- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Mobile Accessories Market Size, Industry Report, 2030GVR Report cover

![U.S. Mobile Accessories Market Size, Share & Trends Report]()

U.S. Mobile Accessories Market Size, Share & Trends Analysis Report By Product (Protective Cases, Power Banks, Headphones & Earphones, Chargers, Screen Protector, Others), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-405-9

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Mobile Accessories Market Trends

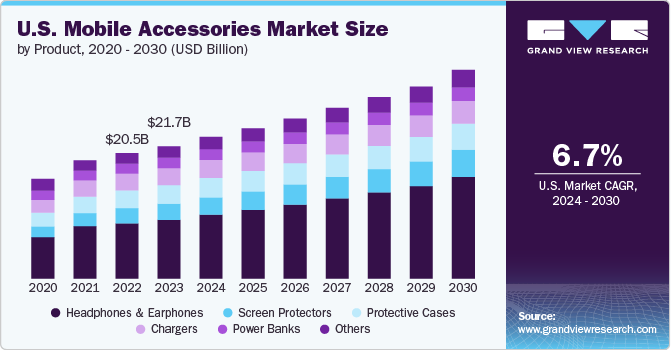

The U.S. mobile accessories market size was estimated at USD 21.66 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. U.S. The demand for mobile accessories in the U.S. is increasing primarily due to the widespread adoption of smartphones. As more people use these devices, there is a growing need for various accessories such as cases, screen protectors, chargers, and headphones to enhance functionality and personalize devices. In addition, the proliferation of smartwatches, fitness trackers, and other connected devices has spurred the demand for complementary accessories.

Technological advancements are also driving this trend. The introduction of wireless and fast-charging technologies has led to a surge in demand for compatible accessories. Innovations in audio quality have boosted the popularity of high-quality headphones and earbuds. Moreover, the rise of 5G technology and the Internet of Things (IoT) has increased the need for tech-friendly accessories that support these advancements. Augmented reality (AR) and virtual reality (VR) are also contributing to this growth as users seek accessories that enhance their experiences with these emerging technologies.

In June 2023, Juice, a tech accessories brand, launched an exclusive power bank in celebration of Pride Month. The power bank features a vibrant and colorful design inspired by the Pride flag, with a 10,000 mAh battery capacity. This limited-edition product is intended to support the LGBTQ+ community and raise awareness for Pride. The power bank is available for purchase on the Juice website.

Furthermore, e-commerce platforms have contributed to market growth of mobile accessories by providing convenient access to a wide range of accessories, offering competitive pricing and a broad selection. Consumer preferences favoring personalization and functionality have boosted demand for customizable cases, high-quality protectors, and technologically advanced accessories like Bluetooth headphones and smart earbuds. The integration of wearables, such as smartwatches, has further expanded the U.S. market, creating a demand for complementary accessories that enhance both style and utility.

Strategic initiatives by several companies, including collaborations, innovative product launches, and effective marketing campaigns, have increased consumer awareness and expanded market reach. There is a notable focus on enhancing user experience through products offering improved performance and convenience, such as noise-canceling headphones and portable power banks.

For instance, leading smartphone manufacturers such as Apple, Samsung, and Huawei have introduced safer ways of charging their phones with cable-free wireless chargers that allow users to charge their electronic devices and smartphones easily. A wireless charger is usually in the form of a mat or a stand that can be connected to a power source.

Product Insights

Headphones & earphones accounted for a revenue share of 44.50% in 2023 of the market. One of the significant drivers for the increased demand for headphones and earphones for mobile devices is the shift towards wireless connectivity. Manufacturers are launching new products as consumers increasingly prefer wireless options due to the convenience, they offer to move freely without being tethered by cords. The advancements in Bluetooth technology have enabled seamless connectivity between mobile devices and wireless headphones/earphones, further fueling their demand. In May 2024, Sennheiser introduced the HD 620S headphones, featuring 42mm dynamic drivers. This launch marked a significant addition to Sennheiser’s renowned line of audio products, catering to U.S. consumers.

Furthermore, continuous technological advancements in the audio industry have led to the development of high-quality headphones and earphones with advanced features. These features include noise cancellation, enhanced sound quality, voice assistance integration, gesture recognition, fitness tracking capabilities, and improved battery life. Such innovations enhance the overall user experience and drive the demand for these products among mobile device users.

Screen protectors are expected to grow at a CAGR of 7.8% from 2024 to 2030. The rising prices of smartphones in the U.S. have made consumers more cautious about protecting their investments. As flagship smartphones come with higher price tags, users are more inclined to purchase screen protectors to prevent costly repairs or replacements in case of accidental damage. As a result, there is a growing trend towards investing in accessories such as screen protectors to safeguard mobile devices and prolong their lifespan.

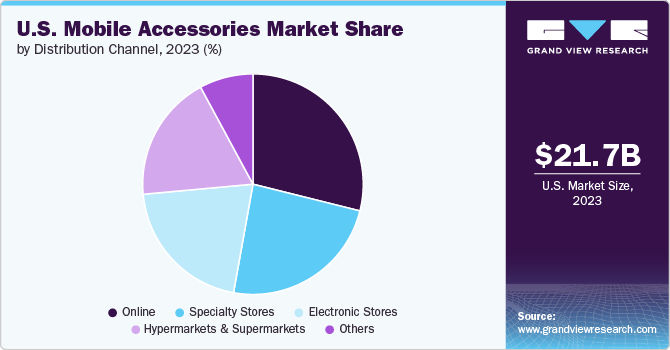

Distribution Channel Insights

Sales through online channels accounted for a revenue share of 35.47% in 2023 of the market. Over recent years, e-commerce has been gaining popularity as it offers convenience of shopping with just a click. Buyers worldwide are gradually turning to online shopping as they can explore various options on a single platform. Numerous niche players in the market are offering high-quality, designer mobile protective covers and cases. These players are giving tough competition to other established names in the market, such as Otterbox and Belkin.

E-commerce has significantly changed people’s shopping habits as it offers benefits such as doorstep delivery, heavy discounts, and the availability of a wide range of products on a single platform. Key players in the market are increasingly launching e-commerce websites to capitalize on the rising popularity of online shopping among the youth.

Sales of mobile accessories through specialty stores are expected to grow with a CAGR of 6.6% from 2024 to 2030. Specialty stores, with their focused product range, provide a curated selection of mobile accessories, catering to the specific needs of tech-savvy consumers who seek quality and compatibility. These retailers often employ knowledgeable staff who can offer expert advice on accessories that best match the customer's device and usage patterns, thereby enhancing the shopping experience and driving sales.

Spigen Inc. is a notable mobile accessories specialty store in the U.S. that offers a wide range of cases, screen protectors, and other accessories for popular smartphone models. Spigen premier mobile accessories are favored by many consumers for their blend of style and functionality.

Key U.S. Mobile Accessories Company Insights

The market is characterized by the presence of numerous well-established players such as Apple Inc., Samsung Electronics Co., Ltd., Belkin International Inc., Otter Products, LLC (Otterbox), and Speck Products, among others. The market players face intense competition from each other as some of them are among the top U.S. mobile accessories manufacturers with diverse product portfolios for mobile accessories.

Manufacturers are continuously developing new and innovative products, such as wireless chargers, advanced earphones, and multifunctional phone cases. Furthermore, with increasing consumer awareness about environmental issues, many manufacturers are focusing on producing eco-friendly accessories using recycled materials and sustainable packaging.

Key U.S. Mobile Accessories Companies:

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Bose Corporation

- Anker Innovations

- ZAGG Inc.

- Otter Products, LLC (Otterbox)

- Belkin International, Inc.

- CG Mobile

- Speck Products

- Spigen Inc.

- RAVPower

- Nomad Goods Inc.

Recent Developments

-

In July 2024, ZAGG Inc. announced its latest screen protection and case offerings for Samsung’s Galaxy Z Fold6, Galaxy Z Flip6, Galaxy Watch Ultra, and Galaxy Watch7, designed to provide robust protection for these devices. These products are certified by the Samsung Mobile Accessory Partnership Program, ensuring they meet Samsung's performance standards.

-

In June 2024, Anker Innovations announced the launch of a 3-in-1 Power Bank in the U.S. through Amazon. This power bank is integrated with AC charger and folding pins that help in the simultaneous charging of two devices. This power bank has a capacity of 5,000mAH and is compatible with Samsung and iPhone.

-

In June 2024, Belkin International, Inc. launched BoostCharge Pro Magnetic Power Bank integrated with Qi2 wireless charging technology. This power bank is available in 5K and 10K options in five new colors including, sand, cyber lime, blue, pink, and gold.

-

In January 2024, Otter Products, LLC (Otterbox) launched a new business unit called OtterBusiness. This new division focuses on providing commercial customers with solutions that go beyond just protective cases, aiming to enhance efficiency and productivity. OtterBusiness will serve a variety of industries, including retail, manufacturing, transportation, healthcare, and education, by offering robust solutions like the uniVERSE case system.

U.S. Mobile Accessories Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.22 billion

Revenue forecast in 2030

USD 34.22 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/ billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Apple Inc.; Samsung Electronics Co., Ltd.; Bose Corporation; Anker Innovations; ZAGG Inc.; Otter Products, LLC (Otterbox); Belkin International, Inc.; CG Mobile; Speck Products; Spigen Inc.; RAVPower; and Nomad Goods Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Mobile Accessories Market Report Segmentation

This report forecasts revenue growth for the U.S. and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. mobile accessories market report based on product, and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Protective Cases

-

Power Banks

-

Headphones and Earphones

-

Chargers

-

Screen Protectors

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Electronic Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. mobile accessories market size was estimated at USD 21.66 billion in 2023 and is expected to reach USD 23.22 billion in 2024.

b. The U.S. mobile accessories market is expected to grow at a compounded growth rate of 6.7% from 2024 to 2030 to reach USD 34.22 billion by 2030.

b. Headphones and earphones dominated the U.S. mobile accessories market with a share of 44.50% in 2023. The shift towards wireless connectivity coupled with manufacturers launching new products as consumers increasingly prefer wireless options due to the convenience, they offer to move freely without being tethered by cords driving the segment growth during the forecast period.

b. Some key players operating in the U.S. mobile accessories market include Apple Inc.; Samsung Electronics Co., Ltd.; Bose Corporation; Anker Innovations; ZAGG Inc.; Otter Products, LLC (Otterbox); Belkin International, Inc.; CG Mobile; Speck Products; Spigen Inc.; RAVPower; and Nomad Goods Inc.

b. Key factors driving market is driven by the rapid development of wireless technology and the increasing popularity of wearable devices which significantly contribute to the market expansion. Products such as wireless earbuds, headphones, and earphones have seen a surge in demand due to their convenience and advanced features.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."