- Home

- »

- Biotechnology

- »

-

U.S. Microfluidics Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Microfluidics Market Size, Share & Trends Report]()

U.S. Microfluidics Market Size, Share & Trends Analysis Report By Product (Microfluidic-based Devices, Microfluidic Components), By Material Type (Silicon, Glass), By Technology, By Application Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-245-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Microfluidics Market Size & Trends

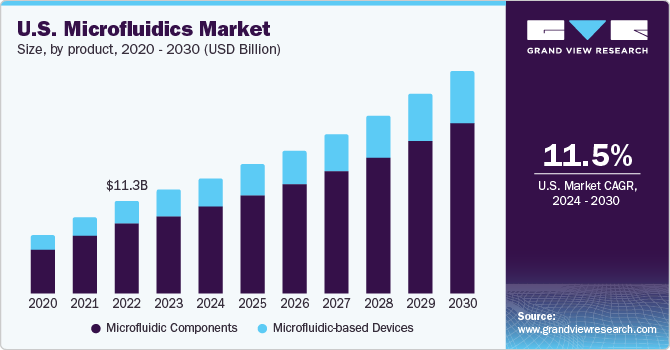

The U.S. microfluidics market size was estimated at USD 12.59 billion in 2023 and is expected to grow at a CAGR of 11.5% from 2024 to 2030. Microfluidics devices’ ability to analyze small sample volumes reduces reagent waste and preserves scarce samples, driving demand for these devices. Their increasing use in research and diagnostics has led to the development of advanced technologies. The transformation of microfluidics-based lab equipment into tools compatible with existing research workflows has expanded their applications in biomedical and pharmaceutical research, contributing to market growth.

U.S. accounted for over 39.2% of the global microfluidics market in 2023. The growing use of microfluidics devices in diverse research and diagnostic fields is anticipated to propel the market. For example, the past decade has seen an increase in microfluidic devices suitable for eye-related conditions. The evolution of microfluidics-based lab equipment into stronger tools compatible with established research workflows largely contributed to the expansion of applications of microfluidics technology across biomedical and pharmaceutical research. Microfluidics is expected to be used in biomedical applications. Professionals in this market perform micro-scale processes to ensure improved control, rapid results, and lower costs at various drug development stages.

The surge in COVID-19 cases has led to an increased demand for microfluidics tools. PCR-based, widely approved tests have become the go-to method for diagnosing COVID-19. In response to the pandemic, many manufacturers have launched new products and increased production to meet the rising demand for IVD tests. Integrating microfluidics with PCR can speed up the testing process, delivering results in less than 10 minutes with high precision. For instance, BeforCure, an Elvesys spin-off, has developed a rapid PCR-on-chip system for virus detection. Based on Fastgen technology, this product utilizes the benefits of microfluidics to provide test results in under 30 minutes.

Microfluidics devices offer a significant advantage in their capacity to analyze small sample volumes. This leads to less reagent waste and aids in conserving hard-to-produce samples. The advent of these devices has spurred demand for low-volume sample devices. An increase in research activities by analytical and clinical researchers has further fueled this demand. Traditional genome analysis methods involve decoding the entire DNA and are time-consuming and costly. Microfluidics devices, capable of analyzing small sample volumes, offer benefits like reduced reagent waste and sample conservation. Their advent has increased demand for low-volume sample analysis and boosted their use in research. These devices require minimal sample volumes for data interpretation, making them more efficient than traditional genome analysis methods. They’ve enabled the downsizing of lab procedures into lab-on-a-chip systems. The market has been stimulated by recent product launches, such as Biotech Fluidics’ low-volume online degassing modules launched in July 2023.

In the past decade, microfluidics devices for ophthalmological conditions have become more available. They’ve successfully measured glucose levels, identified infections, diagnosed dry eye disease, and evaluated vascular endothelium growth factor levels. Recent technologies have used contact lens technology for theranostic and diagnostic solutions. For instance, Guan’s team developed a contact lens-on-a-chip for precision medicine. These advancements include analyzing small-volume nasal secretions to investigate diseases.

In March 2021, a team from Loschmidt laboratories, in collaboration with ETH Zurich, created a microfluidic platform for quick and effective enzyme studies. This innovative platform is already being utilized to develop new thrombolytics for stroke treatment and research bioluminescent enzyme evolution. Furthermore, in November 2019, Panasonic Corporation and IMT co-developed a technology for mass-producing microfluidic devices using glass molding. This method, more cost-effective and precise than traditional glass etching techniques, is used to manufacture biological, environmental, and medical analysis and sensing devices. This is expected to contribute to market growth in the future.

Market Concentration & Characteristics

The U.S. microfluidics industry is leading toward fragmentation, offering opportunities for innovation and growth. This fragmentation allows diverse players to enter the industry, contributing to a dynamic landscape with various companies leading in different subsectors, such as optical semiconductors, ceramic capacitors, and regenerative medicine. Companies like Hamamatsu Photonics and Murata are industry leaders in their respective fields, showcasing the breadth of expertise within the industry.

The microfluidics industry demonstrates high innovation, with companies leveraging advanced technologies and capabilities to drive progress in medical technologies. Japanese companies like Olympus, Hitachi, and Terumo are globally competitive and leaders in their fields, highlighting the innovative nature of the industry. Researchers are developing integrated microfluidics devices for high-precision PCR, offering speed, parallelization, and sensitivity. In October 2022, Standard BioTools launched the X9 Real-Time PCR System, a high-capacity genomics platform using microfluidics. These devices can automate PCR reaction mix preparation, reducing the risk of false positives and contamination.

Mergers and acquisitions are prevalent in the microfluidics industry, with companies investing in regenerative medicine and other innovative sectors to drive growth and competitiveness globally. Over the past few years, major pharmaceutical and medtech companies have increasingly invested in regenerative medicine, signaling a trend toward strategic acquisitions and partnerships. In August 2022, HORIBA announced a partnership with SigTuple to expedite the rollout of its AI100, an AI-supported digital pathology solution, in the Indian subcontinent. SigTuple has amalgamated AI, robotics, microfluidics, and cloud computing to create intelligent diagnostic solutions, making quality healthcare delivery accessible and affordable.

Regulations on medical devices significantly impact microfluidics manufacturers, influencing product development timelines and industry entry strategies. The need for regulatory approvals and adherence to standards poses challenges but also ensures safety and quality in microfluidic medical devices. As microfluidics devices gain traction in research and diagnostics, industry leaders are introducing advanced technologies to capture industry share. Many such devices are under trial for commercialization. For instance, in January 2022, BIOLASE, Inc., and EdgeEndo received FDA clearance for the EdgePRO system, a laser-assisted microfluidic tool for root canal disinfection and cleaning. This system improves upon existing techniques without disrupting workflow or adding significant costs.

The industry is experiencing both product and service expansion. Companies are diversifying their offerings by entering new sectors like regenerative medicine and expanding their services to cater to evolving healthcare needs, such as decentralized healthcare delivery or medical robotics. Enhanced technologies have enabled industry participants to differentiate their products by incorporating minimally invasive features, precision, and rapidity. As a result, microfluidics has established a significant presence in the IVD industry. Furthermore, several industry participants, including Abbott, Roche, and Danaher, have integrated microfluidics technology into their existing diagnostic devices.

Companies in the microfluidics industry are expanding across different parts globally due to factors like government incentives, changing regulatory procedures, and demographic trends supporting healthcare innovation. For example, Japan's advanced industries are broadening their exposure to Medtech globally, showcasing a trend of international expansion among key players in the industry. In February 2023, NanoMake, a device based on microfluidics, was introduced to the industry by Amar Equipment, a company from India. This launch aimed to enhance preclinical studies for COVID-19 mRNA vaccines. Industry growth is anticipated to be driven by such product introductions.

Material Type Insights

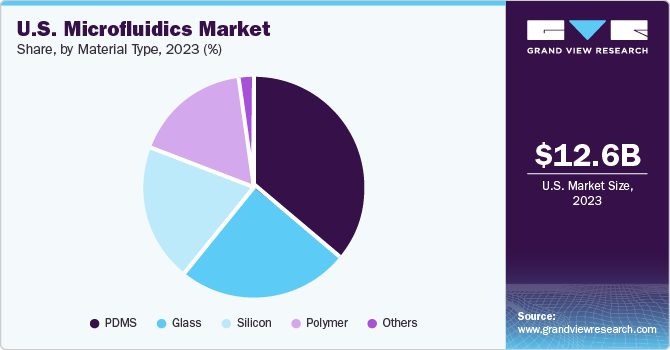

Polydimethylsiloxane (PDMS) dominated the market and held the highest revenue market share of 35.64% in 2023 and is expected to grow at the fastest CAGR during the forecast period. PDMS, a polymer extensively used in microfluidics, offers numerous benefits such as non-toxicity, durability, optical clarity, gas and oxygen permeability, biocompatibility, elasticity, affordability, and the ability to create intricate microfluidic device designs by layering multiple levels. The swift uptake of microfluidics-enabled LOC devices has opened numerous growth avenues for PDMS in experimental microfluidics. Given its biocompatibility, permeability, and minimal autofluorescence, PDMS is projected to see substantial use in various future biotechnology and biomedical engineering applications.

Glass has the second-highest market revenue share in 2023 and is expected to witness lucrative growth during the forecast period. Glass is a preferred material in microfluidics due to its optical transparency, chemical inertness, and biocompatibility, making it suitable for various applications in the field. In addition, Glass offers excellent properties for microfluidic devices, such as low autofluorescence levels and high thermal stability, which are crucial for maintaining the integrity of samples and ensuring accurate results in microfluidic systems. These characteristics make Glass a popular choice in the microfluidics industry, contributing to its significant market revenue share.

Product Insights

Microfluidic components dominated the market with the largest revenue share of 70.4% during 2023 and are expected to grow at the highest CAGR during the forecast period. Based on microfluidic components, the market is segmented into chips, micro-pumps, sensors, and other components used in microfluidic devices. These components are small and offer flexibility in applications. These components support numerous instruments and technological applications, such as automation, screening, analysis, and quantitative determination of biological elements like galactose. The market demand for microfluidic components is predicted to rise in response to the increasing need for analyzing low-volume samples and the ongoing development of advanced technologies in this field. Droplet microfluidics, for example, has emerged as a powerful tool that enables fast and cost-effective compartmentalization of cells and analytes under precisely controlled conditions. This technology is highly robust and can facilitate high-throughput screening, further driving growth in the market during the projected period.

Microfluidic-based devices are anticipated to grow quickly during the forecast period. These devices leverage the principles of microfluidics to analyze fluids at the microscale level. They offer various advantages for biological analysis. Devices based on microfluidics require low reagent volume and smaller samples. These items are generally difficult to isolate when used in bulk quantities and are expensive. Hence, microfluidic-based devices reduce the significant cost of the entire laboratory analytical process. In addition, these devices are smaller, which saves space and allows the simultaneous processing of multiple analytes. Such benefits associated with these systems are expected to drive the microfluidic-based devices market.

Technology Insights

Lab-on-a-chip dominated the market with the highest CAGR of 36.97% in 2023. This technology enables quick DNA probe sequencing and high-speed thermal shifts at the microscale for DNA amplification using PCR. Elveflow’s Fastgene system, the fastest qPCR system, can detect bacteria and viruses in just 7 minutes. Nanopore technologies promise faster genome sequencing of DNA probes than traditional lab-on-a-chip methods. They also offer the potential for quick immunoassays, which can be done in 10 seconds, significantly faster than macroscopic technologies. Lab-on-a-chip technology has shown potential in cell biology, particularly in regulating cells at the single-cell level while handling large volumes of cells quickly. Elveflow’s Opto Reader, a fast-optical detector, aids cell detection and isolation. The technology is also used in stem cell differentiation, micro patch-clamp, cell sorting, and high-speed flow cytometry. Thus, lab-on-a-chip technology holds great promise for ultra-fast detection of viruses and bacteria.

Organs-on-chips is anticipated to witness the fastest growth of CAGR of 14.7% from 2024 to 2030. They play a crucial role in the discovery and development of drugs. The National Center for Advancing Translational Science (NCATS), in collaboration with the FDA and other National Institute of Health (NIH) centers, has focused on drug discovery since 2012 through its Tissue Chip for Drug Screening initiative. This initiative involves creating human tissue chips that accurately represent human organs, aiming to bridge the gap between research discovery and clinical trials and focus on high-need cures. For example, in March 2022, NCATS collaborated with the U.S. The FDA and various NIH institutes are collaborating to create human tissue chips that closely resemble the structure and function of organs in the human body, including the heart, liver, and lungs. This effort aims to enhance the accuracy and speed of predicting human drug safety.

Application Insights

Medical dominated the market and held the highest revenue share of 81.63% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Microfluidics, a key technology in biological analysis, chemical synthesis, and IT, has revolutionized conventional lab equipment. It allows minimal reagent use, maximum information from small samples, simplified assay protocols, improved sample processing, and precise control of cell microenvironments. Its benefits extend to medical and pharmaceutical applications, including infectious disease diagnosis, cancer treatment, and the creation of functional tissues and organs. For instance, in August 2022, a team in Atlanta developed the Cluster-Well chip using microfluidics to detect and treat metastatic cancer swiftly. In addition, the ability to automate the preparation of PCR reaction mix is a feature of microfluidic PCR devices. This automation significantly reduces the chances of false positives and contamination due to human error.

Non-medical segment is expected to grow lucratively during the forecast period. Microfluidics is used for crude oil extraction, plant pathogen detection, and gas bubble production in non-medical fields. It’s ideal for developing methods to extract crude oil from pollutant-mixed porous rocks due to its ability to handle complex interactions between pore structure and fluids. Gas bubbles, particularly micron-scale ones, are widely used in various industries, including food for fat reduction, texture tailoring, and other industries for producing active ingredients, mesoporous materials, and natural gas recovery. Generating micron-scale gas bubbles in the microfluidic industry offers new opportunities for highly controlled fluid compartmentalization.

Key U.S. Microfluidics Company Insights

The U.S. microfluidics market is characterized by intense competition. Companies are employing various strategic measures such as partnerships, expansion of products and services, mergers and acquisitions, and investment in research and development to gain a competitive edge through advanced applications. For instance, SCHOTT AG entered a purchase agreement in September 2019 to acquire the microfluidic company MINIFAB Pty Ltd. This move was anticipated to enable both partners to enhance their product offerings in the diagnostics market significantly. Similarly, Standard BioTools, Inc. introduced the X9 Real-time PCR system in October 2022. This genomics instrument, based on a microfluidics platform, provides high efficiency and data output in a single run, thereby expected to enrich the company’s product portfolio.

Key U.S. Microfluidics Companies:

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Abbott

- Thermo Fisher Scientific

- Standard BioTools

Recent Developments

-

In March 2024, Bio-Rad Laboratories received approval from AOAC International for its dd-Check STEC Solution. This solution, the first of its kind to use the Droplet Digital PCR Method, is designed to detect and confirm the presence of virulence genes from Shiga toxin-producing Escherichia coli (STEC) in raw beef trim, fresh spinach, and carcass sampling cloths. The approval indicates that the dd-Check STEC Solution is aligned with the standard reference method for confirming STEC.

-

In January 2024, Standard BioTools Inc. (Nasdaq: LAB), a company committed to propelling advancements in human health, declared the completion of its merger with SomaLogic. This merger has resulted in forming a leading entity in the field of research, providing unique multi-omics tools.

-

In March 2023, PerkinElmer Inc. announced the successful completion of the divestiture of its Applied, Food, and Enterprise Services businesses. New Mountain Capital, a firm focused on growth-oriented investments, acquired these businesses.

-

In August 2022, Thermo Fisher Scientific, a global pioneer in scientific services, unveiled its Applied Biosystems HIV-1 Genotyping Kit with Integrase. This kit, intended solely for research purposes, scrutinizes samples testing positive for the human immunodeficiency virus (HIV). Its primary function is to detect genetic variations that exhibit resistance to standard antiretroviral treatments.

U.S. Microfluidics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 26.94 billion

Growth rate

CAGR of 11.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, material type, technology

Country scope

U.S.

Key companies profiled

Illumina, Inc.; F. Hoffmann-La Roche Ltd; PerkinElmer, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Abbott; Thermo Fisher Scientific; Standard BioTools

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Microfluidics Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. microfluidics market based on product, application, material type, and technology:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Microfluidic-based Devices

-

Microfluidic Components

-

Chips

-

Micro-pumps

-

Sensors

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical

-

Pharmaceuticals

-

Medical Devices

-

In-vitro Diagnostics

-

Others

-

-

Non-medical

-

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicon

-

Glass

-

Polymer

-

PDMS

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Lab-on-a-chip

-

Organs-on-chips

-

Continuous Flow Microfluidics

-

Optofluidics And Microfluidics

-

Acoustofluidics And Microfluidics

-

Electrophoresis And Microfluidics

-

Frequently Asked Questions About This Report

b. U.S. microfluidics market size was estimated at USD 12.59 billion in 2023.

b. U.S. microfluidics market is expected to grow at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2030 to reach USD 126.94 billion by 2030.

b. Lab-on-a-chip dominated the market with the highest CAGR of 36.97% in 2023. This technology enables quick DNA probe sequencing and high-speed thermal shifts at the microscale for DNA amplification using PCR.

b. Some prominent players in the U.S. microfluidics market include Illumina, Inc.; F. Hoffmann-La Roche Ltd; PerkinElmer, Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Abbott; Thermo Fisher Scientific; Standard BioTools

b. Microfluidics devices’ ability to analyze small sample volumes reduces reagent waste and preserves scarce samples, driving demand for these devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."