- Home

- »

- Medical Devices

- »

-

U.S. Medical Disposables Market Size, Industry Report 2030GVR Report cover

![U.S. Medical Disposables Market Size, Share & Trends Report]()

U.S. Medical Disposables Market Size, Share & Trends Analysis Report By Product (Disposable Masks, Hand Sanitizers), By Raw Material (Plastic Resin, Rubber), By End-use (Hospitals, Home Healthcare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Medical Disposables Market Trends

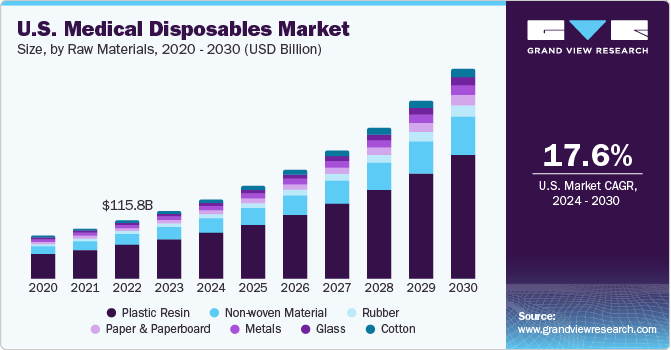

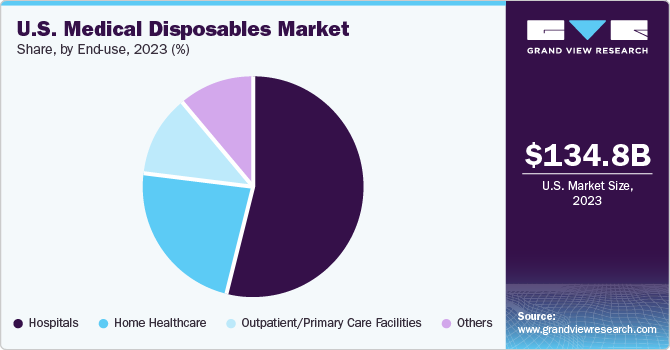

The U.S. medical disposables market size was estimated at USD 134.8 billion in 2023 and is expected to grow at a CAGR of 17.6% from 2024 to 2030. The market’s expansion is propelled by factors such as increase in surgical procedures, the rising global elderly population, growing rate of Hospital Acquired Infections (HAIs), and a higher incidence of chronic diseases necessitating prolonged hospital stays. The World Health Organization’s (WHO’s) 2022 reports 1 in every 10 affected patients die of HAI. Disposable medical supplies, designed for single or short-term use, play a crucial role in healthcare settings. They safeguard healthcare professionals from diseases and infections, and are used in medical examinations, surgeries, and treatments to prevent cross-contamination. These supplies are vital in hospitals, saving staff time and reducing associated costs.

The U.S. accounted for over 27.2% of the global medical disposables market in 2023. The COVID-19 pandemic has further fuelled the market, underscoring the vital role of single-use items in healthcare environments. Furthermore, in both high-income and low- to middle-income countries, a significant number of patients are at risk of contracting Hospital Acquired Infections (HAIs) during their hospital stay. The increase in HAIs, due to insufficient sanitation practices and preventive measures, is a key factor expected to propel market growth. Furthermore, the introduction of innovative products by industry leaders also contributes to this growth. As the focus on preventing infections intensifies, the global demand for disposable medical products has surged.

The future growth of the market is expected to be driven by the rising elderly population susceptible to various chronic conditions. As per the statistics from 2022, the U.S. is home to nearly 58 million adults aged 65 and above, making up about 17.3% of the country’s total population. This percentage is expected to rise to 22% by 2040. As per reports, the population of Americans aged 65 and over is projected to grow from 58 million in 2022 to 82 million by 2050, marking a 47% increase. The demographic landscape is poised for a significant shift with a predicted rise in the population of individuals aged 80 and above.

Moreover, the rise in healthcare expenditure has considerably propelled the market. The escalating demand for healthcare services, such as surgeries, diagnostic examinations, and prolonged care, is driven by an expanding elderly population. This demographic transition has resulted in an increased usage of medical disposable items like syringes, gloves, catheters, and wound care products. The necessity for these disposables in upholding hygienic standards and averting cross-contamination in healthcare environments is fostering market expansion.

Market Concentration & Characteristics

The medical disposables market is rapidly growing. Technological advancements are fostering the development of innovative disposable medical products. Key market strategies include new product launches, expansion, acquisitions, and partnerships. The market is highly fragmented with several key players offering diverse products. Many companies specialize in specific niches, such as manufacturing certain types of gloves or specialized surgical instruments, leading to numerous small and medium-sized enterprises (SMEs) catering to specific segments.

Progress in materials science, including the creation of biodegradable polymers, antimicrobial coatings, and materials with enhanced strength and flexibility, has greatly improved the performance of disposable medical products. As environmental sustainability becomes more important, there’s a growing trend towards eco-friendly disposables. This has led to innovative developments in biodegradable materials and recyclable packaging in the market.

Mergers and acquisitions, collaborations, and partnerships are essential for companies to meet the evolving needs of healthcare providers, share risks and rewards, establish credibility, expand service offerings, and improve the cost and quality of patient care. For instance, in November 2023, Smith+Nephew acquired CartiHeal, a company that developed a unique sports medicine technology named Agili-C, used for regenerating knee cartilage. In addition to this, they expanded their portfolio with 19 more acquisitions in various sectors including Medical Devices, Enterprise Tech in the US, Life Sciences in the US, among others.

Often, manufacturers are required to adhere to quality management systems, particularly ISO 13485, to ensure the consistent quality of medical disposables. Regulatory authorities like the U.S. FDA, and other national health agencies enforce stringent regulations on the approval and marketing of medical disposables. These regulatory bodies set and uphold strict quality and safety standards for medical disposables. These standards are intended to ensure compliance with specific criteria related to materials, manufacturing processes, and performance. Adherence to these standards is crucial for gaining market access, compelling companies to invest in strong quality control measures to maintain regulatory compliance.

Industry players are increasingly launching innovative products to expand their portfolio, impacting the medical disposables market. For example, Inspira-Technologies OXY B.H.N. LTD., in January 2024, announced a plan to develop and launch a single-use blood oxygenation kit. This kit, designed for integration with the INSPIRA ART device series, is compatible with various life support systems. This strategic move highlights the company’s commitment to innovation and market expansion, aiming to meet the growing demand for disposable perfusion systems in the medical device sector.

The industry has seen substantial growth and is expected to have further significant growth in different regions due to rising healthcare needs. The medical disposable sector is predicted to grow in emerging markets in Asia, Latin America, and Africa. The growth in these regions can be attributed to increased awareness of healthcare, enhanced healthcare infrastructure, and higher healthcare spending.

Raw Materials Insights

Plastic resin dominated the market and held the highest revenue share of 58.3% in 2023. Healthcare facilities prioritize infection control. Essential to this is plastic resin, particularly polymers like polyethylene, polypropylene, PVC, etc., used in making medical disposables such as syringes, gloves, and packaging. Its selection is based on characteristics like flexibility and durability. For example, GE Plastics’ Lexan HPX Resin is being used to enhance the functionality of Intlock ITL-S Disposable Blade in PENTAX’s Airway Scope, improving its capabilities and durability. This use of plastic resin in medical disposables is cost-effective and versatile, contributing to efficient production. Advances in resin technology can lead to superior medical disposables with improved performance, biocompatibility, and environmental sustainability, driving innovation and growth in healthcare product development.

Nonwoven material is projected to witness the fastest growth of CAGR 18.4% over the forecast period. Nonwoven materials are vital in healthcare for infection control, acting as a barrier against microorganisms. They are used in products like surgical gowns, masks, drapes, and sterilization wraps, all designed to minimize cross-contamination. Gowns protect medical staff, masks shield against airborne particles, drapes create sterile fields during surgeries, and wraps keep instruments sterile. The use of nonwoven materials enhances safety and efficiency in healthcare practices by reducing the spread of infections, making them key to infection control protocols, and maintaining high standards of patient care and safety.

End-use Insights

Hospitals dominated the market with the highest revenue market share of 54.4% in 2023, due to their extensive range of medical services and treatments across various specialties. Each specialty often needs specific disposable medical products, tailored to meet clinical needs. Hospitals prioritize patient safety and infection control, making medical disposables like gloves, masks, gowns, and drapes crucial for maintaining sterility and preventing infection spread. The need for a wide variety of disposable products to support their diverse services contributes to market growth.

Home healthcare is projected to witness the fastest growth rate of CAGR 18.1% during the forecast period. This is due to a rising preference for at-home medical services and an increasing elderly population. As the number of older individuals grows in many areas, the demand for home healthcare services and the necessary disposable medical supplies also increases. These supplies, which range widely, are designed specifically for home use, ensuring patient safety, hygiene, and convenience. With technological advancements, even complex treatments can now be administered at home, further driving the need for these disposable medical products.

Product Insights

Sterilization supplies dominated the market and held the highest revenue market share of 11.1% in 2023. Maintaining a sterile environment in healthcare settings is crucial. The presence of pathogens on medical tools and equipment can result in healthcare-associated infections (HAIs), endangering patients and escalating healthcare expenses. Essential sterilization equipment, including autoclaves, sterilization pouches, and chemical indicators, play a vital role in eliminating pathogens from medical devices, ensuring their safety for patient use. In October 2023, Advanced Sterilization Products (ASP) announced an expansion of its Sterilization Monitoring portfolio. This included the launch of innovative Steam Monitoring products, aimed at boosting the performance of Sterile Processing departments in healthcare facilities. The goal of these products is to improve efficiency and confidence in achieving sterility, addressing key issues in the healthcare industry. The focus on patient safety and infection control fuels the demand for sterilization supplies.

Diagnostic and laboratory disposables is projected to witness the fastest CAGR of 19.6% during the forecast period. This is due to rising demand for diagnostic tests, driven by an aging population, chronic diseases, and preventive healthcare awareness. These disposables, including test tubes, sample containers, and pipette tips, ensure safe and accurate testing, and are vital for specimen handling and analysis. Their importance contributes to the sector’s growth.

Key U.S. Medical Disposables Company Insights

The U.S. medical disposables companies are enhancing their operations due to significant market trends and demands. To meet this, these players are investing in R&D to innovate and improve products while adhering to strict regulations. Technological advancements are crucial, with the incorporation of smart materials and designs to boost the efficiency of medical disposables. This includes creating sustainable options to address environmental concerns. The industry is experiencing increased demand for disposable protective equipment due to heightened infection control awareness. Globalization and international trade are reshaping the competitive landscape, leading top players to fortify their supply chains and broaden their market presence. Mergers and acquisitions are prevalent strategies to gain a competitive advantage, enabling companies to diversify their product range and expand globally.

Key U.S. Medical Disposables Companies:

- Medline Industries, Inc.

- Smith+Nephew

- Bayer AG

- BD (Becton, Dickinson & Company)

- 3M

- Cardinal Health

Recent Developments

-

In January 2024, Medline Industries, Inc. announced the successful acquisition of United Medco, a national provider and partner of supplemental benefits and member engagement solutions. This strategic move strengthens Medline's commitment to evolving healthcare markets, enabling better service to customers and patients through a combined expertise approach.

-

In November 2023, BD Medical, a part of Becton, Dickinson & Company, has introduced the SiteRite 9 Ultrasound System. This system is engineered to assist healthcare professionals in achieving successful first-attempt insertions of peripherally inserted central catheters (PICCs), central venous catheters, IV lines, and other vascular access devices.

-

In February 2023, Bayer AG introduced the MEDRADTM MRXperion MR Multi-Patient Disposable Kit. This kit is designed for use with multiple patients and has a usage duration of up to 24 hours.

U.S. Medical Disposables Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 415.0 billion

Growth rate

CAGR of 17.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, end-use

Country scope

U.S.

Key companies profiled

Medline Industries, Inc.; Smith+Nephew; Bayer AG; BD (Becton, Dickinson & Company); 3M; Cardinal Health

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Disposables Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical disposables market based on product, raw material, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Management Products

-

Drug Delivery Products

-

Diagnostic and Laboratory Disposables

-

Dialysis Disposables

-

Incontinence Products

-

Respiratory Supplies

-

Sterilization Supplies

-

Non-woven Disposables

-

Disposable Masks

-

Disposable Eye Gear

-

Disposable Gloves

-

Hand Sanitizers

-

Gel

-

Foam

-

Liquid

-

Other

-

-

Others

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic Resin

-

Non-woven Material

-

Rubber

-

Paper and Paperboard

-

Metals

-

Glass

-

Cotton

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Outpatient/Primary Care Facilities

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical disposables market size was estimated at USD 134.8 billion in 2023 and is expected to reach USD 157.22 billion in 2024.

b. The U.S. medical disposables market is expected to grow at a compound annual growth rate of 17.4% from 2024 to 2030 to reach USD 415.0 billion by 2030.

b. Sterilization supplies dominated the U.S. medical disposables market with a share of 11.06% in 2023. This is attributable to the stringent regulatory standards set by bodies such as the FDA (Food and Drug Administration) and CDC (Centers for Disease Control and Prevention) regarding infection control in healthcare facilities necessitate the use of effective sterilization products and practices.

b. Some key players operating in the U.S. medical disposables market include 3M, BD, Medline Industries, Inc., Smith+Nephew, Cardinal Health, Bayer AG.

b. Key factors that are driving the U.S. medical disposables market growth include increased general healthcare awareness, increasing prevalence of lifestyle-associated and other chronic diseases, and rising awareness regarding the infection prevention control norms post-pandemic.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."