- Home

- »

- Medical Devices

- »

-

U.S. Medical Lifting Sling Market Size, Industry Report, 2030GVR Report cover

![U.S. Medical Lifting Sling Market Size, Share & Trends Report]()

U.S. Medical Lifting Sling Market Size, Share & Trends Analysis Report By Product (Nylon, Mesh), By Application (Transfer, Universal), By Usage (Reusable, Disposable), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Medical Lifting Sling Market Trends

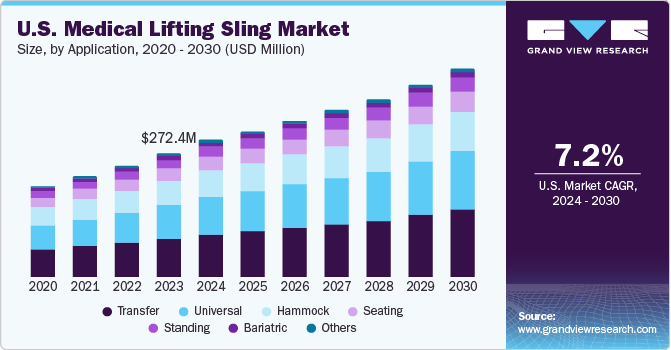

The U.S. medical lifting sling market size was estimated at USD 272.4 million in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. The sales of medical lifting slings are being propelled by various factors such as the growing geriatric population, a rise in the incidence of muscular disorders, the need for universal slings, monetary support from private and government organizations for healthcare development, and advancements in technology in this field.

As per America's Health Rankings analysis of CDC WONDER, 2022, around 17.3% of the U.S. population is over 65. People in old age often lack mobility and require support from an external system to transfer from one place to another. Slings provide patients with structural support, help them enhance respiratory exchange, and increase stimulation in their body without hurting or pressing any wound. It safeguards them from any future injury and reduces the number of nursing staff required to transfer an individual.

Muscular disorders in the U.S. have been continuously on the rise. According to the Bone and Joint Initiative, almost half of all Americans over 18 years old, i.e. 124 million individuals, have a musculoskeletal disorder. In Musculoskeletal disorder (MSD), people suffer from weak joints, reoccurring pain, and swelling-dull aches, decreased range of motion, muscle weakness or atrophy, and redness. MSD varies with lifestyle, occupation, age, and family history, increasing with age and decreasing muscle strength. These instances drive the use of slings.

The U.S. government has increased its focus on healthcare. It supports corporate and governing bodies financially to build its infrastructure, bring better technologies, and provide world-class patient care. For instance, in February 2024, Arkansas received USD 7 million from the U.S. Department of Commerce to support healthcare workforce training and business growth initiatives. This was expected to help strengthen medical education, create 225 jobs, and help build an advanced nursing and health science center in Newport.

Market Concentration & Characteristics

This sector is characterized by a moderate degree of innovation. For instance, the U.S. medical lifting sling industry introduced a new product called the novacare Flexsupport Sling. This innovative hoisting sling has been designed to improve patient comfort and support during transfers. With adjustable head support and breathable mesh fabric, the novacare Flexsupport Sling caters to the different needs of patients, ensuring maximum comfort during transfers.

The level of merger and acquisition activities is moderate, where key players are working on increasing their share through market expansion. For example, in June 2020, GF Health Products, Inc., a company providing healthcare products, acquired most of Gendron's assets. This well-known American company specializes in designing and manufacturing equipment for mobile patient management. Their products include bariatric beds, mobility aids, seating options, and transfer and transport equipment; all used in long-term care, home care, rehabilitation, and acute care settings.

The impact of regulations in this market is moderate. The FDA regulates Medical lifting slings, which are classified according to their intended use and design as outlined in the Code of Federal Regulations (CFR) Title 21. Classification is based on whether the device includes straps and support for the patient, which falls under Class II devices with unique controls or if it consists of straps and a sling to assist the patient, which falls under Class I devices, is subject to general controls, and not required to have premarket notification.

In the U.S. medical lifting sling industry, various alternatives are available for patient handling and mobility needs. These alternatives include overhead lift systems, sit-to-stand lifts and stand aids, and air-assisted lateral transfer mats. These service substitutes complement traditional medical lifting slings, providing alternative solutions for safe patient handling, mobility assistance, and transfer needs.

Moreover, the industry participants are focusing on increasing their presence in regions and improving access to medical devices, including lifting slings eventually driving the global medical lifting slings market. For instance, in June 2023, Joerns Healthcare, a healthcare equipment and technology company, collaborated with Winncare, one of the leading European mobility solutions providers. Winncare provides Lifting Cushion products. The companies partnered to introduce moving and handling product range to the U.S. market. This strategy helps companies distribute their products to many customers across the U.S. Thus, such distribution partnerships among the industry participants are expected to improve the reach of their products across the globe.

Product Insights

The nylon segment dominated the market and accounted for a share of around 30% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Nylon slings resist chemicals such as aldehyde and alkalis and can be stretched up to 8-10%. They showcase durability and comfort. They remain resistant to stretching, which makes them ideal for regular use. As per the findings of Patient Handling and Safety Experts (PHASE), most injuries related to patient handling, which account for 60% of such injuries, occur while moving the patient on or off the stretcher, backboard, stair chair, or similar equipment, which could be prevented by using materials that are strong enough to sustain stress, such as Nylon.

Padded slings held the second largest share based on product in 2023. Padded slings are designed with extra padding in critical areas such as the leg, back, and headrest. This promotes even pressure distribution and offers a softer surface for patients, decreasing the chance of pressure sores and discomfort during transfers. Typically constructed from polyester or nylon, they provide durability and comfort. For instance, the Deluxe Padded Patient Lift Slings are tailored to assist with toileting tasks. These slings are designed to provide maximum comfort and safety to the patient while ensuring ease of use for the caregiver.

Application Insights

Based on application, the transfer segment dominated the market with the largest revenue share in 2023. Transfer slings are an essential tool for lifting patients who may be debilitated, overweight, or have a disability, promoting safe mobility and handling of patients in healthcare settings. For instance, transfer slings such as Protekt Onyx Hydraulic Patient Lift by Proactive Medical utilize a hydraulic system that gradually and safely raises and lowers individuals from any stationary position. It includes a spreader bar with four or 6-point straps, with multiple sling options. It provides added comfort for patients while alleviating the physical strain on healthcare staff, which is why they are increasingly popular and effective.

The universal segment is expected to witness a significant growth rate over the forecast period. Universal slings are widely used in healthcare settings for patient transfer purposes. They are versatile and adjustable, making them suitable for various patient handling requirements. For instance, Universal Slings (U-Sling) is a brand that offers a range of universal slings designed to be compatible with most types of lifts and transfers. They are suitable for various patient lifting tasks and can even be used with a commode.

Usage Insights

Based on usage, the reusable segment dominated the market with the largest revenue share in 2023. Medical lifting slings are durable, easy to use, and cost-effective. They have reinforced corners and stitching for added strength and are water-resistant. They are compatible with most floor lift models and are designed to be used without chains. The slings are made from breathable nylon material for greater patient comfort. They can be easily cleaned through machine washing, enhancing convenience for caregivers. They are a practical choice for healthcare settings where patient transfers are frequent.

The disposable segment is expected to grow at the fastest CAGR over the forecast period. For instance, U-shaped patient slings, from companies such as Medline and Bestcare are meant to be used only for one patient to avoid spreading germs. These slings make positioning and removing patients simple and fast, promoting efficient and clean patient handling procedures. Disposable slings also minimize the risk of injury to healthcare workers during patient lifting and transfer. Managing inventory and ordering is more straightforward, making them ideal for efficient and hygienic healthcare environments. Overall, disposable medical lifting slings ensure high hygiene standards, patient safety, and staff well-being.

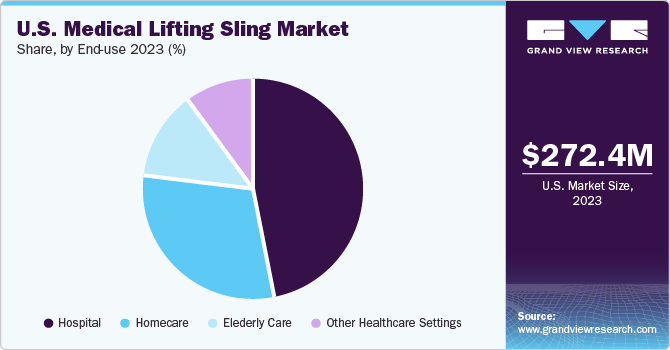

End-use Insights

The hospital segment dominated the market with the largest revenue share in 2023. In healthcare facilities such as hospitals and nursing homes, medical lifting slings offer added support to the back and pelvis areas, making them suitable for users with muscle or bone issues. It features padded leg support for full leg support and slight elevation to prevent the legs from dropping during use. These slings are vital tools that assist in safe and efficient patient handling during transfers, reducing the risk of injuries to patients and caregivers. Patient lifts and slings are crucial in ensuring patient safety during transfers, improving caregiver efficiency, and providing proper care for individuals with mobility impairments or disabilities.

The homecare segment is expected to grow at the fastest CAGR over the forecast period. Medical lifting slings are commonly used in homecare settings to safely and comfortably transfer patients with limited mobility. The slings are crucial in helping individuals with mobility challenges during daily activities such as moving from beds to chairs or bathrooms. For instance, sling by Allegro is an everyday-use product made from durable polyester fabric or mesh. It offers good support for patients with upper body control and is suitable for bathing. The sling features internal padding and color-coded webbing loops for easy sizing selection. Using patient slings in-home care ensures that caregivers can provide proper care while minimizing the risk of injuries to both the patient and them, enhancing the overall quality of care provided in a home setting.

Key U.S. Medical Lifting Sling Company Insights

Some of the key companies operating in the U.S. medical lifting sling market include Bestcare, Hill-Rom Holdings, Inc (Baxter), Invacare Corporation, GF Health Products, Inc., Arjo, Medical Depot, DiaMedical USA

-

Invacare Corporation is a company that specializes in providing products and services that aid individuals in movement, rest, and essential hygiene. These services are vital in caring for people who face various challenges, from active individuals who need extra mobility support for work or school to those receiving care in residential settings, at home, or in rehabilitation centers.

-

Arjo provides products and solutions to promote safe and dignified experiences for patients in healthcare environments. They offer patient handling equipment, medical beds, personal hygiene products, disinfection solutions, diagnostic tools, and preventative measures for pressure injuries and venous thromboembolism.

Key U.S. Medical Lifting Sling Companies:

- Bestcare

- Hill-Rom Holdings, Inc (Baxter)

- Invacare Corporation

- GF Health Products, Inc.

- Arjo

- Medical Depot

- DiaMedical USA

- Joerns Healthcare

- Henry Schein, Inc.

- SSM Health

- Bishop Lifting

- Etac AB

- Binder Lift Inc.

- Winncare

Recent Developments

-

In May 2023, SSM Health launched the LIFTsmart Program, providing patients with essential lifting aids such as slings, lateral transfers, lifts, and standing aids.

-

In April 2023, Bishop Lifting acquired General Work Products, a provider of safety-critical products. Bishop's acquisition of General Work Products was the twelfth since 2012, and the company will continue to operate under its existing branding and locations in California, Texas, Louisiana, and New York.

-

In April 2023, Etac AB expanded its collection of Molift UnoSlings that are designed for single-patient use. These slings are ideal for scenarios such as supine transfers, seated transfers, and gait training.

U.S. Medical Lifting Sling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 301 million

Revenue forecast in 2030

USD 457.1 million

Growth rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, usage, end-use

Country scope

U.S.

Key companies profiled

Bestcare; Hill-Rom Holdings, Inc (Baxter); Invacare Corporation; GF Health Products, Inc.; Arjo; DiaMedical USA; Joerns Healthcare; Henry Schein, Inc.; SSM Health; Bishop Lifting; Etac AB; Binder Lift Inc.; Winncare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Lifting Sling Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical lifting sling market report based on product, application, usage, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nylon

-

Padded

-

Mesh

-

Canvas

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Transfer

-

Universal

-

Hammock

-

Standing

-

Seating

-

Toileting

-

Bariatric

-

Others

-

-

Usage Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable

-

Disposable

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Homecare

-

Elederly Care

-

Other Healthcare Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. medical lifting sling market size was valued at USD 272.4 million in 2023 and is expected to reach USD 301 million in 2024.

b. The U.S. medical lifting sling market is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030 to reach USD 457.1 million by 2030.

b. Nylon dominated the product segment and accounted for a share of around 30% in 2023 and is expected to grow at the fastest CAGR over the forecast period. Nylon slings resist chemicals such as aldehyde and alkalis and can be stretched up to 8-10%. They showcase durability and comfort. They remain resistant to stretching, which makes them ideal for regular use.

b. Some of the key companies operating in the U.S. medical lifting sling market include Bestcare, Hill-Rom Holdings, Inc (Baxter), Invacare Corporation, GF Health Products, Inc., Arjo, Medical Depot, and DiaMedical USA, among others.

b. The sales of medical lifting slings are being propelled by various factors such as the growing geriatric population, a rise in the incidence of muscular disorders, the need for universal slings, monetary support from private and government organizations for healthcare development, and advancements in technology in this field.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."