-La Roche Ltd; Quest Diagnostics Incorporated; Danaher; Thermo Fisher Scientific, Inc.; Hologic Inc.; BD; Charles River Laboratories; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Agilent Technologies, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. molecular diagnostics market report based on disease, and end-use:

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare-associated Infections (HAI)

-

Methicillin-resistant Staphylococcus Aureus

-

Staphylococcus Aureus

-

Enterovirus

-

Clostridioides Difficile

-

Van A

-

Sepsis Panel

-

-

Respiratory

-

Flu

-

Respiratory Syncytial Virus

-

Paraflu

-

Multidrug-resistant Tuberculosis

-

Mycobacterium Avium-intracellulare

-

Group A Streptococcal

-

Adenovirus

-

Human Metapneumovirus

-

Rhinoviruses

-

Middle East Respiratory Syndrome Coronavirus

-

Tuberculosis

-

Severe Acute Respiratory Syndrome Coronavirus 2

-

Human Bocavirus-Infection

-

Bordetella

-

Mycoplasma Pneumonia

-

Respiratory Panels

-

-

Gastrointestinal (GI)

-

Norovirus

-

Helicobacter Pylori

-

Shiga Toxin

-

GI Parasite Panel

-

GI Bacterial Panel

-

GI Viral Panel

-

GI Panels

-

-

Women’s Health/STI

-

Chlamydia trachomatis (CT)/Neisseria Gonorrhoeae (NG)

-

Trichomonas Vaginalis

-

Mycoplasma Genitalium

-

Human Papillomavirus

-

Bacterial Vaginosis

-

Gonorrhoea Colloquially

-

Mycoplasma Genitalium Resistance

-

Herpes Simplex Virus

-

Group B Streptococcus

-

-

Immunocompromised

-

Cytomegalovirus

-

Epstein-barr Virus

-

Varicella-zoster Virus

-

BK virus

-

-

Virology

-

Human Immunodeficiency Viruses

-

Hepatitis C Virus

-

Hepatitis B Virus

-

Hepatitis E Virus

-

-

Other Targets

-

Babesia

-

Zika

-

West Nile Virus

-

Chikungunya Virus/dengue Virus

-

Enhancer of Zeste Homolog 2

-

PIK3CA

-

Malaria

-

Monkeypox Virus

-

-

Other Panels

-

Meningitis Panel

-

Lyme Panel

-

UTI Panel

-

-

Oncology

-

Microsatellite Instability

-

B-raf

-

Epidermal Growth Factor Receptor

-

Kirsten RAT SARCOMA VIRUS

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Core Laboratory

-

Hospital Alternative Sites

-

Decentralized Test Sites

-

Reference Lab

-

Frequently Asked Questions About This Report

b. Some key players operating in the U.S. molecular diagnostics market includeAbbott; Siemens Healthcare GmbH; QIAGEN; F. Hoffmann-La Roche Ltd; Quest Diagnostics Incorporated; Danaher; Thermo Fisher Scientific, Inc.; Hologic Inc.; BD; Charles River Laboratories; Bio-Rad Laboratories, Inc.; Illumina, Inc.; Agilent Technologies, Inc.

b. Key factors that are driving the market growth include increasing prevalence of infections and technological advancements in molecular diagnostic tests.

b. The U.S. molecular diagnostics market was valued at USD 5.83 billion in 2022.

b. The U.S. molecular diagnostics market is expected to expand at a compound annual growth rate (CAGR) of 4.82% from 2023 to 2030 to reach USD 8.46 billion by 2030.

b. The respiratory disease segment dominated the U.S. molecular diagnostics market with a share of 40.79% in 2022. The growth is attributed to the increasing prevalence of respiratory infections such as HPIVs, MDR-TB, and group A streptococcal, among others, coupled with the increasing awareness regarding availability of diagnostics tests for diagnosing and treatment of infections

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."