- Home

- »

- Healthcare IT

- »

-

U.S. Medical Writing Market Size, Industry Report, 2030GVR Report cover

![U.S. Medical Writing Market Size, Share & Trends Report]()

U.S. Medical Writing Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Clinical Writing, Regulatory Writing), By Application (Medical Journalism, Medico Marketing), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-276-0

- Number of Report Pages: 78

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Medical Writing Market Size & Trends

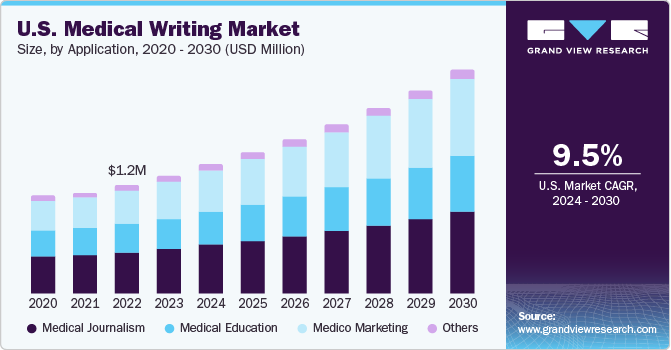

The U.S. medical writing market size was valued at USD 1.33 billion in 2023 and is estimated to expand at a CAGR of 9.47% from 2024 to 2030. Increase in R&D spending, robust pipeline for drug production, expiring patents and draft- preparation for new patents, & outsourcing non-core activities are some of the key driving factors for the market growth.

U.S. accounted for over 32.0% of the global medical writing market in 2023. This market is witnessing a high number of clinical trials and approval of new drugs. Adverse events regarding the post marketing of medical devices were also observed in the region, followed by the implementation of an action plan by concerned regulatory agencies. Moreover, regulatory agencies have made it mandatory for manufacturers to publicly declare clinical information during drug submissions and medical device applications to increase awareness about drug and device-induced adverse events.

With the increase in research activities and related costs, companies face difficulties in adhering to complex regulatory requirements across the globe. These factors increase the need for excellence and expertise in different areas to manage product life cycles, driving the growth of outsourcing services, including medical writing services. Drug & medical device manufacturers are outsourcing clinical trials as well as production processes. Hence, the demand for medical writing services is expected to grow at a significant rate over the forecast period.

A high number of clinical studies being carried out increases the demand for medical writers and is expected to drive the U.S. medical writing market during the forecast period. For instance, in February 2020, there were about 330,113 clinical studies registered on clinical trial databases, out of which 111,640 were registered in the U.S. There are professional organizations set up for medical writers. For instance, in the U.S., the American Medical Writers Association (AMWA) acts as a platform for editors, writers, and other communicators of medical information.

Market Characteristics & Concentration

Medical writers with domain expertise are required for scientific documentation. The increasing demand for medical writers has resulted in a lot of individuals opting for medical writing as a career. However, it has been observed that a lack of subject matter expertise is affecting the quality of work. Thus, the recruitment of professionals with domain knowledge along with writing skills is necessary to enhance the quality of documents.

R&D activities provide market players with a competitive edge. Top pharmaceutical, medical devices, and biotechnology companies spend a large share of their revenues on R&D activities to maintain their position in the market by introducing innovative products. For instance, Roche, Novartis, and Merck invest around 20%, 18%, and 17% of their annual revenues in R&D, respectively.

An increase in mergers & acquisitions, along with partnerships & collaborations are shaping the way research studies are being performed. Some of the pharmaceutical companies are opting for outsourcing the drug development process to CROs. Strategic alliances between large pharmaceutical companies and CROs can be beneficial for businesses and may result in increased process documentation.

The FDA and Clinical Data Interchange Standards Consortium (CDISC) work together to ensure regulatory reviewers can receive/send, review, and process regulatory submissions more effectively. The U.S. FDA provides guidelines and updates for the preparation and submission of regulatory documents. Medical writers are expected to meet regulatory requirements and adhere to guidelines, including International Conference on Harmonisation (ICH) Good Clinical Practice (GCP) guidelines.

Type Insights

Clinical writing segment held the largest revenue share of 40.0% in 2023 owing to Clinical Research Organizations (CROs) establishing medical writing as a feasible extension to their current service portfolio due to their access to a sizable amount of clinical trial data. The target audience for medical writing mainly includes healthcare professionals who are already familiar with the style of medical writing.

The regulatory writing segment is expected to witness the fastest CAGR over the forecast period. Regulatory writing is used throughout the process of product development for clinical documentation. Some of the regulatory documents include investigator brochures, study protocols, and common technical documents. The audience for regulatory writing is usually ethics committees and regulatory authorities.

Application Insights

Medical journalism segment held the largest revenue share of 38.0% in 2023. Medical journalism is mainly concerned with investigating, reporting, and communicating medical issues to a wide audience. Rapid advancements in the field of medicine and the growing importance of medical information have increased the need for medical writers who are capable of comprehending and communicating medical information through their writing.

The medico marketing segment is expected to witness the fastest CAGR over the forecast period. Medico marketing involves the development of advertising and promotional content, training manuals, product monographs, and web content for public. Pharmaceutical and biotechnology companies rely on medical writers for content creation to handle marketing tasks. Medico-marketing writing involves designing marketing content for drugs and other products. Ever changing product mix in the pharmaceutical & biotechnology industry acts as a driving factor for improved marketing practices.

End-use Insights

The CROs & others segment held the largest revenue share of 68.0% in 2023. CROs have a separate service section for medical writing. Increasing biotechnology investments, mergers & collaborations, and new product development are shaping the way research studies are being performed. Some of the pharmaceutical companies are opting for outsourcing the drug development process to CROs.

The medical segment is expected to witness a considerable CAGR over the forecast period. Medical device, pharmaceutical, and biotechnology companies hire medical writers or medical journalists frequently. Established pharmaceutical companies have separate departments for medical writing purposes. In addition, various companies outsource medical writing services. Highly skilled medical writers are involved in handling additional responsibilities such as clinical trial designs, data analysis, product launches, and post-launch strategies.

Key U.S. Medical Writing Company Insights

Some of the major companies in the U.S. medical writing market are IQVIA; Parexel International Corp.; Trilogy Writing & Consulting GmBH; Covance, Inc.; OMICS International; and Freyr Solutions. Top pharmaceutical, medical devices, and biotechnology companies spend a huge share of their revenues on R&D activities to maintain their position in the market by introducing innovative products in the market.

R&D activities provide market players with a competitive edge in the market over other firms. The merger between Quintiles and IMS Health was the biggest in the CRO industry. The strategic alliances between large pharma companies and CROs have become an ongoing trend.

Key U.S. Medical Writing Companies:

- Parexel International Corporation

- Trilogy Writing & Consulting GmBH

- Freyr

- Cactus Communications

- Labcorp Drug Development

- IQVIA Holdings Inc.

- Omics International

- Synchrogenix

- Siro Clinpharm Private Limited

- Quanticate

- Inclin, Inc.

Recent Developments

-

In February 2024, Intellia Therapeutics collaborated with ReCode Therapeutics to develop and extend the reach of Novel Gene Editing Therapies to disease-causing targets in the lung

-

In September 2023, Tessaera Therapeutics announced key advancements across its gene writing and delivery platforms such as data demonstrating the potential of gene writers to write therapeutic messages in the genome of non-human primates

-

In March 2023, Nuance Communications from Microsoft announced the launch of DAX Express which is an AI-powered application designed to help doctors reduce their administrative workload. It is a fully automated workflow-integrated app that combines conversational and ambient AI with OpenAI's advanced GPT-4 model and is aimed at simplifying the note-taking process

U.S. Medical Writing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.45 billion

Revenue forecast in 2030

USD 2.50 billion

Growth rate

CAGR of 9.47% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use

Country scope

U.S.

Key companies profiled

Parexel International Corporation; Trilogy Writing & Consulting GmBH; Freyr; Cactus Communications; Labcorp Drug Development; IQVIA Holdings Inc.; Omics International; Synchrogenix ; Siro Clinpharm Private Limited ; Quanticate ; Inclin, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Medical Writing Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical writing market report based on type, application, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Writing

-

Regulatory Writing

-

Scientific Writing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Journalism

-

Medical Education

-

Medico Marketing

-

Others

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device/Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations & Others

-

Frequently Asked Questions About This Report

b. The U.S. medical writing market size was estimated at USD 1.33 billion in 2023 and is expected to reach USD 1.45 billion in 2024.

b. The U.S. medical writing market is expected to grow at a compound annual growth rate of 9.59% from 2024 to 2030 to reach USD 2.50 billion by 2030.

b. The clinical writing segment dominated the U.S. medical writing market with a share of 39.95% in 2023. Clinical writing is used by health professionals on a regular basis and a clinical writer must have a thorough knowledge of the clinical language as well as culture.

b. Some key players operating in the U.S. medical writing market include IQVIA; Parexel International Corp.; Trilogy Writing & Consulting GmBH; Labcorp Drug Development; OMICS International; Synchrogenix; Siro Clinpharm Private Limited; Quanticate; Inclin, Inc.; and Freyr.

b. Key factors that are driving the U.S. medical writing market growth include high demand for medical writing services can be attributed to a rise in CRO outsourcing, increased R&D investments by market players, favorable environment for clinical trials in developing regions, new medical device regulations, and increasing penetration of internet and social media.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.