- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Medical Tubing Market Size And Share, Report, 2030GVR Report cover

![U.S. Medical Tubing Market Size, Share & Trends Report]()

U.S. Medical Tubing Market Size, Share & Trends Analysis Report By Product (Silicone, Polyolefins, Polyimide, Polycarbonates), By Application (Bulk Disposable Tubing, Catheters, Drug Delivery Systems), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-205-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Medical Tubing Market Size & Trends

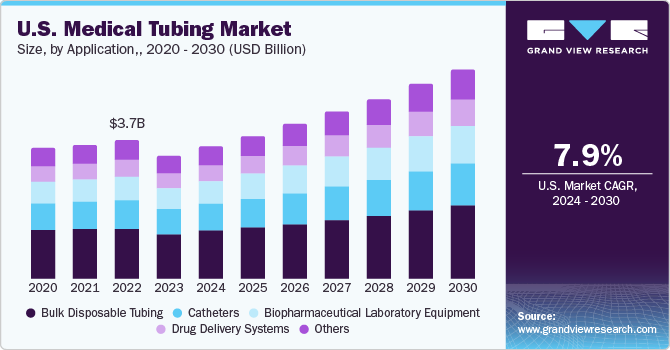

The U.S. medical tubing market size was estimated at USD 3.34 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030. The market is primarily driven by the rising geriatric population and hospitalizations in the U.S. Medical tubes are required to have superior physical properties such as opacity, versatility, and static resistance. Clear tubing is essential for fluid delivery applications as it enables easy tracking of fluid movement and helps eliminate the possibility of potential air bubbles. Plastic is a key raw material used in the manufacturing of medical tubes, such as conduits for collecting biopsy samples, stent holders, and vascular catheters.

Recent technological advancements have optimized the manufacturing processes, thus driving the market growth. Braided tubing, tapered tubing, and paratubing are manufactured using cutting-edge extrusion technologies to eliminate the assembling of two or more tubes. This fosters cost reduction as it eliminates any secondary steps of joining tubes. Latest advancements in extrusion technologies offer plastic tubes with an integration of desired properties, including high tensile strength, flexibility, lightweight, and non-ferrous properties.

Medical devices in the U.S. are highly regulated by the Food and Drug Administration (FDA) Center Devices and Radiological Health (CDRH) to ensure the safety and effectiveness of the devices. Medical devices are classified into Class I, II, and III, with Class III being associated with higher-risk regulations. The U.S. FDA regulates Good Manufacturing Practices (GMP) polyurethane tubes used to administer drugs or medicines. Similar to the FDA, the United States Department of Agriculture (USDA) ensures that the polyurethane tube does not contaminate the food or liquids given to patients. It also regulates the environmental sustainability compliance of medical tubes.

Market Concentration & Characteristics

The market growth stage is high, and the pace of market growth is accelerating. Medical tubing manufacturers are actively adopting challenging strategic initiatives such as mergers & acquisitions, new product launches, and collaborations, among others.

The U.S. medical tubing market is highly competitive due to the presence of well-established healthcare infrastructure and the penetration of foreign players. The market is led by strategic initiatives, including increasing research and development activities and surging bio-pharmaceutical investments by key players.

Prominent technological innovations such as tight-tolerance medical tubing lines for processing high-temperature fluorinated ethylene propylene (FEP) tubing with radiopaque stripes, medical extruder direct drive (MEDD), and alternating polymer tubing lines serve a wide array of medical procedures. The unique design of these tubes offers them flexibility and customization for patients, thereby enhancing their outcomes.

The innovation of co-extrusion technology is one of the significant technological developments that have taken place in the manufacturing of tubes. This technology provides lubricating strength to numerous layers of EFEP and nylon medical tubes, as well as catheters, which were primarily utilized in intensive care units in healthcare facilities.

Supportive regulations by the U.S. FDA, the International Standards for Organization, and U.S. Pharmacopoeia ensure product compliance. For instance, USP Class VI is a certification put in place by the U.S. Pharmacopeia Convention (USP), which judges the material suitability and compatibility of medical-grade devices. The standard includes tests for biochemical compatibility, toxicity, leaching, and inertness. USP Class VI is typically a base requirement for all medical-grade devices.

The competitive rivalry is high owing to the expansion of foreign collaborations in the country. For instance, in February 2023, Benvic Group collaborated with Modenplast to increase the penetration of its products in healthcare applications. Under this collaboration, both companies are expected to develop specific medical tubing.

Application Insights

The bulk disposable segment accounted for the largest market share of 36.75% in 2023. Bulk disposable devices comprise urological products, surgical instruments, syringes, and needles, among others. The growing concerns about containing the spread of communicable diseases are driving segment growth. Furthermore, the prevalence of arthritis, cancer, and cardiovascular diseases has fuelled the adoption of extensive surgical treatment instruments, including trocars and inflators. Polyvinyl chloride (PVC) and silicone are among the most commonly used polymers in disposable medical tubing. They are long-lasting, durable, versatile, and flexible.

Drug delivery systems are expected to expand at the fastest CAGR during the forecast period due to the increasing demand for targeted and controlled drug delivery in patients. Various types of drug delivery systems, such as injectable drug delivery systems, respiratory drug delivery systems, and connected drug delivery systems, use medical tubes to deliver the drug to the target location. The emphasis on improving the efficacy of the drug delivery rate is propelling the demand for medical tubes in the drug delivery systems application segment.

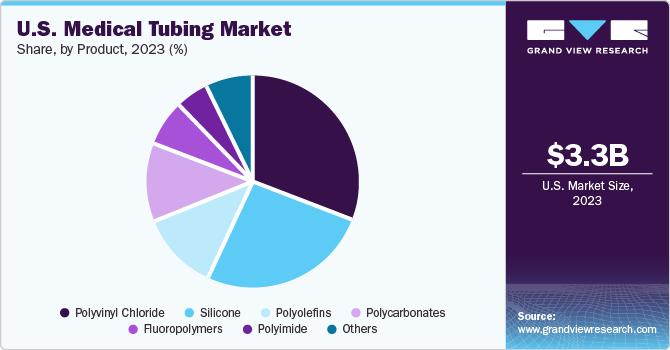

Product Insights

Silicone tubing accounted for the largest revenue share of 25.93% in 2023, owing to its high demand in medical applications. It is non-toxic to living tissues, and patients have no allergenic response. Silicon tubing provides gasketing, sealing, and safe fluid transfer properties, which fosters segment growth. High-grade silicon tubing used in medical devices is manufactured using a continuous vulcanization and extrusion process. Moreover, the material has applications in medical drains, implants, feeding tubes, catheters, and other products where biocompatibility is a key requirement.

Fluoropolymers are projected to grow at the fastest CAGR from 2024 to 2030. It is a preferred material in manufacturing next-generation medical devices, including catheters, sutures, syringes, and biocontainment vessels. Fluoropolymers are inert, non-toxic, sterile, inert, and bio-compatible, making them an ideal choice for medical tubing.

Key U.S. Medical Tubing Company Insights

Key players in the U.S. medical tubing industry are engaged in continuous engagement in R&D activities and mergers & acquisitions to increase their regional and global footprint. Companies such as Nordson Corporation, Spectrum Plastics Group, and Benvic Group are some of the leaders, as they are engaged in continuous R&D and M&A and have a strong supply chain. For instance, in June 2020, Nordson Corporation acquired Fluortek, Inc. and expanded its medical tubing product portfolio for complex medical devices.

Key U.S. Medical Tubing Companies:

- Hitachi Cable America Inc

- NewAge Industries Inc.

- Spectrum Plastics Group

- Bentec Medical

- Kent Elastomer Products

- The Hygenic Company, LLC

- Nordson Corporation

Recent Developments

-

In June 2021, Spectrum Plastics Group acquired KCS Plastics Ltd, to expand its geographical presence and boost manufacturing of polymer-based medical equipment

-

In August 2021, Nordson Corporation acquired NDC Technologies to expand its product offerings. The acquisition has the former’s test and inspection platform into new end markets and adjacent technologies.

-

In May 2020, NewAge Industries, Inc. bought two units in a building within seven miles of its headquarters to increase its production capacities of tubing and molding assemblies.

U.S. Medical Tubing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.59 billion

Revenue forecast in 2030

USD 5.67 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product and application

Key companies profiled

Hitachi Cable America Inc,; NewAge Industries Inc.; Spectrum Plastics Group; Bentec Medical; Kent Elastomer Products; The Hygenic Company, LLC; Nordson Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Tubing Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical tubing market report based on product and application:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Bulk disposable tubing

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Drug delivery systems

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Catheters

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Biopharmaceutical laboratory equipment

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Others

-

Silicone

-

Polyolefins

-

Polyimide

-

Polyvinyl Chloride

-

Polycarbonates

-

Fluoropolymers

-

Polytetrafluoroethylene (PTFE)

-

Fluorinated ethylene propylene (FEP)

-

-

Others

-

-

Frequently Asked Questions About This Report

b. The global U.S. medical tubing market size was estimated at USD 3.34 billion in 2023 and is expected to reach USD 3.59 billion in 2024.

b. The U.S. medical tubing market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.9% from 2024 to 2030 and reach USD 5.67 billion by 2030.

b. Bulk disposable tubing dominated and accounted for 36.7% of the U.S. medical tubing market in 2023 owing to the growing concerns about containing the spread of communicable diseases are driving segment growth.

b. Some of the key players operating in the U.S. medical tubing market include Hitachi Cable America Inc; NewAge Industries Inc.; Spectrum Plastics Group; Bentec Medical; Kent Elastomer Products; The Hygenic Company, LLC; Nordson Corporation

b. The key factors that are driving the U.S. medical tubing market include the market growth is expected to be driven by the by the rising geriatric population and hospitalizations in the U.S. Medical tubes are required to have superior physical properties such as opacity, versatility, and static resistance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."