U.S. Medical Tourism Market Size, Share & Trends Analysis Report By Type (Inbound Medical Tourism, Outbound Medical Tourism), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-096-5

- Number of Report Pages: 84

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Medical Tourism Market Size & Trends

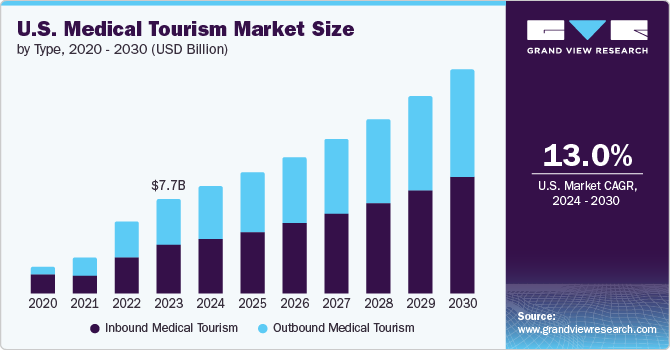

The U.S. medical tourism market size was valued at USD 7.75 billion in 2023 and is projected to grow at a CAGR of 13.02% from 2024 to 2030. The number of Americans traveling outside the U.S. to avail medical treatments is increasing, inbound medical tourism in the country is also witnessing significant growth.

The growing demand for complex surgeries, such as orthopedic and cardiac procedures, is expected to significantly boost inbound medical tourism in the U.S. These treatments, which require advanced technology and specialized care, attract patients seeking top-tier expertise and cutting-edge solutions available in the country. Additionally, the availability of specialized cancer treatments and the presence of major cancer treatment centers further drive market growth.

Furthermore, outbound medical tourism from the U.S. is increasing as patients seek more affordable options internally for cosmetic and dental procedure, and weight loss treatments. These international destinations offer affordable and high-quality care for aesthetic enhancements, dental implants, and joint replacements. This growing preference for both superior domestic care and cost-effective international options is contributing to the growth of the U.S. medical tourism market.

Accreditation from organizations such as the Joint Commission International (JCI) and the National Committee for Quality Assurance (NCQA) to hospitals in the U.S. for high global standards for quality and patient safety is expected to boost the demand for medical tourism in the country. This accreditation ensures international patients receive top-notch care, making U.S. hospitals more attractive than other destinations. Joint Commission International (JCI) is a nonprofit organization that evaluates healthcare facilities globally. JCI accreditation is considered the benchmark for quality care in hospitals and clinics. JCI accredits over 15,000 healthcare facilities in the U.S.

Most hospitals in the country focus on creating a medical tourism revenue stream. Thus, these hospitals are building on their existing portfolio rather than adding new service lines. In the U.S., major healthcare facilities, through their international patient departments, are promoting themselves across different countries globally. Patients from several countries travel to the U.S. for better quality care, faster treatments, and access to unavailable procedures.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, impact of regulations, and regional expansion. The industry is highly fragmented, with many providers offering treatments for international patients. The degree of innovation is low, and the impact of regulations on the industry is high. The level of partnerships & collaborations is low, and the impact of pricing is high.

The impact of regulations on the market is high, influencing the attractiveness of the U.S. as a destination for international patients. Complex and stringent visa requirements can act as barriers for international patients seeking medical treatment in the U.S. Lengthy processing times and strict documentation requirements discourage potential medical tourists. The lack of a specific medical visa category or streamlined visa can make obtaining the necessary travel permissions challenging for patients.

The level of partnerships & collaborations in the market is low. Partnerships involve various stakeholders, including healthcare providers, international medical tourism agencies, travel and hospitality companies, insurance providers, and government entities. Many U.S. hospitals and clinics partner with medical tourism agencies to attract international patients, streamline the referral process, and manage logistical aspects of medical travel.

The impact of pricing is high in the industry. The high cost of medical treatments and procedures in the U.S. drive patients to seek more affordable options internationally. Even though U.S. facilities often offer advanced treatments, the high prices negatively impact the industry.

The degree of innovation in the industry is low. However, the growth of telemedicine and digital health technologies provides alternatives to in-person visits and can positively impact medical tourism by offering remote consultations and follow-up care.

Type Insights

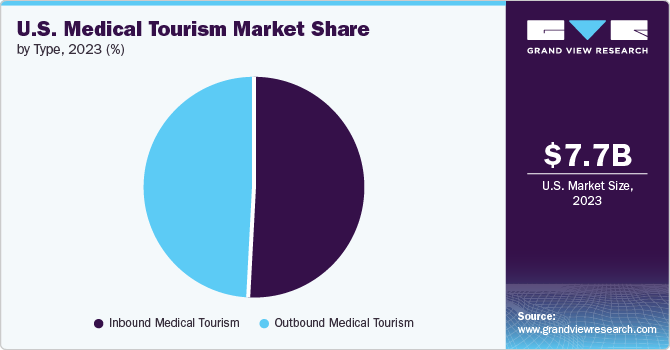

Based on type, the inbound medical tourism segment dominated the market in 2023 with the largest share of 50.64%. Most of the advanced medical institutions, such as the Mayo Clinic, Cleveland Clinic, and Johns Hopkins Hospital, known for their technology, innovative treatments, and rigorous standards of care, are in the U.S. These facilities offer specialized services and cutting-edge medical procedures that may not be available or as advanced in other countries. The ability to access these top-tier medical services and the presence of state-of-the-art treatments are expected to drive the market's growth and make the U.S. a preferred destination for international patients seeking advanced treatments for complex or urgent medical conditions.

However, U.S. outbound medical tourism is expected to grow significantly over the forecast period owing to the high cost of healthcare. Despite having some of the best medical facilities and professionals, the U.S. healthcare system is often characterized by its high treatment costs and complex insurance processes. Hence, patients are seeking more affordable alternatives in countries such as Mexico, Costa Rica, and Thailand, which offer high-quality medical services at a much lower cost, including comprehensive packages that cover travel and accommodation. Additionally, many of these destinations have invested heavily in developing state-of-the-art healthcare facilities and attracting internationally trained medical professionals, ensuring patients receive care that meets international standards.

Key U.S. Medical Tourism Companies:

- The Johns Hopkins Hospital

- Mayo Clinic

- Cleveland Clinic

- Cedars-Sinai

- Massachusetts General Hospital

- UCSF Health

- NewYork-Presbyterian Hospital

- Brigham and Women's Hospital

- Ronald Regan UCLA Medical Center

- Northwestern Memorial Hospital

Key U.S. Medical Tourism Company Insights

The key industry participants undertake several strategies to attract medical tourists, including partnerships and collaborations with employers, overseas physicians, and other travel service organizations. However, countries such as Mexico, Costa Rica, Thailand, India, and Singapore offer competitive healthcare services at lower costs than the U.S. These countries have become popular among U.S. residents for dental work, cosmetic surgery, and elective surgeries.

U.S. Medical Tourism Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.74 billion |

|

Revenue forecast in 2030 |

USD 18.21 billion |

|

Growth rate |

CAGR of 13.02% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type |

|

Country scope |

U.S. |

|

Key companies profiled |

The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Medical Tourism Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical tourism market report based on type.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inbound

-

Outbound

-

Frequently Asked Questions About This Report

b. The U.S. medical tourism market size was estimated at USD 7.75 billion in 2023 and is expected to reach USD 8.74 billion in 2024.

b. The U.S. medical tourism market is expected to grow at a compound annual growth rate of 13.02% from 2024 to 2030 to reach USD 18.21 billion by 2030.

b. The inbound medical tourism segment dominated the market in 2023 due to the increasing incidence of cancer, cardiovascular disorders, and other chronic conditions.

b. The key industry participants in the U.S. inbound medical tourism market include The Johns Hopkins Hospital; Mayo Clinic; Cleveland Clinic; Cedars-Sinai; Massachusetts General Hospital; UCSF Health; New York-Presbyterian Hospital; Brigham and Women's Hospital; Ronald Regan UCLA Medical Center; Northwestern Memorial Hospital.

b. The availability of additional benefits including better healthcare, latest technologies, innovative medicines, modern devices, better hospitality, and personalized care are some of the drivers of this market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."