U.S. Mobile Application Market Size, Share & Trends Analysis Report By Store Type (Google Store, Apple Store), By Application (Gaming, Health & Fitness), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-274-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Mobile Application Market Size & Trends

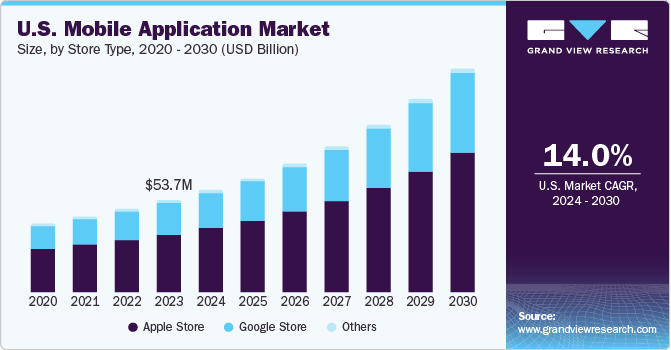

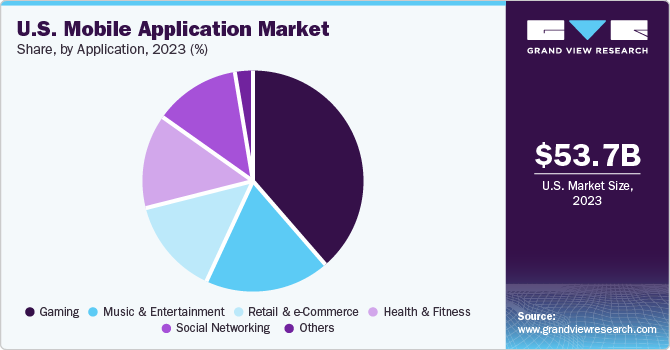

The U.S. mobile application market size was estimated at USD 53.71 billion in 2023 and is projected to grow at a CAGR of 14.0% from 2024 to 2030. The rising necessity of smartphone applications in performing daily tasks is growing day by day, which is fueling the market growth. In addition, almost every business is adopting digital technology and developing smartphone applications for their respective products or services, which is also aiding in the market growth of mobile applications.

In 2023, the U.S. accounted for approximately 23.46% share of the global mobile application market.

As the U.S. is considered the frontrunner in technology innovation and adoption due to its robust technological infrastructure as well as it is home to major technology companies, it is the earliest adopter of many new technological innovations. The proliferation of smartphones has led to the growth of smartphone applications, which has hugely benefitted e-commerce and social media companies as well as gaming companies. The user-friendly and 24x7 accessibility nature of smartphone applications has led to an exponential rise in its users. The advent of mobile applications has given rise to new revenue models such as in-app purchases, in-app advertisements, and paid game applications.

Over the past few years, there has been an upsurge in the number of mobile application buyers owing to growth in the e-commerce industry, product assortment, and various discounts and offers that are available only on e-platforms. The availability of low-cost data plans from telecom operators, which reduces the cost of the internet and attracts more users online is another factor accelerating mobile application downloads across all platforms. In addition, many sectors including healthcare, education, and finance among others are utilizing digital technology and offering various services through mobile applications. For instance, Siemens Healthineers’ Cinematic Reality app on Apple Vision Pro allows surgeons, medical students, and patients to view immersive, interactive holograms of the human body captured through medical scans in their real-world environment.

Data privacy in mobile applications is a growing concern as these platforms often collect sensitive personal information, including location, health, and contact data. The proliferation of mobile apps has led to increased data sharing with third parties, increasing concerns about user consent and control over their information. Despite regulations, there is still a significant risk of privacy invasion due to the extensive data apps can access, often without explicit user permission. Security vulnerabilities within apps can lead to data breaches, compromising user privacy and trust. These data privacy concerns may hamper the market growth of mobile applications.

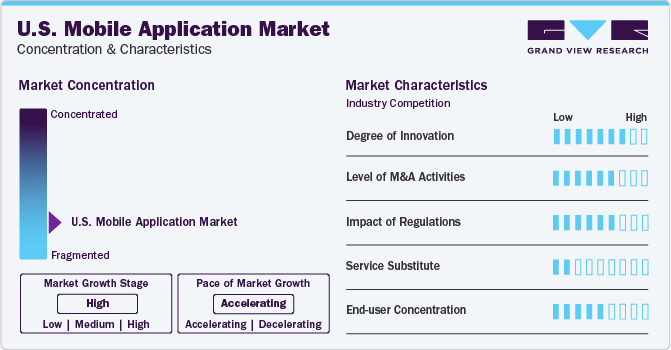

Market Concentration & Characteristics

The stage of growth is high at an accelerating pace. The degree of innovation is high given the rapid developments in the field of artificial intelligence and machine learning, which is extensively being incorporated in the development of diverse mobile applications. Artificial intelligence is empowering mobile apps with cutting-edge features such as voice recognition, chatbots, image recognition, photo apps, etc. Any mobile app can be integrated with AI tools to enhance app functionality and usability.

The U.S. mobile application industry is highly fragmented, with the presence of many big and small companies. The mergers and acquisitions activity in the industry is high as large companies are making strategic acquisitions of small companies to increase market share as well as trying to gain access to the latest technological innovations in the industry.

U.S. regulations are increasingly focusing on mobile applications due to their integral role in the digital ecosystem and the substantial personal data they handle. Authorities like the Federal Trade Commission (FTC) are intensifying privacy enforcement efforts, ensuring apps comply with federal regulations and broader data protection laws such as the California Consumer Privacy Act (CCPA) and General Data Protection Regulations (GDPR). Key concerns include complex data sharing with third parties, inadequate consent mechanisms, and the risk of data breaches. Companies are advised to conduct thorough data protection impact assessments (DPIAs) to identify and mitigate risks associated with mobile app data processing.

The threat of substitutes for mobile applications is low as there are no direct substitutes. Moreover, the growing adoption of mobile apps for various applications, such as online shopping, food ordering, and digital payments, is boosting the demand for mobile applications. With the growing internet and smartphone penetration, the need for mobile applications is expected to grow. The ease of use of mobile applications is likely to sustain their demand among users.

Store Type Insights

The Apple store segment led the U.S. market in 2023 with a revenue share of more than 62%. The Apple Store ecosystem has been a thriving marketplace, which includes revenue from in-app purchases, subscriptions, and premium apps. Apple’s commitment to maintaining a secure and diverse app environment has contributed to this growth. Apple’s ongoing support for developers, reduced in-app purchase fees for smaller developers, and strict App Review process have fostered trust and quality within the ecosystem. The combination of a robust ecosystem, targeted advertising, category-specific growth, and Apple's ongoing support for developers has fueled the remarkable revenue growth of the Apple Store through iOS apps.

The Google Play Store segment is anticipated to witness the fastest CAGR of 14.8% over the forecast period. Google’s proprietary version of Android is used by almost every smartphone. Manufacturers signing up to use Google’s Android fork must pre-install the Google Play Store and other Google services. This exclusivity effectively eliminates competitor app stores, giving Google a dominant position. Google has introduced AI-powered features to highlight the best of app experiences. These include generative AI technology for store listings, making it easier for developers to showcase their apps, and review summaries powered by AI to help users discover titles. The increasing sales of smartphones with Android OS and the introduction of a wide range of mobile applications, coupled with a huge consumer base ensures a strong growth prospect for the Google Play store over the forecast period.

Application Insights

The gaming segment in the U.S. market held the largest revenue share of more than 38% in 2023, and the segment is anticipated to continue its dominance over the forecast period. The growth of this segment can be attributed to several key factors such as strategic marketing, user engagement, and effective monetization strategies. Moreover, marketers are exploring new advertising channels, including connected TV (CTV), to reach wider audiences. In addition, incorporating social features within gaming apps enhances user engagement. Gaming companies are focusing on both installs and monetization strategies, combining downloads with actual revenue generated. Furthermore, there are three primary Operating System (OS) platforms on which mobile games are developed, namely Android, iOS, and Windows. Hence, the gaming application segment is poised for growth due to the aforementioned reasons.

The music and entertainment application segment is anticipated to witness a significant CAGR of around 14.8% over the forecast period. The convenience of on-demand content and personalized viewing experiences is driving the demand. Major players like Netflix, Amazon Prime Video, and Hulu have invested significantly in content creation and acquisition to attract and retain subscribers. The proliferation of original TV shows, movies, and documentaries on these apps further fuels growth. In addition, music streaming has become the preferred way to consume music, surpassing physical and digital sales. Mobile apps have become the primary platform for music streaming. The convenience of on-demand access, personalized playlists, and vast libraries drives this demand. Gen Z and Millennials are major contributors to this trend. The flexibility, cost-effectiveness, and diverse content libraries of streaming services have contributed to this trend.

Key U.S. Mobile Application Company Insights

Some of the key mobile application companies include Google, Apple Inc., and Microsoft Corporation.

-

Amazon Web Services (AWS) provides a robust platform for mobile app development, offering a wide range of services designed to help developers build, deploy, and scale mobile applications efficiently. With the advent of cloud computing, AWS has become a go-to choice for developers looking to leverage the power of the cloud in mobile app development.

-

Google, a subsidiary of Alphabet, is a U.S.-based technology company. The company operates in two reportable segments, namely Google Services and Google Cloud. The company operates the Google Play platform and provides various apps, such as YouTube, Google Maps, Gmail, and Chrome, among others. It has a global presence with over 70 offices across 50 countries.

Cash App and Snap Inc. are some of the emerging mobile application companies

-

Cash App, a subsidiary of Block, Inc., has revolutionized the mobile payment landscape by providing a user-friendly platform for peer-to-peer transactions in the United States and the United Kingdom. As of February 2023, it boasts a robust monthly user base of over 51 million and annual revenues reaching US$ 10.6 billion. The service distinguishes itself with a diverse range of features, including direct deposits, a customizable debit card, investment opportunities in stocks and Bitcoin, and additional services like personal loans and tax filing.

-

Snap Inc., the parent company of the widely popular social media platform Snapchat, has established itself as a leader in the digital communication realm since its inception in 2011. Headquartered in Santa Monica, California, Snap Inc. has expanded its offerings beyond the instant messaging app to include innovative augmented reality (AR) experiences and wearable technology. The company’s commitment to creativity and interactive engagement is evident in its diverse suite of AR tools, such as Lens Studio and Spectacles, which have redefined user interaction within the social media space.

Key U.S. Mobile Application Companies:

- Apple Inc.,

- Google LLC

- Microsoft Corporation

- Amazon Inc.

- Electronic Arts

- Netflix Inc.

- Cash App

- Snap Inc.

- Ubisoft Entertainment

- Zynga

Recent Developments

-

In March 2024, Snap Inc. launched sponsored AR Filters on Snapchat, a new augmented reality (AR) ad offering that expands brands’ reach beyond the pre-capture Lens Carousel. This ad placement occurs after Snapchatters capture their content with the Snapchat Camera, accessible by swiping to the post-capture Filter Carousel. With over 5 billion Snaps created every day, brands can now join in on even more shareable moments.

-

In December 2023, Inc. launched the Journal, a new iPhone app, that helps users reflect and practice gratitude through journaling, which has been shown to improve wellbeing. With Journal, users can capture and write about everyday moments and special events in their lives, and include photos, videos, audio recordings, locations, and more to create rich memories. On-device machine learning provides private, personalized suggestions to inspire journal entries, and customizable notifications help users develop their writing habits.

-

In October 2023, Electronic Arts Inc. revealed a first-look at EA SPORTS FC Tactical – a new way to play the World’s Game on mobile devices. EA SPORTS FC Tactical features interactive simulation with strategic, turn-based gameplay and access to more than 5,000 authentic players across more than 10 top leagues, including the Premier League, LALIGA EA SPORTS, Bundesliga, Ligue 1, and Serie A.

U.S. Mobile Application Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 59.66 billion |

|

Revenue forecast in 2030 |

USD 131.05 billion |

|

Growth rate |

CAGR of 14.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Store type, application |

|

Country scope |

U.S. |

|

Key companies profiled |

Apple, Inc.; Google LLC; Microsoft Corporation; Amazon, Inc.; Electronic Arts; Netflix Inc.; Cash App; Snap Inc.; Ubisoft Entertainment;Zynga |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Mobile Application Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. mobile application market report based on store type, and application:

-

Store Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Google Store

-

Apple Store

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gaming

-

Music & Entertainment

-

Health & Fitness

-

Social Networking

-

Retail & e-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mobile application market size was estimated at USD 53.71 billion in 2023 and is expected to reach USD 59.66 billion in 2024.

b. The U.S. mobile application market is expected to grow at a compound annual growth rate of 14% from 2024 to 2030 to reach USD 131.05 billion by 2030.

b. The gaming segment dominated the U.S. mobile application market with a share of over 38% in 2023.

b. Some key players operating in the U.S. mobile application market include Apple, Inc.; Google LLC; Microsoft Corporation; Amazon, Inc.; Electronic Arts; and Netflix Inc., among others.

b. Key factors driving the market growth include the rising necessity of smartphone applications in performing daily tasks is growing day by day, and almost every business is adopting digital technology and developing smartphone applications for their respective products or services.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."