- Home

- »

- Biotechnology

- »

-

U.S. Metagenomics Market Size, Industry Report, 2030GVR Report cover

![U.S. Metagenomics Market Size, Share & Trends Report]()

U.S. Metagenomics Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Shotgun Sequencing, Whole Genome Sequencing), By Product, By Workflow, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-293-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Metagenomics Market Size & Trends

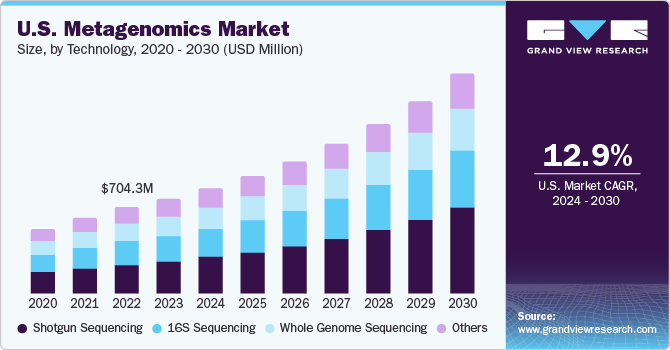

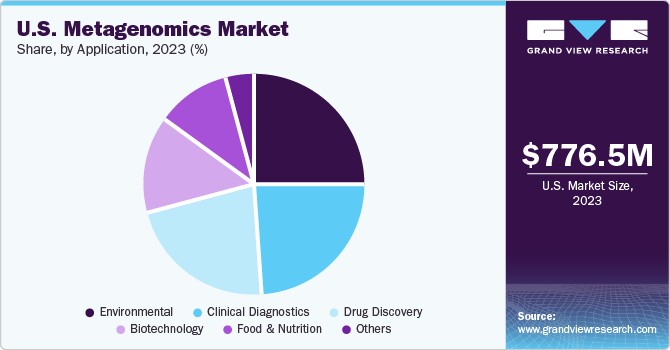

The U.S. metagenomics market size was valued at USD 776.5 million in 2023 and is projected to grow at a CAGR of 12.99% over the forecast period of 2024 to 2030. This can be attributed to the extensive genomics, oncology, and whole-genome sequencing research. Other factors contributing to adoption of metagenomics technology in U.S. are superior infrastructure for medical and research, generous funding, presence of companies striving for newer technologies for diagnosis and therapies, and skilled and efficient personnel.

U.S. metagenomics market accounted for 38.3% of the global metagenomics market in 2023. The presence of prominent companies, such as Life Technologies, Roche, and Illumina, which significantly contribute to development of rapid and high-throughput sequencing capabilities, has widely promoted market growth. These players are undertaking several strategic initiatives to strengthen their market presence such as R&D activities. For instance, in November 2023, researchers at the University of Cambridge's Milner Therapeutics Institute (MTI) announced studies on functional genomics to explore the role of genetic alterations in the onset & advancement of diseases, aiming to enhance therapies and diagnostics.

Recent technological advancements have significantly contributed to cost-cutting of genome sequencing which has resulted in a notable rise in the prevalence of metagenomic studies, particularly in clinical applications for sequence analysis. Anticipated advancements in DNA technologies & bioinformatics, specifically those streamlining RNA-Seq processes, are poised to contribute further to cost reduction in metagenomics while concurrently improving the accuracy of analysis. As the cost of sequencing continues to decrease, adoption of metagenomics research is rising.

Furthermore, there is a growing trend in microbiome analysis using 16S Ribosomal RNA (rRNA) gene amplicons and shotgun metagenomics. This integrated approach enhances the understanding of microbial communities and their functions. The initiation of high-throughput comparative metagenomics, facilitated by the development of Next-generation Sequencing (NGS) platforms, has triggered a surge in research efforts. These endeavors have significantly advanced our comprehension of the composition & functions of bacterial populations across diverse environments, showcasing the transformative impact of metagenomics in various research domains. Such factors are significantly contributing to market growth.

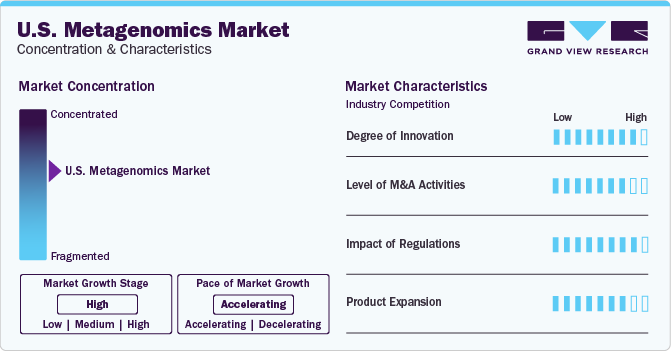

Market Concentration & Characteristics

The industry is projected to expand during the forecast period owing to increasing demand for high-throughput genomics analysis techniques and the increasing adoption of metagenomics for personalized medicine. The metagenomics market is marked by intense competition, with notable companies like Illumina and Thermo Fisher Scientific, Inc. offering a diverse array of solutions.

-

Technological advancements in sequencing technologies, such as the increasing incorporation of automation & software support in research workflows, are boosting the market growth. Several product launches and expansions are also boosting industry growth. For instance, in June 2023, Illumina, Inc. launched its novel PrimateAI-3D, an innovative AI software capable of precisely forecasting genetic mutations responsible for diseases in individuals. This development has increased the demand for metagenomics as a tool for comprehending genetic compositions.

-

Partnerships, acquisitions, and mergers were the most adopted strategies by prominent companies. Several leading companies are acquiring smaller companies to strengthen their market positions which promotes an increase in capabilities, expand product portfolios, and improve competencies. For instance, in August 2023, PacBio announced the acquisition of Apton Biosystems. This acquisition is anticipated to accelerate the development of Short-read Sequencers, propelling the growth of sequencing.

-

In the U.S., it is necessary to receive accreditation from clinical laboratory to be obtained by the CMS with CLIA certification in compliance to conduct genetic & diagnostic tests, such as the New York State Department of Health and College of American Pathologists. However, the presence of government initiatives promoting the usage of advanced technologies in life sciences research is expected to positively impact the industry growth.

Product Insights

The kits & reagents segment held the largest share of over 61.50% in 2023. These are designed for specific applications, such as soil, water, and biological sample analysis, and are widely adopted for screening bacteria, viruses, pathogens, fungi, and microeukaryotic species as per the requirement of the study. Introduction of novel kits for library preparation, Polymerase Chain Reaction (PCR) assays, and other assays is expected to boost the growth.

The sequencing & data analytics services segment is expected to show lucrative growth during the forecast period owing to the increased sequencing adoption leading to increased data analysis platform demands. Furthermore, partnerships and collaborations among companies to enhance services such as launch of new platforms, upgrading existing technology & databases to increase knowledge base, and development of novel algorithms & tools for data analysis are expected to accelerate the segment growth.

Technology Insights

The shotgun sequencing segment held the largest share of over 30.04% in 2023 owing to its widespread applications in genomics research, clinical diagnostics, and various industries such as environmental monitoring & conservation industry and agriculture & crop improvement industry. Furthermore, with continued technological advancements companies are also focusing on reducing costs, enhancing data analysis capabilities, and promoting standardization.

The 16S sequencing segment is expected to register a considerable CAGR during the forecast period. The growing interest in understanding the human microbiome and microbial communities in diverse environments has driven the demand for techniques like 16S sequencing and metagenomics. Furthermore, advancements in high-throughput technologies and data science make simultaneous leveraging of these data types increasingly feasible. These factors are anticipated to propel segment growth over the forecast period.

Workflow Insights

The sequencing segment held the largest share of over 53.35% in 2023 owing to platforms such as shotgun sequencing, 16S & ITS ribosomal RNA (rRNA) sequencing kits, and Ion 16S metagenomics kits which are widely used platforms for metagenomics. Technological advancements have lowered the sequencing cost by 28% yearly which has also contributed to the segment’s growth majorly.

The pre-sequencing segment is expected to register a considerable CAGR during the forecast period. This includes sample purification, sample amplification, and library preparation. The process includes the preparation of a template library through fragmentation, DNA tagging, and library enrichment, using microarray & targeted hybridization or RNA library enrichment. All the established companies, such as Illumina, Thermo Fisher Scientific, & Illumina, offer products and solutions for metagenomics workflow and are expected to witness a high demand.

Application Insights

The environmental segment held the largest share of over 25.0% in 2023. Genetic study of microbial communities from environmental samples introduced an entirely new branch of genomics-environmental metagenomics. This segment includes kits & reagents specifically engineered for sample collection, DNA purification, sample enrichment, library preparation, and verification. Moreover, environmental metagenomics analysis is used to study ecological remediation, agricultural microbiome analysis, oceanic oil spills, or other biological investigations.

The clinical diagnostics segment is expected to show lucrative growth during the forecast period. Metagenomics in clinical diagnostics uses advanced genomic technologies to analyze the genetic material of microbial communities in clinical samples. This approach revolutionizes pathogen detection by offering a comprehensive view of diverse pathogens, including bacteria, viruses, fungi, and parasites, overcoming the limitations of traditional diagnostic methods. This is projected to boost the segment growth.

Key U.S. Metagenomics Company Insights

Some prominent U.S. metagenomics market companies include Bio-Rad Laboratories; Illumina, Inc.; PerkinElmer, Inc.; Thermo Fisher Scientific, Inc.; Novogene Co. Ltd.; Promega Corporation; QIAGEN; and Takara Bio, Inc. These companies have high brand recognition, established distribution networks, and extensive product portfolios, further intensifying the rivalry.

Several companies are undertaking strategic initiatives, such as market expansions, acquisitions, and mergers, which are anticipated to fuel market growth over the forecast period. They are also investing in the development of new technologies and products in this field. Numerous companies have extended sequencing programs for efficient monitoring of mutation to support the development of effective vaccines for various diseases.

Key U.S. Metagenomics Companies:

- Bio-Rad Laboratories, Inc

- Illumina, Inc.

- PerkinElmer, Inc.

- Thermo Fisher Scientific, Inc.

- Novogene Co., Ltd.

- Promega Corporation

- QIAGEN

- Takara Bio, Inc.

- Oxford Nanopore Technologies

- F. Hoffmann-La Roche Ltd.

Recent Developments

-

In November 2023, Pacific Biosciences announced the launch of Kinnex RNA kits, an upgraded assortment of assays designed for RNA sequencing that includes kits for full-length bulk RNA-seq, single-cell RNA-seq, and 16s ribosomal RNA-seq

-

In March 2023, Illumina launched its first-of-its-kind product, Illumina Complete Long Read technology. The technology enables short-read and long-read in a single instrument

-

In January 2023, Qaigen Digital Insights launched its NGS analyzing software, which assists in processing the whole genome at a cloud computing cost of USD 1

-

In January 2023, QIAGEN and Helix made a partnership announcement, intending to develop NGS companion diagnostics for various hereditary diseases

U.S. Metagenomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 776.5 million

Revenue forecast in 2030

USD 1.79 billion

Growth rate

CAGR of 12.99% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, workflow, application

Country scope

U.S.

Key companies profiled

Bio-Rad Laboratories, Inc., Illumina, Inc., PerkinElmer, Inc., Thermo Fisher Scientific, Inc., Novogene Co., Ltd., Promega Corporation, QIAGEN, Takara Bio, Inc., Oxford Nanopore Technologies, F. Hoffmann-La Roche Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Metagenomics Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. metagenomics market report based on product, technology, workflow, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits & Reagents

-

Sequencing & Data Analytics Services

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Shotgun Sequencing

-

16S Sequencing

-

Whole Genome Sequencing

-

Others

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-sequencing

-

Sequencing

-

Data Analysis

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Environmental

-

Clinical Diagnostics

-

Drug Discovery

-

Biotechnology

-

Food & nutrition

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. metagenomics market size was estimated at USD 776.5 million in 2023 and is expected to reach USD 860.9 million in 2024.

b. The U.S. metagenomics market is expected to grow at a compound annual growth rate of 12.99% from 2024 to 2030 to reach USD 1.79 billion by 2030.

b. The kits & reagents segment dominated the U.S. metagenomics market with a share of 61.50% in 2023. This is attributed to a substantial number of kits and reagents being launched and used to support the rising demand for library preparation workflows from research laboratories.

b. Some key players operating in the U.S. metagenomics market include Bio-Rad Laboratories, Inc., Illumina, Inc., PerkinElmer, Inc., Thermo Fisher Scientific, Inc., Novogene Co., Ltd., Promega Corporation, QIAGEN, Takara Bio, Inc., Oxford Nanopore Technologies, F. Hoffmann-La Roche Ltd

b. Key factors that are driving the market growth include increasing interest of researchers in metatranscriptomics, metaproteomics, & metabolomics; and rapid advancements in genomic technologies & ancillary protocols.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.