- Home

- »

- Advanced Interior Materials

- »

-

U.S. And Mexico Stainless Steel Market Size, Report, 2030GVR Report cover

![U.S. And Mexico Stainless Steel Market Size, Share & Trends Report]()

U.S. And Mexico Stainless Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Grade (300 Series, Duplex Series), By Product (Flat, Long), By Application (Consumer Goods), By Country, And Segment Forecasts

- Report ID: GVR-4-68038-860-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. & Mexico Stainless Steel Market Trends

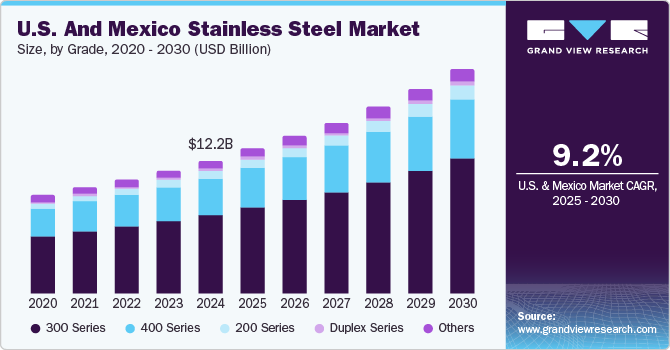

The U.S. and Mexico stainless steel market size was valued at USD 12.22 billion in 2024 and is expected to register a CAGR of 9.2% from 2025 to 2030. This growth is attributed to the increasing industrial activities, particularly in sectors like automotive and construction, which are elevating the demand for stainless steel due to its durability and corrosion resistance. In addition, rising urbanization necessitates more infrastructure development, further boosting the need for stainless steel in construction projects. Moreover, integrating stainless steel into green industries, such as renewable energy and electric vehicles, presents significant market opportunities as both countries focus on sustainability and innovation.

Stainless steel, defined as a corrosion-resistant alloy primarily composed of iron and at least 10.5% chromium, is renowned for its strength, durability, and aesthetic appeal. The rising industrial activities in Mexico are significantly fueling the demand for stainless steel. Various sectors, including automotive, construction, manufacturing, and energy, have experienced substantial industrial growth in recent years. This trend has made stainless steel the material of choice due to its exceptional properties, such as corrosion resistance and reliability.

Moreover, ongoing urbanization and infrastructure development drive this demand in countries such as the U.S. and Mexico. As urban areas expand, there is an increasing need for both residential and commercial construction projects. Stainless steel has gained popularity in architectural applications due to its durability and resistance to harsh environmental conditions.

Furthermore, integrating stainless steel into green industries offers promising market opportunities. Its application in electric vehicle production and sustainable infrastructure positions it as a vital material in these emerging sectors. U.S. and Mexico's investments in renewable energy sources like wind and solar power highlight stainless steel's suitability for components exposed to extreme weather conditions. For example, wind turbine structures benefit from stainless steel's high mechanical strength and corrosion resistance, ensuring their reliability in challenging environments. As both countries continue to evolve economically, stainless steel's versatility underscores its importance in meeting modern industrial demands while supporting sustainability initiatives.

Grade Insights

300 series grade dominated the market and accounted for the largest revenue share of 59.1% in 2024. This growth is attributed to its exceptional corrosion resistance and mechanical properties. This series, particularly known for its high chromium and nickel content, is extensively used in the automotive, construction, and chemical processing industries. In addition, the increasing demand for durable materials that can withstand harsh environments propels the 300 series' popularity. Furthermore, its aesthetic appeal makes it a preferred choice for architectural applications, aligning with the ongoing urbanization and infrastructure development trends across both countries.

The duplex series grade is expected to grow at a CAGR of 13.3% over the forecast period, owing to its unique strength and corrosion resistance combination. This grade is particularly advantageous in applications with high strength and excellent resistance to stress corrosion cracking are required. In addition, the growing focus on sustainable practices in industries such as oil and gas, marine, and chemical processing drives demand for duplex stainless steel, which offers superior performance in challenging environments. Furthermore, the increasing investments in renewable energy projects further enhance the appeal of duplex stainless steel, making it a vital material for components exposed to severe conditions.

Product Insights

The flat product segment led the market and accounted for the largest revenue share of 70.8% in 2024, driven by the rising demand from the construction and automotive industries. As urbanization accelerates, there is a significant need for durable materials in building infrastructure, including residential and commercial structures. In addition, flat products like sheets and plates are essential for various applications, including roofing and structural support. Furthermore, government investments in infrastructure projects further boost the demand for flat stainless steel products, making them a fundamental component of modern construction practices.

The long product segment is expected to grow at a CAGR of 8.2% over the forecast period, owing to its extensive use in construction and heavy industries. Long products, which include bars, rods, and beams, are crucial for structural applications in buildings, bridges, and other infrastructure projects. Furthermore, the increasing focus on enhancing infrastructure in both the U.S. and Mexico drives the demand for these materials. Moreover, the automotive sector's reliance on long stainless steel products for manufacturing components contributes to this growth. As industries continue to evolve and expand, the long-product segment remains vital in meeting the structural demands of various applications across both countries.

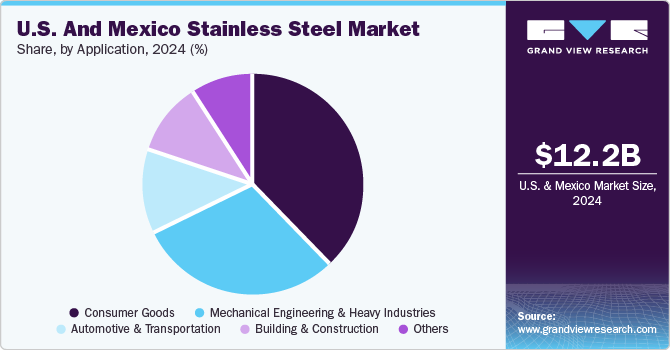

Application Insights

The consumer goods applications held the dominant position in the market, with the largest revenue share of 37.9% in 2024. This growth is attributed to the increasing consumer demand for durable and aesthetically pleasing products. Stainless steel's corrosion resistance and hygienic properties make it ideal for kitchenware, appliances, and various household items. Furthermore, consumers increasingly opt for high-quality stainless steel products, such as cookware, cutlery, and home appliances, as disposable income rises. Moreover, the trend towards sustainable living and recycling further boosts the appeal of stainless steel, reinforcing its position in the consumer goods market.

The building & construction segment is expected to grow at a CAGR of 9.4% from 2025 to 2030, driven by rapid urbanization and significant infrastructure development in both the U.S. and Mexico. In addition, as governments invest in modernizing infrastructure, the demand for stainless steel in construction projects increases due to its strength, durability, and resistance to corrosion. Furthermore, the ongoing focus on sustainable construction practices also drives using recyclable stainless steel, contributing to energy-efficient building designs.

Country Insights

U.S. Stainless Steel Market Trends

The stainless steel market in the U.S. held the dominant position and accounted for the largest revenue share of 75.0% in 2024, driven by significant investments in infrastructure and construction. In addition, the government's focus on modernizing infrastructure has led to increased demand for stainless steel in various applications such as bridges, buildings, and transportation systems. Furthermore, the automotive and aerospace industries are expanding, further boosting the need for high-quality stainless steel due to its lightweight and corrosion-resistant properties. This combination of factors positions the U.S. stainless steel market for steady growth.

Mexico Stainless Steel Market Trends

Mexico stainless steel market is expected to grow at a CAGR of 8.5% over the forecast period, owing to rising industrial activities across multiple sectors, including automotive, construction, and manufacturing. The expansion of these industries has heightened the demand for durable materials like stainless steel, known for its exceptional strength and corrosion resistance. Furthermore, urbanization and infrastructure development are significant contributors to this growth, as there is an increasing need for residential and commercial structures. Moreover, government initiatives to support local manufacturers also play a crucial role in enhancing market dynamics, ensuring a robust outlook for stainless steel in Mexico.

Key U.S. And Mexico Stainless Steel Company Insights

Some of the key players in the market include ATI, POSCO, Outokumpu, and others. The industry players compete on the basis of price and quality of the product offered. Companies are devising strategies to enhance their capacity through merger & acquisition. For instance, in 2018, Outokumpu acquired Fagersta wire rod mill in Sweden. The acquisition was made to enhance technological capabilities to produce stainless steel wire rods. Some of the prominent players in the U.S. & Mexico stainless steel market include:

-

Aperam manufactures various stainless steel solutions, including coils, sheets, tubes, and precision strips, catering to various sectors such as automotive, construction, energy, and food processing. The company operates in the stainless steel segment with a strong focus on sustainability and innovation, leveraging its advanced production capabilities to meet the diverse needs of its customer base.

Key U.S. And Mexico Stainless Steel Companies:

- ATI

- POSCO

- Outokumpu

- Aperam Stainless

- North American Stainless (NAS)

- Continental Steel & Tube Company

- Universal Stainless

- Plymouth Tube Company USA

- Electralloy

- AK Steel International BV

- ArcelorMittal

Recent Developments

-

In February 2024, Acerinox, announced its agreement to acquire Haynes International, a U.S. manufacturer of advanced alloys. This acquisition, unanimously approved by both companies' boards, aims to enhance Acerinox's capabilities in the aerospace sector and expand its U.S. market presence.

-

In January 2023, North American Stainless (NAS) announced a significant USD 244 million expansion of its Ghent, Kentucky facility.

U.S. And Mexico Stainless Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.32 billion

Revenue forecast in 2030

USD 20.63 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, product, application.

Country scope

U.S.; Mexico

Key companies profiled

ATI; POSCO; Outokumpu; North American Stainless (NAS); Aperam Stainless; Continental Steel & Tube Company; Universal Stainless; Plymouth Tube Company USA; Electralloy; AK Steel International BV; ArcelorMittal.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Mexico Stainless Steel Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. and Mexico stainless steel market report based on grade, product, and application.

-

Grade Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

300 series

-

400 series

-

200 series

-

Duplex series

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flat Products

-

Long Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Consumer Goods

-

Mechanical Engineering & Heavy Industries

-

Automotive & Transportation

-

Building & Construction

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.