- Home

- »

- Medical Imaging

- »

-

U.S. Medical Digital Imaging System Market, Industry Report, 2030GVR Report cover

![U.S. Medical Digital Imaging System Market Size, Share & Trends Report]()

U.S. Medical Digital Imaging System Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (MRI, X-ray, Ultrasound, CT, Nuclear Imaging), By Technology (2D, 3D/4D), And Segment Forecasts

- Report ID: GVR-4-68040-234-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

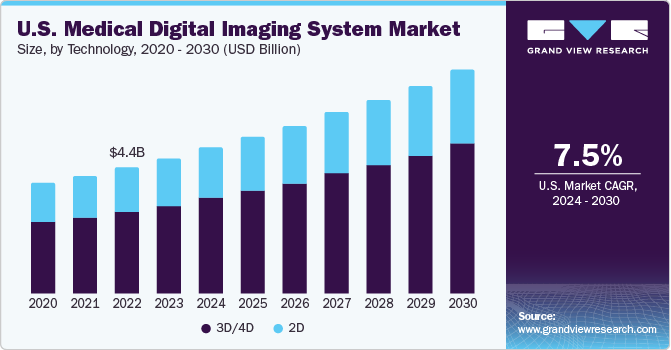

The U.S. medical digital imaging system market size was valued at USD 4.71 billion in 2023 and is expected to grow at a CAGR of 7.5% from 2024 to 2030. Increasing incidences of lifestyle-oriented diseases and the surge in the need for early detection tools are fueling the market demand. Furthermore, growth in technological advancements to enhance turnaround time and reimbursement initiatives by the government is opportunistic for the U.S. market growth.

In 2023, U.S. accounted for a market share of over 27.0% in the global medical digital imaging system market. Rapid breakthroughs in technologies paired with increasing geriatric population base in the country are influencing the demand for better and faster access to healthcare services. Healthcare systems in the country are constantly advancing and due to robust economic power, it is witnessing growth in healthcare spending. The growing awareness about diagnostic efficiency and safety of medical digital imaging systems among healthcare providers has also contributed to the increasing product demand.

The increasing incidence of chronic diseases including cardiovascular disorders, breast cancer, and neurological diseases, has spurred the demand for imaging diagnostics. As per the U.S. National Center for Health Statistics, there were over 1.96 million cancer cases and 609,820 cancer-related deaths in the country in 2023. Advancements in imaging technologies, including detailing in 3D and 4D images, prevalence of point-of-care technologies, and workflow automation are reinforcing the technological ecosystem.

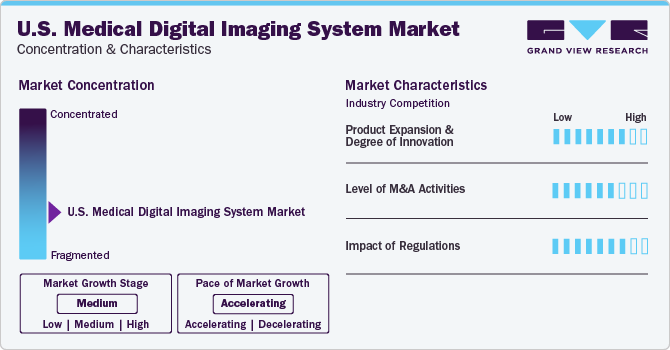

Market Concentration & Characteristics

The market growth stage is medium (CAGR: 5-10%), and the market growth is accelerating. Product innovations in miniaturization, image quality, and wireless connectivity capabilities have improved digital imaging devices' usability and diagnostic capabilities.

Rapid advancements in medical imaging systems are expected to boost their adoption. Market players are developing advanced medical imaging devices, such as portable and digital X-ray devices. For instance, AiRTouch by Aspenstate is a portable X-ray system with a built-in touchscreen workstation. Medical professionals can use the touchscreen workstation to capture an image directly from the device and send it to a Picture Archiving and Communication System (PACS) without needing a computer.

The market is witnessing an increasing number of merger & acquisition (M&A) activities that the prominent players are undertaking. Several key companies are adopting these strategies to upgrade their portfolio. For instance, in March 2023, Koninklijke Philips N.V. announced its strategic partnership with the Champalimaud Foundation. The partnership aimed to reduce carbon footprint by over 50% from Champalimaud's use of diagnostic & interventional imaging systems by 2028.

Various regulatory reforms are expected in the coming years, which are likely to impact the medical device industry. The reforms include the adoption of ISO 13485:2016 by medical device manufacturers and the medical device single audit program. Further, reimbursement policy in the country is favorable for providers and patients compared to other nations, as all of these agents launched in the past decade were reimbursed (100%) by the government through public insurance programs. This helped improve treatment accessibility at reasonable prices.

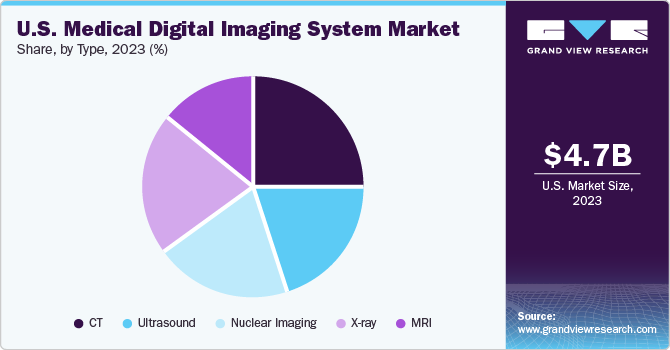

Type Insights

The CT segment held the largest share of 25.2% in 2023 and is expected to maintain its lead over the forecast period. CT provides more detailed pictures of the body's internal organs than conventional radiography. The development of high-precision CT scanners by integrating advanced technologies such as AI & ML and advanced visualization systems are projected to drive the segment growth.

The nuclear imaging segment is expected to grow fastest during the forecast period. Single-photon emission Computed Tomography (SPECT) and Positron Emission Tomography (PET) technologies are widely used in nuclear diagnostic procedures. Affordability, ease of handling devices, compatible half-life of radioisotopes, and a wide range of applications are some major factors driving the market. Oncology contributes approximately 90% of the total clinical PET scan procedures. The utilization of PET is increasing in translation research involved in developing novel therapies and diagnostic procedures specific to lung diseases.

Technology Insights

3D/4D captured the largest market share of 64.2% in 2023. The segment is also expected to witness significant growth during the forecast period. 3D and 4D image detailing helps diagnose diseases more accurately by providing detailed images. Exceptional quality images of organs, such as the lungs, heart, and brain, can be obtained rapidly in seconds & without any invasive efforts. They can also help detect blood clots, diseases, infections, and hemorrhages.

Technological innovations in 3D/4D imaging solutions aid in precise and real-time visualization of the human body, thereby reducing distortion. 4D imaging is a 3D technology with real-time movement capabilities. The market for 3D and 4D imaging systems is anticipated to experience substantial growth in the upcoming years owing to the growing adoption of these systems in fetal monitoring.

Key U.S. Medical Digital Imaging System Company Insights

The key U.S. medical digital imaging system companies include GE Healthcare, Koninklijke Philips N.V., and Siemens Healthineers. Leading manufacturers increasingly focus on technological innovations and develop advanced products to gain substantial market share. Furthermore, the country has a wide scope of design & innovation expertise, R&D collaborations, demonstration & test facilities, high-tech applications, and public-private partnerships.

Key U.S. Medical Digital Imaging System Companies:

- Koninklijke Philips N.V

- GE Healthcare

- Siemens Healthineers

- Esaote SPA

- Canon Medical Systems Corporation

- Hologic

- Hitachi

- Shimadzu

Recent Developments

-

In June 2023, GE Healthcare announced the launch of the FDA-approved Sonic DL, a deep learning-driven solution purposed to substantially boost image generation in MRI systems.

-

In May 2023, Koninklijke Philips N.V. unveiled the launch of the Philips CT 3500, an advanced CT device that caters to the needs of routine radiology and voluminous screening applications.

-

In January 2023, Pie Medical Digital Imaging System announced the launch of CAAS Qardia 2.0, an enhanced version of the company’s echocardiography software platform. The platform offers AI-enabled workflows for clinical measurements. It also provides in-hospital zero-footprint deployment and can be accessed from a PC within the hospital premises network with the help of a web browser.

U.S. Medical Digital Imaging System Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7.79 billion

Growth rate

CAGR of 7.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V; GE Healthcare; Siemens Healthineers; Esaote SPA; Canon Medical Systems Corporation; Hologic; Hitachi; Shimadzu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Medical Digital Imaging System Market Report SegmentationThis report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical digital imaging system market report based on type, and technology:

-

Type (Revenue, USD Million, 2018 - 2030)

-

MRI

-

X-ray

-

Ultrasound

-

CT

-

Nuclear Imaging

-

-

Technology (Revenue, USD Million, 2018 - 2030)

-

2D

-

BnW

-

Color

-

- 3D/4D

-

Frequently Asked Questions About This Report

b. The U.S. medical digital imaging system market size was estimated at USD 4.71 billion in 2023 and is expected to reach USD 5.05 billion in 2024.

b. The U.S. medical digital imaging system market is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 7.79 billion by 2030.

b. Computed tomography accounted for the largest U.S. medical digital imaging system market share and accounted for over the 25.20% in 2023.

b. Key factors that are driving the market growth include increasing medicare reimbursement for surging demand for effective early diagnostic methods and widening base of aging population. Furthermore, Advancements in digital and communication technologies are have been augmenting the market. New imaging techniques provide accurate anatomical detail in most diagnostic radiology procedures

b. Some key players operating in the U.S. medical digital imaging system market include Siemens Healthcare, Hitachi, GE Healthcare, Koninklijke Philips, Canon Medical Systems Corporation, Hologic, Medtronic, and Shimadzu Corporation

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.