U.S. Medical Computer Workstation Market Size, Share & Trends Analysis Report By Energy Source (Powered, Non-powered), By Configuration (Wall-mounted, Mobile), By Application, By Type, By End-use, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-296-1

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

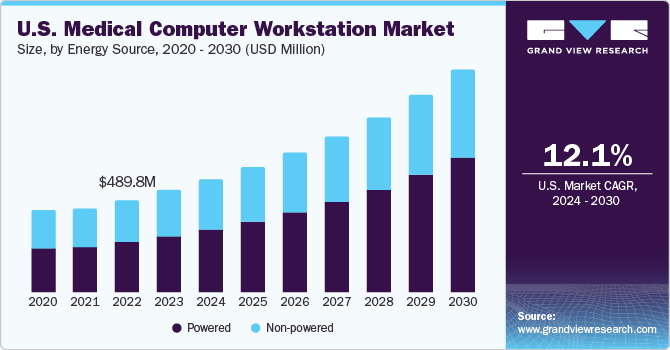

The U.S. medical computer workstation market size was estimated at USD 542.59 million in 2023 and is projected to grow at a CAGR of 12.1% from 2024 to 2030. The increasing adoption of Electronic Health Records (EHRs) indeed plays a significant role in driving the medical computer workstation market. Patient health data, such as medical histories, treatment schedules, prescriptions, and the outcomes of diagnostic tests, is digitalized by EHRs. Efficient computer workstations are necessary for healthcare practitioners to safely and quickly access, examine, update, and manage electronic data at the point of service.

Moreover, medical computer workstations provide healthcare professionals with dedicated interfaces to interact with EHR systems seamlessly. These workstations are equipped with features such as touchscreen displays, barcode scanners, ergonomic designs, facilitating rapid data entry, retrieval, and navigation within Electronic Health Records (her) platforms. This enhances workflow efficiency and clinical productivity. Further, it helps promote seamless communication, collaboration, and care coordination among clinicians, leading to improved patient outcomes and satisfaction. Thereby, the aforementioned benefits associated with the adoption of EHRs fuel the medical computer workstation market growth.

Medical computer workstations equipped with mobile carts or wall-mounted configurations enable healthcare professionals to document patient encounters directly into EHR systems at the bedside or in clinical settings, reducing documentation delays and errors. In addition, medical computer workstations play a crucial role in ensuring compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) and the Meaningful Use criteria, driving their adoption in healthcare settings. Thus, the increasing adoption of EHRs necessitates the deployment of efficient and user-friendly medical computer workstations to support seamless data access, documentation, care coordination, decision support, regulatory compliance, and future scalability in healthcare settings. This drives market growth and innovation in the medical computer workstation industry.

Technological innovations and advances play a crucial role in driving the growth of the medical computer workstation market by enhancing functionality, usability, efficiency, and safety. Integration of touchscreen interfaces allows for intuitive interaction with medical computer workstations, facilitating rapid data entry, navigation, and gesture-based commands. Touchscreen technology enhances user experience and efficiency, particularly in fast-paced clinical environments. Investing in high-quality, high-resolution screens allows medical workers to see electronic health records (EHRs), diagnostic data, and medical pictures more clearly and clearly. Exact interpretation of medical data and enhanced diagnostic accuracy are facilitated by high-resolution screens.

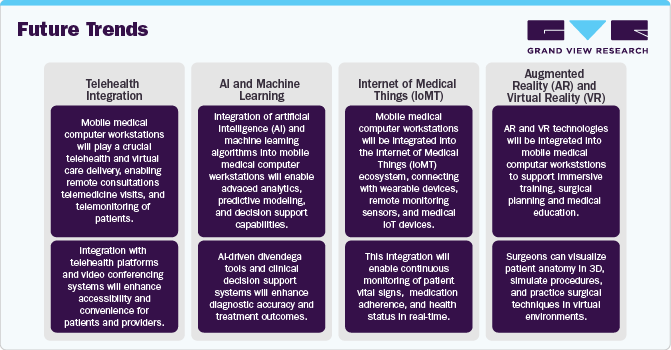

Incorporation of wireless connectivity features, such as Wi-Fi and Bluetooth, enables seamless integration of medical computer workstations with hospital networks, diagnostic devices, and peripheral equipment. Wireless connectivity enhances mobility, flexibility, and interoperability, supporting collaborative care delivery and telemedicine initiatives. Nonetheless, design advancements focus on ergonomic considerations, including adjustable height, tilt, and swivel options, as well as customizable workstation configurations to accommodate user preferences and ergonomic guidelines. Ergonomic design features promote user comfort, reduce fatigue, and minimize the risk of musculoskeletal injuries among healthcare professionals. Therefore, by integrating cutting-edge technologies, medical computer workstations empower healthcare professionals to deliver high-quality care, improve patient outcomes, and adapt to evolving healthcare trends and challenges.

The growing adoption of telemedicine and remote patient monitoring solutions necessitates reliable and user-friendly interfaces for healthcare professionals to interact with patients remotely. Medical computer workstations equipped with video conferencing capabilities, diagnostic peripherals, and secure communication features facilitate telemedicine consultations. For instance, the Trio Telemedicine Workstation, by Capsa Healthcare, is a hospital computer cart that allows for video connection and the use of diagnostic accessories, facilitating virtual treatment and rapid diagnosis. Integrated video conferencing, telepresence, and telehealth platforms facilitate remote interactions between healthcare providers and patients, expanding access to care and improving care coordination. Thus, upsurge in adoption of telemedicine is expected to fuel the medical computer workstation market growth in coming years.

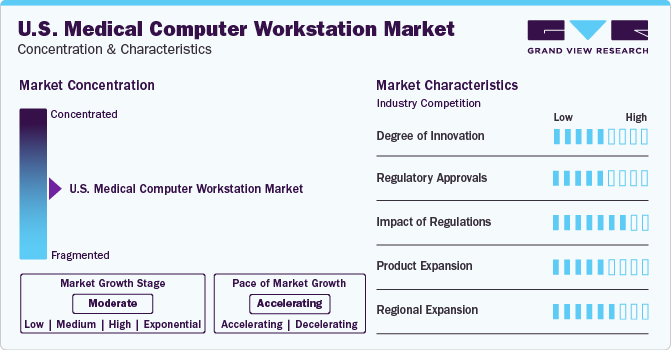

Market Concentration & Characteristics

The market growth stage is moderate, and pace of the market growth is accelerating. The medical computer workstation market is characterized by a high degree of growth owing to rising cases of chronic vein disorders, growing number of orthopedic procedures, and increasing incidence of obesity.

Key strategies implemented by players in medical computer workstation market are new product launches, expansion, acquisitions, partnerships, and other strategies. In August 2020, Capsa Healthcare launched its new Trio mobile computing workstation. It is the most recent point-of-care platform designed to deploy electronic health information and assist efficient and accurate medication management. Trio combines cutting-edge technology to provide the most intelligent and dependable computing carts available. Trio has an improved ergonomic design as well as improvements in usability, mobility, and power system runtime. In addition to standard clinical documentation and medicine delivery requirements, Trio may be customized to serve a number of applications such as telehealth, registration, and phlebotomy.

Integration of artificial intelligence (AI) capabilities, such as machine learning algorithms and natural language processing, enables medical computer workstations to analyze medical data, provide predictive insights, and assist healthcare professionals in clinical decision-making. AI integration enhances diagnostic accuracy, treatment planning, and patient outcomes.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA) in the U.S. establish stringent regulations governing the design, manufacturing, and marketing of medical devices, including medical computer workstations. Compliance with regulatory standards is mandatory to ensure patient safety and product efficacy. In the U.S., medical computer workstations may require pre-market approval (PMA) or 510(k) clearance from the FDA before they can be legally marketed and sold.

Regulations profoundly impact the medical computer workstations market by shaping product development, manufacturing practices, market access, patient safety, and post-market surveillance. Compliance with regulatory requirements is essential for manufacturers to ensure the safety, efficacy, and quality of medical computer workstations and maintain trust among healthcare providers, regulatory agencies, and patients.

Product expansion in the medical computer workstations market involves the introduction of new products, features, and solutions to meet evolving healthcare needs and technological advancements. Medical computer workstation manufacturers expand their product portfolios to offer a diverse range of solutions tailored to specific clinical settings, specialties, and user requirements. This includes workstation models designed for operating rooms, intensive care units, nursing stations, telehealth environments, and among others. Moreover, manufacturers develop specialized medical computer workstations optimized for unique clinical applications and workflows. These may include workstations equipped with antimicrobial coatings for infection control, battery-powered mobile carts for point-of-care use, and wall-mounted units for space-constrained environments.

Product expansion focuses on seamless integration with Electronic Health Record (EHR) Systems, Picture Archiving And Communication Systems (PACS), and other healthcare IT platforms. This enables medical computer workstations to access patient data, diagnostic images, and clinical applications in real-time, supporting efficient care delivery and documentation. Thus, product expansion drives market growth in the medical computer workstations market by addressing diverse clinical needs, integrating advanced technologies, expanding into new markets, and ensuring compliance with regulatory requirements. By offering innovative solutions that enhance clinical workflows, support telemedicine initiatives, and improve patient care delivery, manufacturers can capitalize on opportunities for market expansion and differentiation.

Medical computer workstation market comprises a wide range of products designed to meet the diverse needs of healthcare providers across various clinical settings. Companies offer different types of workstations, including mobile carts, wall-mounted units, desktop models, and specialized configurations tailored to specific medical specialties or applications.

This strategic approach enables medical computer workstation manufacturers to penetrate new markets and increase their market share. By targeting healthcare IT solutions, companies can capitalize on growth opportunities and expand their customer base. By expanding regionally, medical computer workstation manufacturers can tailor their products and services to meet the specific needs and preferences of healthcare providers in different geographic markets. This may involve customization of software interfaces, language support, and compliance with local regulatory standards.

Energy Source Insights

The powered segment dominated the market in 2023 and is also expected to register the fastest CAGR of 14.0% during the forecast period. These types of medical carts are made of inbuilt energy sources, such as batteries. This segment is expected to grow lucratively in the coming years due to associated benefits and a rise in demand from hospitals. The demand for powered computer workstations in medical carts is propelled by the increasing adoption of EHR, telemedicine, and point-of-care technologies in healthcare settings. Healthcare providers require immediate access to patient information, clinical applications, & communication tools at the bedside or point of care to support informed decision-making and deliver high-quality patient care efficiently.

Furthermore, technological advancements are also expected to boost the market growth. Technological advancements in powered computer workstations enable seamless integration with EHR systems, diagnostic equipment, and telemedicine platforms. It also empowers healthcare providers to access real-time patient data, review medical images, & conduct virtual consultations on-the-go. The technology offers features such as touchscreen displays, wireless connectivity, and ergonomic design to enhance usability & workflow efficiency, while advanced power management systems ensure reliable operation and uninterrupted access to critical information. Powered computer workstations in medical carts enable healthcare providers to enhance patient safety, streamline clinical workflows, and improve care coordination, ultimately leading to better patient outcomes & satisfaction. Thus, a higher attractiveness index of these products is expected to contribute to the market growth.

Configuration Insights

The mobile medical computer workstation segment dominated the market in 2023. Mobile medical computer workstations are evolving rapidly due to technological advances and changing healthcare needs. Integration of wireless technologies such as Wi-Fi, Bluetooth, and 5G enables seamless connectivity between mobile medical computer workstations and hospital networks, diagnostic devices, and electronic health record (EHR) systems. This facilitates real-time data access, communication, and collaboration among healthcare providers. Moreover, advancements in battery technology have led to the development of high-capacity, long-lasting batteries for mobile medical computer workstations. These batteries provide extended operating times, allowing healthcare professionals to use workstations throughout their shifts without interruption.

Furthermore, innovations in design and engineering have resulted in lightweight and compact mobile medical computer workstations that are easy to maneuver and transport within healthcare facilities. Ergonomic handles, swivel casters, and adjustable height options enhance portability and user mobility. Thus, factors such as demand for point-of-care solutions, remote patient monitoring, EHR adoption, and ergonomic design are driving the growth of the mobile medical computer workstation market.

Wall-mounted medical computer workstation segment is expected to register the fastest CAGR of 14.6% during the forecast period.Wall-mounted medical computer workstations help optimize space in healthcare settings, particularly in crowded patient rooms, clinics, and emergency departments. With limited floor space, wall-mounted workstations provide a compact solution for accessing electronic health records (EHRs), diagnostic tools, and communication systems without cluttering the environment. These workstations offer flexibility and adaptability to evolving healthcare needs and facility layouts. Modular designs allow for easy customization and expansion of workstation configurations, accommodating additional peripherals, storage accessories, or medical devices as required by healthcare providers. These factors collectively drive market growth and adoption of wall-mounted workstations in healthcare environments.

Application Insights

The medication delivery segment dominated the market in 2023. These workstations enhance the efficiency and accuracy of medication administration by integrating electronic health records (EHRs), barcode scanning, and automated dispensing systems. Key drivers include the increasing focus on reducing medication errors, improving patient safety, and streamlining clinical workflows. The adoption of advanced technologies such as real-time data access, secure medication storage, and connectivity with hospital information systems further supports the market expansion by enabling healthcare providers to deliver medications more effectively and efficiently.

The telehealth workstation segment is expected to register the fastest CAGR of 13.56% during the forecast period. The telehealth workstation is a key application within the medical computer workstation market, driven by the increasing adoption of telemedicine practices. These workstations are designed to support remote consultations, diagnostics, and patient monitoring, enabling healthcare providers to deliver care efficiently across distances. Key drivers include the rising demand for remote healthcare services, advancements in telecommunication technologies, and the need for efficient healthcare delivery in rural and underserved areas. The integration of high-resolution cameras, secure communication platforms, and user-friendly interfaces in these workstations enhances their functionality, making them essential tools in modern healthcare settings.

Type Insights

The emergency carts segment dominated the market in 2023. Emergency carts, often known as crash carts, are essential for delivering rapid and life-saving interventions during medical emergencies. These carts enable healthcare providers to respond quickly and effectively to medical emergencies, delivering essential medications, equipment, and supplies directly to the point of care. This rapid response capability is critical for stabilizing patients and initiating life-saving interventions, such as Cardiopulmonary Resuscitation (CPR), defibrillation, & emergency medication administration, in time-sensitive situations. Thereby, the surge in such situations leads to increasing adoption of these carts.

The procedure cart segment is expected to register the fastest CAGR of 13.01% during the forecast period. This segment is expected to gain popularity in the coming years due to its consistent usage in several healthcare settings. Procedure carts improve clinical workflows by allowing healthcare providers convenient access to the supplies, medications, and equipment required to carry out procedures effectively and efficiently. These carts improve overall workflow efficiency in crowded healthcare facilities by combining everything required for particular procedures into a single, movable unit.

These products are especially helpful in operating procedures, such as cardiology & endoscopy, as well as provide access to essential therapeutics. There are various types of procedure carts, including portable, adjustable, and powered. They are sanitary and movable storage solutions that support surgical procedures in operating rooms. These carts help in reducing the risk of cross-contamination by eliminating dust during the storage of supplies and instruments in small spaces. Thus, the aforementioned factors are expected to drive market growth.

End-use Insights

The hospitals segment dominated the market in 2023. Hospitals are a primary end-user segment for medical computer workstations, utilizing these systems across various departments and clinical settings. Medical computer workstations streamline clinical workflows by providing healthcare professionals with convenient access to patient data, electronic health records (EHRs), diagnostic tools, and clinical decision support systems. Workstations located at nurses' stations, patient rooms, and clinical areas optimize information access, documentation, and care coordination, improving operational efficiency. Hospitals leverage medical computer workstations for point-of-care documentation, enabling clinicians to document patient encounters, medications, procedures, and treatment plans directly into EHR systems at the bedside or point of care.

In addition, hospitals rely on medical computer workstations equipped with clinical decision support systems (CDSS) to provide evidence-based guidelines, alerts, and recommendations to healthcare providers during patient care encounters. CDSS integration enhances diagnostic accuracy, treatment adherence, and patient safety by guiding clinicians in making informed decisions based on the latest clinical evidence and best practices. Thus, the aforementioned factors are projected to drive the segment growth.

The physician offices/ clinics/ office based labs segment is expected to register the fastest CAGR of 13.9% during the forecast period. This can be attributed to an increase in awareness and demand for one-stop solutions that require less space & can be used for all medical requirements, as these carts include medicine, medical equipment, computers, & storage cabinets and are mobile. Physician offices, clinics, and office-based labs require versatile and mobile solutions to support diverse clinical activities and patient care needs. Hence, the rise in adoption of mobile workstations is expected to propel segment growth.

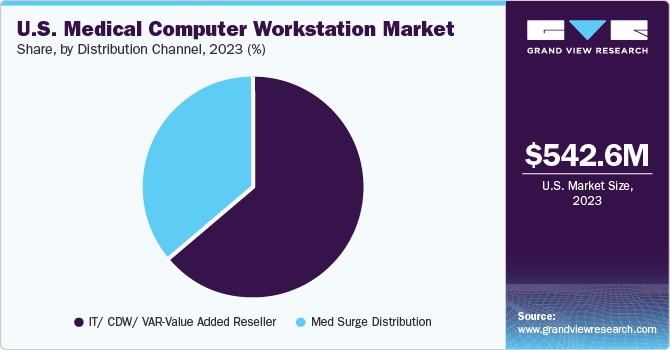

Distribution Channel Insights

IT/ CDW/ VAR-Value Added Reseller segment dominated the market in 2023 and is expected to witness growth at the fastest CAGR of 13.47%. These channels act as intermediaries between manufacturers and end users, offering expertise in technology integration, customization, & customer support. IT/CDW/VAR partners possess specialized knowledge & expertise in healthcare technology solutions, enabling them to understand the unique requirements and challenges of healthcare providers. They offer guidance and recommendations on selecting the most suitable medical cart solutions tailored to specific clinical workflows, environments, and integration needs.

Moreover, IT/CDW/VAR partners play a vital role in integrating medical cart solutions with existing IT infrastructure, EHR systems, and clinical software applications. They offer customization services to configure carts according to end-user preferences, ensuring seamless compatibility & functionality within healthcare environments. Thereby, due to the aforementioned factors, the segment is likely to witness considerable growth over the forecast period.

The medical surge distribution channels segment is expected to register a considerable CAGR during the forecast period. Medical surge distribution channels play a pivotal role in ensuring the efficient & timely delivery of essential medical supplies and equipment, including medical carts, during increased demand or emergencies such as pandemics or natural disasters. The distribution channels for medical carts typically involve a network of manufacturers, distributors, wholesalers, and healthcare providers working collaboratively to meet the urgent needs of healthcare facilities. By leveraging efficient distribution networks, supply chain resilience, collaboration, & technology integration, stakeholders can effectively address surge capacity needs, enhance patient care delivery, and mitigate the impact of emergencies on healthcare systems.

Key U.S. Medical Computer Workstation Company Insights

Capsa Healthcare, Bytec Medical, Ergotron, and Midmark Corporation are some of the major players in the U.S. medical computer workstation market. The U.S. medical computer workstation market has been witnessing notable trends that are impacting the activities of emerging players in the industry. These companies offer a wide range of mobile and wall-mounted medical workstations.

Moreover, advancements in medical computer workstation technologies have led to the development of innovative products. Some notable advancements include touchscreen interfaces, high-resolution displays with superior image quality, incorporation of wireless connectivity features, such as Wi-Fi and Bluetooth, ergonomic design, integration of artificial intelligence (AI) capabilities, adoption of cloud-based solutions, and telehealth and remote monitoring capabilities.

Key U.S. Medical Computer Workstation Companies:

- Capsa Healthcare

- Ergotron, Inc.

- Bytec Healthcare Ltd.

- Midmark Corporation

- Altus, Inc.

- AFC Industries, Inc.

- Newcastle Systems, Inc.

- Enovate Medical

- GCX Corporation (Jaco Inc.)

Recent Developments

-

In March 2024, GCX launched its GCX Tablet Roll Stand to ensure safe, secure access to patient services and medical records from anywhere in the hospital. The carts are effortlessly maneuverable and include a fixed or adjustable-height tablet arm for excellent viewing and access to video conferencing, electronic medical data, and patient care.

-

In October 2023,Ergotron, acquired Enovate Medical, a manufacturer of nurse-ready workstation solutions and services that improve clinical workflows and facilitate real-time Electronic Health Record (EHR) charting at the point of care. Through this transaction, the merged firms might become the U.S. leader in offering ergonomic workflow solutions for healthcare.

-

In July 2023, Midmark Corp., announced its 2023 Workstation Promotion. The objective of the initiative is to guarantee that healthcare institutions have access to mobile workstations that are easy to use and ergonomic, which can enhance the experience between patients and caregivers.

-

In December 2022, GCX Mounting Solutions acquired Jaco, Inc. The acquisition of Jaco's battery-powered EVO Series mobility carts adds to GCX's range of medical instrument and mounting options. The acquisition also brings additional commercial and production capabilities.

U.S. Medical Computer Workstation Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 1,195.72 million |

|

Growth rate |

CAGR of 12.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Energy source, configuration, application, type, end-use, distribution channel |

|

Country Scope |

U.S. |

|

Key companies profiled |

Capsa Healthcare; Ergotron Inc.; Bytec Healthcare Ltd.; Midmark Corporation; Altus Inc.; AFC Industries Inc.; Newcastle Systems Inc.; Enovate Medical; GCX Corporation (Jaco Inc.) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Medical Computer Workstation Market Report Segmentation

This report forecasts revenue growth at U.S. level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical computer workstation market report based on energy source, configuration, application, type, end-use, and distribution channel:

-

Energy Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Powered

-

Non-powered

-

-

Configuration Outlook (Revenue, USD Million, 2018 - 2030)

-

Wall-mounted

-

Mobile

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Documentation

-

Medical Equipment

-

Medication Delivery

-

Telehealth Workstation

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia Carts

-

Emergency Carts

-

Procedure Carts

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Physician Offices/ Clinics/ Office Based Labs

-

Skilled Nursing Facilities

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Med Surge Distribution

-

IT/ CDW/ VAR-Value Added Reseller

-

Frequently Asked Questions About This Report

b. The U.S. medical computer workstations market size was estimated at USD 542.59 million in 2023 and is expected to reach USD 601.79 million in 2024.

b. The U.S. medical computer workstations market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 1195.72 million by 2030.

b. Powered segment dominated the market in 2023 and is also expected to register the fastest CAGR of 14.0% during the forecast period. These types of medical carts are made of inbuilt energy sources, such as batteries. This segment is expected to grow lucratively in the coming years due to associated benefits and a rise in demand from hospitals.

b. Some key players operating in the U.S. medical computer workstations market include Capsa Healthcare, Ergotron, Inc., Bytec Healthcare Ltd., Midmark Corporation, Altus, Inc., AFC Industries, Inc., Newcastle Systems, Inc., Enovate Medical, GCX Corporation (Jaco Inc.)

b. Key factors that are driving the market growth include the medical computer workstation market is characterized by a high degree of growth owing to rising cases of chronic vein disorders, growing number of orthopedic procedures, and increasing incidence of obesity.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."