U.S. Medical Foods Market Size, Share & Trends Analysis Report By Route Of Administration, By Product, By Application, By Sales Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-297-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Medical Foods Market Size & Trends

The U.S. medical foods market size was estimated at USD 6.2 billion in 2023 and is anticipated to advance at a CAGR of 5.6% from 2024 to 2030. The increasing prevalence of Parkinson’s disease, epilepsy, cancer, and kidney diseases among other ailments has created a strong demand for medical food items from healthcare professionals. For instance, according to The Alzheimer's Association's 2022 Report, in the U.S., an estimated 6.5 million individuals lived with Alzheimer’s disease in 2022. Moreover, as per the Parkinson’s Foundation, around 90,000 people in the economy are diagnosed with Parkinson’s disease annually. Thus, the growing incidence of such chronic diseases owing to factors such as the rising geriatric population is expected to drive the demand for medical foods in the U.S.

The U.S. accounted for a 26.4% revenue share of the global medical foods market in 2023. Rising incidences of target disorders, along with the country’s advancements in drug development, are driving the demand for disease-specific formulas in healthcare institutions and other end-use areas. Medical foods are increasingly being utilized for personalized treatment of disorders such as cystic fibrosis and cancer. Such conditions require specialized nutrition to prevent any adverse drug interaction. For example, in cases of cystic fibrosis, a special digestive enzyme containing capsules is administered to the patient under consideration. The properties of these digestive enzymes may potentially vary in different individuals.

Additionally, a noticeable growth in research activities across various fields, including nutrigenomics, proteomics, and metabolomics, helps in establishing relationships between food and genes, thus boosting the demand for medical food items in customized treatment regimens. Medical foods can improve in-born metabolic issues, wherein a particular enzyme defect can interfere with the regular metabolism of carbohydrates, proteins, and fats.

A strong focus on following regulatory guidelines and maintaining product standards among manufacturers has helped improve the quality of medical food items, leading to increasing completion among countrywide players. This has resulted in the availability of an increasing number of product options for customers, leading to positive developments in the market. In the U.S., enteral feeding formulas/medical foods are regulated under the provisions of the Federal Food, Drugs, and Cosmetics Act and the Fair Packaging and Labeling Act. Manufacturers are required to comply with all applicable laws as per these acts.

As per the Federal Food, Drug, and Cosmetic Act, to classify a product as a medical food, it needs to be labeled for the dietary management of a particular disease condition that has discrete nutritional needs and should be directed for tube or oral feeding. Additionally, the product has to be intended for usage under medical supervision. However, medical food is exempted from the FDA’s regulation for nutrient content and health claims. Moreover, any food facility that manufactures and distributes medical food in the U.S. intended for consumption must register its products with the FDA and adhere to the latest Good Manufacturing Practice (GMP) regulations enforced by the U.S. FDA.

Route Of Administration Insights

The oral route of administration segment accounted for the largest revenue share of 69.1% in 2023. Nutrient and vitamin administration via the oral method is practiced widely across healthcare institutions in the country. Several products are administered via the oral route. Oral supplements are available in various forms, including liquid, powder, pudding, pills, and pre-thickened products.

In general, most people requiring Oral Nutritional Supplements (ONS) are treated using standard ONS products, which have a calorific value of 1.5 to 2.4 Kcal/mL. These products are available in different flavors to suit patient preferences. This mode of drug administration is convenient, popular, and cost-effective, driving its extensive adoption in the country.

The enteral route of administration segment is expected to advance at a faster CAGR of 5.9% during the forecast period. Enteral feeding formulas have been developed to suit the nutritional demands of adults, pregnant women, and the geriatric and pediatric populations. The U.S. Food and Drug Administration’s directives regulate the manufacturing and quality standards of these products.

The demand for these formulas is on the rise due to the increasing prevalence of chronic diseases such as cancer and cardiovascular disorders resulting in various metabolic issues, leading to difficulty in consuming food during the treatment of these diseases. Moreover, technological developments in supplementary industries, for instance, enteral feeding devices, are helping shape market expansion. Key players are introducing new products that can be conveniently administered via the enteral route, thereby propelling market expansion in the United States.

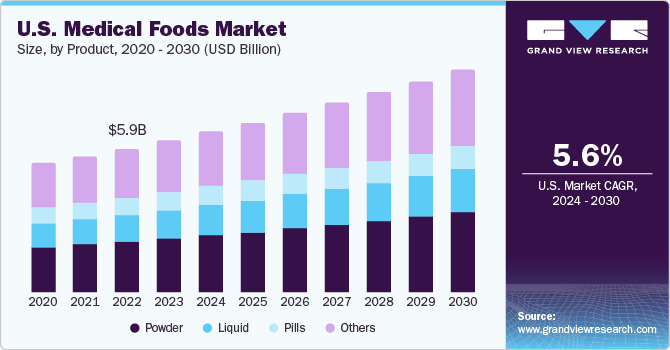

Product Insights

The powdered form of medical foods accounted for the leading revenue share in 2023. Medical food products are extensively available in powder form that can be easily administered via the enteral or oral route by combining them with water or milk, as per the directions of the physician. These food items, in the form of powdered formula, can be easily administered to patients of every age group, particularly in cases of oral administration.

Increasing consumer preference for powdered formulas on account of their ease of consumption is encouraging manufacturers to focus on developing different product categories. Companies such as Danone, Abbott, and Nestlé have developed a range of medical food items in powdered form that address a range of nutritional requirements, disorders, and deficiencies.

The liquid formulated medical food segment is anticipated to advance at the fastest CAGR from 2024 to 2030. Liquid products are administered to patients diagnosed with dysphagia or when there are limitations to their oral physiology. Moreover, these formulations are extensively adopted by the geriatric and pediatric demographics when solid formulation intake is not possible or is limited.

The rising commercial viability of liquid medical foods and their rising adoption owing to ease of administration advance segment growth. Moreover, doctors recommend the intake of liquid-formulated food items to patients suffering from functional gastrointestinal disorders. Thus, a substantial rise in the number of such patients is fueling segment expansion. Additionally, the intake of liquid-formulated medical food helps maintain the required electrolyte balance and hydration, thus driving its demand.

Application Insights

The cancer segment accounted for the largest revenue share of the U.S. medical food industry in 2023. Cancer is a widespread disorder affecting the general population in the United States, leading to an increasing demand for cancer-related medical food products from healthcare institutions. For instance, the American Cancer Society estimated that in 2023, there would be close to 1.96 million new cases of cancer in the country, while this number is expected to cross two million in 2024. The disease is known to weaken the immune system and result in malnutrition in around 40%-80% of overall cases, leading to the administration of medical food being considered a viable option to restore nutritional balance in such patients.

The Parkinson’s disease segment is anticipated to advance at the fastest CAGR during the projection period. The high prevalence of this disease is a major factor driving market expansion in this segment. As per the Parkinson’s Foundation, an estimated 60,000 people in the U.S. are diagnosed with Parkinson’s disease annually. Although there is no particular dietary treatment plan to manage it, some foods for medical purposes have shown good potential. Commonly prescribed medical food items for Parkinson’s disease contain omega-3 fatty acids, coenzyme Q, and vitamins D & B.

Moreover, ketogenic diet plans and probiotics have shown a positive impact and complemented pharmacotherapy. As per an NCBI article on the role of specialized nutrition products in managing Parkinson’s disease published in September 2017, nutritional products with coenzyme Q and fish oil successfully reduced Parkinson’s disease progression. Thus, proper planning of medical food administration is expected to address the disorder effectively in the coming years.

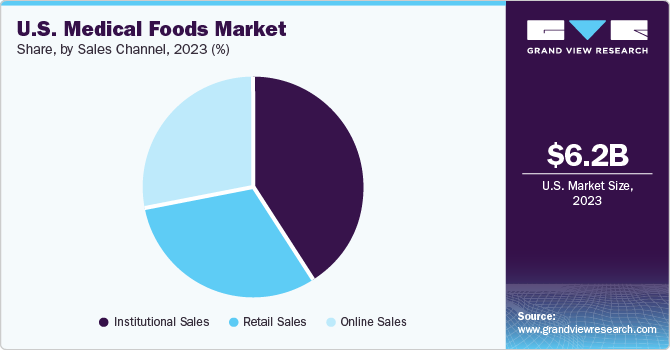

Sales Channel Insights

The institutional sales segment accounted for the largest revenue share of 40.7% in 2023. Notable institutions that buy medical foods for patient administration include long-term care centers, hospitals, hospices, and disability facilities. The decision regarding which type of medical food is to be purchased is influenced by healthcare professionals. Since the consumption of medical foods is recommended under medical supervision, the revenue generated through institutional sales remains dominant. Furthermore, the rising establishment of public and private healthcare institutions and the expanding demographic of patients suffering from chronic diseases are expected to contribute to the segment’s expansion.

The online sales channel is expected to advance at the fastest CAGR of 6.3% from 2024 to 2030. There has been an acceleration toward direct selling via e-commerce platforms to customers by medical food manufacturers. The growing preference for online purchases of medical food products is increasing on account of the convenience provided by this sales channel. Even though consumed with proper medical guidance, these products are directed for nutrition management in the long term, resulting in growing sales through the e-commerce mode. As a result, with the high popularity of e-commerce, there has been a gradual shift toward the buying of medical food items online, which offers lucrative market opportunities to major companies.

Key U.S. Medical Foods Company Insights

Leading companies involved in developing medical food products include Danone, Nestlé, Abbott, and Fresenius Kabi. These companies are mainly focusing on new product launches to boost their revenue and geographical presence.

-

Danone, headquartered in France, is a leading global food company and operates through four business segments: fresh dairy products, waters, early life nutrition, and advanced medical nutrition. The company has a North American division with headquarters located in New York, along with an innovation & technology center located in Colorado. Danone offers a range of products in the tube feeds, oral feeds, pediatric, and metabolic segments.

-

Abbott, headquartered in Illinois, is a biotechnology company involved in the development of IVD instrument systems and tests for hospitals, physician offices, reference laboratories, clinics, & blood banks. Its portfolio offerings are in the fields of medical devices, diagnostics, nutritional products, and branded generic pharmaceuticals. Some notable products by the company include Glucerna for adult diabetic patients; Cyclinex-2 to support children and adults suffering from urea cycle disorder, HHH syndrome, or gyrate atrophy; I-Valex-2 to support adults and children suffering from leucine catabolism; and Phenex-2 that addresses patients afflicted with phenylketonuria (PKU).

Key U.S. Medical Foods Companies:

- Danone North America Public Benefit Corporation

- Nestlé

- Abbott

- Targeted Medical Pharma, Inc.

- Fresenius Kabi AG

- Primus Pharmaceuticals, Inc.

- Mead Johnson & Company, LLC (a part of Reckitt Benckiser Group PLC)

- Metagenics

- Alfasigma USA, Inc.

Recent Developments

-

In May 2024, Danone announced the acquisition of Functional Formularies, a U.S.-based whole foods tube feeding company. The development is part of Danone’s ‘Renew Danone’ strategy and is expected to strengthen the company’s Medical Nutrition portfolio in the country through further expansion of its enteral tube feeding range. Functional Formularies provides organic and whole-food alternatives to conventional feeding tube formulas. The company caters to institutional customers in hospitals and long-term care settings and to retail customers online across the U.S. and Canada.

-

In April 2024, Brain Ritual, a Switzerland-based wellness brand, announced the launch of the medical food product MigraKet, which aims to address the root cause of migraines. The product has been developed by Elena Gross, PhD, a well-known neuroscientist and former chronic migraineur, and released for customers in the United States.

-

In January 2024, Abbott announced the launch of the company’s PROTALITY brand, with the first product of this brand being a high-protein nutrition shake aimed at supporting adults who are looking to pursue weight loss while maintaining good nutrition and muscle mass. The product features a mix of slow- and fast-digesting protein that can feed the muscles for up to 7 hours. Other notable nutrients include eight essential B vitamins, 4 grams of comfort fiber, 150 calories, 1 gram of sugar, and 25 minerals and vitamins.

U.S. Medical Foods Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 6.21 billion |

|

Revenue forecast in 2030 |

USD 9.09 billion |

|

Growth rate |

CAGR of 5.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Route of administration, product, application, sales channel |

|

Key companies profiled |

Danone North America Public Benefit Corporation; Nestlé; Abbott; Targeted Medical Pharma, Inc.; Fresenius Kabi AG; Primus Pharmaceuticals, Inc.; Mead Johnson & Company, LLC (a part of Reckitt Benckiser Group PLC); Metagenics; Alfasigma USA, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Medical Foods Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical foods market report based on route of administration, product, application, and sales channel:

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Pills

-

Liquid

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Disease

-

Minimal Hepatic Encephalopathy

-

Chemotherapy Induced Diarrhoea

-

Pathogen Related Infections

-

Diabetic Neuropathy

-

ADHD

-

Depression

-

Alzheimer's Disease

-

Nutritional Deficiency

-

Orphan Diseases

-

Tyrosinemia

-

Eosinophilic Esophagitis

-

FPIES

-

Phenylketonuria

-

MSUD

-

Homocystinuria

-

Others

-

-

Wound Healing

-

Chronic Diarrhea

-

Constipation Relief

-

Protein Booster

-

Dysphagia

-

Pain Management

-

Parkinson's Disease

-

Epilepsy

-

Other Cancer related treatments

-

Severe Protein Allergy

-

Cancer

-

Cachexia

-

Other

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."