- Home

- »

- Medical Devices

- »

-

U.S. Microscope Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Microscope Market Size, Share & Trends Report]()

U.S. Microscope Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Optical, Electron, Scanning Probe), By Application (Material Science, Nanotechnology, Life Science, Semiconductors), And Segment Forecasts

- Report ID: GVR-4-68040-276-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Microscope Market Size & Trends

The U.S. microscope market size was valued at USD 3.7 billion in 2023 and is expected to expand at a CAGR of 7.03% from 2024 to 2030. Major factors contributing to the growth include rapid technological advancements and extensive research being conducted in different industries such as nanotechnology, life sciences, & semiconductors. Additionally, government entities are partnering with industry stakeholders to acquire high-quality products essential for R&D purposes.

Furthermore, there has been an increased investment in fertility services by private firms in the country, impacting the dominance of standalone clinics in the market. The growing investments from both public and private players, coupled with increased research in the field of cell and microbiology, are some of the key drivers. The life sciences segment holds the leading position, primarily due to the high incidence of infectious diseases and the presence of key companies in the region.

Significant medical research is being conducted in the area, focusing on understanding the mechanisms of infectious diseases, viral structures, cancer cell proliferation mechanisms, and various pathways. High-resolution microscopy plays a crucial role in these studies. Additionally, the nation is experiencing a rising demand, particularly in the state of California, where there is a provision of egg donation agencies, surrogacy brokers, and efficient laboratories.

As nanotechnology finds most of its application in the area of semiconductors, material sciences, and life sciences, it helps government organizations and other corporate enterprises support R&D via funding. In 2021, the U.S. government announced a budget of USD 1.7 billion for the National Nanotechnology Initiative to support nanotechnology research. Thus, significant funding in nanotechnology is further expected to positively impact the market growth.

The emergence of advanced technologies such as the Internet of Things (IoT), deep learning, and Extended Ultraviolet Lithography (EUVL) is fostering the expansion of the industry. IoT generates demand for memory, connectivity, sensors, and microcontrollers, while the utilization of neural networks for data analysis enhances the manufacturing of Integrated Circuits (ICs). EUVL plays a crucial role in the production of high-end computing chips. Electron microscopy provides high-resolution imaging and enables a wide evaluation range from packaged devices to the atomic level gate structure. Electron beam-based systems find applications in analyzing sources of device failure, contributing to process improvement in manufacturing. As a result, innovations within the semiconductor industry are anticipated to drive the microscope market.

Market Concentration & Characteristics

The market is fragmented due to the presence of several prominent industry players. With several innovations, partnerships, and R&D activities, the market is projected to witness a considerable amount of growth and expansion.

The market is characterized by a considerable amount of degree of innovation. Increasing focus on R&D for applications such as neuroscience, life sciences, nanotechnology, and semiconductors is expected to increase the adoption rate of super-resolution microscopes. In December 2021, Hitachi High-Tech Corporation launched two Field Emission Scanning Electron Microscopes (FE-SEMs)-the SU8600 and SU8700. The products have applications across fields of study, including materials development, life sciences, & semiconductors, and are capable of acquiring large amounts of high-quality data.

The competitive rivalry is high in the microscope market leading to several mergers and acquisitions, along with collaborations, and partnerships. Strategies such as mergers & acquisitions are being adopted by major companies to maintain market dominance. For instance, in February 2019, Danaher Corporation acquired the Biopharma business of GE Life Sciences, a provider of SIM technology-based microscopes.

An increase in research funding by governments worldwide is likely to propel the uptake of super-resolution microscopes. However, delays in obtaining FDA approvals for microscopes negatively impact the operation, business, and financial aspects of the business. The delay in product release may negatively affect product demand due to the availability of alternative products in the market by that time.

Research such as studying the effect of microgravity on bones and the structure of plants can be conducted using optical microscopes. High demand for optical microscopes in healthcare facilities due to their diagnostic applications is a major factor contributing to the market growth. Companies are initiating development strategies with a focus on optical microscopes. For instance, in December 2021, Bruker Corporation launched JPK NanoWizard V, a system that integrates with optical microscopes and is designed for mechanobiology research.

Companies such as Zeiss Group, Bruker Corporation, and CAMECA among others, have a strong presence in the U.S. market. However, these companies are also focusing on market expansion in other parts of North America and European and Asian countries. For instance, in March 2022, Olympus Corporation inaugurated its Olympus Discovery Center at the University Of Maryland (UMD). The center equips bioengineering researchers with high-performance microscopy systems, enabling analysis of living tissue to encourage the study of cellular and subcellular events.

Product Insights

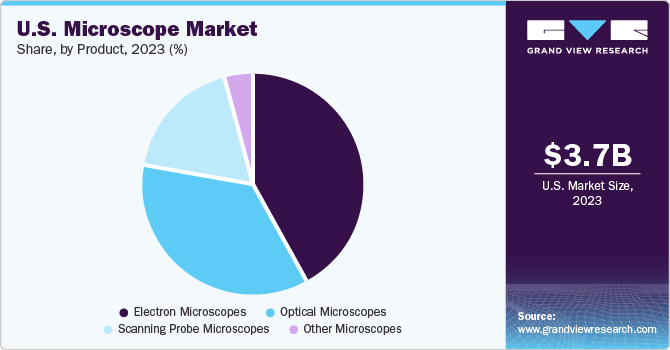

The electron microscope segment held the largest revenue share of 42% in 2023. The market penetration of electron microscopes is expected to increase due to the association between manufacturers and academic/research organizations. In addition, electron microscope usage is projected to increase owing to the association between manufacturers and academic/research organizations.

The scanning probes microscope segment is expected to witness the fastest CAGR over the forecast period. Factors such as the increasing number of applications and rapid technological advancements are driving the market growth. The Scanning Probe Microscope (SPM) is used to study specimens at the nanoscale and manipulate atoms to move in the desired pattern. In April 2020, Marposs developed a WRSP60 probe compatible with scanning devices directly on chip removal machine tools.

Application Insights

The life sciences segment held the largest revenue share of 37% in 2023. Lifesciences is a vast domain including biological research and healthcare activities such as diagnosis & treatment. Microscopes have applications in biomedical research and disease diagnosis. Growing applications of microscopy in medical sciences is one of the key drivers of this market. The conventional use of microscopes in diagnostics is expanding to other areas of life sciences, thus increasing opportunities.

The nanotechnology segment is expected to witness the fastest CAGR over the forecast period. The field of microscopic imaging and its application in nanotechnology is relatively new and still developing. The term encompasses technology, engineering, and science conducted at the nanoscale, 1 to 100 nanometers. Microscopes are used for manipulating, measuring, and imaging at the nanoscale. Global funding for nanotechnology research by governments is further impelling growth in this area. For instance, the U.S. government announced a USD 1.7 billion funding in 2021 for nanotechnology research.

Key U.S. Microscope Company Insights

Zeiss Group, Brukar Corporation, and Thermo Fisher Scientific, Inc. are some of the major market companies. The market is highly fragmented with many local manufacturers competing with international companies. These key companies are identified based on their product portfolios, revenues, collaborations, and other strategic initiatives adopted by them.

Expansion strategies, high R&D activities, and the introduction of several advanced versions of existing products are some of the other strategies followed by major companies to maintain their dominance.

Key U.S. Microscope Companies:

- Zeiss Group

- Bruker Corporation

- CAMECA

- Thermo Fisher Scientific, Inc.

- Nikon Corporation

- Olympus Corporation

- NT-MDT SI

- Hitachi High-Tech Corporation

- JEOL Ltd.

- Oxford Instruments (Asylum Corporation)

Recent Developments

-

In August 2023, Abacux dx announced its partnership with Nikon Australia’s Healthcare Business Unit with a shared commitment to excellence in providing innovative and advanced scientific tools to pathology laboratories and scientific professionals

-

In July 2023, JEOL introduced two new Scanning Electron Microscopes that incorporate the next level of intelligent technology and automation for ease of operation and fast, high-resolution imaging and analysis

-

In June 2022, Hitachi High-Tech Corporation announced the launch of the AFM100 Pro High-Sensitivity Scanning Probe Microscope System. It is a high-end scanning probe microscope that is equipped with a newly developed high-sensitivity optical head. This improves sensitivity when measuring physical properties and enables measurement at atomic and molecular scales

U.S. Microscope Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.9 billion

Revenue forecast in 2030

USD 5.9 billion

Growth Rate

CAGR of 7.03% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Zeiss Group; Bruker Corporation; CAMECA; Thermo Fisher Scientific, Inc.; Nikon Corporation; Olympus Corporation; NT-MDT SI; Hitachi High-Tech Corporation; JEOL Ltd.; Oxford Instruments (Asylum Corporation)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Microscope Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. microscope market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical microscopes

-

Upright Microscopes

-

Inverted Microscopes

-

Stereomicroscopes

-

Phase Contrast Microscopes

-

Fluorescence Microscopes

-

Confocal Scanning Microscopes

-

Near Field Scanning Microscopes

-

Other Optical Microscopes

-

-

Electron microscopes

-

Transmission Microscopes

-

Scanning Electron Microscopes

-

-

Scanning probe microscopes

-

Other microscopes

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Material Science

-

Nanotechnology

-

Life Science

-

Semiconductors

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. microscope market size was estimated at USD 3.7 billion in 2023 and is expected to reach USD 3.9 billion in 2024.

b. The U.S. microscope market is expected to grow at a compound annual growth rate of 7.03% from 2024 to 2030 to reach USD 5.9 billion by 2030.

b. Electron microscope segment dominated the U.S. microscope market with a share of 41.64% in 2023. Unlike optical microscopes, electron microscopes use an accelerated electron beam for illumination, capitalizing on the shorter wavelength of electrons compared to visible light, resulting in superior resolving power.

b. Some key players operating in the U.S. microscope market include Zeiss Group, Bruker Corporation, CAMECA, Thermo Fisher Scientific, Inc., Nikon Corporation, Olympus Corporation, NT-MDT SI, Hitachi High-Tech Corporation, JEOL Ltd., and Oxford Instruments (Asylum Corporation).

b. Key factors that are driving the U.S. microscope market growth include increasing demand for nanotechnology-based research and consequent rise in funding, rapidly growing semiconductor industry, rising R&D expenditure catering to emerging application areas, and growing demand in application areas such as miniature transistor chips and quantum.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.