- Home

- »

- Sensors & Controls

- »

-

U.S. Micro LED Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Micro LED Market Size, Share & Trends Report]()

U.S. Micro LED Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Display Lighting), By Display Pixel Density (Less Than 3000ppi, 3000ppi to 5000ppi), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-292-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Micro LED Market Size & Trends

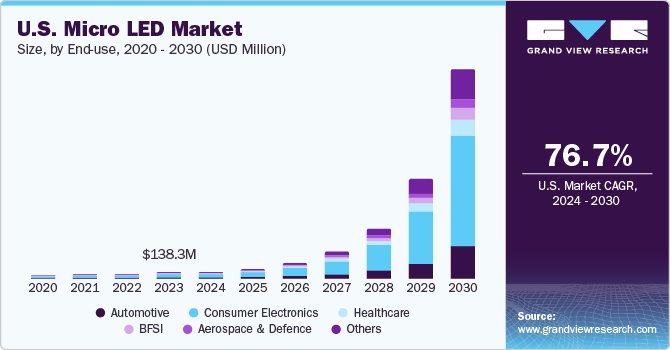

The U.S. micro LED market size was estimated at USD 138.25 million in 2023 and is projected to grow at a CAGR of 76.7% from 2024 to 2030. The rising demand for high-quality displays, increasing investments in research and development, and the advancements in manufacturing processes drive the market. Micro LEDs are a cutting-edge display technology that offers high brightness, low power consumption, and superior image quality.

Micro light-emitting diodes (micro-LEDs) are an innovative emissive display technology that offers significant advantages over organic LEDs and liquid-crystal displays. These benefits include higher brightness, more accurate color reproduction, smaller minimum pixel size, and longer lifespan. Micro LEDs' small size, with single-micrometer-emitter sizes and pixel pitches, permits the development of innovative display applications like near-to-eye technologies and pico-projectors. As a result, micro LED displays have the potential to transform the visual display industry, opening new possibilities for high-quality, low-energy-consumption displays in various applications.

There has been a growing trend among consumers to seek out displays that offer superior image quality, high brightness, and low power consumption. Micro LEDs have emerged as a technology that meets these demands, prompting manufacturers and technology companies to invest heavily in developing and producing micro LED displays. This emphasis on innovation is driven by a need to remain competitive in the market and adapt to evolving consumer preferences.

Furthermore, virtual reality (VR) has emerged as a rapidly expanding industry, encompassing various gaming, entertainment, education, and healthcare sectors. The immersive nature of VR experiences necessitates displays that can deliver exceptional image quality while being close to the eyes, high brightness, and low power consumption, characteristics that micro LED technology excels in providing. As the demand for immersive VR experiences continues to rise, there is a growing need for displays that can offer enhanced visual quality, reduced motion blur, and increased pixel density to create more realistic and engaging virtual environments. Micro LEDs are well-suited for meeting these requirements due to their ability to deliver vibrant colors, high contrast ratios, and fast response times, making them an ideal choice for VR applications where visual fidelity and responsiveness are paramount. The rising demand for VR solutions is expected to boost the need for micro LEDs in the market. According to the National Research Group, 13% of U.S. households owned a VR headset in 2022, of which 68% owned a single headset, 23% owned two, and 10% owned three or more. 60% of the owners use it every week.

In addition, the advent of High Dynamic Range (HDR) technology has been complemented by the development of micro LED displays, which offer a wide range of brightness levels and enhance the ability of screens to reproduce features in both bright and dark environments. The dynamic HDR capabilities of these displays have led to an immersive viewing experience, especially in HDR-enabled content, thereby driving the market's growth. Integrating micro LED displays with smart technologies such as gesture control, virtual and augmented reality (AR), biometric recognition systems, and real-time data processing aligns with the Industry 4.0 model, emphasizing automation, connectivity, and data exchange. Incorporating innovative features in micro LED displays enables real-time monitoring, control, and decision-making processes in manufacturing and industrial settings.

Market Concentration & Characteristics

The market is concentrated as major technology companies increasingly integrate micro LED displays into smartphones, smartwatches, tablets, and laptops. The market growth stage is high, and the pace is accelerating. The market is characterized by a high degree of innovation, driven by continuous technological advancements and research in micro LED technology.

Companies invest heavily in R&D to enhance display performance, improve manufacturing processes, and develop new micro LED applications. This culture of innovation fosters competition and drives the development of cutting-edge products with superior image quality, brightness, and energy efficiency, positioning the U.S. market at the forefront of micro LED technology globally.

Product substitutes are another factor influencing the market, with competing technologies such as Organic Light-Emitting Diode (OLED) displays and traditional Liquid Crystal Display (LCD) screens posing alternatives to micro LED technology. While micro LEDs offer advantages in terms of brightness, energy efficiency, and longevity, other display technologies like OLEDs are also evolving rapidly and offering competitive features such as flexibility, thinness, and color vibrancy. The presence of viable substitutes creates a dynamic competitive landscape that drives innovation, differentiation, and ongoing improvements in micro LED products to maintain market relevance and competitiveness.

Application Insights

Based on the application, the market is bifurcated in display and lighting. The display segment led the market with a share of over 80% in 2023. The growing trend towards miniaturization and lightweight design in consumer electronics drives the demand for smaller, more power-efficient display solutions. Micro LEDs offer a compelling advantage due to their small form factor, high pixel density, and low power consumption, making them an ideal choice for portable devices where space and energy efficiency are critical.

The lighting segment is anticipated to grow at a significant CAGR over the forecast period, owing to the increasing demand for energy-efficient lighting solutions that offer superior performance and longevity. Micro LEDs are known for their high efficiency, long lifespan, and ability to produce bright and uniform light, making them an attractive choice for various lighting applications ranging from residential and commercial lighting to automotive and horticulture lighting. Moreover, the growing focus on sustainability and environmental consciousness promotes the demand for micro LEDs. As governments and organizations worldwide emphasize the importance of reducing energy consumption and carbon footprint, a rising demand for eco-friendly lighting solutions can help achieve energy efficiency goals. Micro LEDs, with their low power consumption, high efficiency, and recyclability, are well-positioned to meet these sustainability requirements and drive the adoption of energy-efficient lighting solutions.

Display Pixel Density Insights

Based on display pixel density, the greater than 5000ppi segment held the largest revenue share in 2023 due to increasing demand for displays with exceptional clarity, sharpness, and detail in applications such as VR, AR, medical imaging, microscopy, and high-end displays. Consumers and industries are seeking displays that can deliver lifelike images, fine details, and immersive visual experiences, all of which can be achieved with ultra-high-resolution micro LED displays. Industries such as medical imaging, scientific research, aerospace, defense, and high-end entertainment increasingly turn to ultra-high-resolution displays to visualize complex data, perform intricate tasks, and deliver immersive experiences that demand exceptional visual fidelity.

The 3000ppi to 5000ppi segment is expected to grow significantly over the forecast period. Technological advancements in micro LED manufacturing processes are a crucial driver for this market segment. Improved epitaxial growth techniques, precise transfer methods, and advanced lithography processes enable manufacturers to produce displays with higher pixel densities and smaller pixel sizes in this range.

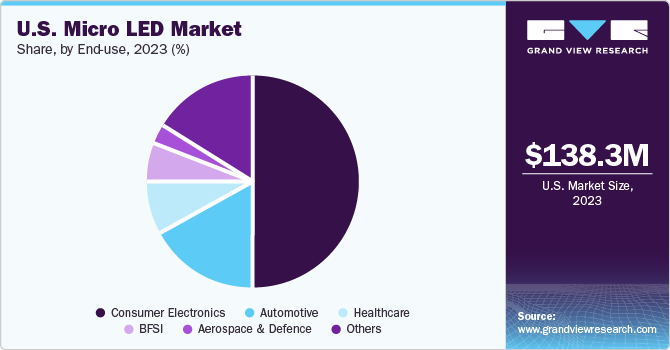

End-use Insights

Based on end-use, the consumer electronics segment led the market with the largest revenue share in 2023. Micro LEDs are widely recognized for their exceptional durability and reliability, which make them an ideal choice for consumer electronics that require long-term performance without any degradation in display quality. This factor has been instrumental in the extensive adoption of Micro LEDs in products such as smartwatches and automotive displays. In addition, Micro LEDs offer remarkable customization and flexibility regarding display resolution, shape, and size. This versatility allows manufacturers to create innovative products with distinctive form factors and unique features to cater to diverse consumer preferences.

The healthcare segment is expected to grow rapidly during the forecast period. Micro LEDs are critical components in precision medicine and diagnostics, as they enable advanced imaging techniques, including endoscopy, microscopy, and fluorescence imaging, which drive the market. Their high brightness and color accuracy enhance the quality of medical imaging and lead to more accurate diagnoses and treatments. In addition, micro LEDs are increasingly being employed in therapeutic applications in healthcare, such as phototherapy for skin conditions, optogenetics for neural stimulation, and light-based treatments for various medical conditions. The precise control over light intensity and wavelength micro LEDs offer makes them invaluable tools for therapeutic interventions.

Key U.S. Micro LED Company Insights

Some of the key players operating in the market include Nanosys, eLux, Inc., Alphabet, Inc., Plessey Semiconductors, VerLase Technologies,

-

Nanosys is a leading provider of quantum dot technology for displays, offering innovative solutions that enhance the performance and efficiency of display technologies. The company has been at the forefront of developing micro LED technology, considered the next-generation display technology due to its high brightness, energy efficiency, and color accuracy. One of Nanosys’ key offerings in the micro LED space is its Quantum Dot Enhancement Film (QDEF), designed to work with micro LEDs to deliver vibrant colors and high brightness.

-

eLux is a company that specializes in micro LED technology, offering cutting-edge solutions for various applications. Micro LEDs are display technology that uses tiny light-emitting diodes to create high-resolution and energy-efficient displays. Elux has been at the forefront of developing and commercializing micro LED products, catering to consumer electronics, automotive, signage, and more industries.

Key U.S. Micro LED Companies:

- eLux, Inc.

- Shoei Electronic Materials, Inc. (Nanosys)

- VerLase Technologies

- Alphabet, Inc.

- Lumiode

- Plessey Semiconductors

- VueReal

Recent Developments

-

In May 2023, Apple plans to produce its microLED displays to reduce reliance on Samsung and gain more control over supply. Apple has spent around USD 1 billion on microLED R&D in the past decade. The company plans to fabricate microLED chips on wafers and partner with ams-Osram, LG Display, and TSMC for components, substrates, and wafers. The technology is anticipated to be seen in the Apple Watch Ultra before being made into iPhones.

-

In July 2022, Nanosys, a pioneer in Quantum Dot and MicroLED technology, secured over USD 50 million in Series B equity & debt financing. The investment, led by Fortress, Centerbridge, and Kilonova, will be used to expand their development of innovative technologies such as quantum dots, micro LEDs, and nano LEDs. The funding will also support the continued expansion of xQDEF and QDEF quantum dot technologies for LCDs.

-

In May 2022, Google completed the acquisition of Raxium, a startup based on MicroLED technology that is expected to be used to build a new generation of virtual, augmented, and mixed-reality headsets. This acquisition aligns with Google's move toward its next AR innovation. In addition, Raxium is working on "monolithic integration" for MicroLEDs, which could potentially drive the price down significantly for the solutions.

U.S. Micro LED Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 182.11 million

Revenue forecast in 2030

USD 5,544.16 million

Growth rate

CAGR of 76.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, display pixel density, end-use

Key companies profiled

eLux, Inc.; Shoei Electronic Materials, Inc. (Nanosys); VerLase Technologies; Alphabet, Inc.; Lumiode; Plessey Semiconductors; VueReal

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Micro LED Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this report, Grand View Research has segmented the U.S. micro LED market research report based on application, display pixel density, and end-use:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Display

-

Television

-

AR & VR

-

Automotive

-

Smartwatch

-

Smartphone, Tablets, and Laptops

-

-

Lighting

-

General Lighting

-

Automotive Lighting

-

-

-

Display Pixel Density Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 3000ppi

-

3000ppi to 5000ppi

-

Greater than 5000ppi

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

BFSI

-

Aerospace & Defence

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. micro LED market size was estimated at USD 138.25 million in 2023 and is expected to reach USD 182.11 million in 2024

b. The U.S. micro LED market is expected to grow at a compound annual growth rate of 76.7% from 2024 to 2030 to reach USD 5,544.16 million by 2030

b. The display segment dominated the market with a share of over 80% in 2023, owing to the growing trend towards miniaturization and lightweight design in consumer electronics drives the demand for smaller, more power-efficient display solutions

b. Some key players operating in the U.S. micro LED market include eLux, Inc.; Shoei Electronic Materials, Inc. (Nanosys); VerLase Technologies; Alphabet, Inc.; Lumiode; Plessey Semiconductors; VueReal

b. Factors such as the rising demand for high-quality displays, increasing investments in research and development, and advancements in manufacturing processes drive the U.S. micro LED market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.