U.S. Microprocessor Market Size, Share & Trend Analysis Report By Architecture Type (ARM MPU, x64, x86, MIPS), By Application (Smartphones, Personal Computers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-229-7

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

U.S. Microprocessor Market Size & Trends

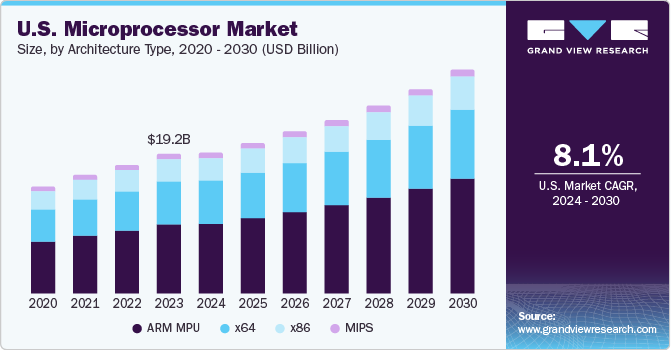

The U.S. microprocessor market size was estimated at USD 19.19 billion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. As an early adopter of advanced technologies, the U.S. has the presence of major microprocessor companies and has extensive industries as end-users of microprocessors. The growing demand for microprocessors for use in embedded devices, consumer electronics, and automotive applications is expected to play a vital role in driving the demand for microprocessors over the forecast period. The rapidly growing demand for smartphones, personal computers, and tablets is expected to drive market growth over the forecast period.

In 2023, the U.S. microprocessor industry accounted for approximately 16.22% share of the global microprocessor market. The market is expected to witness an increase in demand owing to the exponential growth of smartphone use, which requires energy-efficient and high-performance processors. According to GVR analysis, globally approximately 75% of the total mobile phone owners will own a smartphone by 2025. The microprocessor enhances the performance of the smartphone, as it is used for enhancing the speed and efficiency of a smartphone. The performance speed of any smartphone is directly proportional to the performance of the microprocessor.

With the advent of the Internet of Things (IoT) in various industries as well as in smart home applications, there has been increasing use of microprocessors in various electrical products such as smart televisions, digital cameras, laptops, and wearables devices, which offer various smart functionalities and smart applications. The rise in the number of wearable smart devices as smartphone accessories has also fueled the market growth. Microprocessors were initially designed for use in personal computers and servers. However, microprocessors are now being used in automotive applications such as infotainment systems and Advanced Driver-Assistance Systems (ADAS) to offer improved connectivity and high-speed to vehicle systems. The core use of microprocessors is in the servers, PCs, and large mainframes. With growing functionalities across various industries, the growth of the market is poised to witness an upward curve.

On the other hand, factors such as the high cost of manufacturing microprocessor integrated circuits, circuit designing cost, growing sales of low-priced mobile devices, declining shipment of individual computers, and high raw material prices are anticipated to hinder the market growth over the forecast years.

Market Concentration & Characteristics

The stage of market growth is medium and the pace of growth is accelerating. The U.S. microprocessor industry is highly competitive with the presence of key global corporations. There have been various advancements in microprocessor technologies, some of the ongoing advancements include miniaturization and power efficiency, specialized accelerators, multi-core processors, quantum computing, and heterogeneous computing among others.

The HAILO 8TM microprocessor is a noteworthy addition to the microprocessor industry. It is specifically designed for AI applications, offering exceptional performance and power efficiency. With dedicated AI acceleration engines, this processor brings immense computational power to the field of artificial intelligence.

The mergers and acquisitions activities in the U.S. microprocessor industry are moderate. Large companies, as a strategic initiative, are acquiring small companies to increase market share as well as acquire the latest innovative technologies in microprocessors, which may serve as a competitive edge over their competitors.

Government policies regarding intellectual property rights, export controls, and antitrust regulations significantly impact the industry's operations. Compliance with standards such as those set by organizations like IEEE and ANSI ensures interoperability and fosters global market access. Moreover, regulations related to cybersecurity and data privacy are increasingly important in the digital age, shaping product development and consumer trust.

The end-user concentration in the U.S. microprocessor industry is notable, with a select group of customers wielding substantial influence over market demand. These end-users typically include large corporations, government entities, and major technology firms that require significant volumes of microprocessors for their products and services. However, with the increasing adoption of IoT and smart homes, and smart wearables, the market is poised to witness a diverse array of companies/end-users in the coming years.

Architecture Type Insights

In terms of architecture type, there are four types of architecture-based microprocessors, namely ARM MPU, x64 MPU, x86 MPU, and MIPS. The ARM MPU segment is anticipated to witness the fastest CAGR of 8.8% over the projected period of 2024 to 2030. The ARM segment dominated the market in 2023 with the largest market share of over 49%. The increased utilization of ARM processors in smartphones and personal computers is driving this trend. ARM architecture presents several benefits, including streamlined design, energy efficiency, and manageable operation. Its exceptional energy efficiency makes it particularly suitable for portable and low-power embedded devices like notebooks and smartphones. Furthermore, ongoing advancements in ARM architecture have empowered these processors to deliver superior computing performance when compared to x86 processors.

The dominance of the combined x86 and x64 segments in the processor market is from their extensive usage across PC and server environments. The x64 processor represents an advancement in the x86 architecture, both adhering to the Complex Instruction Set Computing (CISC) model. Within the x86 and x64 landscape, x64 processors lead the market due to their superior memory and processing capabilities compared to their x86 counterparts. In addition, x64 processors handle dual instructions better in contrast to the 32-bit architecture of x86 processors, resulting in enhanced efficiency. They are widely applied in mobile processing, video game consoles, supercomputers, and virtualization technology. On the other hand, x86 processors find their niche in personal computers, gaming consoles, laptops, and high-performance workstations.

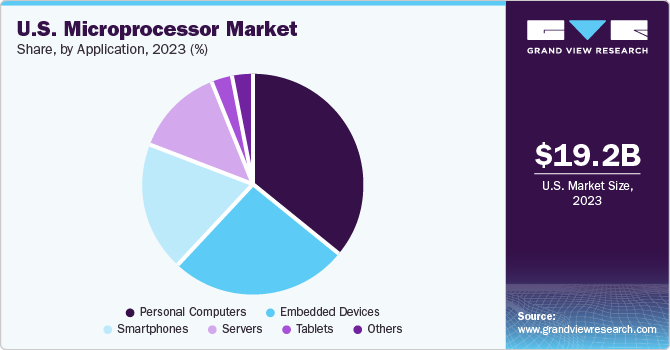

Application Insights

Based on application, the microprocessor market has been segmented into smartphones, personal computers, servers, tablets, embedded devices, and others. The personal computer (PC) segment held the largest market share of more than 35% in 2023. This large share is attributed to microprocessors as they provide several benefits, such as enhanced storage, upgraded volatile memory, expanded logical functionalities, increased capability for operating system tasks, and reduced power consumption, which contribute to their widespread adoption in personal computer applications. Furthermore, major companies in the market are consistently introducing innovative products featuring advanced technologies to secure significant market share in the PC segment, which is resulting in propelling the growth of the segment.

The smartphone segment is anticipated to witness the fastest CAGR of 9.0% over the projected period. This growth can be attributed to microprocessors as every smartphone is equipped with a microprocessor, which enables a broad spectrum of functionalities such as placing calls, sending texts, browsing the web, and running diverse applications. The integration of microprocessors in smartphones has significantly enhanced their power and capabilities. As microprocessor technology advances, smartphones evolve into more potent devices capable of handling increasingly intricate tasks. With the current technological scenario, key companies are always launching new smartphones with better capabilities and superior power. Hence, the demand for microprocessors is on the rise with the increasing adoption of smartphones.

Key Companies & Market Share Insights

Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, and Qualcomm are some of the key companies in the U.S., microprocessor industry.

-

Intel Corporation designs and manufactures technologies that power cloud, smart, connected, and computing devices. Its computing, networking, data storage, and communications platforms are used in a wide range of applications, such as medical devices, automated factory systems, automobiles, smartphones, tablets, data centers, and PCs. Its portfolio includes digital imaging products, server products, system management software, software development tools, network and communication products, graphics drivers, flash memory, microcontrollers, embedded processors, chipsets, and solid-state drives. The company also offers system-on-chip, microprocessor, and multichip packaging products.

-

Advanced Micro Devices, Inc. (AMD) provides various semiconductor products and devices. AMD’s microprocessors are incorporated into computing platforms and designed to provide a complete computing solution. These microprocessors and chipsets are based on the AMD Infinity Fabric and the x86 instruction set architecture, connecting an on-chip memory controller and I/O channels directly to microprocessor cores. AMD’s geographic footprint spans regions such as the Americas, Europe, Asia Pacific, and the MEA. The company’s product offerings comprise accelerated processing units (APU), graphics processing units (GPU), x86 microprocessors (CPU), semi-custom System-on-chip (SOC) products, and chipsets. AMD is focused on computing technology, software, and product leadership.

Rigetti Computing and Cerebras Systems are some of the emerging companies in the U.S. microprocessor industry.

-

Rigetti Computing, Inc. is a Berkeley, California-based developer of quantum integrated circuits used for quantum computers. The company operates quantum computers and serves global enterprise, government, and research clients through its Rigetti Quantum Cloud Services platform. The Company’s proprietary quantum-classical infrastructure provides high-performance integration with public and private clouds for practical quantum computing. It has developed a multi-chip quantum processor for scalable quantum computing systems. The Company designs and manufactures its chips in-house at Fab-1, an integrated quantum device manufacturing facility.

-

Cerebras Systems is a technology company known for its innovation in the field of artificial intelligence (AI) and deep learning. The company has developed an AI computer system called the Cerebras Wafer Scale Engine (WSE). This AI chip features a single, massive processor that covers an entire wafer, providing computational power for AI and machine learning tasks.

Key U.S. Microprocessor Companies:

- Advanced Micro Devices, Inc

- Intel Corporation

- Marvell Semiconductor Components Industries, LLC

- Toshiba Electronic Devices & Storage Corporation

- Texas Instruments Incorporated

- Microchip Technology Inc.

- Nvidia Corporation

- MediaTek Inc.

- Broadcom Inc.

- Qualcomm Technologies, Inc.

Recent Developments

-

In February 2024, Advanced Micro Devices (AMD) announced the launch of AMD Embedded+, a new architectural solution that combines AMD Ryzen™ Embedded processors with Versal™ adaptive SoCs onto a single integrated board to deliver scalable and power-efficient solutions that accelerate time-to-market for original design manufacturer (ODM) partners. Validated by AMD, the Embedded+ integrated compute platform enables ODM customers to reduce qualification and build times for faster time-to-market without expending additional hardware and R&D resources.

-

In January 2024, NVIDIA announced the GeForce RTX™ 40 SUPER Series family of GPUs - including the GeForce RTX 4080 SUPER, GeForce RTX 4070 Ti SUPER, and GeForce RTX 4070 SUPER - which supercharge the latest games and form the core of AI-powered PCs. This latest version of NVIDIA Ada Lovelace architecture-based GPUs can deliver up to 52 shader TFLOPS, 121 RT TFLOPS, and 836 AI TOPS to supercharge gaming and creating - and provide the power to develop new entertainment worlds and experiences.

-

In July 2023, Cerebras Systems, the pioneer in accelerating generative AI, and G42, the UAE-based technology holding group, announced Condor Galaxy, a network of nine interconnected supercomputers, offering a new approach to AI compute that potentially reduces AI model training time. The first AI supercomputer on this network, Condor Galaxy 1 (CG-1), has 4 exaFLOPs and 54 million cores. Cerebras and G42 plan to deploy two more AI supercomputers, CG-2 and CG-3, in the U.S. in 2024. With a projected capacity of 36 exaFLOPs in total, this supercomputing network will revolutionize the advancement of AI.

U.S. Microprocessor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.26 billion |

|

Revenue forecast in 2030 |

USD 30.67 billion |

|

Growth Rate |

CAGR of 8.1 % from 2024 to 2030 |

|

Market Demand in 2023 |

USD 205.5 million units |

|

Volume forecast in 2030 |

USD 302.7 million units |

|

Historic year |

2017 - 2022 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Architecture type. application |

|

Country scope |

U.S. |

|

Key companies profiled |

Advanced Micro Devices, Inc.; Intel Corporation; Marvell Semiconductor Components Industries, LLC; Toshiba Electronic Devices & Storage Corporation; Texas Instruments Incorporated; Microchip Technology Inc.; Nvidia Corporation; MediaTek Inc.; Broadcom Inc.; Qualcomm Technologies, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Microprocessor Market Report Segmentation

This report forecasts volume and revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. microprocessor market report based on architecture type and application:

-

Architecture Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

ARM MPU

-

By ARM Size

-

ARM 32-Bit

-

ARM 64-Bit

-

-

By End Use Industry

-

Consumer Electronics

-

Networking & Communication

-

Automotive

-

Industrial

-

Medical Systems

-

Aerospace & Defense

-

Energy

-

Oil & Gas

-

Others

-

-

Others

-

-

-

x64

-

x86

-

MIPS

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Personal Computers

-

Servers

-

Tablets

-

Embedded Devices

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. microprocessor market was estimated at USD 19.19 billion in 2023 and is expected to reach USD 19.26 billion in 2024.

b. The U.S. microprocessor market is expected to progress at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 30.67 billion in 2030.

b. The smartphones segment accounted for the largest revenue share of more than 45% in 2023 in the U.S. microprocessor market. It will maintain its dominance over the forecast period owing to enhanced storage, upgraded volatile memory, expanded logical functionalities, increased capability for operating system tasks, and reduced power consumption.

b. The key players operating in the U.S. microprocessor market include Intel Corporation, Advanced Micro Devices Inc., Nvidia Corporation, and Qualcomm, among others.

b. Key factors driving the U.S. microprocessor market include growing demand for microprocessors for use in embedded devices, consumer electronics, and automotive applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."