U.S. Medical Billing Outsourcing Market Size, Share & Trends Analysis Report By Component (In-house, Outsourced), By End-use (Hospitals, Physician Offices), By Service (Front-end, Middle-end, Back-end), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-824-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. medical billing outsourcing market size was valued at USD 6.28 billion in 2024 and is projected to grow at a CAGR of 12.00% from 2025 to 2030. Healthcare providers' increasing challenges in managing a large volume of claims and reimbursements, resulting in significant revenue losses, are attributed to the rising demand for medical billing outsourcing services in the U.S. Moreover, amplifying patient load and the need to address the growing records and bills burden medical practitioners. Hospitals are outsourcing the medical billing process to counter such a situation, thus anticipating market growth.

Moreover, hospitals outsource to companies that have end-to-end knowledge of the Affordable Medical Care Act, Medicaid, and other healthcare and insurance programs. In addition, the healthcare industry is observing an increase in the outsourcing of billing activities by physicians and hospitals due to mandatory implementation of the intricate ICD-10 coding structure, growing care costs, and regulatory pressure to implement electronic medical records to sustain compensation levels. Medical services are facing complex challenges in billing and precise payment, which is anticipated to drive the demand for innovative RCM solutions. The availability of advanced innovative RCM solutions offered by renowned third-party service providers can help healthcare organizations leverage the economic value and efficacy of these RCM solutions while simultaneously focusing on improving patient care.

Furthermore, hassle-free claims settlement processes featuring accounts receivable management and claims management and the availability of professional coders acquainted with the latest medical codes are the primary reasons practices outsource their billing services. However, high threats of data breaches associated with medical billing are expected to hinder market growth during the forecast period. For instance, according to the 2024 Healthcare Data Breach Report published in January 2025 by the Department of Health and Human Services (HHS) Office for Civil Rights (OCR), more than 500 data breach records were reported in 2024.

The pandemic had both positive and negative effects on the market. Introducing the new ICD, Current Procedural Terminology (CPT), and diagnosis codes for COVID-19 billing and telehealth billing posed significant challenges for medical billing service providers. However, the adoption of RCM increased in the U.S. during and after the pandemic. For instance, according to a survey by AKASA published in April 2021, around 75% of health systems in the US deployed RCM solutions during the pandemic.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The market is consolidated, with the presence of key providers dominating the market. The degree of innovation is high, and the level of merger and acquisition activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

Several industry players launch new products to enhance their product portfolio. For instance, in February 2023, Experian Health launched AI Advantage, a product specially designed to tackle the growing issue of healthcare insurance claims denials. This new system leverages artificial intelligence and Experian's expertise in big data solutions to provide a seamless and comprehensive solution for claims management in the healthcare industry.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in September 2024, The Rawlings Group, Apixio Payment Integrity, and VARIS merged to create a leading platform focused on payment accuracy and integrity in healthcare.

The impact of regulations on the market is high. The continuous policy changes and upgradation of regulations are expected to hinder market growth. RCM is relatively low due to changes in regulatory frameworks, specific demands of healthcare organizations, and varying reimbursement policies across the U.S. However, with the growing adoption of digital healthcare solutions and the increasing need for efficient RCM, the market is expected to witness significant growth in the coming years.

The industry is witnessing moderate regional expansion, driven by an increasing customer base for medical billing and RCM solutions. For instance, in September 2024, Tritent International Corp. and Burst Technologies, Inc. signed a MoU to build AI-Driven Healthcare Billing Solutions for U.S. Nursing Homes.

Component Insights

Based on components, the outsourced segment held the largest revenue share of 58.90% in 2024 and is expected to grow fastest over the forecast period. Outsourcing medical billing services is expected to significantly reduce costs, making it easier for small and medium-sized practices to manage their finances. Many hospitals and independent physicians prefer outsourcing these services to reduce healthcare costs, increase profit margins, and improve patient-physician relationships. Furthermore, doctors cannot provide the best possible care to patients if they are engaged in managing administrative processes, such as recovering claims and bills. Hence, to enhance their focus on medical care, large hospitals started outsourcing these services.

Many companies are adopting or launching innovative cloud-based medical billing capabilities for superior security of patient data. For instance, in January 2025, MyMedicalBillingService.com launched a comprehensive medical billing company aimed at healthcare providers across the U.S. In addition, outsourcing reduces labor costs by eliminating the need to hire an accounting team. Also, the company does not have to train or stay up to date, saving additional training costs.

Service Insights

Based on service, the front-end services segment dominated the market with a revenue share of 38.60% in 2024. These services comprise scheduling, pre-registration, registration, eligibility, insurance verification, and pre-authorization. Managing front-end services is essential for reducing repetitive work and improving the patient experience with faster service. Therefore, the demand for outsourcing these services is robust.

Moreover, middle-end services are anticipated to witness the fastest growth in coming years due to the entry of new market players, growing awareness among healthcare practitioners, and increasing service adoption. Furthermore, the rising number of claim denials due to inefficient claim management and the increasing burden on front-end service providers is likely to propel demand for back-end services. Back-end services minimize the burden of front-end services.

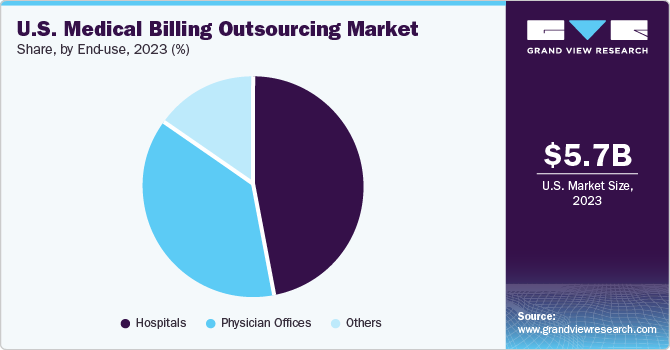

End-use Insights

Based on end-use, the hospital segment accounted for the largest revenue share of 46.95% in 2024. Hospitals are the key users of outsourcing services due to the high claim volume. Consolidations of hospitals further increase the complexity of billing and reimbursement procedures, thereby fueling segment growth. Most hospitals and healthcare facilities are shifting towards RCM services to minimize errors and find a cost-effective solution.They are focusing on implementing innovative RCM solutions by collaborating with vendors to transform the reimbursement scenario, which is anticipated to boost segment growth. Moreover, the growing demand to optimize hospitals’ workflow to improve efficiency and productivity is expected to boost the adoption of integrated RCM systems in hospitals. For instance, in December 2021, Allied Digestive Health integrated athenahealth's medical billing and patient engagement services to enhance its operations. This partnership aims to improve efficiency in billing processes and patient interactions, leading to better healthcare delivery and patient satisfaction within the organization.

The physician office segment is expected to grow at the fastest rate over the forecast period. Rising expenditure on healthcare services provided by small and midsized providers due to the growing emphasis on risk management and regulatory compliance and complex technology and staffing requirements is expected to drive the segment in the years to come. As the number of services provided by physicians is increasing and government regulations are changing, a significant number of physicians have begun using RCM services at their medical facilities.

Key U.S. Medical Billing Outsourcing Company Insights

Key players operating in the U.S. medical billing outsourcing market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling market growth.

Key U.S. Medical Billing Outsourcing Companies:

- R1RCM Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- Oracle (Cerner Corporation)

- eClinicalWorks

- Kareo, Inc.

- McKesson Corporation

- Quest Diagnostics

- Promantra Inc.

- AdvancedMD, Inc.

View a comprehensive list of companies in the U.S. Medical Billing Outsourcing Market

Recent Developments

-

In February 2025, Athelas partnered with Resilient Healthcare to streamline outpatient care and hospital billing processes.

-

In November 2024, a startup founded by Brown University students, Kyron Medical, aims to revolutionize medical billing using AI.

-

In May 2024, SmarterDx raised USD 50 million in Series B funding to enhance its clinical AI platform, which automates medical billing processes for hospitals. By analyzing over 30,000 data points per patient visit, it improves billing accuracy and reduces claim denials, helping healthcare providers recover millions in lost revenue.

-

In March 2022, Connecticut Children's Hospital started implementing Nym's coding technology. This innovative system aims to automate medical billing processes, enhancing patient care journeys by streamlining administrative tasks and allowing healthcare providers to focus more on patient needs.

-

In January 2022, R1RCM Inc. entered into a definitive agreement to acquire Cloudmed. The deal was worth USD 4.1 billion and is expected to enter into an 18-month lock-up agreement.

U.S. Medical Billing Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 12.26 billion |

|

Growth rate |

CAGR of 12.00% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, service, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

R1RCM Inc.; Veradigm LLC (Allscripts Healthcare, LLC); Oracle (Cerner Corporation); eClinicalWorks; Kareo, Inc.; McKesson Corporation; Quest Diagnostics; Promantra Inc.; AdvancedMD, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Medical Billing Outsourcing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. medical billing outsourcing market report based on component, service, and end-use:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

In-House

-

Outsourced

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Front-end Services

-

Middle-end Services

-

Back-end Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Physician Offices

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. medical billing outsourcing market size was estimated at USD 6.28 billion in 2024 and is expected to reach USD 6.95 billion in 2025.

b. The U.S. medical billing outsourcing market is expected to grow at a compound annual growth rate of 12.00% from 2025 to 2030 to reach USD 12.26 billion by 2030.

b. Outsourced segment dominated the U.S. medical billing outsourcing market with a share of 58.90% in 2024. This is attributable to reduced cost & administrative burden, increasing profit margins, and improving the physician-patient relationship.

b. Some key players operating in the U.S. medical billing outsourcing market include R1RCM Inc., Allscripts Healthcare, LLC, Oracle (Cerner Corporation), eClinicalWorks, Kareo, Inc., McKesson Corporation, Quest Diagnostics, Promantra Inc., and AdvancedMD, Inc.

b. Key factors that are driving the U.S. medical billing outsourcing market growth include an increase in stringent government regulatory requirements and debt & uncollectible accounts.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."