- Home

- »

- Medical Devices

- »

-

U.S. Medical Image Analysis Software Market, Industry Report, 2030GVR Report cover

![U.S. Medical Image Report]()

U.S. Medical Image Analysis Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Software Type (Integrated, Standalone), By Imaging Type (3D, 4D), By Modality, By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-285-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

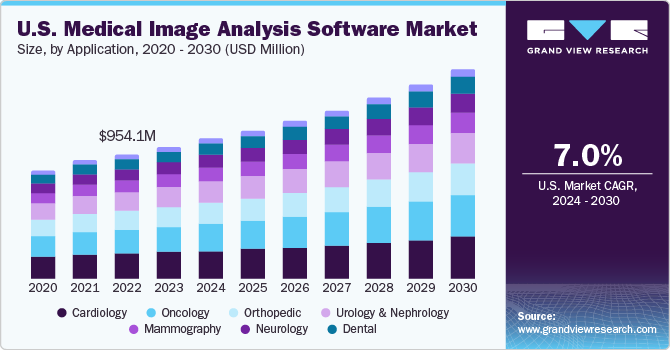

The U.S. medical image analysis software market size was estimated at USD 1.00 billion in 2023 and is expected to grow at a CAGR of 7.0% from 2024 to 2030. This can be attributed to affordable rates, an increase in technological advances & the number of diagnostic procedures. Hence, with the growing demand for advanced healthcare systems among the elderly population, well-established healthcare facilities, and the growing prevalence of chronic diseases, the market is expected to grow over the forecast period.

U.S. accounted for 34.0% of the global medical image analysis software market in 2023. Furthermore, the U.S. has witnessed a trend of AI inclusion in medical imaging aimed at helping in integration and clinical workflow in the diagnostic space. Increased adoption of medical imaging technology in primary care settings, improved accessibility, and high healthcare spending in countries with efficient reimbursement policies have significantly contributed to the surge in market growth.

The growing awareness about medical imaging devices' safety and diagnostic efficiency among healthcare providers has contributed to their rising adoption. In the U.S., the number of ultrasound unit installations has significantly increased over the years. Moreover, the increasing incidence of bone fractures is boosting the adoption of medical imaging equipment for diagnosis and treatment. Precision and accuracy are important factors while diagnosing and treating a patient. The increasing need for efficient and effective diagnosis & treatment is another key factor driving the medical image analysis software market.

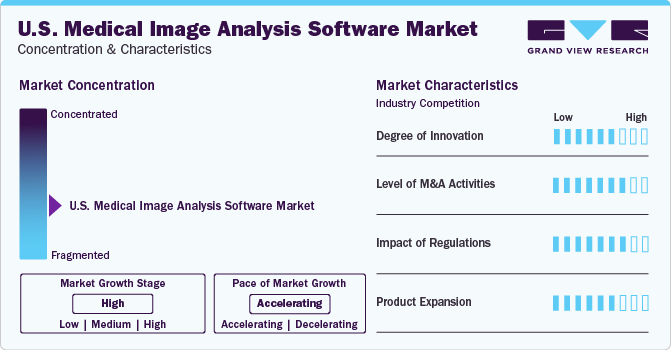

Market Concentration & Characteristics

The industry is fragmented due to the presence of several large and midsized companies. Market leaders are focusing on introducing new products, collaborating, making agreements, and acquiring other companies. These actions are anticipated to enhance the market growth throughout the projected duration. Increasing adoption of diagnostic imaging devices, especially ones that offer superior imaging and real-time analysis, is boosting the market growth.

-

Major industry players are introducing advanced tele-ultrasound and portable imaging devices, significantly speeding up the interpretation of medical imaging and improving the scope of accurate and effective diagnoses & treatments. New products are increasingly being launched for product portfolio expansion along with geographical expansion by key players in the market owing to technological advancements. For instance, in November 2022, Canon Medical Systems Corporation established a new subsidiary called Canon Healthcare USA, INC. to boost medical business development by expanding its position in the market.

-

The industry players are adopting initiatives such as mergers and acquisitions, partnerships, and collaborations to keep the industry competitive and expand their presence. For instance, in March 2023, GE Healthcare collaborated with DePuy Synthes to bring GE HealthCare's OEC 3D Imaging System and DePuy Synthe's extensive product portfolio to spine practices in the U.S.

-

Implementing stringent regulations in developed countries, such as the U.S., through organizations such as the DEA and Medical Imaging & Technology Alliance (MITA) can track the use of radioactive materials in radiotherapy. This is expected to impact the scope of medical imaging devices. However, extensive public and private funding initiatives in the U.S. are expected to propel the market.

Software Type Insights

Integrated segment dominated the market with a share of 54.79% in 2023 owing to its rapid adoption, which can be attributed to benefits such as a uniform data pool. Moreover, integrated software allows users to access and maintain a health record data system, resulting in low maintenance costs and less troubleshooting time. These factors significantly contribute to the segment’s growth.

The standalone segment is expected to grow most over the forecast period. This is attributed to factors such as efficient data protection. This means that even though a single damaged system will not affect the other associated systems. Moreover, standalone software is easy to use and does not require special skills or training to operate. It also offers advanced functions as well as the ability to generate in-depth reports. These factors are projected to boost the segment’s growth in the upcoming years.

Modality Insights

Tomography segment dominated the market with a share of 37.22% in 2023. The segment's growth is driven by its cost-effectiveness and ability to eliminate harmful radiation that can negatively impact patients. It offers 2D, 3D, or 4D images of the body and is categorized into different types, such as computed tomography, positron emission tomography, and single-photon emission tomography.

The ultrasound imaging segment is expected to grow most over the forecast period. The growing adoption of ultrasound imaging for treating kidney stones and prostate cancer will most likely drive the segment. The introduction of technologically advanced systems, with compact designs for easy portability and user-friendly interface, is a major factor expected to propel the adoption of ultrasonic imaging.

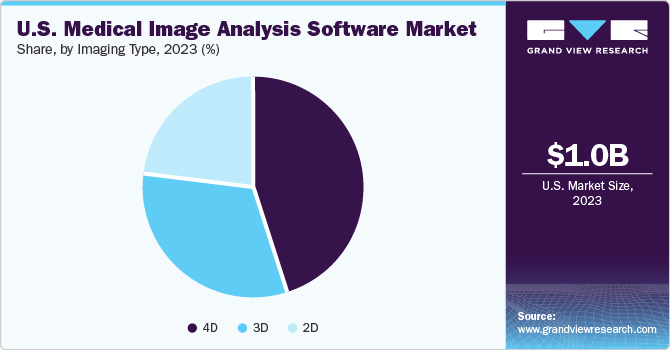

Imaging Type Insights

4D segment dominated the market with a share of 44.80% in 2023. This is attributed to its capability of monitoring an object and producing a 3D view. It can be used in various branches of medicine, most commonly in cardiology, oncology, and neurology. In image-guided surgery, it is used to obtain preoperative images that show a view of anatomy merged to create a digital map, helping surgeons accurately position and adjust surgical tools.

The 3D segment is expected to witness considerable growth over the forecast period. 3D imaging is gaining popularity over other imaging modalities, such as X-rays or conventional fluoroscopy, as they can improve the examination of implant position, bone details, and mammography, among others. Advancements in 3D imaging are likely to accelerate the growth of this segment.

Application Insights

Cardiology segment dominated the market with a share of 20.37% in 2023. This growth can be attributed to growing prevalence of cardiovascular & congenital heart diseases and increasing support from the government to improve accessibility of treatments. Furthermore, advancements in diagnostic techniques, such as open MRI, superconducting magnets, and visualization software are expected to drive the segment.

The oncology segment is expected to witness highest growth over the forecast period. The increasing cases of cancer such as lung, prostate, breast, and colorectal, in the U.S. and active R&D dedicated to advancements in imaging modalities are contributing to the segment’s growth. Based on a study by the American College of Surgeons Clinical Congress it can be seen that surgeons are focusing on advancements in computer technologies that further improve the visualization of cancerous tumors.

End-use Insights

Diagnostic centers segment dominated the market with a share of 34.30% in 2023. Due to the increasing demand for efficient solutions to improve patient outcomes, diagnostic and research centers are expected to emerge as key end-users. Increasing government initiatives to facilitate the setting up of diagnostic centers and expanding public-private partnerships present growth opportunities for diagnostic centers.

The ambulatory surgical centers segment is expected to grow most over the forecast period. Rising healthcare costs are leading to deprivation from the diagnosis and treatment of diseases. This has obliged several organizations to introduce new ways to make medical services affordable without compromising quality. Ambulatory surgical centers have proven to be a competent solution in this scenario. Moreover, government initiatives to inflate the reach of advanced care in rural parts are one of the prime segment drivers.

Key U.S. Medical Image Analysis Software Company Insights

Some prominent U.S. medical image analysis software market companies include Toshiba Medical Systems Corporation (Canon Medical Systems Corporation), Spacelabs Healthcare, MIM Software, Inc., Koninklijke Philips N.V., and GE Healthcare, Inc. These players are also focusing on developing multimodal imaging devices for preclinical research.

These players are working on developing AI-based, user-friendly, and technologically advanced X-ray, MRI, & ultrasound imaging systems for accurate & effective diagnosis. The adoption of artificial intelligence (AI) in healthcare is increasing as healthcare providers focus on enhancing patient care. Recent developments in medical imaging indicate how technology can be persuaded to fight major diseases to help combat mortality rates.

Key U.S. Medical Image Analysis Software Companies:

- Koninklijke Philips N.V.

- Agfa-Gevaert Group

- Canon Medical Systems

- MIM Software, Inc.

- Bruker

- Siemens Healthineers AG

- ESAOTE SPA

- Deep Rui Medical (Deepwise)

- Infervision Medical Technology Co., Ltd.

- Neusoft Medical Systems Co., Ltd.

Recent Developments

-

In January 2023, Bruker Corporation announced the acquisition of ACQUIFER Imaging GmbH, intending to expand its portfolio for bioimaging applications by including big data management and high-content screening solutions

-

In January 2023, Canon Medical Systems USA Inc., partnered with ScImage, Inc. This partnership was aimed at broadening and advancing the company’s outreach in hemodynamics with the Fysicon QMAPP*¹ Hemo portfolio

U.S. Medical Image Analysis Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.00 billion

Revenue forecast in 2030

USD 1.60 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Software type, modality, imaging type, application, end use

Country Scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; Agfa-Gevaert Group; Canon Medical Systems; MIM Software, Inc.; Bruker; Siemens Healthineers AG; ESAOTE SPA; Deep Rui Medical (Deepwise); Infervision Medical Technology Co., Ltd.; Neusoft Medical Systems Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Image Analysis Software Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical image analysis software market report based on the software type, modality, imaging type, application, and end use:

-

Software Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated Software

-

Stand-alone Software

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Tomography

-

Computed Tomography

-

Magnetic Resonance Imaging

-

Positron Emission Tomography

-

Single-Photon Emission Tomography

-

-

Ultrasound Imaging

-

2D

-

3D&4D

-

Doppler

-

-

Radiographic Imaging

-

Combined Modalities

-

PET/MR

-

SPECT/CT

-

PET/MR

-

-

Mammography

-

-

Imaging Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2D Imaging

-

3D Imaging

-

4D Imaging

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedic

-

Dental

-

Neurology

-

Cardiology

-

Oncology

-

Obstetrics & Gynecology

-

Mammography

-

Urology & Nephrology

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Ambulatory Surgical Centers (ASCs)

-

Others (Academic & Research Centers)

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth attributed to the presence of well-established healthcare facilities equipped with advanced diagnostic equipment and favorable government initiatives promoting the adoption of healthcare IT. Furthermore, the growth is further driven by increasing research and development investments and the presence of major market players.

b. The U.S. medical image analysis software market size was estimated at USD 1.00 billion in 2023 and is expected to reach USD 1,066.8 million in 2024.

b. The U.S. medical image analysis software market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 1.60 billion by 2030.

b. The integrated software segment led the market in 2023 and is expected to grow at a CAGR of 7.4% from 2024 to 2030. The significant market share is owing to the advantages linked with the utilization of these solutions. Specifically, the integrated toolkit is designed for diverse radiology applications, aiming to enhance workflow efficiency.

b. Some key players operating in the U.S. medical image analysis software market include Koninklijke Philips N.V.; Agfa-Gevaert Group; Canon Medical Systems; MIM Software, Inc.; Bruker; Siemens Healthineers AG; ESAOTE SPA; Deep Rui Medical (Deepwise); Infervision Medical Technology Co., Ltd.; Neusoft Medical Systems Co., Ltd.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.