U.S. Minimally Invasive Surgical Instruments Market Size, Share & Trends Analysis Report By Device (Handheld Instruments, Inflation Devices), By Application (Cardiac, Gastrointestinal), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-281-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

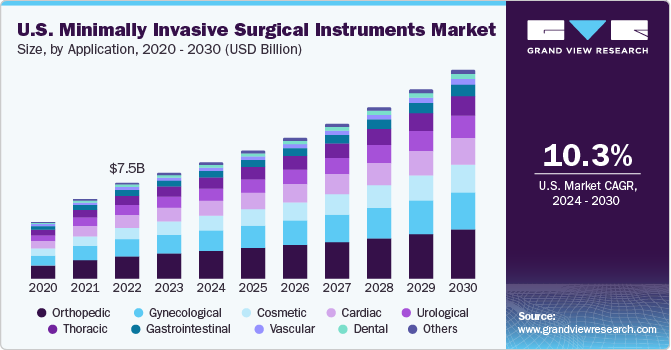

The U.S. minimally invasive surgical instruments market size was valued at USD 8.28 billion in 2023 and is anticipated to grow at a CAGR of 10.3% from 2024 to 2030. The major growth factor of the market includes high purchasing power, rising prevalence of chronic disorders, such as cardiac, orthopedic, and gastrointestinal disorders, available reimbursement policies, and government-supportive quality healthcare facilities.

U.S. accounted for 26.18% of the global minimally invasive surgical instruments market in 2023. Increasing number of minimally invasive surgeries (MIS) in fields of esthetics, dentistry, orthopedics, thoracic, cardiology, and gynecology are anticipated to fuel market growth. In addition, rising geriatric population and growing incidence of obesity have increased the risk of several chronic diseases, which is anticipated to boost the adoption of minimally invasive surgical instruments.

A constant rise in the geriatric population is increasing the financial burden on the healthcare system. The government is undertaking initiatives to develop elderly care programs and facilities, which is expected to boost market growth. In addition, growing concern about cancer which is one of the leading causes of death, and considered a universal healthcare complication, is anticipated to promote the adoption of MIS. In the U.S., lung cancer is the second most common cancer requiring minimally invasive thoracic surgery. Minimally invasive techniques are gaining traction as they offer more benefits than regular procedures. In addition, increasing incidence of cardiovascular disorders is also creating substantial demand for minimally invasive surgical instruments.

Factors such as surgical instrument innovations and growing adoption of advanced devices by surgeons are projected to drive the market over the forecast period. Surgeons are focusing on the usage of superior quality instruments that allow them to perform surgeries smoothly and speedily with no compromise on the patient’s health. Introduction of novel minimally invasive surgical products is anticipated to boost market growth. These products offer accuracy, portability, and cost-effectiveness, and are among the key factors contributing to their adoption.

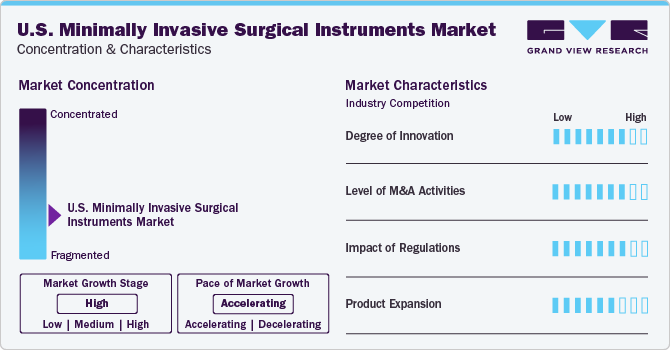

Market Concentration & Characteristics

Currently, the industry is relatively fragmented with several key players dominating the industry. Increasing prevalence of chronic diseases and technological advancement are the key factors driving minimally invasive surgical instruments industry. The increasing healthcare expenditure by governments and private organizations is also contributing to the industry's growth.

Technological advancements such as accuracy, portability, and cost-effectiveness are prompting market players to constantly launch and improve advanced devices. In recent years, robotics and computer science enabled surgeons to attain considerably better accuracy & precision in difficult surgeries. For instance, in July 2021, NuVasive, Inc. announced the launch of Pulse platform which is designed to enhance efficacy, procedural reproducibility, and safety of spine surgery. Increasing launches of new products and a growing number of product approvals by several market players to gain a larger market share are anticipated to create robust growth opportunities during the forecast period.

Many companies are involved in strategic partnerships and mergers & acquisitions as their strategies. The market players are focusing on innovation and expansion through mergers and acquisitions, to strengthen their market position. For instance, in February 2022, Depuy Synthes, which is a subsidiary of J&J, announced the acquisition of CrossRoads Extremity Systems intending to cater to DePuy Synthes’s foot and ankle portfolio.

Increasing FDA audits and investigations leading to strict law enforcement for market players are anticipated to limit market growth. However, favorable government policies and laws ensure the safety and efficacy of medical devices. In the U.S., government initiatives are helping improve the overall healthcare system, thus boosting the growth of minimally invasive surgical instruments industry. Favorable reimbursement policies are also expected to boost the demand for minimally invasive procedures.

Device Insights

The handheld device segment dominated the market with a share of 22.1% in 2023. Rise in the adoption of these instruments decreased the complexity of minimally invasive surgeries, thereby reducing postoperative pain & facilitating quicker recovery. Furthermore, handheld devices are easier to access during surgery with instrument triangulation that minimizes the risk of potential mistakes. On the other hand, disposable handheld instruments are also facing a surge owing to increasing incidence of surgical site infections and hospital-acquired infections. These factors are expected to boost the segment’s growth in the upcoming years.

The electrosurgical device segment is expected to witness highest growth over the forecast period. These devices are used in a variety of medical disciplines, including dermatology, orthopedic surgery, and general surgery, to cut, coagulate, desiccate, and fulgurate tissues during surgical procedures. Rapid increase in the geriatric population and healthcare infrastructure improvement investments are primary factors contributing to growth of electrosurgical products.

Application Insights

The gynecological segment dominated the market with a share of 17.89% in 2023. Gynecology-related procedures involve usage of surgical equipment and tiny scopes that are inserted either through small incisions in the abdomen or through the vagina. Growing awareness among surgeons about advanced hysterectomy surgical techniques such as laparoscopic and nerve-sparing electrosurgery is expected to propel market growth.

The cosmetic segment is expected to witness highest growth over the forecast period. The most popular cosmetic procedures include breast augmentation, body & facelift, and tummy tuck. The growing MIS procedures in cosmetics involve the use of newer technologies such as lasers that quickly remove the outer layer of the skin. This further helps in tightening the skin, which leads to smoothening and clearing of large pores & brown spots. Factors as such are projected to contribute to the market expansion during the forecast period.

End-use Insights

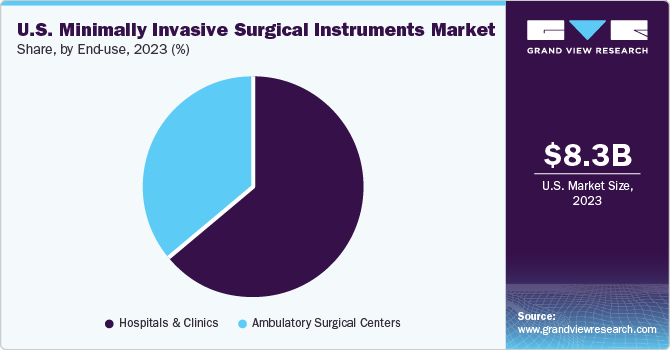

The hospital segment dominated the market with a share of 63.69% in 2023. The number of surgeries performed in hospitals is higher than in any other health system. This is due to favorable reimbursement structure and availability of hospitals for primary care. Moreover, investments in MIS devices are increasing in hospitals gradually, thereby driving the market.

The ambulatory surgical centers segment is expected to witness highest growth over the forecast period. Factors owing to the segment’s growth are preference for same-day surgery, reduction in significant cost savings & waiting time, and rise in the number of patients requiring surgical interventions. In addition, there has been increase in hospital-physician ambulatory surgery center joint ventures, which is also expected to drive market growth.

Key U.S. Minimally Invasive Surgical Instruments Company Insights

Some prominent U.S. minimally invasive surgical instruments companies include Medtronic, Siemens Healthineers AG, Johnson & Johnson Services, GE Healthcare, Abbott, Intuitive Surgical, ArthroCare Corporation, NuVasive, and Zimmer Biomet. These companies have a strong presence in the market and offer a wide range of minimally invasive surgical instruments.

However, there is a constant increase in number of players operating in this industry. Companies have adopted various strategies such as product launches, mergers & acquisitions, and to gain a competitive advantage. In addition, companies are more focused on developing and receiving FDA clearance for technologically advanced minimally invasive surgical instruments with higher efficiency and accuracy. For instance, in December 2021, Intuitive Surgical, Inc. received FDA clearance for its 8 mm SureForm 30 Curved-Tip Stapler.

Key U.S. Minimally Invasive Surgical Instruments Companies:

- Medtronic

- Siemens Healthineer AG

- Ethicon, Inc. (Johnson & Johnson)

- Depuy Synthes

- GE Healthcare

- Abbott Laboratories

- Intutive Surgical, Inc.

- Nuvasive, Inc.

- Zimmer Biomet

Recent Development

-

In January 2023, Abbott received FDA clearance for its latest-generation transcatheter aortic valve implantation (TAVI) system, Navitor. The device is used for treating people with severe aortic stenosis, at high or extreme risk for open-heart surgery

-

In June 2022, Johnson & Johnson announced the launch of the ECHELON 3000 Stapler which is a stapler that has wide applications in general and minimally invasive surgery

-

In May 2022, Ethicon by Johnson & Johnson received its FDA 510(k) clearance for its MONARCH Platform which is a flexible and multispecialty robotic solution for urology & bronchoscopy

Minimally Invasive Surgical Instruments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 8.28 billion |

|

Revenue forecast in 2030 |

USD 16.41 billion |

|

Growth rate |

CAGR of 10.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Device, end-use, application |

|

Country Scope |

U.S. |

|

Key companies profiled |

Medtronic; Siemens; Healthineer AG; Ethicon, Inc. (Johnson & Johnson); Depuy Synthes; GE Healthcare; Abbott Laboratories; Intutive Surgical, Inc.; Nuvasive, Inc.; Zimmer Biomet |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Minimally Invasive Surgical Instruments Market Report Segmentation

This report forecasts revenue growth at country level, and provides an analysis on industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. minimally invasive surgical instruments market based on device, application, and end-use:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld Instruments

-

Inflation Devices

-

Cutter Instruments

-

Guiding Devices

-

Electrosurgical Devices

-

Auxiliary Devices

-

Monitoring & Visualization Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac

-

Gastrointestinal

-

Orthopedic

-

Vascular

-

Gynecological

-

Urological

-

Thoracic

-

Cosmetic

-

Dental

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Frequently Asked Questions About This Report

b. The U.S. minimally invasive surgical instruments market size was estimated at USD 8.28 billion in 2023 and is expected to reach USD 9,106.5 million in 2024.

b. The U.S. minimally invasive surgical instruments market is expected to grow at a compound annual growth rate of 10.3% from 2024 to 2030 to reach USD 16.41 billion by 2030.

b. Handheld Instruments dominated the product segment with a share of 22.0% in 2023. This is attributable to the high rate of accidental injuries and the large geriatric population.

b. Some key players operating in the U.S. minimally invasive surgical instruments market include Medtronic, Stryker, Smith & Nephew, Abbott, NuVasive, Inc., CONMED, Zimmer Biomet, Intuitive Surgical, Inc.

b. Key factors driving the U.S. minimally invasive surgical instruments market growth include cost-effectiveness of the procedure, improved adoption among geriatric patients, and reduction in recovery time.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."