U.S. Microcontroller Market Size, Share & Trends Analysis Report By Product (8-bit, 16-bit, 32-bit), By Type (Peripheral Interface Controller (PIC), ARM, 8051, TriCore, Others), By Architecture, By Instruction Set, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-275-0

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

U.S. Microcontroller Market Size & Trends

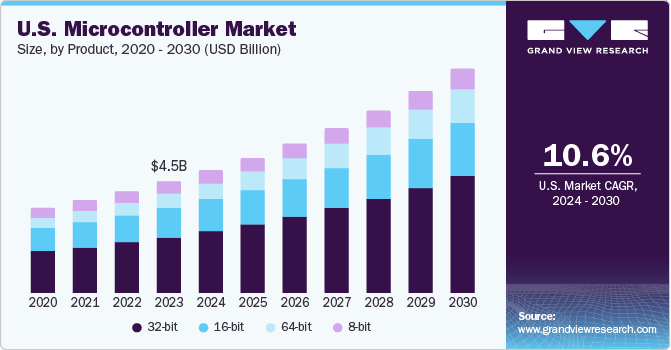

The U.S. microcontroller market size was estimated at USD 4.508.6 million in 2023 and is projected to grow at a CAGR of 10.6% from 2024 to 2030. The increasing adoption of microcontroller units (MCUs) in smart meters and the growing demand for MCUs in automotive and medical applications are some of the key factors driving the growth of the market. Microcontrollers find numerous applications in automotive, industrial electronics, telecommunications, healthcare, and consumer electronics, among other industries and industry verticals thereby fueling market growth.

In 2023, the U.S. accounted for approximately 13.93% share of the global microcontroller market. The growing demand for Internet of Things (IoT) MCUs has been the latest highlight of the market. The growing web of connected devices encompasses smartphones, televisions, tablets, home appliances, gaming consoles, smart meters, and security systems. By leveraging this ever-increasing Web of Things, the market for IoT MCUs is growing rapidly. Many connected devices that operate on batteries for months and years without the need for battery replacement or maintenance require energy-efficient IoT end-node applications. IoT applications need ultra-low-power architecture, in addition to high processing power. Thus, the buyers and integrators of IoT applications are opting for 32-bit microcontrollers owing to their high RAM sizes and better performance. As a result, the market for MCUs is expected to witness steady growth over the forecast period.

Medical device manufacturers are introducing affordable and reliable medical equipment in the market. Microcontrollers are crucial components used in all kinds of medical care devices to achieve higher reliability and affordability. Devices such as blood glucose meters and blood pressure monitors incorporate a significant number of microcontrollers (MCUs). Thus, there is substantial demand for MCUs from the medical industry. In addition, hybrid electric vehicles require microcontrollers in higher numbers compared to conventional vehicles. The growing awareness of resource efficiency resulted in the rising adoption of electric and hybrid vehicles. Furthermore, the players from the automotive industry are making huge investments in research and development related to fuel and energy conservation technologies such as auto stop-start, new transmission options, braking energy recapture, and cylinder deactivation. All these technologies require numerous electronic components, including microcontrollers, to function. Thus, the demand for microcontrollers is steadily increasing in the automotive industry.

The challenges associated with operational failure in extreme climatic conditions harm the microcontroller market. Microcontrollers are widely used in various industries, including automotive, aerospace, defense, and industrial automation, where they are often required to operate in harsh environmental conditions. However, extreme climatic conditions, such as high temperatures, humidity, and corrosive environments, can cause operational failure in microcontrollers, resulting in a decline in demand for these devices. For example, in the aerospace and defense industries, microcontrollers are used in critical applications such as flight control systems, guidance systems, and communication systems. Hence, failure of these devices due to extreme climatic conditions can result in catastrophic consequences, including loss of life and property.

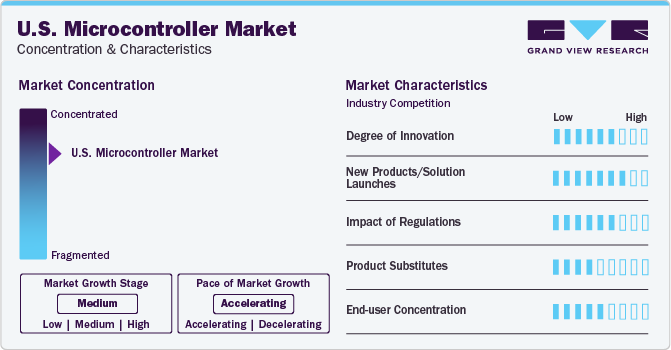

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is consolidated, with the top players capturing a significant market share. The major manufacturers in the microcontroller market are designing innovative products and are consistently investing in Research and Development (R&D) to provide breakthrough solutions.

Microcontroller miniaturization is enabling system designers to expand the use cases of MCUs to include new, emerging applications. Features such as wireless communications and advanced security are being embedded in MCUs, simplifying design complexities and reducing device size and power consumption. This trend is particularly crucial for IoT devices, where space and power efficiency are paramount. For instance, Texas Instruments’ SimpleLink MCUs exemplify this integration by offering wireless connectivity and advanced security features. In addition, MCUs with advanced security features are becoming standard in 2024. These include hardware-based encryption, secure boot processes, and integrated threat detection capabilities. Such advanced features are especially useful in applications involving sensitive data like financial transactions or personal health information. Microchip’s SAM L10 and SAM L11 MCU families prioritize advanced security, ensuring secure microcontroller solutions.

Regulatory bodies enforce safety standards for electronic devices, including microcontrollers. Compliance with these standards ensures that microcontrollers meet safety requirements, especially in applications like home appliances. For instance, UL 1998 standard in the U.S. define safety requirements for home appliances. The Advanced Semiconductors Rule, the Semiconductor Manufacturing Equipment Rule was introduced, which focuses on controlling semiconductor manufacturing equipment essential for producing ICs used in advanced weapons systems. Regulations specify restrictions based on the intended use of microcontrollers. For instance, microcontrollers used in sensitive applications like defense or nuclear technology may face stricter controls.

When considering alternatives to traditional microcontrollers, several options exist such as FPGAs, Arduino boards, Raspberry Pi Pico, BeagleBone Black, etc. While these alternatives offer flexibility and unique features, they may not match the specialized capabilities, efficiency, and reliability of dedicated microcontrollers in certain scenarios. For instance, unlike traditional microcontrollers, the Pico lacks built-in peripherals like analog-to-digital converters (ADCs) or digital-to-analog converters (DACs). The Pico’s versatility comes with added complexity. It requires more development effort compared to straightforward microcontrollers. Arduino alternatives often have less processing power than dedicated microcontrollers. This can impact performance in complex applications.

Microcontrollers are used for numerous applications, including consumer electronics, automotive, embedded systems, and medical devices, among others. As microcontrollers become more powerful and capable, buyers are increasingly looking for devices that consume low power and offer advanced features such as high-speed communication, advanced signal processing, and sophisticated security features.

Product Insights

In terms of product, the market is classified into 8-Bit, 16-Bit, 32-Bit, and 64-bit segments. Among these, the 32-Bit microcontroller market dominated the market in 2023, gaining a market share of 50.02%. A 32-bit microcontroller is a type of embedded SoC with a CPU capable of handling 32 bits of data at a time. The demand for 32-bit microcontrollers is on the rise due to their enhanced processing power, expansive memory, advanced connectivity options, and reliability. These features make them a compelling choice for a wide range of complex applications across various industries, including those requiring real-time control, high-resolution analog data processing, and sophisticated graphical user interfaces.

The 64-Bit segment is anticipated to grow at the fastest CAGR of 13.3% over the forecast period. This growth is due to 64-bit microcontrollers being the most powerful microcontrollers that can handle data and instruction in 64- bit chunks. This enables them to handle more data compared to the other three types of microcontrollers. A 64-bit microcontroller can perform numerous operations every second and can be deployed for intense data processing. It helps handle heavy and complex data applications as they can fetch, move, and process larger chunks of data in a short time.

Type Insights

In terms of type, the microcontroller market is classified into Peripheral Interface Controller (PIC), ARM, 8051, TriCore, and Others segments. The ARM segment dominated the market in 2023 with a revenue share of 45.1%. It is also anticipated to grow at the fastest CAGR of 11.7% over the forecast period. The growing innovations and the rising penetration of smartphones and wearables are driving the segment growth. Advanced RISC Machine (ARM) microcontrollers are built on Reduced Instruction Set Computer (RISC). ARM microcontrollers are generally available in 32-bit and 64-bit variants and are used widely in various consumer electronic devices, such as tablets, smartphones, wearables, and multimedia players. They perform fewer instructions, enabling them to operate at high speed and perform a Million Instructions Per Second (MIPS).

The TriCore segment is anticipated to grow at a considerable CAGR of 11.4% over the forecast period. TriCore is a 32-bit microcontroller family launched by Infineon Technologies AG, a Germany-based company, in 1999. This family of microcontrollers is designed for real-time embedded systems. TriCore microcontrollers can be used in various automotive applications, such as hybrid and electrical vehicles, airbags, electric powering systems, and advanced driver assistance systems. The growing advancements in Autonomous Vehicles (AVs) and the rising adoption of Electric Vehicles (EVs) are driving the segment growth. With the growing penetration of EVs, the TriCore microcontroller segment is expected to witness significant growth.

Architecture Insights

In terms of architecture, the microcontroller market is classified into Harvard architecture, Von Neumann architecture, and others segments. The Von Neumann architecture segment dominated the market in 2023, with a revenue share of 40.1%. The affordability and simplicity of the Von Neumann architecture are driving the segment growth. The design and development of the Von Neumann architecture is simpler compared to Harvard architecture. Moreover, less physical space is required and it is cheaper compared to Harvard architecture.

The Harvard architecture segment is anticipated to grow at the fastest CAGR of 11.2% over the forecast period. Harvard architectures offer superior performance and minimize the risk of data corruption. As application complexity and data utilization increase, the adoption of Harvard architecture is expected to grow significantly. Its suitability for critical real-time applications and the impressive performance of Harvard-architecture-based microcontrollers are key drivers for this segment’s growth.

Instruction Set Insights

In terms of instruction set, the microcontroller market is classified into Reduced Instruction Set Computer (RISC) and Complex Instruction Set Computer (CISC) segments. The Reduced Instruction Set Computer (RISC) segment dominated the industry in 2023 with a revenue share of 71.2%. It is also anticipated to grow at the fastest CAGR of 10.7% over the forecast period. A Reduced Instruction Set Computer (RISC) architecture in a microcontroller employs streamlined yet highly optimized instruction sets. RISC architecture finds application in high-end application such as image and video processing, as well as telecommunications. Prominent microcontroller families utilizing RISC architecture include ARM and TriCore. The simplicity of RISC instructions, coupled with uniform instruction lengths, contributes to reduced execution time.

The Complex Instruction Set Computer (CISC) segment is anticipated to grow at a considerable CAGR of 10.2% over the forecast period. Complex Instruction Set Computer (CISC) instruction set architecture is used in various applications, such as home automation and security systems. The CISC instruction set uses the memory efficiently. The demand for smart home automation is steadily increasing as people prefer more convenience in their homes. CISC instruction set is often used in automation devices; hence, with the growing adoption of smart home automation devices, CISC instruction set-based microcontrollers are likely to witness significant growth over the forecast period.

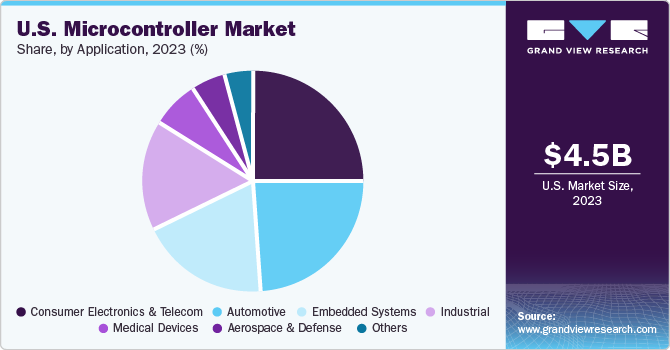

Application Insights

In terms of application, the market is classified into consumer electronics & telecom, automotive, medical devices, industrial, aerospace & defense, and others segments. The consumer electronics & telecom segment dominated the overall market in 2023 with a market share of 25.5%. Microcontrollers are employed in consumer electronics and telecom applications owing to their capability to process data, regulate functions, and interact with other devices. They are used to handle user inputs, interact with other devices, and control a variety of operations in smart home appliances such as smart locks, smart thermostats, and smart lighting systems. In wearable gadgets such as smartwatches and fitness trackers, microcontrollers are employed to keep track of sensors, process data, and interact with smartphones and other gadgets. Moreover, in telecom infrastructure such as cell towers and base stations, microcontrollers are used to process and manage network traffic, regulate power usage, and carry out real-time monitoring and diagnostics.

Embedded systems are gaining prominence in diverse sectors, including consumer electronics, automotive, and industrial control systems. As industries embrace digitization and automation, the need for embedded system development solutions-both hardware and software-is expected to surge. However, creating a microcontroller-based embedded system can be complex. Developers must carefully weigh factors like microcontroller selection and system architecture development.

Embedded system development tools, encompassing both hardware and software, empower developers to design and create embedded systems. Addressing challenges like power efficiency, system updates, and seamless integration is crucial. Furthermore, the design must prioritize safety and prevent unintended actions. Consequently, the imperative to enhance user safety and optimize embedded system development costs propels the growth of the microcontroller embedded systems market.

The medical devices segment is anticipated to witness the fastest growth, growing at a CAGR of 12.3% throughout the forecast period. Medical devices widely use microcontrollers to provide advanced features and capabilities. These devices are used in various medical applications, from patient monitoring and diagnostics to drug delivery and surgical tools. One of the primary applications of microcontrollers in medical devices is patient monitoring systems. Microcontrollers can collect and analyze data from sensors and other medical equipment, providing doctors and nurses with real-time information on patient health and wellbeing. CT scanners and MRI machines rely on microcontrollers to control the movement of motors and other actuators, enabling them to capture high-quality images of the body. These several medical applications are anticipated to fuel the growth of this segment.

Key U.S. Microcontroller Company Insights

Some key companies in the U.S. include Microchip Technology Inc., Intel Inc., Zilog Inc., and Texas Instruments Incorporated, among others.

-

Microchip Technology Inc. is a manufacturer of microcontrollers, memory, and analog semiconductors. The company operates through two business segments, namely semiconductor products and technology licensing. Its product offerings include PIC microcontrollers, amplifiers, motor drivers, converters, regulators, controllers, PMICs, power modules, high-speed networking solutions, security ICs, and display & LED drivers. Moreover, it provides design support and training services to its customers. It offers 8-, 16-, and 32-bit microcontrollers as well as 32-bit microprocessors. Microchip Technology Inc. offers its services to industries such as automotive, aerospace, battery management, embedded security, home appliance, power monitoring, wireless connectivity, medical, and smartphone accessories.

-

Texas Instruments Incorporated is a U.S.-based company that designs and manufactures semiconductors for electronic manufacturers and designers across the world. The company operates through two business segments, namely analog and embedded processing. Its product offerings include analog products, embedded processors, and Digital Light Processing (DLP) products. Through the embedded processing business segment, the company offers connected microcontrollers and processors. Connected microcontrollers include microcontrollers, microcontrollers with integrated wireless capabilities, and stand-alone wireless connectivity solutions. The company offers its services to industries and sectors such as automotive, communication equipment, industrial, enterprise system, and personal electronics.

Broadcom and Qualcomm Technologies are some of the emerging companies in the U.S. microcontroller industry.

-

Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated, is a leading American multinational corporation headquartered in San Diego, California. With a rich history in wireless technology, Qualcomm creates semiconductors, software, and services that drive connectivity and intelligence across a wide range of devices.

-

Broadcom Inc is a technology firm that specializes in developing and delivering a variety of semiconductor and infrastructure software solutions. The company's offerings include products for data center, networking, broadband, enterprise software, wireless, storage, and industrial applications. Its solutions cover data center networking and storage, cybersecurity software, automation, monitoring, security, smartphone components, and factory automation.

Key U.S. Microcontroller Companies:

- Infineon Technologies AG

- Qualcomm Technologies

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics

- Analog Devices

- Texas Instruments Incorporated

- Zilog, Inc.

- Broadcom

Recent Developments

-

In March 2024, Renesas Electronics Corporation, a premier supplier of advanced semiconductor solutions, announced the industry’s first general-purpose 32-bit RISC-V-based microcontrollers (MCUs) built with an internally developed CPU core. While many MCU providers have recently joined investment alliances to advance the development of RISC-V products, Renesas has already designed and tested a new RISC-V core independently, which is now implemented in a commercial product and available globally. The new, R9A02G021 group of MCUs provides embedded systems designers a clear path to developing a wide range of power-conscious, cost-sensitive applications based on the open-source instruction set architecture (ISA).

-

In January 2024, Texas Instruments (TI) introduced new semiconductors designed to improve automotive safety and intelligence. The AWR2544 77GHz millimeter-wave radar sensor chip is the industry's first for satellite radar architectures, enabling higher levels of autonomy by improving sensor fusion and decision-making in ADAS. TI's new software-programmable driver chips, the DRV3946-Q1 integrated contactor driver and DRV3901-Q1 integrated squib driver for pyro fuses, offer built-in diagnostics and support functional safety for battery management and powertrain systems.

-

In February 2023, Microchip Technology Inc. a leading provider of smart, connected and secure embedded control solutions, announced plans to invest $880M to expand its silicon carbide (SiC) and silicon (Si) production capacity at its Colorado Springs, Colo. manufacturing facility over the next several years.

U.S. Microcontroller Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4961.5 million |

|

Revenue forecast in 2030 |

USD 9071.2 million |

|

Growth Rate |

CAGR of 10.6% from 2024 to 2030 |

|

Historic year |

2017 - 2023 |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million units, revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, architecture, instruction set, application |

|

Country scope |

U.S. |

|

Key companies profiled |

Infineon Technologies AG; Qualcomm Technologies; Microchip Technology Inc.; NXP Semiconductors; Renesas Electronics Corporation; STMicroelectronics; Analog Devices; Texas Instruments Incorporated; Zilog, Inc.; Broadcom |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Microcontroller Market Report Segmentation

This report forecasts revenue & volume growth at a country level and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. Microcontroller market report based on product, type, architecture, instruction set and application.

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

8-bit

-

16-bit

-

32-bit

- 64-bit

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Peripheral Interface Controller (PIC)

-

ARM

-

8051

-

TriCore

-

Others

-

-

Architecture Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Harvard Architecture

-

Von Neumann Architecture

-

Others

-

Instruction Set Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Reduced Instruction Set Computer (RISC)

-

Complex Instruction Set Computer (CISC)

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Consumer Electronics & Telecom

-

Industrial

-

Embedded Systems Medical Devices

-

Hardware

-

Software/Embedded Development Tools

-

-

Medical Devices

-

Aerospace & Defense

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. microcontroller market size was estimated at USD 4.508.6 million in 2023 and is expected to reach USD 4961.5 million in 2024.

b. The U.S. microcontroller market is expected to grow at a compound annual growth rate of 10.6% from 2024 to 2030 to reach USD 9071.2 million by 2030.

b. The consumer electronics & telecom segment dominated the U.S. microcontroller market with a share of over 25% in 2023.

b. Some key players operating in the U.S. microcontroller market include Microchip Technology Inc., Intel Inc., Zilog Inc., and Texas Instruments Incorporated, among others.

b. Key factors driving the market growth include the increasing adoption of microcontroller units (MCUs) in smart meters and the growing demand for MCUs in automotive and medical applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."